UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM ll

-

K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK

PURCHASE, SAVINGS AND SIMILAR PLANS

PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

(

Mark

O

ne

)

:

|

|

x

|

ANNU

A

L RE

PORT PURSUA

NT T

O

SE

C

T

I

ON

1

5

(

d

) O

F

T

H

E S

E

CURITI

E

S

E

X

CH

ANG

E

ACT OF

1

93

4

|

|

|

|

|

F

o

r the fis

c

al year ended December 31

,

2015

|

|

|

|

|

OR

|

|

|

|

|

¨

|

TRANSITION REP

O

RT PUR

S

UANT TO SE

C

TION 15

(

d

)

OF THE S

ECU

RIT

I

E

S

EX

CHA

NGE A

C

T

O

F 1934

|

|

|

|

|

For the

t

ransit

i

on p

e

riod from _____________ to _____________

|

|

|

|

|

|

|

|

C

ommission file number 001-05794

|

|

|

|

|

A.

|

Full title of th

e

p

l

an and the addres

s o

f the plan, if di

ff

er

e

nt fr

o

m that of the issuer named below

:

|

|

|

|

|

M

asco

Cor

p

o

ration 4

0

1

(

k

)

Plan

|

|

|

|

|

B.

|

Name

of

issuer o

f

th

e

se

cu

rities held pu

r

suan

t

t

o t

he pla

n

an

d

the address

o

f its prin

ci

pal ex

e

cutive office

:

|

|

|

|

|

Masco Corporation

|

|

21001 Van Born Road

|

|

Taylor, Michigan 48180

|

MASCO CORPORATION 401(k) PLAN

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Pages

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

|

|

|

|

|

Financial Statements:

|

|

|

|

|

|

|

|

Statements of Net Assets Available for Benefits at December 31, 2015 and 2014

|

|

|

|

|

|

|

|

Statement of Changes in Net Assets Available for Benefits for the year ended December 31, 2015

|

|

|

|

|

|

|

|

Notes to Financial Statements

|

|

|

|

|

|

|

|

Supplemental Schedule:

|

|

|

|

|

|

|

|

Schedule H, line 4i - Schedule of Assets (Held at End of Year)

|

|

|

|

|

|

|

|

|

|

|

|

Note: Other schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under ERISA have been omitted because they are not applicable.

|

|

|

Report of Independent Registered Public Accounting Firm

To the Trustee and Participants of

Masco Corporation 401(k) Plan

We have audited the accompanying statements of net assets available for benefit

s

of Masco Corpo

r

ation 401(k) Plan (the "Plan") as of

December 31, 2015

and

2014

,

and the related statement of changes in net assets available for benefits for the year ended

December 31, 2015

. These financial statements are the responsibility of the Plan

'

s mana

g

ement

.

Our responsibility is to express an opinion on these finan

ci

al stat

e

ments based on our aud

i

ts

.

We conducted our audits in accordance with the standards of the Public Company Acco

u

nting Oversight Boa

r

d (United States). T

h

ose standards require that we plan

a

nd perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of

the Plan

'

s interna

l

control over financia

l

reporting

.

Our audit

s

included cons

i

derati

o

n of internal control over financia

l

reporting as a basis fo

r

design

i

ng audit procedures that are appropriate in the ci

r

cumstances, but not for the purpose of expressing an opin

i

on on the effectiveness of the Plan

'

s internal control over financ

i

al reporting

.

Accordingly

,

we express no such opinion

.

An audit al

s

o includes exam

in

ing

,

on a t

e

st basis

,

evidence supporting the amounts and disclosures in the financial statements

,

assessing the accounting principles used and s

i

gnificant estimates made by management

,

as well as evaluating the overall financial statement pres

e

ntation

.

We believe that our audits provide a reasonable basis for our opin

i

on

.

In our opinion

,

the financial statements referred to above present fair

l

y

,

in al

l

material respects

,

the net assets available fo

r

benefits of Masco Corporat

i

on 401(

k

) P

l

an as of

December 31, 2015

and

2014

,

and the changes in net asset

s

avail

ab

le

f

or benefits for the year ended

December 31, 2015

in conformity with accounting principles generally accepted in the United States of America

.

The

s

upplem

e

ntal

i

nformation in the accompanying schedule

,

Schedule H

,

Line 4i

Schedule of Assets (Held at End of Year) as of

December 31, 2015

has been subjected to aud

i

t procedures performed in conjunction with the audit of Masco Corporation 401(k) Plan

'

s fin

a

ncial statements. The supplement

al

information is pre

s

ented for purp

o

ses o

f

addit

i

onal analysis and is not a requi

r

ed part of the basic finan

c

ial statements but include supplemental info

r

mation required by the Department of Labor

'

s Rules and Regulations fo

r

Reporting and Disclosure under the Employee Retirement Income Security Act of 1974

.

The supplementary information is the respon

s

ibilit

y

of the

P

lan

'

s management

.

Our audit procedures included determining whether the supplemental information reconciles

t

o the basic financial statements or the unde

rl

ying accounting and other records

,

as applicable

,

and performing procedures to test the completeness and acc

u

racy of the information presented in the suppleme

n

tal info

r

mation

.

In forming our opinion on the s

u

pplemental information in the accompanying schedule

,

we evaluated whether the supplemental information

,

includ

i

ng its form and content

,

is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirem

e

nt In

co

me Secu

r

ity Ac

t

of 1974. In our opinion

,

the supplemental information referred to above is fairly stated

,

in all material respects

,

in relation to the basic financial statements taken as a whole

.

