UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 17, 2015

MOODY’S CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

1-14037 |

|

13-3998945 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

7 World Trade Center at 250 Greenwich Street

New York, New York 10007

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (212) 553-0300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01, “Other Events”

As previously announced, on November 12, 2015, Moody’s Corporation (the “Company”) entered into an underwriting agreement by and among the

Company and Citigroup Global Markets Inc. and J.P. Morgan Securities LLC, as representatives of the several underwriters named therein (the “Underwriting Agreement”), with respect to the issuance and sale of $300 million aggregate

principal amount of the Company’s 5.250% Senior Notes due 2044 (the “notes”). The notes were registered under the Company’s Registration Statement on Form S-3 (Registration No. 333-190259) (the “Registration

Statement”) filed with the Securities and Exchange Commission (the “Commission”) on July 31, 2013. On November 17, 2015, the Company closed its public offering of the notes.

The notes will be a further issuance of, will be fungible with and will be consolidated and form a single series with the Company’s outstanding 5.250%

Senior Notes due 2044, issued on July 16, 2014 in the amount of $300 million. The notes will have the same CUSIP number and will trade interchangeable with the previously issued notes in this series and the aggregate principal amount of

outstanding notes of this series is $600 million.

The notes were issued under an Indenture between the Company and Wells Fargo Bank, National

Association, as trustee (the “Trustee”), dated as of August 19, 2010 (the “Base Indenture”), as supplemented by the fourth supplemental indenture, dated as of July 16, 2014 (the “Fourth Supplemental Indenture”

and, together with the Base Indenture, the “Indenture”). The net proceeds of the offering are expected to be used for general corporate purposes, including working capital, capital expenditures, acquisitions of or investments in businesses

or assets, redemption and repayment of other indebtedness, and purchases of the Company’s common stock under its ongoing stock repurchase program.

The 2044 notes bear interest at the fixed rate of 5.250% per year and mature on July 15, 2044. Interest on the notes will be due semiannually on

January 15 and July 15 of each year, commencing January 15, 2016. The Company may redeem, in whole or in part, the 2044 notes at any time, at a price equal to 100% of the principal amount being prepaid, plus accrued and unpaid

interest and a make-whole premium. Additionally, at the option of the holders of the notes, the Company may be required to purchase all or a portion of the notes upon the occurrence of a “Change of Control Triggering Event,” as defined in

the Indenture, at a price equal to 101% of the principal amount thereof, plus accrued and unpaid interest to the date of purchase.

The Indenture contains

covenants that limit the ability of the Company and certain of its subsidiaries to, among other things, incur or create liens and enter into sale and leaseback transactions. In addition, the Indenture contains a covenant that limits the ability of

the Company to consolidate or merge with another entity or to sell all or substantially all of its assets to another entity.

The Indenture contains

customary default provisions. In addition, an event of default will occur if the Company or certain of its subsidiaries fail to pay the principal of any Indebtedness (as defined in the Indenture) when due at maturity in an aggregate amount of $50

million or more, or a default occurs that results in the acceleration of the maturity of the Company’s or certain of its subsidiaries’ Indebtedness in an aggregate amount of $50 million or more. Upon the occurrence and during the

continuation of an event of default under the Indenture, the notes may become immediately due and payable either automatically or by the vote of the holders of more than 25% of the aggregate principal amount of all of the notes then outstanding.

The description of the Base Indenture, Fourth Supplemental Indenture and the form of the notes are summaries and are qualified in their entirety by the

terms of the indentures and the form of notes included therein. The Base Indenture and Fourth Supplemental Indenture are attached as Exhibits 4.1 to the Company’s Current Reports on Form 8-K dated August 19, 2010 and July 16, 2014,

respectively, filed with the Commission. The form of notes for this offering is attached hereto as Exhibit 4.1.

