2016 Fourth Quarter Key

Highlights

- Sales for the fourth quarter increased

3 percent to $1.8 billion; in local currencies, sales increased 4

percent

- Gross margin improved to 32.6 percent

from 31.0 percent

- Earnings per share for the quarter grew

36 percent to $0.30 per common share; adjusted earnings per share

grew 14 percent to $0.33 per common share

- Repurchased 6.6 million shares for $207

million

Masco Corporation (NYSE: MAS), one of the world’s leading

manufacturers of branded home improvement and building products,

reported net sales and operating profit growth for the fourth

quarter and full year of 2016.

2016 Fourth Quarter

Commentary

- On a reported basis, compared to fourth

quarter 2015:

- Net sales from continuing operations

increased 3 percent to $1.8 billion

- In local currency, North American sales

increased 3 percent and international sales increased 8

percent

- Gross margin improved to 32.6 percent

from 31.0 percent

- Operating margin decreased to 12.2

percent from 12.4 percent, reflecting planned growth and

incremental insurance costs

- Income from continuing operations was

$0.30 per common share compared to $0.22 per common share

- Compared to fourth quarter 2015,

results for key financial measures, as adjusted for certain items

(see Exhibit A) and with a normalized tax rate of 36 percent, were

as follows:

- Gross margin improved to 32.8 percent

compared to 31.3 percent

- Operating margin decreased to 12.6

percent compared to 12.8 percent

- Income from continuing operations was

$0.33 per common share compared to $0.29 per common share

- Liquidity at the end of the fourth

quarter was approximately $1.2 billion

2016 Fourth Quarter Operating Segment

Highlights

- Plumbing Products’ net sales increased

5 percent (7 percent excluding the impact of foreign currency

translation), driven by growth in North America and

internationally

- Decorative Architectural Products’ net

sales increased 5 percent with strong volume growth partially

offset by promotional activity

- Cabinetry Products’ net sales decreased

8 percent (7 percent excluding the impact of foreign currency

translation) due to the exit of lower margin business in the

direct-to-builder channel, partially offset by growth in the retail

and dealer channels and favorable product mix

- Windows and Other Specialty Products’

net sales decreased 2 percent. Excluding the impact of foreign

currency translation, net sales increased 2 percent, led by both

our international and North American windows businesses

“We finished the year with good fourth quarter results,” said

Keith Allman, Masco’s President and CEO. “Our Plumbing Products

segment had another record quarter on both the top and bottom

lines, demonstrating the strength of our brands and our innovative

products. Our Decorative Architectural Products segment posted

solid 5 percent growth in the quarter, and we executed our planned

investment to drive future profitable growth. Our Cabinetry

Products segment continued its strategy of exiting certain

direct-to-builder business, introducing new products, and driving

growth with our market-leading Merillat® and KraftMaid® brands. We

began to see improvements in the operations of our U.S. window

business, and we continued our disciplined capital allocation by

returning approximately $240 million to shareholders through share

repurchases and dividends during the quarter.”

2016 Full Year Key

Highlights

- Sales for the year increased 3 percent

to $7.4 billion; in local currencies, sales increased 4

percent

- Operating profit grew 15 percent to

$1,053 million; adjusted operating profit grew 16 percent to $1,075

million

- Operating profit margin for the year

increased to 14.3 percent, a 150 basis point expansion; adjusted

operating profit margin increased to 14.6 percent, a 160 basis

point expansion

- Earnings per share from continuing

operations for the year grew 43 percent to $1.47 per common share;

adjusted earnings per share from continuing operations grew 27

percent to $1.51 per common share

2016 Full Year

Commentary

- On a reported basis, compared to full

year 2015:

- Net sales from continuing operations

increased 3 percent to $7.4 billion

- In local currency, North American sales

increased 3 percent and international sales increased 6

percent

- Gross margin improved to 33.4 percent

from 31.5 percent

- Operating margin increased to 14.3

percent from 12.8 percent

- Income from continuing operations was

$1.47 per common share compared to $1.03 per common share

- Compared to full year 2015, results for

key financial measures, as adjusted for certain items (see Exhibit

A) and with a normalized tax rate of 36 percent, were as follows:

- Gross margin improved to 33.6 percent

compared to 31.6 percent

- Operating margin increased to 14.6

percent compared to 13.0 percent

- Income from continuing operations was

$1.51 per common share compared to $1.19 per common share

- Free cash flow was $535 million

“Masco delivered another strong year in 2016,” said Allman. “We

continued to execute against our long-term growth and capital

allocation strategies that we established in 2015. We demonstrated

our ability to capitalize on improving end markets by driving sales

growth and expanding our operating margin. We successfully executed

our plan to reduce leverage by paying down approximately $400

million in debt early in the year, further strengthening our

balance sheet. Lastly, we generated a significant amount of free

cash flow and continued our commitment to return capital to

shareholders by increasing our dividend and repurchasing $459

million of our shares, enabling us to once again generate solid

returns for our shareholders,” continued Allman. “We will continue

to execute our strategy and remain confident in our ability to

drive growth and productivity as we move into 2017.”