/s/ Grant Thornton LLP

Southfield

,

Michigan

Jun

e

24

,

2016

MASCO CORPORATION 401(k) PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

December 31, 2015

and

2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

ASSETS

|

|

|

|

|

|

Investments, at fair value:

|

|

|

|

|

|

|

|

|

|

|

|

Collective trust funds

|

|

$

|

366,679,614

|

|

|

$

|

—

|

|

|

Mutual funds

|

|

381,362,460

|

|

|

723,617,881

|

|

|

Stock funds

|

|

18,832,296

|

|

|

16,993,903

|

|

|

Brokerage account

|

|

12,220,129

|

|

|

8,810,489

|

|

|

|

|

|

|

|

|

Total investments

|

|

779,094,499

|

|

|

749,422,273

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

|

|

|

|

|

|

Notes receivable from participants

|

|

24,636,858

|

|

|

19,629,807

|

|

|

Participant contributions

|

|

1,382

|

|

|

192,319

|

|

|

Employer contributions

|

|

20,713,382

|

|

|

3,582,718

|

|

|

|

|

|

|

|

|

Total receivables

|

|

45,351,622

|

|

|

23,404,844

|

|

|

|

|

|

|

|

|

Net Assets Available for Benefits

|

|

$

|

824,446,121

|

|

|

$

|

772,827,117

|

|

The

acco

mpanying notes a

re

an integr

al

part o

f t

he financial stat

e

m

e

n

ts

.

MASCO CORPORATION 401(k) PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

For the year ended

December 31, 2015

|

|

|

|

|

|

|

|

|

Additions:

|

|

|

|

|

|

|

|

Investment activity:

|

|

|

|

Net depreciation in fair value of investments

|

|

$

|

(25,517,869

|

)

|

|

Interest and dividend income

|

|

32,419,799

|

|

|

|

|

|

|

Total investment activity

|

|

6,901,930

|

|

|

|

|

|

|

Participant contributions

|

|

36,126,688

|

|

|

Participant rollover contributions

|

|

3,270,416

|

|

|

Employer contributions

|

|

37,794,966

|

|

|

Interest income on notes receivable from participants

|

|

768,767

|

|

|

Other, net

|

|

80,604

|

|

|

|

|

|

|

Total additions

|

|

84,943,371

|

|

|

|

|

|

|

Deductions:

|

|

|

|

|

|

|

|

Benefit payments

|

|

(84,921,928

|

)

|

|

|

|

|

|

Transfers:

|

|

|

|

|

|

|

|

Net transfers into the Plan (Note A)

|

|

51,597,561

|

|

|

|

|

|

|

Net increase

|

|

51,619,004

|

|

|

|

|

|

|

Net assets available for benefits:

|

|

|

|

|

|

|

|

Beginning of year

|

|

772,827,117

|

|

|

|

|

|

|

End of year

|

|

$

|

824,446,121

|

|

The accompa

nying note

s are an i

ntegral pa

r

t o

f t

h

e

fin

a

n

ci

a

l statements.

MASCO CORPORATION 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

The fol

l

o

w

i

ng description of the

M

asco C

o

rporat

i

on

(

"

Company

"

) 40

1

(k) Plan (

"

Plan

"

)

pr

ovides

o

nly general inf

o

r

mat

i

o

n

.

Part

i

c

i

pants sh

o

uld refer to the Plan document

f

or a m

o

re c

o

mplete descri

pti

o

n of

the Pl

a

n

'

s pro

v

i

sions

.

1.

G

e

n

e

ral

.

Th

e P

l

a

n

is a defi

ne

d

con

t

ri

bution plan

cov

eri

n

g h

o

ur

l

y and salaried

emp

l

o

y

ee

s

at c

e

rtain

div

isi

on

s and subsidiaries

o

f the Compan

y

.

El

i

g

i

ble employees

m

ay pa

r

t

i

c

i

pate in

t

h

e Pl

an on the

i

r

da

t

e o

f

h

ire

.

The

P

la

n

i

s

subj

e

ct t

o

t

h

e pro

v

isi

ons of th

e

Emp

lo

ye

e

Re

ti

re

men

t

I

n

co

me S

e

curit

y Ac

t

o

f 1974

,

as

amend

e

d

(

"

ERI

S

A

"

)

.

2.

Contri

butions

.

Particip

ant

s

m

ay

co

ntribut

e

u

p

to 5

0

percent o

f th

e

ir p

retax

annual co

mpensation

,

as

defi

ne

d i

n

th

e

Pl

an. A

l

l employees who a

re

e

ligibl

e to pa

rticipa

t

e

und

e

r th

i

s Pl

a

n

a

nd who ha

v

e a

ttai

ned the age of 50

bef

o

r

e the clo

se of

the pla

n y

ear

s

hall be eligib

l

e to make c

a

tch

-

u

p con

trib

utions

.

Pa

r

t

i

c

ip

ants

m

ay also mak

e

roll

ov

er

cont

ri

bu

t

i

ons representing dist

r

ibutions from

i

ndivid

u

al IRAs

,

SEP

s

,

4

03(b)

a

n

d 457 p

l

ans

o

r

o

t

her e

m

plo

y

e

r

s

'

tax

qual

ifie

d pl

a

ns. The Compan

y m

ak

es m

atchi

ng and/

or pr

o

f

i

t shar

i

ng cont

ri

buti

o

ns in

ac

c

o

rdanc

e

with

t

h

e p

r

ov

ision

s

of

the

P

lan

.

These Compan

y

co

ntr

i

buti

ons

,

i

f applicabl

e

,

v

ar

y by div

ision or subs

i

d

i

a

ry

and

are i

nvested purs

ua

n

t

t

o

the partic

i

pant

'

s in

v

es

t

men

t

elect

i

on

.

Cont

r

ibu

tio

ns a

re s

ubject to ce

rtai

n Interna

l

Re

v

e

nu

e Serv

i

ce

(

"

IRS

"

)

l

i

mit

ati

ons

.

P

arti

c

ipant

s ma

y direc

t

co

ntrib

ut

i

ons

i

n one pe

r

c

ent in

c

r

e

m

ents in

a

ny of the variou

s inves

tment

option

s.

T

hese options

i

nc

l

ud

e pro

f

ess

i

ona

ll

y m

a

naged mu

t

ual fu

nds

, collective trust funds,

sto

c

k f

u

nds

a

nd a b

r

o

ker

age account

which all

ows

partici

p

a

nts to buy

,

s

e

l

l

or trade

m

os

t pu

b

l

i

c

l

y l

is

t

ed comm

on s

tocks

,

co

rporate

and government bond

s

o

r

c

e

r

t

i

ficates o

f

depos

i

t

;

these o

pti

ons vary in

t

h

eir

resp

ec

t

i

ve

strat

egi

e

s

,

risks a

n

d g

o

a

ls

.

