U.K. Business Group Says Exit From EU Could Be Costly

March 21 2016 - 8:30PM

Dow Jones News

By Jason Douglas and Max Colchester

LONDON--Leaving the European Union could cost the U.K. economy

up to GBP100 billion ($145 billion) in lost income by 2020 and

almost 1 million jobs, one of the U.K.'s most influential business

groups said on Monday, in a report that adds fresh fuel to an

already heated debate in the U.K. about its relationship with

Europe.

Separately, a financial-services lobby group said that Britain's

financial sector could be hit in the event of so-called Brexit

while, in a third report, credit-rating agency Moody's Investors

Service said that a vote in favor of departure could have negative

consequences for the creditworthiness of British-based companies

and the U.K. government.

The trio of reports bolster Prime Minister David Cameron's

arguments that the U.K. would be better off economically by

remaining in the EU ahead of a referendum in June.

But they also come as Mr. Cameron faces deepening divisions

within his ruling Conservative Party over the U.K.'s future in

Europe and broader government strategy, after a senior government

minister who supports Britain's exit from the EU resigned on

Friday, citing differences over economic policy.

Proponents of Britain's exit say claims that the economy will

suffer are exaggerated, arguing instead that the economy will be

freer to prosper outside of the EU because the U.K. could focus on

trade with faster-growing regions and won't be burdened by the cost

of membership.

Senior figures from both sides of the campaign will duke it out

this week in appearances before a parliamentary committee looking

into the costs and benefits of the U.K.'s EU membership. Pro-Brexit

London Mayor Boris Johnson provides testimony on Wednesday and U.K.

Treasury chief George Osborne is due to argue for the benefits of

remaining in the EU when he appears on Thursday.

In its report on Monday, the Confederation of British Industry,

which represents around 190,000 employers in Britain, said that it

assessed the economic impact of leaving the EU based on two

possible post-exit futures: One in which the U.K. wasn't an EU

member but was able to negotiate a free-trade deal with the other

27 members of the bloc, and a second scenario in which no such deal

was reached and the relationship between the EU and the U.K. was

governed by the World Trade Organization.

The analysis suggested that the British economy could be around

3% smaller by 2020 under a free-trade deal than it would be had it

stayed in the EU, and 5.5% smaller under a WTO deal. That equates

to between GBP55 billion and GBP100 billion of lost income,

according to the report, which was prepared by business services

firm PricewaterhouseCoopers LLP for the CBI.

In both scenarios, the largest drag on growth comes from weaker

investment, particularly in the short-term, as the U.K. would need

to negotiate some form of continued access to the EU's single

market for goods and services. Trade and immigration are also

forecast to be lower.

Employment growth could also suffer if Britain left the EU, the

CBI said. It estimated that there would be 550,000 fewer jobs in

the economy by 2020 under the free-trade scenario, compared with

continued EU membership, and 950,000 fewer under the WTO

scenario.

But the report highlighted that the drag on the economy from

leaving the EU would eventually fade--a finding quickly seized on

by proponents of quitting the bloc. The CBI said it estimates the

economy would be 36% to 39% larger in 2030 than in 2015 under

either exit scenarios, but staying in would mean only a slightly

larger boost, of 41%.

Vote Leave, which campaigns in favor of a British exit from the

EU, criticized the CBI's analysis in a lengthy rebuttal, saying

that many of its assumptions were "unrealistic and unreasonable."

David Davis, a Conservative lawmaker and advocate of leaving the

EU, accused the CBI of "scaremongering."

In a separate analysis on Monday, the Association for Financial

Markets in Europe said that some financial-services activity could

move out of the U.K., with investment, wealth and private banking

especially vulnerable to any restrictions on cross-border activity.

Banks and other financial firms based in the U.K. can currently

sell their products and services in all EU countries, but such

"passporting" arrangements may be threatened if the U.K. wasn't an

EU member, the group's report said.

Supporters of leaving say that the U.K. would be able to hammer

out favorable access to the EU while also getting more freedom to

dictate financial regulation. But some investors say that there

could be an EU backlash against the U.K. if the country tries to

position itself as an offshore financial center: A Morgan Stanley

poll of investors found that 67% thought that the EU would strike

back if the U.K. tried to market itself in this way.

Moody's, in its report due to be published on Tuesday, said that

it believes the economic costs of leaving the EU outweigh the

benefits. The agency said that departure would likely trigger

downgrades on the ratings of U.K. corporate bonds because of likely

new barriers to trade and immigration.

Brexit could also result in a negative outlook for the U.K.'s

own credit rating, currently one rung below the agency's highest

credit grade, Moody's said.

Moody's added that the U.K. and the remainder of the EU would

have strong incentives to minimize the economic impact of a British

departure, given the strong links between the two, which Vote Leave

highlighted as evidence that concerns over lost trade are

overblown.

Write to Jason Douglas at jason.douglas@wsj.com and Max

Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

March 21, 2016 20:15 ET (00:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

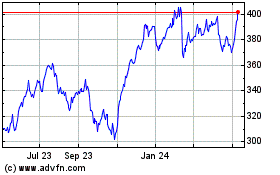

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

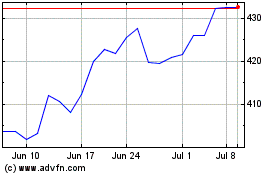

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024