By Austen Hufford

Lowe's Cos. said it would acquire Canadian home-improvement

chain Rona Inc. for about 3.2 billion Canadian dollars (US$2.3

billion) in a move to expand its operations in Canada, less than

four years after Rona rebuffed a buyout offer from the home

improvement chain.

Lowe's will pay about C$24 (US$17.15) for each outstanding

common share and C$20 for each outstanding preferred share of Rona.

The deal may include debt. The price represents a 104% premium over

Rona's closing common share price of C$11.77 on Tuesday.

Rona shares nearly doubled to $23.37 in trading on the Toronto

Stock Exchange, while Lowe's shares fell 8.6% to $65.49 in trading

in New York.

Michael Baker, a senior analyst with Deutsche Bank, said the

Canadian expansion could take resources and executives' time and

thought away from Lowe's main business.

"There is concern this could be a distraction." Mr. Baker said.

"It seems less risky for Lowe's to focus on its core U.S.

business."

Despite the cultural and economic similarities to the U.S.,

Canada has been a difficult market to crack for some U.S.

companies. Sears Holdings Corp. spun off most of its stake in Sears

Canada Inc. in 2014 and the Canadian unit has continued to

experienced a decade-long string of annual revenue declines.

Target, after spending the equivalent of more than $4 billion

setting up its Canadian operations, ended its money-losing

operation and shut down its more than 130 stores in the country in

early 2015.

Perry Sadorsky, Associate Professor of Economics at the Schulich

School of Business in Toronto, said with that Target, many Canadian

consumers had expected similar products and prices as in American

Target stores and didn't find them.

But he noted that Lowe's has been in Canada since 2007 and that

Rona is already profitable.

Rona sells and distributes hardware, home-renovation products

and building materials. The company operates a network of 236

corporate and 260 dealer-owned stores with nine distribution

centers throughout Canada.

Rona's acceptance of the deal is a turnaround from the cold

shoulder it gave Lowe's previous 2012 offer to buy the company for

C$1.76 billion (worth about US$1.75 billion at the time). That

offer represented a 37% premium over Rona's stock price. At the

time, Rona said the unsolicited proposal wasn't in the best

interests of the company or its shareholders.

In response to the higher cost and higher premium of the new

deal, Lowe's Chief Executive Robert Niblock said Rona is worth more

today.

"They've done quite a bit to improve their operations" Mr.

Niblock said on a call to discuss the deal. In an interview with

The Wall Street Journal, Mr. Niblock said, "we are in a much

different place than where we were last time."

The 2012 offer also faced challenges from the Quebec government,

with its then finance minister telling reporters that Rona was a

"strategic asset" that shouldn't fall into foreign hands.

Lowe's current bid includes key differences that may increase

its chances of success this time. Lowe's said it agreed to several

stipulations related to keeping jobs and operations in Canada.

Lowe's said it would keep employing the "vast majority" of current

employees, will base Lowe's Canadian operations in Boucherville,

Quebec, and will continue to use Rona brands.

The latest offer requires approval from Canada's antitrust

authority, known as the Competition Bureau, and it needs to show

that the deal would generate a net economic benefit for Canada

under the country's foreign-takeover rules.

Unlike the previous unsolicited proposal, the offer was friendly

and has the unanimously support of both companies' boards. Mr.

Niblock, Lowe's CEO, said in the interview that Lowe's had been

following the progress of Rona over the past several years and that

he reached out to Rona's chairman in 2015.

Citing in part Lowe's commitments to its presence in Quebec,

Caisse de Depot et Placement du Quebec, the giant provincial

pension fund, said it supports the transaction. The Caisse is

Rona's largest shareholder with about a 17% stake, according to

FactSet data.

Since 2012, the Canadian dollar has depreciated against the

American dollar falling from roughly parity to C$1.39 for each

US$1, making the deal relatively cheaper for Lowe's.

Lowe's Canada, which entered the country in 2007, now operates

42 stores, primarily in Ontario. Lowe's doesn't have any stores in

Quebec and the company didn't previously have plans to expand

eastward. Almost half of Rona's stores are in Quebec.

With the Rona acquisition included, the Canadian operations

would have had revenue of C$5.6 billion in 2015. French-speaking

Sylvain Prud'homme, a Canadian retail veteran and president of

Lowe's Canada, will continue to head the Canadian operation after

the acquisition. Mr. Prud'homme's hiring in 2013 was seen at the

time as a sign that Lowe's hadn't given up on Rona.

The deal is expected to close in the second half of the year and

will add to Lowe's earnings. Lowe's said it has identified ways to

get more than C$1 billion of increased revenue and operating

profitability in Canada, including using shared suppliers and

introducing appliances into some Rona stores.

Recently, Lowe's has benefited from higher home values and more

people moving into new homes, which both spur spending on home

projects.

Ben Dummett in Toronto contributed to this article

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

February 03, 2016 13:58 ET (18:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

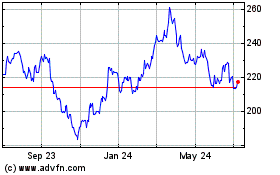

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

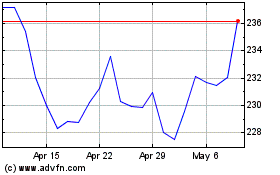

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024