Part

i

cipants

m

ay ch

a

nge thei

r

inv

est

m

e

nt

o

pt

i

o

n

s

d

aily

. At December 31, 2015, profit sharing employer contributions receivable totaled $20,139,828.

3.

P

a

r

ticipa

nt

A

ccoun

ts

.

Each a

ct

i

ve

particip

a

nt

'

s a

cco

u

nt

is cr

ed

ited with the pa

rt

ic

i

pan

t

'

s

cont

ri

buti

on

s a

n

d a

l

loc

a

tions

o

f

(

a

)

th

e C

ompany

'

s

cont

ri

butions

(

i

f app

li

cab

l

e

)

,

and

(

b

)

investm

e

n

t

earnings

,

as

defined

in the Pl

an

.

P

lan adm

i

n

istra

ti

v

e

ex

p

enses ar

e

paid

b

y the Company and n

ot charg

e

d

to

participa

nts

'

account

s

.

Ce

rt

ai

n

expense

s

m

a

y be incurred

by

i

n

d

ivid

ua

l part

ic

ipant

s fo

r

special

ser

v

i

ces re

l

a

tin

g

t

o

the

i

r

accounts

.

Thes

e

costs

are

charg

e

d di

r

e

c

tly to the

i

n

di

vidual part

i

c

i

pa

n

t

'

s

account

.

T

he ben

efit to wh

i

c

h a

pa

r

t

i

ci

pant

i

s entitl

ed

is the be

n

ef

it th

a

t

can be prov

i

d

ed fr

om the p

articipa

nt

'

s

v

es

te

d account

.

4.

V

es

ting a

n

d

F

orf

eited Employer

Con

tribution

s

.

Par

t

icipants are

i

mme

di

ate

l

y vest

e

d in th

ei

r cont

r

ibutions pl

u

s

ac

tual earning

s

ther

eo

n

.

Partici

pa

nts ar

e also

i

mme

d

i

ately v

e

sted in the

C

om

pa

n

y

match

i

ng cont

r

ibuti

on

plus earnin

gs

thereon

.

V

esting

in

Company p

r

o

fit s

haring c

o

ntr

i

bu

t

i

ons

oc

cu

rs a

fter th

r

ee yea

rs of s

ervice comm

enci

ng at d

a

t

e of h

i

re

.

A

t

December 31, 2015

and

2014

,

f

orfe

ited non

vested e

mployer

contribu

t

ions tot

a

l

e

d

$455,844

and

$24,833

,

r

espec

t

ively

.

All forfeit

e

d amoun

ts

wer

e us

e

d in each

s

uccee

din

g

y

ea

r t

o

red

uce employer co

nt

rib

ution

s

.

5.

Voting R

ights

.

Each

parti

cipant w

h

o

has an i

nterest

i

n either the Masco Corporation

Company S

toc

k Fund or the TopBuild Corp. Stock Fund is enti

tle

d

to ex

ercise

vot

i

ng

r

ights

attributa

b

l

e to the sh

ares alloc

ated

to his or

he

r

Company

Stoc

k Fund account

and i

s

n

ot

i

fied

b

y t

he

Tru

s

te

e

(

Fidelit

y Manag

e

ment Tru

st C

o

m

pany

(

"F

idel

i

ty

"

)

as

defi

ne

d by t

he Plan

)

p

r

i

o

r

to th

e tim

e that such

rights

are to be exe

r

c

ise

d

.

If

t

he Tru

s

te

e d

oe

s n

o

t re

c

ei

v

e

timely

i

nstruct

i

on

s

,

the Trustee its

e

l

f

o

r

by proxy sha

ll

vot

e all s

uch

shares in t

he s

a

me rat

i

o

as

the share

s

with

respe

ct to wh

i

ch inst

r

u

ctions

were

r

ec

ei

v

ed fr

o

m pa

r

ti

ci

p

a

nts

.

6.

Notes Re

ce

i

v

a

ble from P

arti

c

i

pants

.

Gen

erally, par

tic

i

pant

s may borrow fr

o

m their accoun

t a

m

in

i

m

u

m

of

$

1

,

0

0

0 up t

o

a

m

axim

u

m

eq

u

al t

o the lesser of $50,000 or 5

0

perc

ent o

f their

ves

t

e

d ac

co

unt bala

nce at

th

e t

ime of the loan

.

Loan terms g

en

e

rally

range fr

om

1-

5

ye

ars, or up

to 20 yea

rs in lim

ite

d circumstance

s

.

The

loans a

re co

ll

ate

rali

z

ed b

y the

b

al

ance in

t

h

e

participant

'

s account

a

n

d ge

n

era

lly bear inte

rest at

a

r

a

t

e equa

l to the

Prime R

a

t

e on t

he la

s

t bus

i

n

ess da

y of

t

he month

pri

or to the

da

te o

f the l

oa

n

a

pplicati

on

.

Princip

al a

n

d

interest ar

e pai

d ratably t

h

rou

g

h

pa

y

r

o

ll dedu

c

ti

on

s

.

7.

Pay

m

e

nt of

Be

nefit

s.

G

e

ne

r

ally

,

afte

r separa

tion from

service due

to

terminati

o

n, de

a

t

h

, disabilit

y o

r

r

et

ir

e

m

ent

,

a p

a

r

t

i

cip

a

nt

may elect t

o

receive an a

mo

un

t e

qual to the

va

l

u

e

of th

e partici

pant

'

s ve

sted interest in his or her a

c

c

o

u

nt i

n either a single

l

ump-sum amoun

t o

r in

an

nual installment

s

over a peri

o

d n

o

t

to

exceed fi

v

e

ye

ar

s.

In

-

ser

v

i

c

e

an

d h

a

rdship withdrawa

ls

are distrib

uted in a

s

i

ngle p

ayment

.

MASCO CORPORATION 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

|

|

|

|

A.

|

DESCRIPTION OF PLAN (Concluded)

|

8.