About Masco

Headquartered in Taylor, Michigan, Masco Corporation is a global

leader in the design, manufacture and distribution of branded home

improvement and building products. Our portfolio of

industry-leading brands includes Behr® paint; Delta® and Hansgrohe®

faucets, bath and shower fixtures; KraftMaid® and Merillat®

cabinets; Milgard® windows and doors; and Hot Spring® spas. We

leverage our powerful brands across product categories, sales

channels and geographies to create value for our customers and

shareholders. For more information about Masco Corporation, visit

www.masco.com.

The 2016 fourth quarter supplemental material, including a

presentation in PDF format, is available on the Company’s website

at www.masco.com.

Conference Call Details

A conference call regarding items contained in this release is

scheduled for Thursday, February 9, 2017 at 8:00 a.m. ET.

Participants in the call are asked to register five to ten minutes

prior to the scheduled start time by dialing (855) 226-2726

(855-22MASCO) and from outside the U.S. at (706) 679-3614. Please

use the conference identification number 47955207. The conference

call will be webcast simultaneously and in its entirety through the

Company’s website. Shareholders, media representatives and others

interested in Masco may participate in the webcast by registering

through the Investor Relations section on the Company’s

website.

A replay of the call will be available on Masco’s website or by

phone by dialing (855) 859-2056 and from outside the U.S. at (404)

537-3406. Please use the conference identification number 47955207.

The telephone replay will be available approximately two hours

after the end of the call and continue through March 9, 2017.

Safe Harbor Statement

This press release contains statements that reflect our views

about our future performance and constitute “forward-looking

statements” under the Private Securities Litigation Reform Act of

1995. Forward-looking statements can be identified by words such as

“believe,” “anticipate,” “appear,” “may,” “will,” “should,”

“intend,” “plan,” “estimate,” “expect,” “assume,” “seek,”

“forecast,” and similar references to future periods. Our views

about future performance involve risks and uncertainties that are

difficult to predict and, accordingly, our actual results may

differ materially from the results discussed in our forward-looking

statements. We caution you against relying on any of these

forward-looking statements.

Our future performance may be affected by the levels of home

improvement activity and new home construction, our ability to

maintain our strong brands and to develop and introduce new and

improved products, our ability to maintain our competitive position

in our industries, our reliance on key customers, our ability to

achieve the anticipated benefits of our strategic initiatives, our

ability to improve our under-performing U.S. window business, the

cost and availability of raw materials, our dependence on third

party suppliers, and risks associated with international operations

and global strategies. These and other factors are discussed in

detail in Item 1A, “Risk Factors” in our most recent Annual Report

on Form 10-K, as well as in our Quarterly Reports on Form 10-Q and

in other filings we make with the Securities and Exchange

Commission. The forward-looking statements in this press release

speak only as of the date of this press release. Factors or events

that could cause our actual results to differ may emerge from time

to time, and it is not possible for us to predict all of them.

Unless required by law, we undertake no obligation to update

publicly any forward-looking statements as a result of new

information, future events or otherwise.

)

MASCO CORPORATION Condensed Consolidated Statements of

Operations - Unaudited For the Three Months and Twelve

Months Ended December 31, 2016 and 2015

(in millions, except per common share

data)

Three Months Ended Twelve Months Ended

December 31, December 31, 2016

2015 2016 2015 Net sales $ 1,759 $

1,715 $ 7,357 $ 7,142 Cost of sales 1,186 1,183 4,901

4,889 Gross profit 573 532 2,456 2,253

Selling, general and administrative expenses 358 320

1,403 1,339 Operating profit 215 212 1,053 914

Other income (expense), net: Interest expense (43 ) (54 ) (229 )

(225 ) Other, net 1 2 6 — (42 ) (52 )

