Current Report Filing (8-k)

June 08 2015 - 4:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 8, 2015

Masco Corporation

(Exact name of registrant as specified in its charter)

|

DELAWARE |

|

001-5794 |

|

38-1794485 |

|

(State or other Jurisdiction of Incorporation) |

|

(Commission

File Numbers) |

|

(IRS Employer

Identification Nos.) |

|

21001 Van Born Road, Taylor, Michigan

(Addresses of Principal Executive Offices) |

|

48180

(Zip Code) |

Registrants’ telephone number, including area code: (313) 274-7400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

Separation of TopBuild

On June 8, 2015, the Board of Directors of Masco Corporation (“Masco”) approved the separation of its installation and other services businesses (the “Separation”), which will be achieved through the distribution of 100% of the shares of its wholly-owned subsidiary, TopBuild Corp. (“TopBuild”), to holders of Masco common stock at the close of business on the record date of June 19, 2015. Masco stockholders of record will receive one share of TopBuild common stock for every nine shares of Masco common stock. The distribution is expected to be completed after the New York Stock Exchange market closing on June 30, 2015, or such other date that the conditions to the distribution set forth in the Separation and Distribution Agreement (described below) are satisfied or waived (the “Distribution Date”). Following the Separation, TopBuild will be an independent, publicly-traded company, and Masco will retain no ownership interest in TopBuild. No fractional shares of TopBuild common stock will be distributed. Fractional shares of TopBuild common stock will be aggregated and sold on the open market, and the aggregate net proceeds of the sales will be distributed ratably in the form of cash payments to Masco stockholders who would otherwise be entitled to receive a fractional share of TopBuild common stock.

The distribution will be made pursuant to the terms of a Separation and Distribution Agreement (the “Separation and Distribution Agreement”) to be entered into between Masco and TopBuild. The Separation and Distribution Agreement sets forth, among other things, the agreements between Masco and TopBuild regarding the principal actions needed to be taken in connection with the Separation. It will also set forth other agreements that govern certain aspects of the relationship between Masco and TopBuild following the Separation. A summary of certain important features of the Separation and Distribution Agreement can be found in the information statement (the “Information Statement”) under the section entitled “The Separation—Agreements with Masco”, which is filed as an exhibit to the Registration Statement on Form 10 (the “Registration Statement”) of TopBuild filed with the Securities and Exchange Commission, which summary is incorporated by reference herein. The summary description of the Separation and Distribution Agreement is qualified in its entirety by reference to the terms and conditions of the Separation and Distribution Agreement, a form of which is filed as an exhibit to the Registration Statement.

In addition to the Separation and Distribution Agreement, Masco and TopBuild will enter into certain ancillary agreements, including an Employee Matters Agreement, a Tax Matters Agreement and a Transition Services Agreement. A summary of certain important features of these agreements can be found in the Information Statement under the section entitled “The Separation—Agreements with Masco,” which summary is incorporated by reference herein. The descriptions of these agreements are qualified in their entirety by reference to the terms and conditions of such agreements, forms of which are filed as exhibits to the Registration Statement.

The summary descriptions of these agreements provide you with information regarding their terms, but are not intended to provide any other factual information about Masco or TopBuild.

A copy of the press release announcing the Separation, including the record date relating thereto, is filed herewith as Exhibit 99.1.