Transfe

r

s.

On March 20, 2015

,

certai

n participants

'

a

ccounts of

t

he Ma

sco Corpora

tion Fut

ure Ser

v

i

ce P

r

ofit Sh

ari

ng P

l

an and Masco Corpora

t

ion M

aster Defi

ned Cont

r

i

butio

n Plan were mer

ge

d into the P

l

a

n

.

Pa

r

t

i

c

i

pants

i

n

the

Masco Corpo

ratio

n Future Servic

e Pr

ofit Sharing P

l

an and Masco Corporat

i

on Maste

r

Defined

C

ontribut

i

on Plan b

e

c

a

me participants in the P

l

an

. As a result of the merger, transfers of net assets into the Plan totaled $208,063,005. On June 30, 2015, the Company completed the spin off of its Installation and Other Services business into an independent, publicly-traded company named TopBuild Corp. ("TopBuild") through a tax-free distribution of the stock of TopBuild to the Company's stockholders.

Upo

n TopBu

ild

'

s sepa

ration f

rom the Company

,

certain part

i

cip

ant

s

'

account balanc

es

were trans

ferred

out of the Plan

i

nto a newly create

d

p

la

n for TopBuild em

p

loyees

. As a result of the spin off, transfers of net assets out of the Plan totaled $155,726,684. During 2015, other transfers of net assets out of the Plan totaled $738,760.

Total transf

ers o

f net ass

et

s into th

e

Plan am

o

un

ted

t

o

$51,597,561

f

o

r

the ye

ar ended

December 31, 2015

.

|

|

|

|

B.

|

S

UMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

T

he following i

s a summ

ar

y

of sig

n

i

fic

a

nt acco

u

nt

ing

po

li

c

i

e

s

(

in a

cco

rdan

ce

w

it

h

acco

unting pri

nciples gen

erally ac

cepted in the Un

ited

State

s

o

f Am

e

rica

(

"

GAAP

"

)

f

ollow

ed in

the p

re

parat

i

o

n of t

he

s

e f

i

nancial

state

m

e

nts

.

Basis

o

f Ac

co

un

t

in

g.

The accompa

ny

in

g

f

i

n

a

n

c

ial st

a

t

e

m

ent

s

are

prepared

on

t

he ac

crual basis

o

f

ac

counting.

Use of

Est

imates.

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and reported amounts of additions and deductions during the reporting period. Actual results could differ from these estimates and assumptions.

Risks a

n

d Uncertainties.

The Pla

n

provides for

v

ar

i

ous in

v

estment options in collective trust funds, mut

ua

l fund

s an

d oth

er i

nvestm

ent

secu

r

i

tie

s

.

Inv

es

tment sec

uri

ties a

r

e exposed to var

ious

r

i

sk

s

,

i

ncludin

g

interest rate

,

ma

r

ket a

n

d credit risks

.

Due

t

o the lev

e

l of ris

k

ass

o

ciat

e

d with ce

r

tain collective trust funds,

m

utu

a

l fun

d

s and in

v

estment securities and th

e l

e

v

el o

f un

c

e

r

ta

i

nty related t

o c

hanges i

n

the val

u

e o

f

in

v

es

t

ment securiti

e

s

,

it is reasonab

l

y poss

i

b

l

e

t

hat changes in risks in the n

e

ar term could mater

ia

lly affec

t p

artic

ipan

ts

'

account ba

l

ance

s

a

n

d t

h

e

am

ounts re

p

orted in

t

he statem

ents

o

f

n

et a

ssets

avai

lable

f

o

r

benefits

a

nd the st

at

ement o

f

changes in net asse

ts a

vai

l

a

b

l

e

for ben

efi

ts

.

I

n

v

estment

V

a

l

uat

i

on and Income

R

e

co

gnition.

I

nvest

ments

are s

ta

ted at fa

i

r va

l

ue as dete

r

min

e

d by Fide

lit

y Pric

ing a

nd Ca

sh M

anagem

ent

Servic

es

,

Inc

. Mutual funds and common stock are valued

u

s

ing quoted market p

ri

ces at

December 31, 2015

a

nd

2014

. The fair values of the collective trust funds are determined

on a daily basis by the Trustee using the net asset value ("NAV") of units held of the funds. The NAV is

based on the fair value of the underlying investments held by each collective trust fund less its liabilities.

I

n

v

es

tm

e

nt

transact

i

ons are r

e

fle

c

te

d

on a

t

ra

d

e

-

d

a

te ba

si

s

.

Interest inc

o

me i

s

recogni

ze

d on the accrua

l

ba

si

s of accounting

.

Div

i

dend income is reco

rde

d on th

e e

x

-

div

id

e

nd

da

t

e

.

Income

f

rom othe

r

sec

uri

t

i

e

s i

s

r

eco

rde

d as e

arned

on

a

n

accrual

bas

is

.

The Plan p

r

esents in the stat

e

ment

of

ch

a

nges i

n

n

e

t assets available for benef

i

ts

t

he ne

t a

pprec

i

at

i

o

n

(

depreciati

o

n

)

in the fair v

a

lue

o

f it

s

in

v

estm

e

nts

,

which consist

s

of the rea

li

zed ga

in

s or losses and the un

rea

lized a

ppr

eciatio

n (d

epre

ci

a

ti

on) of

th

ose inve

s

tments

.

Notes R

ece

ivable f

r

om Participan

t

s.

Notes

r

ecei

v

ab

l

e f

r

om pa

r

tic

i

pants are measu

r

ed at their unp

a

id princi

pa

l balanc

e

p

l

us any

a

ccrued bu

t u

npaid

in

tere

s

t

. I

nterest income is r

ec

orded on

the

a

c

cru

al b

as

i

s

.

De

linquen

t

notes rec

e

ivab

l

e

fr

o

m

part

i

c

ip

ants ar

e r

ecorde

d

a

s b

ene

fi

t

paymen

ts b

ased upon the term

s

of the P

la

n.

Payment of Benefit

s.

B

enef

i

t

s ar

e

r

eco

r

d

e

d when p

a

i

d.