Item 9.01, “Financial

Statements and Exhibits”

(d) Exhibits

|

|

|

|

|

| 4.1 |

|

Form of 5.250% Notes due 2044. |

|

|

| 5.1 |

|

Opinion of Gibson, Dunn & Crutcher LLP, New York, New York. |

|

|

| 23.1 |

|

Consent of Gibson, Dunn & Crutcher LLP, New York, New York (included in Exhibit 5.1). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

| MOODY’S CORPORATION |

|

|

| By: |

|

/s/ John J. Goggins |

|

|

John J. Goggins |

|

|

Executive Vice President and General Counsel |

Date: November 17, 2015

INDEX TO EXHIBITS

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 4.1 |

|

Form of 5.250% Notes due 2044. |

|

|

| 5.1 |

|

Opinion of Gibson, Dunn & Crutcher LLP, New York, New York. |

|

|

| 23.1 |

|

Consent of Gibson, Dunn & Crutcher LLP, New York, New York (included in Exhibit 5.1). |

Exhibit 4.1

[FORM OF FACE OF 2044 NOTE]

THIS NOTE IS A

GLOBAL SECURITY WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF THE DEPOSITARY OR A NOMINEE OF THE DEPOSITARY, WHICH MAY BE TREATED BY THE COMPANY, THE TRUSTEE AND ANY AGENT THEREOF AS OWNER AND HOLDER OF

THIS NOTE FOR ALL PURPOSES.

UNLESS THIS CERTIFICATE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY (55 WATER STREET, NEW

YORK, NEW YORK) (“DTC”) TO THE COMPANY OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY CERTIFICATE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED

REPRESENTATIVE OF DTC (AND ANY PAYMENT HEREON IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS

WRONGFUL SINCE THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

TRANSFERS OF THIS GLOBAL SECURITY SHALL BE LIMITED TO TRANSFERS

IN WHOLE, BUT NOT IN PART, BY THE DEPOSITARY TO A NOMINEE OF THE DEPOSITARY, OR BY A NOMINEE OF THE DEPOSITARY TO THE DEPOSITARY OR ANOTHER NOMINEE OF THE DEPOSITARY, OR BY THE DEPOSITARY OR ANY SUCH NOMINEE TO A SUCCESSOR DEPOSITARY OR A NOMINEE OF

SUCH SUCCESSOR DEPOSITARY.

CUSIP No. 615369AE5

MOODY’S CORPORATION

5.250% SENIOR NOTES DUE 2044

Principal and Interest. Moody’s Corporation, a corporation duly organized and existing under the

laws of the State of Delaware (herein called the “Company,” which term includes any successor Person under the Indenture hereinafter referred to), for value received, hereby promises to pay to Cede & Co. or

registered assigns, the principal sum of three hundred million dollars ($300,000,000) on July 15, 2044 and to pay interest thereon from July 15, 2015 or from the most recent Interest Payment Date to which interest has been paid or duly

provided for, semiannually in arrears on January 15 and July 15 in each year, commencing January 15, 2016 at the rate of 5.250% per annum, until the principal hereof is paid or made available for payment.

Method of Payment. The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date shall, as provided

in such Indenture, be paid to the Person in whose name this Note (or one or more Predecessor Securities) is registered at the close of business on the Record Date for such interest, which shall be January 1 or July 1, as the case may be,

next preceding such Interest Payment Date. Any such interest not so punctually paid or duly provided for shall forthwith cease to be payable to the Holder on such Record Date and may either be paid to the Person in whose name this Note (or one or

more Predecessor Securities) is registered at the close of business on a Special Record Date for the payment of such Defaulted Interest to be fixed by the Trustee, notice thereof having been given to Holders of Notes not less than 10 days prior to

such Special Record Date, all as more fully provided in said Indenture. Payment of the principal of (and premium, if any) and any such interest on this Note shall be made at the Corporate Trust Office in U.S. Dollars.

Reference is hereby made to the further provisions of this Note set forth on the reverse hereof, which further provisions shall for all

purposes have the same effect as if set forth at this place.

Authentication. Unless the certificate of authentication hereon has

been executed by the Trustee referred to on the reverse hereof by manual signature, this Note shall not be entitled to any benefit under the Indenture or be valid or obligatory for any purpose.

IN WITNESS WHEREOF, the Company has caused this instrument to be duly executed under its

corporate seal.

Dated: November 17, 2015

|

|

|

| MOODY’S CORPORATION |

|

|

| By: |

|

|

|

|

Name: John J. Goggins |

|

|

Title: Executive Vice President and |

|

|

General Counsel |

TRUSTEE’S CERTIFICATE OF AUTHENTICATION

Dated: November 17, 2015

WELLS FARGO BANK, NATIONAL

ASSOCIATION

as Trustee, certifies

that this is one of

the Securities referred

to in the Indenture.

