Hudson's Bay Says Sales, Profits Helped by German Acquisition

April 04 2016 - 7:35PM

Dow Jones News

By Suzanne Kapner

Hudson's Bay Co. reported Monday that sales and profits surged

during its year-end period, driven by its acquisition of a large

German department store chain.

Sales jumped 70% to 4.5 billion Canadian dollars (US$3.44

billion) in the three months to Jan. 30, while profit more than

tripled to C$370 million. In September, the retailer completed the

purchase of Galeria Kaufhof Group, the parent of German department

store chain Kaufhof.

Hudson's Bay's Chief Executive Jerry Storch said in an interview

that the retailer's strategy to build out operations in different

geographic markets and at different price points is "working well

in this environment." It now has a sizable business in the U.S.,

Canada and Germany at the luxury, midprice and off-price tiers of

the market, Mr. Storch said.

Hudson's Bay has outperformed rivals, including Macy's Inc. and

Neiman Marcus Group, which posted lackluster sales for their recent

quarters. Yet its shares are down 31% over the past 12 months in a

sign of the pressure facing retailers as they grapple with changes

in consumer buying habits that include more online purchases and a

greater share of disposable income going to restaurants and

travel.

On Monday, Hudson's Bay's shares closed up less than 1% to

C$18.55. The company is scheduled to hold a conference call with

investors Tuesday morning to discuss its results.

The company is continuing to expand in other markets. Saks Fifth

Avenue recently opened its first two stores in Canada, and it plans

to build 40 Saks Off 5th locations, which sell name brands at

discounted prices, in Germany beginning in 2017, according to

Richard Baker, Hudson's Bay's chairman.

As previously reported in February, sales at existing stores

excluding currency fluctuations rose 1.8% in the year-end period.

That figure included a 4% gain at its department store group, which

consists of its namesake stores and Lord & Taylor, a 2% gain at

Saks Off 5th, and a 0.4% rise at Galeria Kaufhof. That helped

offset a 1.2% decline at Saks Fifth Avenue.

Digital sales increased 23% excluding currency moves. In

January, Hudson's Bay bought online flash-sale site Gilt Groupe for

$250 million. Such sites, which offer deep discounts on designer

goods for a limited time, have struggled amid fiercer

competition.

The owner of Beyond the Rack, which had raised millions of

dollars in venture capital financing, filed for protection last

month from creditors after negotiations with a potential buyer fell

through.

Mr. Storch said online flash-sale sites work better when they

are joined with brick-and-mortar retailers that can help them clear

excess inventory and handle returned merchandise. Gilt shoppers can

now return goods to Saks Off 5th stores, a policy that Mr. Storch

said has been well received by customers.

Hudson's Bay has also been working to cash in on the value of

its real estate, a strategy that Macy's is now pursuing at the

urging of activist investor Starwood Value LP.

Last year, Hudson's Bay began creating joint ventures with mall

operators that it eventually plans to spin off into a real-estate

investment trust. Meanwhile, Hudson's Bay has been selling off

pieces of its stake in some of the ventures and using the proceeds

to pay down debt, including one such deal announced last week in

which it sold $50 million of equity in a venture with Simon

Property Group.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

April 04, 2016 19:20 ET (23:20 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

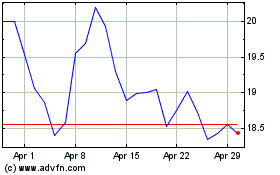

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

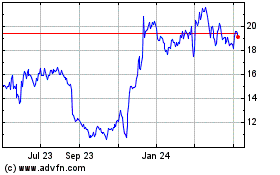

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024