MASCO CORPORATION 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

|

|

|

|

B.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Concluded)

|

Recently Issued

Account

i

n

g Prono

unc

e

me

n

ts.

I

n

May 2015, th

e

Fi

nanc

ial Acc

ount

i

ng S

t

an

da

r

ds B

o

ard ("FASB") i

ss

ue

d Accounting Standards Update 2015-07 ("ASU 2015-07")

, "Fair Value Measurement (Topic 820): Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent)", which exempts investments measured using the NAV (or its equivalent) practical expedient in ASC 820, Fair Value Measurement, from categorization within the fair value hierarchy.

The guidance is effective for the Plan for fiscal years beginning after December 15, 2015 and shall be applied retrospectively to all periods presented. The Plan's administrator is currently evaluating the impact adoption of the standard will have on the Plan's financial statements.

In July 2015,

th

e

FASB i

ss

ue

d Accounting Standards Update 2015-12 ("ASU 2015-12")

, "Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), and Health and Welfare Benefit Plans (Topic 965): Part (I) Fully Benefit-Responsive Investment Contracts, Part (II) Plan Investment Disclosures, Part (III) Measurement Date Practical Expedient". This three-part standard simplifies employee benefit plan reporting with respect to fully benefit-responsive investment contracts and plan investment disclosures, and provides for a measurement-date practical expedient. We retrospectively adopted Part II of the new standard as of December 31, 2015. As a result of the retrospective adoption of Part II of this standard, we removed the disclosures for individual investments greater than 5 percent of net assets, removed the aggregation of net appreciation (depreciation) by type of investment in the Plan's investments disclosure (Note C), and grouped our investments only by general type, as opposed to disaggregating by nature and risk (Note D). Parts I and III are not applicable to this Plan.

During

2015

, t

he Pl

an

'

s in

v

estmen

t

s

(

in

c

luding realized gains an

d

l

osse

s on investments sold during the year, as well as unrealized appreciation (depreciation) on investments held at year-end) depreciated in value by

$25,517,869

.

At

December 31, 2015

, the s

tock funds were mad

e u

p

o

f the Masco Corporat

io

n Company Stock Fund totaling

$16,988,932

(which was comprised exclusively of Masco Corporation Common Stock), and the TopBuild Corp. Stock Fund totaling

$1,843,364

. At

December 31, 2014

,

the

stock funds were mad

e u

p exclusively of Masco Corporation Common Stock Fund, which was comprised

o

f Masco Corporat

io

n

Co

mmon Sto

c

k t

ota

ling

$16,707,828

,

and cash and m

o

ne

y

market investments

o

f

$286,075

.

|

|

|

|

D.

|

FAIR VALUE MEASUREMENTS

|

Accounting Poli

cy

.

T

he

Plan foll

ows

f

a

i

r v

alue

g

uidan

ce (

A

SC 820)

that defin

es fa

ir value

,

es

tab

l

ishes

a fra

mewor

k

for

measuring f

a

ir

val

u

e

and expa

nds

d

i

sclosures about f

air v

alue meas

urem

en

ts

. T

h

e

g

uida

nce d

efin

e

s fair val

ue as

"t

h

e price tha

t wou

l

d be

received

to se

ll

an a

sset or

p

aid

to tr

ansf

e

r a

li

ab

i

l

ity in

an orderl

y t

r

an

s

act

i

on

bet

w

ee

n mark

e

t part

icipa

n

ts

at the

m

e

as

u

r

e

ment dat

e

." Fur

t

her

,

i

t de

f

ine

s

a fai

r

v

al

u

e

h

i

era

r

ch

y

,

a

s follo

w

s

:

L

e

v

e

l l inpu

ts as qu

ote

d

p

ri

c

es in a

c

ti

ve

ma

rket

s

fo

r ide

nt

i

cal asset

s or liab

iliti

e

s

;

Leve

l 2 inp

u

t

s as ob

ser

v

a

b

le inpu

t

s

ot

h

e

r than Le

vel 1

p

rices

, such as

quot

e

d ma

rket prices

fo

r

s

imi

l

ar assets

o

r liab

i

lities

o

r

oth

e

r

i

n

p

u

ts that ar

e observ

able or can

be

c

o

rroborated b

y ma

rk

et

data; and Le

ve

l

3

i

n

p

ut

s as unobser

v

abl

e

inputs that are supported by little

or no

market act

ivi

t

y a

nd

t

hat are fi

na

n

c

i

a

l instruments whose value is determin

e

d u

s

ing pricing m

o

d

e

ls or ins

t

rumen

t

s for which the determination

of fa

ir

v

al

u

e r

e

quires

si

gni

f

icant

m

a

n

a

g

e

me

nt judgment

o

r

e

stimation

.

A

desc

ri

ption

of the

valua

ti

on metho

dol

o

gi

e

s u

sed fo

r assets m

e

asur

ed at f

air value is as follows:

Collective trust funds:

Valued based on NAV, which approximates fair value as of

December 31, 2015

. Such basis is determined by reference to the fund’s underlying assets, which are primarily marketable equity and fixed income securities.

Mutual funds:

Valu

e

d at the daily

c

losing price as rep

o

rt

e

d by the fund

.

Mutual funds held by th

e

Plan are open

-

end mutual fun

d

s that are r

e

gistered with the

S

ecurities and E

xc

ha

nge

Commissi

o

n. T

hese

funds are r

equi

r

ed to

publish t

he

ir d

a

ily

NAV

and

t

r

a

n

s

ac

t at

tha

t

pric

e

. Th

e

m

u

tual funds

h

eld b

y

the Plan ar

e de

e

med to

be acti

v

e

ly

tr

aded

.

MASCO CORPORATION 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

|

|

|

|

D.

|

FAIR VALUE MEASURMENTS (Continued)

|

Stock funds

:

V

al

ue

d at

t

he

c

l

o

s

ing p

r

ice re

p

o

rted on

the

a

ctive

market on whi

c

h th

e

individual s

ec

u

ri

ties are

t

ra

d

e

d

.

