Lockheed Martin Rides New Wave of Military Spending -- Update

October 25 2016 - 3:42PM

Dow Jones News

By Doug Cameron

Lockheed Martin Corp. expects sales next year to grow at the

fastest clip in a decade as the reshaped company rides a new wave

of military spending at home and abroad.

The world's largest defense contractor said orders for its F-35

jet fighters, missile defense systems and Sikorsky helicopter

business will boost revenue by 7% to around $50 billion in 2017, a

welcome boon after seven years of broadly flat sales.

The F-35 still faces production and funding challenges. But

orders from U.S. allies such as the U.K. and Japan are expected to

push exports to around 30% of company sales in the next few years,

double the level four years ago.

The bullish outlook combined with forecast-beating quarterly

earnings and assurances that pension payments are under control

helped to drive Lockheed shares up 7% on Tuesday.

Chief Executive Marillyn Hewson has reshaped the company over

the past year, buying Sikorsky for $9 billion and selling its

low-margin government information-technology business to Leidos

Holdings Inc.

Lockheed's fortunes remain closely tied to the F-35 fighter,

which already accounts for a fifth of sales and continues to run

into problems even after its long-delayed entry into service with

the U.S. Air Force and Marine Corps.

Problems with the fuel tanks have grounded some planes and

slowed deliveries. Chief Financial Officer Bruce Tanner said on an

investor call that Lockheed wouldn't catch up with fixes on the

production line until well into next year.

A bigger issue is whether expected global orders for around

3,000 of the jets will materialize while the Pentagon and other

militaries juggle budget pressures such as replacing much of the

U.S. nuclear deterrent.

Lockheed is due to end production of its F-16 jet fighter next

year unless it wins fresh orders. The F-35 is less profitable than

the older jet, and the Pentagon is pushing for better deals.

The Pentagon said it may split a $14 billion order for the next

two batches of F-35s after months of talks that have left the two

sides unable to agree on price and other terms. It may now award a

deal for just the next batch, leaving Lockheed to shoulder more of

the cost of paying suppliers.

The F-35 is an important contributor to sales and earnings at

other contractors, including Northrop Grumman Corp and BAE Systems

PLC.

Lockheed's third-quarter profit of $2.4 billion was up from $865

million a year earlier as per-share earnings rose to $7.93 from

$2.77, and sales climbed 15% to $11.55 billion. For the full year,

it boosted earnings expectations to about $12.10 a share and

revenue to $46.5 billion.

Lockheed shares were recently up 7% at $248.38, erasing half

their losses since hitting an all-time high in August.

Rivals Boeing Co, Northrop and General Dynamics Corp. report

quarterly earnings on Wednesday.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

October 25, 2016 15:27 ET (19:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

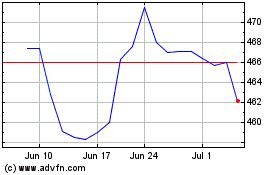

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

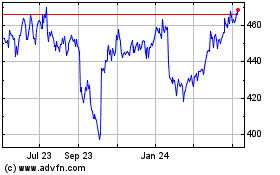

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024