[FORM OF REVERSE OF 2044 NOTE]

Indenture. This Note is one of a duly authorized issue of Securities of the Company (herein called the

“Note” or collectively, the “Notes”), issued and to be issued under an Indenture, dated as of August 19, 2010, as supplemented by a Fourth Supplemental Indenture dated July 16,

2014 (as so supplemented, herein called the “Indenture”), between the Company and Wells Fargo Bank, National Association, as Trustee (herein called the “Trustee,” which term includes any

successor trustee under the Indenture), to which Indenture and all indentures supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the Company, the Trustee

and the Holders of the Notes and of the terms upon which the Notes are, and are to be, authenticated and delivered. This Note is one of the series designated on the face hereof, limited as of the date hereof in aggregate principal amount to

$600,000,000.

Optional Redemption. The Notes are subject to redemption at the Company’s option, in whole or in part,

at any time at a redemption price equal to the greater of (i) 100% of the principal amount to be redeemed plus accrued and unpaid interest thereon to, but excluding, the Redemption Date, and (ii) the sum, as determined by an Independent

Investment Banker, of the present values of the remaining scheduled payments of principal and interest on the Notes to be redeemed (exclusive of interest accrued to the Redemption Date) discounted to the Redemption Date on a semiannual basis

(assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate plus 30 basis points plus accrued and unpaid interest on the principal amount being redeemed to, but excluding, the Redemption Date.

For purposes of determining the optional redemption price, the following definitions are applicable:

“Comparable Treasury Issue” means the United States Treasury security selected by an Independent Investment Banker as having a

maturity comparable to the remaining term (“Remaining Life”) of the Notes to be redeemed that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt

securities of comparable maturity to the remaining term of the Notes.

“Comparable Treasury Price” means, with respect to any

redemption date, (1) the average of the Reference Treasury Dealer Quotations for such redemption date, after excluding the highest and lowest such Reference Treasury Dealer Quotations, or (2) if the Independent Investment Banker obtains

fewer than four such Reference Treasury Dealer Quotations, the average of all such Quotations or, if only one such Quotation is obtained, such Quotation.

“Independent Investment Banker” means an independent investment banking institution of national standing appointed by the Company,

which may be one of the Reference Treasury Dealers.

“Reference Treasury Dealer” means (1) J.P. Morgan Securities LLC and Merrill

Lynch, Pierce, Fenner & Smith Incorporated, and their respective successors, and (2) any other primary U.S. government securities dealer in New York City that the Company selects (each, a “Reference Treasury Dealer”).

“Reference Treasury Dealer Quotation” means, with respect to each Reference Treasury Dealer and any Redemption Date for the Notes,

the average, as determined by the Independent Investment Banker, of the bid and asked prices for the Comparable Treasury Issue for the Notes (expressed in each case as a percentage of its principal amount) quoted in writing to the Independent

Investment Banker by such Reference Treasury Dealer at 5:00 p.m., New York City time, on the third business day preceding such Redemption Date.

“Treasury Rate” means, with respect to any Redemption Date, (1) the yield, under the heading which represents the average for

the immediately preceding week, appearing in the most recently published statistical release designated “H.15(519)” or any successor publication which is published weekly by the Board of Governors of the Federal Reserve System and which

establishes yields on actively traded United States Treasury securities adjusted to constant maturity under the caption “Treasury Constant Maturities,” for the maturity corresponding to the Comparable Treasury Issue (if no maturity is

within three months before or after the Remaining Life, yields for the two published maturities most closely corresponding to the Comparable Treasury Issue shall be determined and the Treasury Rate shall be interpolated or extrapolated from such

yields on a straight line basis, rounding to the nearest month), (2) if the period from the Redemption Date to the maturity date of the notes to be redeemed is less than one year, the weekly average yield on actually traded United States

Treasury securities adjusted to a constant maturity of one year will be used, or (3) if such release (or any successor release) is not published during the week preceding the calculation date or does not contain such yields, the rate per annum

equal to the semiannual equivalent yield to maturity of the Comparable Treasury Issue, calculated using a price for the Comparable Treasury Issue (expressed as a percentage of its principal amount) equal to the Comparable Treasury Price for such

Redemption Date. The Treasury Rate shall be calculated on the third business day preceding the redemption date.