B

r

ok

erage acc

ount

:

Part

icipant dir

ected inve

stments

coul

d

inclu

de c

o

mm

on

st

ocks

, mutual funds, c

o

rpo

rate o

r go

v

er

nment b

o

nds o

r other i

nvestment

s.

T

h

e methods desc

r

ib

e

d ab

o

v

e

m

a

y

pr

oduc

e

a

f

air

value ca

lcu

lat

io

n that may not be

i

ndicative of

n

et

r

ealizable

va

lu

e or re

flective

of

f

ut

ure fair values

.

Furthermore

,

while t

h

e Pla

n

belie

v

e

s

i

ts

va

l

uation meth

o

d

s are

appropriate and consistent with oth

er

market partici

p

ants

,

the use of dif

f

er

e

nt methodologies or assumptions to d

e

term

in

e the fair

v

alue of certain fina

nc

i

a

l

i

nstruments cou

l

d result in a dif

fe

re

nt

fair value

me

a

su

r

e

m

e

nt at the rep

o

r

t

in

g

da

t

e.

T

h

e f

ollowing table sets fort

h by

l

ev

e

l

,

w

it

hi

n t

h

e fair value hierarchy

,

th

e P

l

a

n

's

assets at fair value as

o

f

December 31, 2015

and

2014

.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of December 31, 2015

|

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|

Collective trust funds

|

$

|

—

|

|

$

|

366,679,614

|

|

$

|

—

|

|

$

|

366,679,614

|

|

|

Mutual funds

|

381,362,460

|

|

—

|

|

—

|

|

381,362,460

|

|

|

Stock funds

|

18,832,296

|

|

—

|

|

—

|

|

18,832,296

|

|

|

Br

ok

e

r

a

ge account

|

12,220,129

|

|

—

|

|

—

|

|

12,220,129

|

|

|

Total assets at fair value

|

$

|

412,414,885

|

|

$

|

366,679,614

|

|

$

|

—

|

|

$

|

779,094,499

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of December 31, 2014

|

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|

Mutual funds

|

$

|

723,617,881

|

|

$

|

—

|

|

$

|

—

|

|

$

|

723,617,881

|

|

|

Stock funds

|

16,993,903

|

|

—

|

|

—

|

|

16,993,903

|

|

|

Br

ok

e

r

a

ge account

|

8,810,489

|

|

—

|

|

—

|

|

8,810,489

|

|

|

Total assets at fair value

|

$

|

749,422,273

|

|

$

|

—

|

|

$

|

—

|

|

$

|

749,422,273

|

|

MASCO CORPORATION 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

|

|

|

|

D.

|

FAIR VALUE MEASUREMENTS (Concluded)

|

The following table summarizes investments measured at fair value using the NAV per share practical expedient as of

December 31, 2015

.

Were the Plan to initiate a full redemption of the collective trust, the investment adviser reserves the right to temporarily delay withdrawal from the trust in order to ensure the securities liquidations will be carried out in an orderly business manner.

|

|

|

|

|

|

|

|

|

|

|

December 31, 2015

|

Fair Value

|

Unfunded Commitments

|

Redemption Frequency (if currently eligible)

|

Redemption Notice Period

|

|

Collective trust funds:

|

|

|

|

|

|

FIAM Small Capitalization Core Commingled Pool Class D

1

|

$

|

18,899,365

|

|

None

|

Daily

|

30 days

|

|

Fidelity® Diversified International Commingled Pool

|

$

|

39,621,056

|

|

None

|

Daily

|

90 days

|

|

Fidelity® Low-Priced Stock Commingled Pool

|

$

|

34,917,532

|

|

None

|

Daily

|

90 days

|

|

FIAM Target Date 2005 Commingled Pool Class X

1

|

$

|

869,651

|

|

None

|

Daily

|

30 days

|

|

FIAM Target Date 2010 Commingled Pool Class X

1

|

$

|

5,746,184

|

|

None

|

Daily

|

30 days

|

|

FIAM Target Date 2015 Commingled Pool Class X

1

|

$

|

10,049,828

|

|

None

|

Daily

|

30 days

|

|

FIAM Target Date 2020 Commingled Pool Class X

1

|

$

|

32,409,331

|

|

None

|

Daily

|

30 days

|

|

FIAM Target Date 2025 Commingled Pool Class X

1

|

$

|

30,937,746

|

|

None

|

Daily

|

30 days

|

|

FIAM Target Date 2030 Commingled Pool Class X

1

|

$

|

44,312,008

|

|

None

|

Daily

|

30 days

|

|

FIAM Target Date 2035 Commingled Pool Class X

1

|

$

|

31,328,684

|

|

None

|

Daily

|

30 days

|

|

FIAM Target Date 2040 Commingled Pool Class X

1

|

$

|

28,029,130

|

|

None

|

Daily

|

30 days

|

|

FIAM Target Date 2045 Commingled Pool Class X

1

|

$

|

19,840,956

|

|

None

|

Daily

|

30 days

|

|

FIAM Target Date 2050 Commingled Pool Class X

1

|

$

|

11,234,098

|

|

None

|

Daily

|

30 days

|

|

FIAM Target Date 2055 Commingled Pool Class X

1

|

$

|

2,968,424

|

|

None

|

Daily

|

30 days

|

|

FIAM Target Date 2060 Commingled Pool Class X

1

|

$

|

146,779

|

|

None

|

Daily

|

30 days

|

|

FIAM Target Date Income Commingled Pool Class X

1

|

$

|

5,020,283

|

|

None

|

Daily

|

30 days

|

|

FIAM Core Plus Commingled Pool Class K

1

|

$

|

50,348,559

|

|

None

|

Daily

|

30 days

|

|

Total Investments Measured at NAV

|

$

|

366,679,614

|

|

|

|

|

1

These funds changed their legal names on February 12, 2016. The fund names listed represent the new legal name of the funds.

The IRS determined and informed the Company by letter dated November 6, 2014 that the Plan is designed in accordance with the applicable sections of the Internal Revenue Code ("Code"). The Plan has since been amended; however, the Plan administrator believes that the Plan is currently designed and being operated in compliance with the applicable requirements of the Code. Therefore, no provision for income taxes has been included in the Plan's financial statements.