Forward-Looking Statements

Statements contained in this Current Report on Form 8-K that reflect our views about our future performance constitute “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “believe,” “anticipate,” “appear,” “may,” “will,” “should,” “intend,” “plan,” “estimate,” “expect,” “assume,” “seek,” “forecast,” and similar references to future periods. These views involve risks and uncertainties that are difficult to predict and, accordingly, our actual results may differ materially from the results discussed in our forward-looking statements. We caution you against relying on any of these forward-looking statements. Our future performance may be affected by our reliance on new home construction and home improvement, our reliance on key customers, the cost and availability of raw materials, uncertainty in the international economy, shifts in consumer preferences and purchasing practices, our ability to improve our underperforming businesses, our ability to maintain our competitive position in our industries, our ability to reduce corporate expense and simplify our organizational structure and risks associated with the Separation, including that the Separation may not be completed as anticipated or at all, that delays or other difficulties in completing the Separation may be experienced, and whether the Registration Statement is declared effective by the SEC. We discuss many of the risks we face in Item 1A, “Risk Factors” in our most recent Annual Report on Form 10-K, as well as in our Quarterly Reports on Form 10-Q and in other filings we make with the Securities and Exchange Commission. Our forward-looking statements in this Current Report on Form 8-K speak only as of the date hereof. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible

2

for us to predict all of them. Unless required by law, we undertake no obligation to update publicly any forward-looking statements as a result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

Number |

|

Title |

|

99.1 |

|

Press Release dated June 8, 2015. |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MASCO CORP. |

|

|

|

|

|

By: |

/s/ John G. Sznewajs |

|

|

|

Name: |

John G. Sznewajs |

|

|

|

Title: |

Vice President, Treasurer and Chief Financial Officer |

Dated: June 8, 2015

4

EXHIBIT INDEX

|

Exhibit

Number |

|

Title |

|

99.1 |

|

Press Release dated June 8, 2015. |

5

Exhibit 99.1

MASCO CORPORATION APPROVES SPIN-OFF OF TOPBUILD CORP.

Record Date June 19, 2015

TAYLOR, Mich. (June 8, 2015) — Masco Corporation (NYSE:MAS) today announced that its Board of Directors has approved the previously-announced spin-off of TopBuild Corp. (NYSE:BLD), which will, upon completion of the spin-off, hold the assets and operations of Masco’s Installation and Other Services businesses.

In the spin-off, Masco will distribute 100% of the shares of common stock of TopBuild. The distribution of TopBuild shares is expected to be completed after the New York Stock Exchange market closing on June 30, 2015, with Masco stockholders receiving one share of TopBuild common stock for every nine shares of Masco common stock held at the close of business on the record date of June 19, 2015. Following the distribution of TopBuild common stock, TopBuild will be an independent, publicly-traded company. TopBuild has received approval for the listing of its common stock on the New York Stock Exchange under the symbol “BLD.”

Keith Allman, Masco’s President and Chief Executive Officer stated, “Last fall, we announced our plan to spin off TopBuild as part of our strategic initiatives to enhance shareholder value. Under the leadership of Jerry Volas as its Chief Executive Officer, I am confident that TopBuild is well positioned to operate as an independent public company. Following the spin-off, both TopBuild and Masco will have greater flexibility to focus on and pursue their respective growth strategies. For Masco, this is our ongoing commitment to create shareholder value by profitably growing in branded building products.”

Masco stockholders who hold their shares through a brokerage account will receive a credit to their brokerage account reflecting their ownership of TopBuild common stock. Masco stockholders who hold their shares in certificated form will receive a book-entry account statement reflecting their ownership of TopBuild common stock and should retain their Masco stock certificates. Fractional shares of TopBuild common stock will not be distributed. Any fractional share of TopBuild common stock otherwise issuable to a Masco stockholder will be sold in the open market on such stockholder’s behalf, and such stockholder will receive a cash payment for the fractional share based on the stockholder’s pro rata portion of the net cash proceeds from sales of all fractional shares.

Masco will furnish an information statement to all stockholders entitled to receive the distribution of shares of TopBuild common stock. The information statement describes TopBuild and other details regarding the spin-off. The information statement is included as an exhibit to TopBuild’s Registration Statement on Form 10, which it has filed with the Securities and Exchange Commission (SEC) and is available at the SEC’s website at www.sec.gov.

The completion of the distribution is subject to satisfaction of a number of customary conditions, including the SEC having declared effective TopBuild’s Registration Statement on Form 10.