Notice of any redemption

shall be mailed at least 30 days but not more than 60 days before the Redemption Date to each registered Holder of the Notes to be redeemed. If money sufficient to pay the redemption price of all of the Notes (or portions thereof) to be redeemed on

the Redemption Date is deposited with the Trustee or Paying Agent on or before the Redemption Date, and unless the Company defaults in payment of the redemption price, on and after the Redemption Date, interest shall cease to accrue on the Notes or

portions of the Notes called for redemption. If fewer than all of the Notes are to be redeemed, and such Notes are at the time represented by a Global Security, the Depositary shall select by lot the particular interests to be redeemed. If the

Company elects to redeem fewer than all of the Notes, and any of such Notes are not represented by a Global Security, then the Trustee shall select the particular Notes to be redeemed in a manner it deems appropriate and fair (and the Depositary

shall select by lot the particular interests in any Global Security to be redeemed).

The Company may at any time, and from time to time,

purchase the Notes at any price or prices in the open market or otherwise.

Defaults and Remedies. If an Event of Default with respect to Notes shall occur and be

continuing, the principal of the Notes may be declared due and payable in the manner and with the effect provided in the Indenture.

Amendment, Modification and Waiver. The Indenture permits, with certain exceptions as therein provided, the amendment thereof and the

modification of the rights and obligations of the Company and the rights of the Holders of the Notes at any time by the Company and the Trustee with the consent of the Holders of a majority in aggregate principal amount of the Notes at the time

Outstanding. The Indenture also contains provisions permitting the Holders of a majority in aggregate principal amount of the Notes at the time Outstanding, on behalf of the Holders of all Notes, to waive compliance by the Company with certain

provisions of the Indenture and certain past defaults under the Indenture and their consequences. Any such consent or waiver by the Holder of this Note shall be conclusive and binding upon such Holder and upon all future Holders of this Note and of

any Note issued upon the registration of transfer hereof or in exchange herefor or in lieu hereof, whether or not notation of such consent or waiver is made upon this Note.

Restrictive Covenants. The Indenture does not limit the incurrence of additional debt by the Company or any of its Subsidiaries;

however, it does limit the creation of certain Liens and the entry into sale and leaseback transactions by the Company or any of its Restricted Subsidiaries. The limitations are subject to a number of important qualifications and exceptions. Once a

year, the Company must report to the Trustee on its compliance with these limitations.

Denominations, Transfer and

Exchange. The Notes are issuable only in registered form without coupons in minimum denominations of $2,000 and in integral multiples of $1,000 in excess thereof. As provided in the Indenture and subject to certain limitations therein set forth,

Notes are exchangeable for a like aggregate principal amount of Notes of any different authorized denomination or denominations, as requested by the Holder surrendering the same.

As provided in the Indenture and subject to certain limitations therein set forth, including Section 3.06 of the Base Indenture,

the transfer of this Note is registerable in the Register, upon surrender of this Note for registration of transfer at the Registrar accompanied by a written request for transfer in form satisfactory to the Company and the Registrar duly executed by

the Holder hereof or his attorney duly authorized in writing, and thereupon one or more new Notes of any different authorized denomination or denominations and for the same aggregate principal amount, shall be issued to the designated transferee or

transferees.

No service charge shall be made for any such registration of transfer or exchange, but the Company or the Trustee may

require payment of a sum sufficient to cover any tax or other governmental charge payable in connection therewith.

Persons Deemed

Owners. Prior to due presentment of this Note for registration of transfer, the Company, the Trustee and any agent of the Company or the Trustee may treat the Person in whose name this Note is registered as the owner hereof for the purpose of

receiving payment of principal of and premium, if any, and (subject to Section 3.08 of the Base Indenture) interest, if any, on such Note and for all other purposes whatsoever, whether or not this Note be overdue, and neither the Company, the

Trustee nor any agent shall of the Company or the Trustee shall be affected by notice to the contrary.

Defined Terms. All terms used in this Note and not defined herein shall have the meanings

assigned to them in the Indenture.

OPTION OF HOLDER TO ELECT PURCHASE

If you want to elect to have this Note purchased by the Company pursuant to the provisions hereof, check the box: ¨

If you want to elect to have only part of the Note purchased by the Company pursuant to the

provisions hereof, state the amount you elect to have purchased: $

Date:

|

|

|

|

|

|

|

Your |

|

|

|

|

Signature: |

|

|

|

|

|

|

(Sign exactly as your name appears on the face of this Note) |

|

|

|

|

|

Tax |

|

|

|

|

Identification |

|

|

|

|

No.: |

|

|

| * |

Participant in a recognized Signature Guarantee Medallion Program (or other signature guarantor acceptable to the Trustee). |

