Esté e Lauder Offers Downbeat View

August 19 2016 - 9:30AM

Dow Jones News

Esté e Lauder Cos. gave a disappointing outlook for its new

business year as the cosmetics company pushes through restructuring

plans, grapples with falling foot traffic at many department stores

and faces weakness in certain foreign markets.

The full-year view follows quarterly earnings and revenue

results that fell short of expectations. Shares fell 3.3% in

premarket trading.

For the year ending in June 2017, the company expects to report

$3.38 to $3.44 in per-share profit, excluding restructuring

charges. The range is short of the $3.53 analysts have projected.

Sales will rise 6% to 7%, the company said, translating to roughly

$12 billion and below the $12.8 billion average analyst

estimate.

The New York makeup company, which owns higher-end lines

including Bobbi Brown, Smashbox and Clinique, set out in May a

range of measures it would implement over the next five years to

boost profitability. Among the moves, Esté e Lauder said it would

cut about 2.5% of its global workforce, strengthen its digital

business and invest more to grow its makeup brands.

The company has acknowledged shifting consumer preferences in

cosmetics and is struggling with a strong U.S. dollar's effect on

pricing in international markets and tourist spending, and it said

Friday that social and political instability in countries such as

France and in some emerging markets has been an additional

headwind.

Meanwhile, Esté e Lauder is feeling the heat from a shifting

retail landscape. Department stores—where many Esté e Lauder

counters are found—and other retailers across the spectrum have

reported sliding sales as shoppers increasingly opt to buy online

and spend less time in stores. Last week, Macy's Inc. said it would

shut 100 more stores, or 15% of its store base, while Nordstrom

Inc. posted its first quarterly sales decline in seven years.

In its latest quarter ended in June, the company said total

sales rose 4.8% from a year earlier, to $2.65 billion. Analysts

were looking for a bigger increase to $2.81 billion. A 10% jump in

makeup sales paced the increase and offset a 2% decline in its

fragrance category.

Over all, Esté e Lauder reported a profit of $93.5 million, or

25 cents a share, down from $153 million, or 40 cents a share, a

year earlier. Excluding restructuring charges and other items,

earnings edged up to 43 cents from 40 cents. Analysts predicted an

adjusted 48 cents a share.

For the current quarter ending in September, the company said it

expects to report 73 cents to 77 cents in adjusted profit per

share, well below the $1.02 average analyst estimate.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

August 19, 2016 09:15 ET (13:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

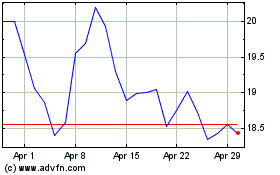

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

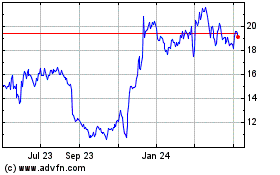

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024