Acco

un

ti

ng p

r

inciples generall

y

ac

c

ep

t

ed

i

n the United States of Ame

ri

c

a require Pla

n m

a

n

age

ment to evaluate tax pos

i

t

i

o

ns taken b

y

the Plan and recogn

ize a tax liabili

ty if the Plan has take

n

an uncer

t

ai

n

position that more l

i

k

e

ly

t

h

an not would

not b

e s

ustained upon exa

m

inat

i

o

n b

y

the IRS. The Plan admini

s

t

rator has anal

y

zed

th

e

tax positions take

n

b

y

t

he Pla

n

,

and has conclud

e

d

t

h

at as of

December 31, 2015

,

there are n

o

un

c

e

rt

ai

n

positions taken or exp

e

ct

e

d to

be taken that

would r

e

qu

i

re recognition of a

li

ab

ili

t

y

or disclosure

i

n th

e financial state

m

e

n

ts.

The Plan is subject to

r

o

u

tine audits by taxing ju

risdictions; ho

w

e

v

er,

th

e

re

a

re currently no audi

t

s f

o

r

an

y

tax period in prog

ress.

MASCO CORPORATION 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS, Concluded

Altho

ugh the

Company has not

e

xpressed an

i

n

t

e

nt

to do so

,

the Com

pany

h

a

s the right

at an

y time to discontinue its contribu

ti

on

s

a

n

d to terminat

e t

h

e

Plan

,

subjec

t to

the provisions of ERISA

.

At the date o

f

a

n

y such termin

a

t

i

on

,

all partic

ipan

t

s

would become fully vested in their accounts and the Adm

ini

st

r

ative Committ

ee

of the Pl

a

n shall direct the

T

r

u

s

t

ee to

dist

rib

ut

e

to the participant

s

all assets of th

e

Plan

,

net of any t

er

minatio

n

expen

s

e

s

w

hi

ch wi

ll

be prorat

e

d among the partici

pa

nts

'

accou

n

ts

.

|

|

|

|

G.

|

RELATED PARTY TRANSACTIONS

|

Cert

ain Plan

invest

m

ents a

r

e

shar

es of

collective trust funds

and

m

utual funds managed by Fidel

ity

.

Fid

e

l

ity is

also the T

rustee as defin

ed

by

t

he P

l

an and

,

th

eref

ore

,

the purch

ases and

sales qual

ify as pa

rty

-

in

-

interest transactions

.

The

r

e were no fees paid

by the

Pla

n

for

in

v

est

m

e

nt management

ser

v

i

ces for the year ended

December 31, 2015

.

Notes receiv

a

b

le

f

r

om participant

s ar

e also considered party

-i

n

-

interest

t

ran

s

actions.

The Pla

n

inv

e

sts in a Masco Co

r

poration Common Stock Fund

.

As of

December 31, 2015

a

n

d

2014

, t

h

e

v

a

lue of Masco Corporation Comm

o

n Stock Fund was

$16,988,932

and

$16,993,903

,

respect

i

vely

.

On January 1, 2016, Wellness Marketing Corporation was added as a currently participating employer; as a result, $5,656,358 in net assets were transferred into the Plan.

The Plan has evaluated subsequ

e

nt events through th

e

date the financ

ial

s

t

a

t

eme

n

ts wer

e

issued

.

MASCO CORPORATION 401(k) PLAN

SCHEDULE H, LINE 4i - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue,

Borrower or

Similar Party

|

|

(c)

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value and Number of Shares Outstanding

|

|

(d)

Cost*

|

|

(e)