Exhibit 5.1

November 17, 2015

Moody’s Corporation

7 World Trade Center at 250 Greenwich Street

New York, New York,

10007

| |

$300,000,000 of 5.250% Senior Notes due 2044 |

Ladies and Gentlemen:

We have examined the Registration Statement on Form S-3, file no. 190259 (the “Registration Statement”) of Moody’s Corporation (the

“Company”), filed with the Securities and Exchange Commission (the “Commission”) pursuant to the Securities Act of 1933 (as amended, the “Securities Act”), the prospectus included therein, the

prospectus supplement, dated November 12, 2015, filed with the Commission on November 12, 2015 pursuant to Rule 424(b) of the Securities Act (the “Prospectus Supplement”), in connection with the offering and sale by the Company of

$300,000,000 aggregate principal amount of the Company’s 5.250% Senior Notes due July 15, 2044 (the “Notes”).

The Notes have been

issued pursuant to the Indenture dated as of August 19, 2010 (as so amended prior to the date hereof, the “Base Indenture”), between the Company and Wells Fargo Bank, National Association, as trustee (the

“Trustee”), as supplemented by the Fourth Supplemental Indenture, dated July 16, 2014 (the “Supplemental Indenture” and together with the Base Indenture, the “Indenture”) between the Company and the

Trustee.

In arriving at the opinions expressed below, we have examined originals, or copies certified or otherwise identified to our satisfaction as

being true and complete copies of the originals, of the Base Indenture, the Supplemental Indenture and the Notes and such other documents, corporate records, certificates of officers of the Company and of public officials and other instruments as we

have deemed necessary or advisable to enable us to render these opinions. In our examination, we have assumed, without independent investigation, the genuineness of all signatures, the legal capacity and competency of all natural persons, the

authenticity of all documents submitted to us as originals and the conformity to original documents of all documents submitted to us as copies. As to any facts material to these opinions, we have relied to the extent we deemed appropriate and

without independent investigation upon statements and representations of officers and other representatives of the Company and others.

Based upon the

foregoing, and subject to the assumptions, exceptions, qualifications and limitations set forth herein, we are of the opinion that the Notes are legal, valid and binding obligations of the Company, enforceable against the Company in accordance with

their terms.

Moody’s Corporation

November 17, 2015

Page 2

The opinion expressed above is subject to the following additional exceptions, qualifications, limitations

and assumptions:

A. We render no opinion herein as to matters involving the laws of any jurisdiction other than the State of New York.

This opinion is limited to the effect of the current state of the laws of the State of New York and the facts as they currently exist. We assume no obligation to revise or supplement this opinion in the event of future changes in such laws or the

interpretations thereof or such facts.

B. The opinion above is subject to (i) the effect of any bankruptcy, insolvency,

reorganization, moratorium, arrangement or similar laws affecting the rights and remedies of creditors’ generally, including the effect of statutory or other laws regarding fraudulent transfers or preferential transfers, and (ii) general

principles of equity, including concepts of materiality, reasonableness, good faith and fair dealing and the possible unavailability of specific performance, injunctive relief or other equitable remedies regardless of whether enforceability is

considered in a proceeding in equity or at law.

C. We express no opinion regarding the effectiveness of (i) any waiver of stay,

extension or usury laws or of unknown future rights, (ii) provisions relating to indemnification, exculpation or contribution, to the extent such provisions may be held unenforceable as contrary to public policy or federal or state securities

laws; (iii) any waiver of the right to jury trial; or (iv) any provision to the effect that every right or remedy is cumulative and may be exercised in addition to any other right or remedy or that the election of some particular remedy does not

preclude recourse to one or more others.

We consent to the filing of this opinion as an exhibit to the Registration Statement, and we further consent to

the use of our name under the caption “Validity of Securities” in the Registration Statement and “Validity of Notes” in the Prospectus Supplement. In giving these consents, we do not thereby admit that we are within the category

of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

Very

truly yours,

/s/ Gibson, Dunn & Crutcher LLP

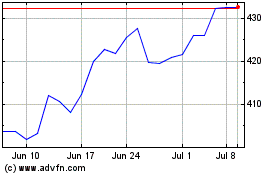

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

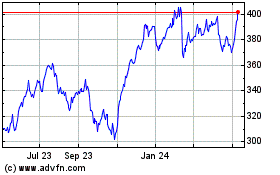

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024