(223 ) (225 ) Income from continuing operations before income taxes

173 160 830 689 Income tax expense 67 74 296

293 Income from continuing operations 106 86 534 396

Loss from discontinued operations, net — (1 ) —

(2 ) Net income 106 85 534 394 Less: Net income

attributable to noncontrolling interest 8 10 43

39 Net income attributable to Masco Corporation $ 98

$ 75 $ 491 $ 355 Income per

common share attributable to Masco Corporation (diluted): Income

from continuing operations $ 0.30 $ 0.22 $ 1.47 $ 1.03 Loss from

discontinued operations, net — — — (0.01 ) Net

income $ 0.30 $ 0.22 $ 1.47 $ 1.02

Average diluted common shares outstanding 323 335

330 341 Amounts attributable to Masco

Corporation: Income from continuing operations $ 98 $ 76 $ 491 $

357 Loss from discontinued operations, net — (1 ) —

(2 ) Net income $ 98 $ 75 $ 491 $ 355

Historical information is available on our website.

MASCO CORPORATION Exhibit A: Reconciliations -

Unaudited For the Three Months and Twelve Months Ended

December 31, 2016 and 2015 (in millions, except per

common share data) Three Months Ended

Twelve Months Ended December 31, December 31,

2016 2015 2016 2015

Gross Profit,

Selling, General and Administrative Expenses, and Operating Profit

Reconciliations

Net sales $ 1,759 $

1,715 $ 7,357 $

7,142 Gross profit, as reported

$ 573 $ 532 $ 2,456

$ 2,253 Rationalization charges 4 6 14 8 (Gain) on

sale of property and equipment — (2 ) — (5 )

Gross

profit, as adjusted $ 577 $

536 $ 2,470 $

2,256 Gross margin, as reported 32.6 % 31.0 %

33.4 % 31.5 % Gross margin, as adjusted 32.8 % 31.3 % 33.6 % 31.6 %

Selling, general and administrative expenses, as

reported $ 358 $ 320 $

1,403 $ 1,339 Rationalization charges 2

3 8 10

Selling, general and administrative

expenses, as adjusted $ 356 $

317 $ 1,395 $

1,329 Selling, general and administrative

expenses as percent of net sales, as reported 20.4 % 18.7 % 19.1 %

18.7 % Selling, general and administrative expenses as percent of

net sales, as adjusted 20.2 % 18.5 % 19.0 % 18.6 %

Operating profit, as reported $ 215 $

212 $ 1,053 $ 914

Rationalization charges 6 9 22 18 (Gain) on sale of property and

equipment — (2 ) — (5 )

Operating profit, as

adjusted $ 221 $ 219

$ 1,075 $ 927

Operating margin, as reported 12.2 % 12.4 % 14.3 % 12.8 % Operating

margin, as adjusted 12.6 % 12.8 % 14.6 % 13.0 %

Earnings Per

Common Share Reconciliation

Income from continuing operations before income taxes, as

reported $ 173 $ 160 $

830 $ 689 Rationalization charges 6 9 22 18

(Gain) on sale of property and equipment — (2 ) — (5 ) (Gain) from

auction rate securities (2 ) — (3 ) — (Gains) from private equity

funds, net (3 ) (1 ) (5 ) (6 ) (Earnings) from equity investments,

net (1 ) — (2 ) (2 ) Loss from other investments 3 —

3 —

Income from continuing operations before

income taxes, as adjusted 176 166 845

694 Tax at 36% rate (63 ) (60 ) (304 ) (250 ) Less: Net

income attributable to noncontrolling interest 8 10

43 39

Income from continuing operations, as

adjusted $ 105 $ 96

$ 498 $ 405

Income per common share, as adjusted $ 0.33

$ 0.29 $ 1.51

$ 1.19 Average diluted common shares

outstanding 323 335 330 341

Historical information is available on our website.

MASCO CORPORATION Condensed Consolidated Balance Sheets

and Other Financial Data - Unaudited (dollars

in millions) December 31, December

31, 2016 2015 Balance Sheet Assets

Current Assets: Cash and cash investments $ 990 $ 1,468 Short-term

bank deposits 201 248 Receivables 917 853 Inventories 712 687

Prepaid expenses and other 114 72 Total Current Assets 2,934

3,328 Property and equipment, net 1,060 1,027 Goodwill 832

839 Other intangible assets, net 154 160 Other assets 157

310 Total Assets $ 5,137 $ 5,664

Liabilities

Current Liabilities: Accounts payable $ 800 $ 749 Notes payable 2

1,004 Accrued liabilities 658 650 Total Current Liabilities

1,460 2,403 Long-term debt 2,995 2,403 Other liabilities 785

800 Total Liabilities 5,240 5,606

Equity (103

) 58 Total Liabilities and Equity $ 5,137 $ 5,664

As of December 31, December 31,

2016 2015 Other Financial Data Working

Capital Days Receivable days 49 46 Inventory days 54 52 Payable

days 70 69 Working capital $ 829 $ 791 Working capital as a % of

sales (LTM) 11.3 % 11.1 %

Historical information is available on our website.