Current Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Artisan Mid Cap Fund

|

|

Mutual Fund

|

|

|

|

|

|

|

|

- Institutional Class

|

|

1,000,736 shares

|

|

|

|

$

|

42,651,357

|

|

|

|

|

JP Morgan Mid Cap Value Fund

|

|

Mutual Fund

|

|

|

|

|

|

|

|

- Institutional Class

|

|

1,093,135 shares

|

|

|

|

37,133,778

|

|

|

|

|

Vanguard Wellington Fund

™

|

|

Mutual Fund

|

|

|

|

|

|

|

|

- Admiral™ Shares

|

|

447,324 shares

|

|

|

|

28,422,943

|

|

|

|

|

Dodge & Cox Stock Fund

|

|

Mutual Fund

|

|

|

|

|

|

|

|

|

|

141,075 shares

|

|

|

|

22,962,790

|

|

|

|

|

Harbor Capital Appreciation Fund

|

|

Mutual Fund

|

|

|

|

|

|

|

|

- Institutional Class

|

|

1,549,986 shares

|

|

|

|

94,254,632

|

|

|

**

|

|

Spartan® Extended Market Index Fund

|

|

Mutual Fund

|

|

|

|

|

|

|

|

- Fidelity Advantage Class

|

|

5,545 shares

|

|

|

|

278,376

|

|

|

**

|

|

Fidelity® Institutional Money Market

|

|

Mutual Fund

|

|

|

|

|

|

|

|

Government Portfolio - Institutional Class

|

|

42,192,108 shares

|

|

|

|

42,192,108

|

|

|

**

|

|

Fidelity® Independence Fund - Class K

|

|

Mutual Fund

|

|

|

|

|

|

|

|

|

|

1,149,024 shares

|

|

|

|

41,353,367

|

|

|

**

|

|

Spartan® 500 Index Fund

|

|

Mutual Fund

|

|

|

|

|

|

|

|

- Institutional Class

|

|

762,526 shares

|

|

|

|

54,756,969

|

|

|

**

|

|

Fidelity® Emerging Markets Fund - Class K

|

|

Mutual Fund

|

|

|

|

|

|

|

|

|

|

529,726 shares

|

|

|

|

11,521,541

|

|

|

**

|

|

Spartan® International Index Fund

|

|

Mutual Fund

|

|

|

|

|

|

|

|

- Fidelity Advantage Class

|

|

60,255 shares

|

|

|

|

2,164,965

|

|

|

**

|

|

Spartan® U.S. Bond Index Fund

|

|

Mutual Fund

|

|

|

|

|

|

|

|

- Fidelity Advantage Class

|

|

319,376 shares

|

|

|

|

3,669,634

|

|

|

**

|

|

Fidelity® Diversified International

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool

|

|

3,737,835 shares

|

|

|

|

39,621,056

|

|

|

**

|

|

Fidelity® Low-Priced Stock

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool

|

|

3,233,105 shares

|

|

|

|

34,917,532

|

|

|

**

|

|

FIAM Small Capitalization Core

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class D

|

|

206,663 shares

|

|

|

|

18,899,365

|

|

|

**

|

|

FIAM Target Date Income

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

412,513 shares

|

|

|

|

5,020,283

|

|

|

**

|

|

FIAM Core Plus

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class K

|

|

2,823,811 shares

|

|

|

|

50,348,559

|

|

|

|

|

|

|

|

|

|

|

|

MASCO CORPORATION 401(k) PLAN

SCHEDULE H, LINE 4i - SCHEDULE OF ASSETS (HELD AT END OF YEAR), Concluded

December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue,

Borrower or

Similar Party

|

|

(c)

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value and Number of Shares Outstanding

|

|

(d)

Cost*

|

|

(e)

Current Value

|

|

|

|

|

|

|

|

|

|

|

|

**

|

|

FIAM Target Date 2005

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

68,261 shares

|

|

|

|

869,651

|

|

|

**

|

|

FIAM Target Date 2010

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

424,386 shares

|

|

|

|

5,746,184

|

|

|

**

|

|

FIAM Target Date 2015

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

745,536 shares

|

|

|

|

10,049,828

|

|

|

**

|

|

FIAM Target Date 2020

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

2,470,223 shares

|

|

|

|

32,409,331

|

|

|

**

|

|

FIAM Target Date 2025

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

2,288,295 shares

|

|

|

|

30,937,746

|

|

|

**

|

|

FIAM Target Date 2030

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

3,392,956 shares

|

|

|

|

44,312,008

|

|

|

**

|

|

FIAM Target Date 2035

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

2,357,313 shares

|

|

|

|

31,328,684

|

|

|

**

|

|

FIAM Target Date 2040

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

2,137,996 shares

|

|

|

|

28,029,130

|

|

|

**

|

|

FIAM Target Date 2045

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

1,505,384 shares

|

|

|

|

19,840,956

|

|

|

**

|

|

FIAM Target Date 2050

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

864,827 shares

|

|

|

|

11,234,098

|

|

|

**

|

|

FIAM Target Date 2055

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

213,096 shares

|

|

|

|

2,968,424

|

|

|

**

|

|

FIAM Target Date 2060

|

|

Collective Trust Fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

15,732 shares

|

|

|

|

146,779

|

|

|

|

|

TopBuild Corp. Stock Fund

|

|

Other Stock Fund

|

|

|

|

|

|

|

|

|

|

59,908 shares

|

|

|

|

1,843,364

|

|

|

**

|

|

Masco Corporation Company Stock Fund

|

|

Company Stock Fund

|

|

|

|

|

|

|

|

|

|

600,316 shares

|

|

|

|

16,988,932

|

|

|

|

|

Brokerage account

|

|

Brokerage Account

|

|

|

|

|

|

|

|

|

|

12,220,129 shares

|

|

|

|

12,220,129

|

|

|

**

|

|

Notes Receivable from Participants

|

|

Ranging 1-20 years maturity with Rates of Interest, 3.25% - 10.5%

|

|

|

|

24,636,858

|

|

|

|

|

|

|

|

|

|

|

$

|

803,731,357

|

|

*

His

t

orical cost informa

tio

n

is no lo

nger req

u

ir

ed on

t

he Sch

edule

o

f

As

se

ts

(

He

l

d a

t En

d o

f Year

)

for

par

t

ic

ipant directed

in

v

es

tme

nts

.

** Th

ese inv

estments are

with a party

-

i

n

-interes

t.

MASCO CORPORATION 401(k) PLAN

SIGNATURE

The Plan

.

Pursuant to t

h

e re

qu

ire

m

ents

o

f t

h

e Sec

u

rities Exchange Act o

f

1

934, the tr

u

s

t

ees

(or other persons

who

adm

i

n

i

s

t

er the employee benefit plan) h

a

v

e duly caused t

h

is a

nnual report to be sig

n

ed

o

n i

t

s behalf by the undersigned h

ere

u

nto duly authorize

d

.

|

|

|

|

|

|

|

|

Masco Corporation 401(k) Plan

|

|

|

|

|

|

|

|

|

By:

|

Masco Corporation, Plan Administrator of the Masco Corporation 401(k) Plan

|

|

|

|

|

|

|

|

|

Date:

|

June 24, 2016

|

By:

|

/s/ John G. Sznewajs

|

|

|

|

|

John G. Sznewajs

|

|

|

|

|

Vice President, Chief Financial Officer

|

|

|

|

|

Authorized Signatory

|

MASCO CORPORATION 401 (k) PLAN

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

23.1

|

|

Consent of Grant Thornton LLP relating to the Plan's financial statements

|

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have issued our report dated June 24

,

2016

,

with respect to the financial statements and supplemental schedule included in

the Annual Report of the Masco Corporation 401(k) Plan on Form ll-K for the year ended December 31, 2015

.

We hereb

y

consent to the incorporation by reference of said report in the Registration Statements of Masco Corporation on Form S-8 (File Nos. 333-74815 and 333-168827).

/s/ Grant Thornton LLP

Southfield, Michigan

June 24, 2016

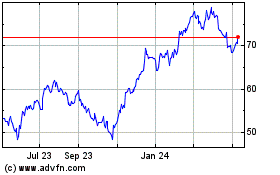

Masco (NYSE:MAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

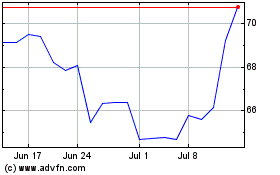

Masco (NYSE:MAS)

Historical Stock Chart

From Apr 2023 to Apr 2024