Lexington Realty Trust Final Dividend Allocation for 2015

January 21 2016 - 4:16PM

Lexington Realty Trust (“Lexington”) (NYSE:LXP), a real estate

investment trust (REIT) focused on single-tenant real estate

investments, today announced its final 2015 dividend income

allocations for both its common and preferred shares as they will

be reported on Form 1099-DIV. Additionally, the return of capital

on the common shares (Nondividend Distributions in the table below)

was reported on Internal Revenue Service Form 8937 pursuant to U.S.

tax basis reporting as required under Internal Revenue Code

6045B. A copy of the Internal Revenue Service Form 8937 was

posted to Lexington’s web site (www.lxp.com) on January 15, 2016.

| Common

Shares |

|

RecordDate |

PayableDate |

TotalDistributionsPer Share |

Total OrdinaryDividends |

QualifiedDividends |

Total Capital GainDistributions |

Unrecaptured Section 1250Gain |

NondividendDistributions (1) |

|

12/31/2014 |

01/15/2015 |

$ |

0.170 |

|

$ |

0.107216 |

|

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0 |

|

$ |

0.062784 |

|

|

03/31/2015 |

04/15/2015 |

$ |

0.170 |

|

$ |

0.107216 |

|

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0 |

|

$ |

0.062784 |

|

|

06/30/2015 |

07/15/2015 |

$ |

0.170 |

|

$ |

0.107216 |

|

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0 |

|

$ |

0.062784 |

|

|

09/30/2015 |

10/15/2015 |

$ |

0.170 |

|

$ |

0.107216 |

|

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0 |

|

$ |

0.062784 |

|

| Form 1099 –

Div Box |

1a |

1b |

2a |

2b |

|

3 |

|

| Series C

Cumulative Convertible Preferred Stock |

|

RecordDate |

PayableDate |

TotalDistributionsPer Share |

TotalOrdinaryDividends |

QualifiedDividends |

Total Capital GainDistributions |

Unrecaptured Section 1250Gain |

NondividendDistributions (1) |

|

01/30/2015 |

02/17/2015 |

$ |

0.812500 |

|

$ |

0.812500 |

|

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0 |

|

$ |

0 |

|

|

04/30/2015 |

05/15/2015 |

$ |

0.812500 |

|

$ |

0.812500 |

|

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0 |

|

$ |

0 |

|

|

07/31/2015 |

08/17/2015 |

$ |

0.812500 |

|

$ |

0.812500 |

|

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0 |

|

$ |

0 |

|

|

10/30/2015 |

11/16/2015 |

$ |

0.812500 |

|

$ |

0.812500 |

|

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0 |

|

$ |

0 |

|

| Form 1099 –

Div Box |

1a |

1b |

2a |

2b |

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(1) Return of

Capital. |

ABOUT LEXINGTON REALTY TRUST

Lexington Realty Trust is a real estate

investment trust that owns a diversified portfolio of equity and

debt interests in single-tenant commercial properties and land.

Lexington seeks to expand its portfolio through acquisitions,

sale-leaseback transactions, build-to-suit arrangements and other

transactions. A majority of these properties and all land interests

are subject to net or similar leases, where the tenant bears all or

substantially all of the operating costs, including cost increases,

for real estate taxes, utilities, insurance and ordinary repairs.

Lexington also provides investment advisory and asset management

services to investors in the single-tenant area. Lexington common

shares are traded on the New York Stock Exchange under the symbol

“LXP”. Additional information about Lexington is available

on-line at www.lxp.com or by contacting Lexington Realty

Trust, One Penn Plaza, Suite 4015, New York, New York 10119-4015,

Attention: Investor Relations.

Contact:

Investor or Media Inquiries for Lexington Realty Trust:

Heather Gentry, Senior Vice President of Investor Relations

Lexington Realty Trust

Phone: (212) 692-7200 E-mail: hgentry@lxp.com

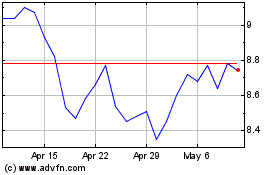

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

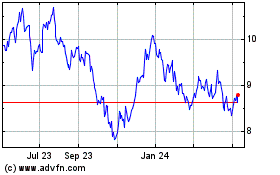

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Apr 2023 to Apr 2024