MASCO CORPORATION Condensed Consolidated Statements of

Cash Flows and Other Financial Data - Unaudited

(dollars in millions) Twelve Months Ended

December 31, 2016 2015 Cash Flows

From (For) Operating Activities: Cash provided by operating

activities $ 814 $ 704 Working capital changes (88 ) (5 ) Net cash

from operating activities 726 699

Cash

Flows From (For) Financing Activities: Retirement of notes

(1,300 ) (500 ) Purchase of Company common stock (459 ) (456 ) Cash

dividends paid (128 ) (126 ) Dividends paid to noncontrolling

interest (31 ) (36 ) Cash distributed to TopBuild Corp. — (63 )

Issuance of TopBuild Corp. debt — 200 Issuance of notes, net of

issuance costs 889 497 Debt extinguishment costs (40 ) — Issuance

of Company common stock 1 2 Excess tax benefit from stock-based

compensation 23 75 Credit Agreement and other financing costs — (3

) Decrease in debt, net (1 ) — Net cash for financing

activities (1,046 ) (410 )

Cash Flows From (For)

Investing Activities: Capital expenditures (180 ) (158 ) Other,

net 56 (31 ) Net cash for investing activities (124 ) (189 )

Effect of exchange rate changes on cash and cash investments

(34 ) (15 )

Cash and Cash Investments: (Decrease)

increase for the period (478 ) 85 At January 1 1,468 1,383

At December 31 $ 990 $ 1,468

As

of December 31, December 31, 2016

2015 Liquidity Cash and cash investments $ 990 $

1,468 Short-term bank deposits 201 248

Total

Liquidity $ 1,191 $ 1,716

Historical information is available on our website.

MASCO CORPORATION Segment Data - Unaudited For the

Three Months and Twelve Months Ended December 31, 2016 and 2015

(dollars in millions)

Three Months Ended Twelve Months Ended December

31, December 31, 2016 2015

Change 2016 2015 Change

Plumbing Products Net sales $ 891 $ 846 5 % $

3,526 $ 3,341 6 % Operating profit, as

reported $ 151 $ 126 $ 642 $ 512 Operating margin, as reported 16.9

% 14.9 % 18.2 % 15.3 % Rationalization charges 2 7

13 9 Operating profit, as adjusted 153 133 655

521 Operating margin, as adjusted 17.2 % 15.7 % 18.6 % 15.6 %

Depreciation and amortization 15 14 57

56 EBITDA, as adjusted $ 168 $ 147 $

712 $ 577

Decorative Architectural

Products Net sales $ 443 $ 420 5 % $ 2,092

$ 2,020 4 % Operating profit, as reported $ 75 $ 85 $

430 $ 403 Operating margin, as reported 16.9 % 20.2 % 20.6 % 20.0 %

Depreciation and amortization 4 4 16 16

EBITDA $ 79 $ 89 $ 446 $ 419

Cabinetry Products Net sales $ 234 $

254 (8 )% $ 970 $ 1,025 (5 )% Operating

profit, as reported $ 16 $ 19 $ 93 $ 51 Operating margin, as

reported 6.8 % 7.5 % 9.6 % 5.0 % Rationalization charges 3 2

8 5 (Gain) on sale of property and equipment — (2 ) —

(5 ) Operating profit, as adjusted 19 19 101 51 Operating margin,

as adjusted 8.1 % 7.5 % 10.4 % 5.0 % Depreciation and

amortization 6 6 21 24 EBITDA,

as adjusted $ 25 $ 25 $ 122 $ 75

Historical information is available on our website.

