By Paul Sonne

The makers of precision-guided missiles and bombs are running to

keep up with demand as the U.S. military bombards Islamic State

from the air.

Companies such as Boeing Co., Lockheed Martin Corp. and BAE

Systems PLC -- which make the precision-guidance kits that carry

U.S. missiles and bombs to their targets -- are benefiting from the

U.S. military's increased reliance on air power in the Middle

East.

Nowhere is the U.S. emphasis on air power more pronounced than

in the campaign against Islamic State. As of mid-December, the U.S.

had conducted 13,041 airstrikes against Islamic State in Iraq and

Syria over about 28 months, according to U.S. Central Command, with

a single strike often carrying more than one munition. Coalition

allies carried out an additional 3,747 strikes over the same

period.

"Right now, we're more kinetic than we've ever been in this

campaign," U.S. Air Force Chief of Staff Gen. David Goldfein said

in an interview late last year. "We're hitting more targets than

we've ever hit in a long time in Iraq, Syria and in Afghanistan, so

when that goes up, that means more munitions are required."

The extremely accurate munitions don't come cheap. Equipped with

sophisticated laser or GPS targeting technology, a single bomb or

missile can cost from $30,000 to $115,000. Overall, the U.S. Air

Force has expended about $2 billion worth of precision-guided

munitions on Islamic State since the start of the campaign in

August 2014, dropping more than 40,000, according to Air Force

officials. U.S. aircraft have dropped nearly 18 times more weapons

on Islamic State than on targets in Afghanistan over the same

period.

Gen. Goldfein says that for U.S. pilots, extreme accuracy is the

difference "between hero and zero" and a matter of American values.

"You either get it exactly right, or you get it exactly wrong," he

said. "In the business of modern warfare, the expectation is

precision on every strike. So through that lens, the cost factor is

less of an issue."

The accuracy helps the military avoid killing civilians. Still,

the Pentagon said Jan. 2 that coalition airstrikes had

unintentionally killed at least 188 civilians during the campaign.

Groups that track the strikes primarily using open-source reports,

such as Airwars, put the number far higher.

Airstrikes have become central to the Islamic State campaign in

part because of the rise of U.S. drone capabilities and an

increased imperative in Washington to reduce American military

casualties.

The air-centric nature of the fight has strained U.S. supplies

of the three preferred precision-guided munitions: Lockheed

Martin's hellfire missile, and Boeing's small-diameter bomb and

joint direct attack munition, or JDAM.

As a result, Gen. Goldfein says he is shifting supplies to the

Middle East from Europe and the Pacific to keep campaign commanders

armed with what they need, and then backfilling the arsenal in

Europe and the Pacific when new munitions arrive.

"It's a daily management issue," Gen. Goldfein said. "It's not a

crisis by any means, but it is a concern, because any given day,

you do have some risk that other combatant commands are carrying

until you replenish their stocks."

Looking to invest in other areas, the U.S. military didn't

devote large swaths of the defense budget to stockpiling

precision-guided munitions following the withdrawal from Iraq. But

after Islamic State swept the country in 2014, the U.S. was forced

back into a full-scale air war -- and needed to shore up its

arsenal.

Since then, lawmakers have allocated more funding for

precision-guided munitions, and the White House shortened the time

it takes to replenish expended munitions -- previously as long as

four years.

Suppliers, meanwhile, are ramping up production.

Boeing is producing about 120 GPS guidance kits for the JDAM

each day at its plant outside St. Louis, Mo., up from about 40 in

early 2015, according to Greg Coffey, the company's JDAM programs

director. He expects production to reach 150 a day by next July, or

about 36,500 a year.

The ramp-up will take Boeing's JDAM production rates to a high

not seen since the early days of the Iraq War, according to the

company.

"I see demand for the weapon in significant quantities for the

next decade," Mr. Coffey said.

The Air Force has dropped JDAMs on Islamic State targets more

than any other precision-guided munition in the past year. The JDAM

kits transform a 2,000- or 500-pound "dumb bomb" into a

hyperprecise weapon that pinpoints its target using either GPS or

laser technology. In the year ended Sept. 30, the Air Force dropped

14,764 of them, according to Air Force officials.

Boeing also is preparing to boost production of small-diameter

bombs to five times the current production rate by the end of 2017,

Mr. Coffey said.

Lockheed Martin increased deliveries of hellfire missiles for

its contract with the U.S. Army. In the third quarter of 2016,

Lockheed reported a $45 million jump in net sales of tactical

missiles compared with the prior year, attributing the increase

mainly to hellfire deliveries.

Officials also are adding other munitions. The Air Force

introduced a new precision-guided rocket to the fight against

Islamic State in April. Known as the advanced precision kill weapon

system, or APKWS, it consists of a round of seven hydra rockets

manufactured by General Dynamics, harnessed with laser-guidance

kits made by BAE Systems.

BAE is increasing production of the laser-guidance kits at its

plants in New Hampshire and Texas, preparing to manufacture 10,000

a year by the end of 2017 and 20,000 a year by the end of 2018,

according to the company.

Write to Paul Sonne at paul.sonne@wsj.com

(END) Dow Jones Newswires

January 05, 2017 05:44 ET (10:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

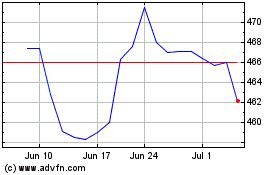

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

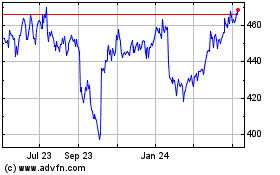

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024