Masco expects to receive an opinion from its special tax counsel, Davis Polk & Wardwell LLP, confirming the tax-free status of the spin-off to Masco and its stockholders (except to the extent of cash received in lieu of fractional shares).

Masco expects that a “when-issued” public trading market for TopBuild common stock will commence on or about June 17, 2015 under the symbol “BLD WI”, and will continue through the distribution date. Masco also anticipates that “regular way” trading of TopBuild common stock will begin on July 1, 2015, the first trading day following the distribution date.

Masco expects that, beginning on or about June 17, 2015, and through the distribution date, there will be two ways to trade Masco common stock — either with or without the distribution of TopBuild common stock. Masco stockholders who sell their shares of Masco common stock in the “regular-way” market (that is, the normal trading market on the NYSE under the symbol “MAS”) after the June 19 record date and on or prior to the June 30 distribution date will be selling their right to receive shares of TopBuild common stock in connection with the spin-off. Masco also expects that shares of Masco common stock will trade ex-distribution (that is, without the right to receive the TopBuild distribution) during this period under the symbol “MAS WI.” Investors are encouraged to consult with their financial advisors regarding the specific implications of buying or selling shares of Masco common stock on or before the distribution date.

Greenhill & Co., LLC and J.P. Morgan Securities LLC acted as financial advisors to Masco regarding the spin-off.

About Masco

Headquartered in Taylor, Michigan, Masco Corporation is one of the world’s leading manufacturers of home improvement and building products.

About TopBuild

TopBuild installs insulation and other building products nationwide through its TruTeam Contractor Services business, which has over 190 installation branches located in 43 states. TopBuild distributes insulation and other building products nationwide through its Service Partners business from its 72 distribution centers located in 35 states. TopBuild is based in Daytona Beach, Florida.

Safe Harbor Statement

Statements contained in this press release that reflect our views about our future performance constitute “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “believe,” “anticipate,” “appear,” “may,” “will,” “should,” “intend,” “plan,” “estimate,” “expect,” “assume,” “seek,” “forecast,” and similar references to future periods. Forward-looking statements include, with respect to the completion of the spin-off of TopBuild, the expected distribution date, the listing of shares of TopBuild common stock on the NYSE, the tax-free nature of the spin-off and the anticipated dates for TopBuild common stock to begin trading on a “when-issued” basis and on a “regular-way” basis and for Masco common stock to begin trading on an “ex-distribution” basis. Our views about future performance involve risks and uncertainties that are difficult to predict and, accordingly, our actual results may differ materially from the results discussed in our forward-looking statements. We caution you against relying on any of these forward-looking statements. Our and TopBuild’s future performance may be affected by our and their reliance on new home construction and home improvement, our and their reliance on key customers, the cost and availability of raw materials, uncertainty in the international economy, shifts in consumer preferences and purchasing practices, our ability to improve our underperforming businesses, our ability to maintain our competitive position in our industries. We discuss many of the risks we face in Item 1A, “Risk Factors” in our most recent Annual Report on Form 10-K, as well as in our Quarterly Reports on Form 10-Q and in other filings we make with the Securities and Exchange Commission. TopBuild discusses many of the risks it faces under the caption “Risk Factors” in the information statement filed as part of its Registration Statement on Form 10. The forward-looking statements in this press release speak only as of the date of this press release. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. Unless required by law, we and TopBuild undertake no obligation to update publicly any forward-looking statements as a result of new information, future events or otherwise.

#####

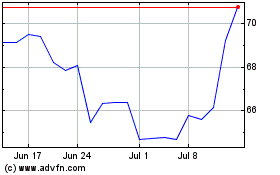

Masco (NYSE:MAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

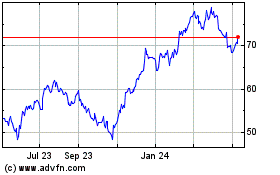

Masco (NYSE:MAS)

Historical Stock Chart

From Apr 2023 to Apr 2024