MASCO CORPORATION Segment Data - Unaudited For the

Three Months and Twelve Months Ended December 31, 2016 and 2015

(dollars in millions)

Three Months Ended Twelve Months Ended December

31, December 31, 2016 2015

Change 2016 2015 Change

Windows and Other Specialty Products Net sales $ 191

$ 195 (2 )% $ 769 $ 756 2 % Operating

profit (loss), as reported $ 6 $ 7 $ (3 ) $ 57 Operating margin, as

reported 3.1 % 3.6 % (0.4 )% 7.5 % Rationalization charges 1

— 1

— Operating profit (loss),

as adjusted 7 7 (2 ) 57 Operating margin, as adjusted 3.7 % 3.6 %

(0.3 )% 7.5 % Depreciation and amortization 5 5

21 18 EBITDA, as adjusted $ 12 $

12 $ 19 $ 75

Total Net sales $

1,759 $ 1,715 3 % $ 7,357 $ 7,142 3 %

Operating profit, as reported - segment $ 248 $ 237 $ 1,162

$ 1,023 General corporate expense, net (GCE) (33 ) (25 ) (109 )

(109 ) Operating profit, as reported 215 212 1,053 914 Operating

margin, as reported 12.2 % 12.4 % 14.3 % 12.8 %

Rationalization charges - segment 6 9 22 14 Rationalization charges

- GCE — — — 4 (Gain) on sale of property and equipment — (2

) — (5 ) Operating profit, as adjusted 221 219 1,075 927

Operating margin, as adjusted 12.6 % 12.8 % 14.6 % 13.0 %

Depreciation and amortization - segment 30 29 115 114 Depreciation

and amortization - non-operating 4 4 19 13

EBITDA, as adjusted $ 255 $ 252 $ 1,209

$ 1,054

Historical information is available on our website.

MASCO CORPORATION North American and International Data -

Unaudited For the Three Months and Twelve Months Ended

December 31, 2016 and 2015 (dollars in millions)

Three Months Ended Twelve

Months Ended December 31, December 31,

2016 2015 Change 2016

2015 Change North American Net sales $ 1,389

$ 1,347 3 % $ 5,834 $ 5,645 3 %

Operating profit, as reported $ 212 $ 196 $ 961 $ 841 Operating

margin, as reported 15.3 % 14.6 % 16.5 % 14.9 %

Rationalization charges 3 6 15 10 (Gain) on sale of property and

equipment — (2 ) — (5 ) Operating profit, as adjusted

215 200 976 846 Operating margin, as adjusted 15.5 % 14.8 % 16.7 %

15.0 % Depreciation and amortization 20 20 78

78 EBITDA, as adjusted $ 235 $ 220

$ 1,054 $ 924

International Net

sales $ 370 $ 368 1 % $ 1,523 $ 1,497 2

% Operating profit, as reported $ 36 $ 41 $ 201 $ 182

Operating margin, as reported 9.7 % 11.1 % 13.2 % 12.2 %

Rationalization charges 3 3 7 4

Operating profit, as adjusted 39 44 208 186 Operating margin, as

adjusted 10.5 % 12.0 % 13.7 % 12.4 % Depreciation and

amortization 10 9 37 36 EBITDA,

as adjusted $ 49 $ 53 $ 245 $ 222

Total Net sales $ 1,759 $ 1,715 3 % $

7,357 $ 7,142 3 % Operating profit, as

reported - segment $ 248 $ 237 $ 1,162 $ 1,023 General corporate

expense, net (GCE) (33 ) (25 ) (109 ) (109 ) Operating profit, as

reported 215 212 1,053 914 Operating margin, as reported 12.2 %

12.4 % 14.3 % 12.8 % Rationalization charges - segment 6 9

22 14 Rationalization charges - GCE — — — 4 (Gain) on sale of

property and equipment — (2 ) — (5 ) Operating

profit, as adjusted 221 219 1,075 927 Operating margin, as adjusted

12.6 % 12.8 % 14.6 % 13.0 % Depreciation and amortization -

segment 30 29 115 114 Depreciation and amortization - non-operating

4 4 19 13 EBITDA, as adjusted $

255 $ 252 $ 1,209 $ 1,054

Historical information is available on our website.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170209005165/en/

Investor ContactMasco

CorporationDavid ChaikaVice President, Treasurer and Investor

Relations313.792.5500david_chaika@mascohq.com

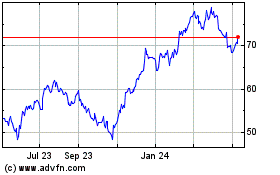

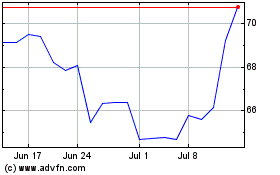

Masco (NYSE:MAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Masco (NYSE:MAS)

Historical Stock Chart

From Apr 2023 to Apr 2024