UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 15, 2016

LOWE’S COMPANIES, INC.

(Exact name of registrant as specified in its charter)

|

| | | | | | |

| North Carolina | | 1-7898 | | 56-0578072 | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) | |

|

| | | |

| 1000 Lowe’s Blvd., Mooresville, NC | 28117 | |

| (Address of principal executive offices) | (Zip Code) | |

| | | |

| Registrant’s telephone number, including area code | (704) 758-1000 | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Item 2.06 | Material Impairments |

On January 15, 2016, Lowe’s Companies, Inc. (the “Company”) provided notice (“Notice of Intention”) to Woolworths Limited, its joint venture partner in Australia, of the Company’s intent to exercise its put option with respect to its investment in the joint venture, which operates Masters Home Improvement stores and Home Timber and Hardware Group’s retail stores and wholesale distribution in Australia. Following a period of 390 days, the shares which are the subject of the put option will be sold. However, Woolworths may bring forward the date of the sale during this period, by the exercise of its call option. The purchase price will be determined by reference to the fair market value of the shares, as of Monday, January 18, 2016. The valuation process will commence immediately. In connection with the planned divestiture, the Company expects to record, in its fourth quarter ending January 29, 2016, a non-cash impairment charge, subject to adjustment based on the final outcome of the valuation process. At this time, the Company is unable to estimate in good faith the amount or range of amounts of the impairment charge. However, the Company believes the valuation process referenced above will provide a reasonable estimate of such amounts for inclusion in its Annual Report on Form 10-K. The Company expects to file an amended Current Report on Form 8-K under this Item 2.06 within four business days after the date upon which it makes a determination of an estimate or range of estimates for any such impairment charge.

A copy of the press release announcing the Company’s plan to exit from the joint venture is filed as Exhibit 99.1 to this Form 8-K.

| |

Item 9.01 | Financial Statements and Exhibits |

| |

99.1 | Press Release dated January 18, 2016, announcing the Company’s exit from the joint venture with Woolworths Limited |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| LOWE’S COMPANIES, INC. | |

| | | |

Date: January 22, 2016 | By: | /s/ Ross W. McCanless | |

| | Ross W. McCanless General Counsel, Secretary and Chief Compliance Officer | |

INDEX TO EXHIBITS

|

| | |

Exhibit No. | | Description |

99.1 | |

Press Release, dated January 18, 2016, announcing the Company’s exit from the joint venture with Woolworths Limited

|

Exhibit 99.1

For Immediate Release

January 18, 2016

|

| | | |

Contacts: | Media Inquiries: | | Analysts’/Shareholders’ Inquiries: |

| Colleen Penhall | | Tiffany Mason |

| 704-758-2958 | | 704-758-2033 |

| colleen.b.penhall@lowes.com | | tiffany.l.mason@lowes.com |

LOWE’S PLANS TO EXIT HOME IMPROVEMENT JOINT VENTURE IN AUSTRALIA

MOORESVILLE, N.C. - Lowe’s Companies, Inc. (NYSE: LOW) today announced it has provided notification to Woolworths Limited, its joint venture partner in Australia, of its intent to begin the process of exiting its investment in the joint venture, which operates Masters Home Improvement stores and Home Timber and Hardware Group’s retail stores and wholesale distribution in Australia. Woolworth’s owns two-thirds of the joint venture, and Lowe’s owns one-third.

Richard D. Maltsbarger, Lowe’s chief development officer and president of international, commented, “While Australia offers an attractive home improvement market and the joint venture has made progress, we have decided, following a comprehensive strategic analysis, to focus our resources on areas of our business where we see greater potential return on our investment. We have enjoyed partnering with Woolworths’ management and are committed to working closely with them as we transition out of this investment.”

Under the terms of the joint venture agreement, Lowe’s has an option to exercise its right to exit the agreement following its notice to Woolworths. This notification was sent on Jan. 15, 2016 and triggers a process for determining the purchase price of Lowe’s portion of the joint venture, which will be based on the fair market value as of the date of the receipt of the notice. Lowe’s expects to record, in its fourth quarter ending Jan. 29, 2016, a non-cash impairment charge, subject to adjustment based on the outcome of the valuation process. Lowe’s net investment in the joint venture to date is approximately $930 million. In the interim period, from now until the option is exercised, Lowe’s is no longer required to make capital contributions to the business.

The joint venture agreement was signed in 2009, and the first Masters stores were opened in the second half of 2011 and now exceed 60 stores. Revenues for the joint venture, including both the Masters stores and the Home Timber and Hardware Group, were A$1.9 billion (US$1.6 billion) in its latest fiscal year ended June 28, 2015.

About Lowe’s

Lowe’s Companies, Inc. (NYSE: LOW) is a FORTUNE® 50 home improvement company serving approximately 16 million customers a week in the United States, Canada and Mexico through its stores and online at Lowes.com, Lowes.ca and Lowes.com.mx. With fiscal year 2014 sales of $56.2 billion, Lowe’s has more than 1,845 home improvement and hardware stores and 265,000 employees. Founded in 1946 and based in Mooresville, N.C., Lowe’s supports the communities it serves through programs that focus on K-12 public education and community improvement projects. For more information, visit Lowes.com.

Disclosure Regarding Forward-Looking Statements

This news release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”). Statements of the company’s expectations for exiting its investment in the Australian joint venture, exercise of the option to exit the joint venture, incurrence of an impairment charge related to the planned divestment, making no further capital contributions to the joint venture, valuation of the joint venture and any statement of an assumption underlying any of the foregoing, constitute “forward-looking statements” under the Act. Although we believe that the expectations, opinions, projections, and comments reflected in these forward-looking statements are reasonable, we can give no assurance that such statements will prove to be correct. A wide variety of potential risks, uncertainties, and other factors could materially affect our ability to achieve the results either expressed or implied by our forward-looking statements including, but not limited to, the valuation of the joint venture and changes in general economic conditions, such as the rate of unemployment, interest rate and currency fluctuations, higher fuel and other energy costs, slower growth in personal income, changes in consumer spending, changes in the rate of housing turnover, the availability of consumer credit and of mortgage financing, inflation or deflation of

commodity prices, and other factors which can negatively affect our customers. For more information about these and other risks and uncertainties that we are exposed to, you should read the “Risk Factors” and “Critical Accounting Policies and Estimates” included in our Annual Report on Form 10-K to the United States Securities and Exchange Commission (the “SEC”) and the description of material changes therein or updated version thereof, if any, included in our Quarterly Reports on Form 10-Q.

The forward-looking statements contained in this news release are based upon data available as of the date of this release or other specified date and speak only as of such date. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf about any of the matters covered in this release are qualified by these cautionary statements and the “Risk Factors” included in our Annual Report on Form 10-K to the SEC and the description of material changes, if any, therein included in our Quarterly Reports on Form 10-Q. We expressly disclaim any obligation to update or revise any forward-looking statement, whether as a result of new information, change in circumstances, future events, or otherwise.

# # #

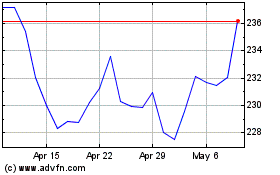

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

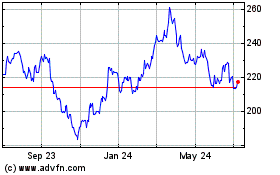

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024