Target Points to Weakening Sales -- WSJ

May 19 2016 - 3:04AM

Dow Jones News

Retailer pins decline on consumer caution and wet weather in

latest quarter Recent data from the U.S. Commerce Department showed

that consumer spending in April rose to the best level in more than

a year. In the past year, Internet and catalog sales have grown

more than three times as fast as overall sales, up 10.2%, while

department-store sales sank 1.7% over the past 12 months. "It's

been a very wet and cold start to the year and it's reflected in

our sales," he said. "We haven't seen anything

By Khadeeja Safdar and Lisa Beilfuss

Target Corp. said consumers pulled back on spending in the first

quarter and warned that a key sales measure could fall in the

current period -- the first such decline in two years.

Chief Executive Brian Cornell cited "an increasingly volatile

consumer environment" and said he expects "excess inventory" at

other retailers to "extend the very intense promotional environment

into the months ahead."

Shares of the company were off 7.6% at $68 as of 4 p.m. trading

on Wednesday. Sales at stores open at least a year rose 1.2% in the

quarter ended April 30, short of Target's 1.5% to 2.5% annual

target.

The company warned that metric would be flat to down 2% in the

current quarter. A decline would be a first for Target since Mr.

Cornell took over as CEO in 2014.

Target joins a growing list of retailers reporting a

disappointing start to the year.

Last week, soft results from department stores like Macy's Inc.

and Nordstrom Inc. illustrated shoppers' shift away from

brick-and-mortar stores and sparked declines across the retail

sector.

That pressure was renewed Wednesday as shares in Wal-Mart Stores

Inc. fell 2.2%. Wal-Mart was slated to report quarterly results

Thursday.

Off-price chain TJX Cos. and home-improvement stores like Home

Depot Inc. reported healthy traffic and spending at their

locations. Wednesday, Lowe's Cos. posted a strong earnings beat

with a profit of $884 million, or 98 cents a share, up from $673

million, or 70 cents, a year earlier. Revenue rose 7.8% to $15.2

billion.

Despite weakness in the first half of the year, Target said it

still sees its full-year earnings forecast as "achievable." Mr.

Cornell said the spending slowdown at the start of the year was the

result of consumer caution and unusually cold and wet weather in

certain regions.

The Minneapolis company has been spending aggressively to beef

up digital sales. In the first quarter, Target's digital sales rose

23%. Online sales represented 3.5% of Target's top line, a smaller

chunk than the 5% achieved in the holiday period, though up from

2.8% a year earlier.

Overall for the quarter, Target reported a profit of $632

million, down from $635 million a year earlier. Revenue declined

5.4% to $16.2 billion, largely due to the sale of its pharmacy and

clinic businesses. Analysts had forecast $16.32 billion in revenue,

according to Thomson Reuters.

Write to Khadeeja Safdar at khadeeja.safdar@wsj.com and Lisa

Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

May 19, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

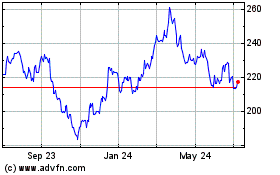

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

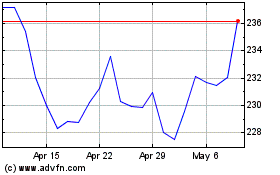

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024