Lennar Tops Expectations as Housing Market Continues to Improve -- 2nd Update

September 21 2015 - 4:11PM

Dow Jones News

By Lisa Beilfuss and Kris Hudson

Home builder Lennar Corp. posted double-digit percentage gains

in new orders, deliveries and net income for its fiscal third

quarter, underscoring a sustained but unspectacular recovery in the

U.S. new-home market.

Lennar Chief Executive Stuart Miller described the market as

improving in a "slow and steady manner" in Lennar's quarter ended

Aug. 31, echoing what the Federal Reserve's monetary policy-setting

arm said in its statement last week. Miami-based Lennar, the

second-largest U.S. home builder by houses constructed, behind D.R.

Horton Inc., posted a 10% increase in orders from a year earlier, a

16% increase in deliveries of completed homes and a 5% increase in

average price to $350,000.

"We have believed and continue to believe that the downside in

the housing market is very limited and the upside very

significant," Mr. Miller said Monday in a conference call with

investors to discuss Lennar's results.

Mr. Miller outlined several points that bode well for a U.S.

home-construction market that, though it is rebounding, remains at

roughly half of its average annual output in the latest normal

housing market of 2001 to 2003 due to weak demand for starter homes

so far in the recovery and shortages of construction labor and

buildable land. Construction starts on single-family homes in the

U.S. in this year's first eight months are up a lukewarm 11% from

the same period last year.

First, Mr. Miller noted that, though mortgage-qualification

standards remain prohibitive for many borrowers, the share of

Lennar's sales going to first-time buyers rose to 30% in its third

quarter from 25% a year earlier. That dovetails with a report by

the National Association of Realtors on Monday that 32% of sales of

existing homes in August went to first-time buyers, up from 29% a

year ago.

Even so, Lennar remains bullish on its rental-apartment

business, which has 28 projects totaling 7,700 units under

development with partners. "There is very, very large pent-up

demand both in rental and in for-sale (housing) for buyers who need

to come back in," Mr. Miller said.

Despite Lennar's gains in orders and closings, and a 24%

increase in revenue to $2.5 billion, the builder's gross margins

slipped to 24.1% from 25.2% a year earlier. That was due mostly to

higher land costs, which surged 56% from last year's quarter.

Analysts were expecting a steeper decline in margin, but the

surge in closings and incentives that were little changed from a

year earlier were behind the gross-margin beat, said Jay McCanless,

an analyst at Sterne Agee.

For the quarter, Lennar reported a profit of $223 million, or 96

cents a share, up from $177.8 million, or 78 cents a share, a year

earlier. Analysts projected 80 cents in per-share profit and $2.42

billion in sales, according to Thomson Reuters.

Mr. Miller also provided an update on Lennar's nascent efforts

to build communities of single-family homes for rent. The builder

earlier this year started its first such project of 80 homes near

Reno, Nev. Lennar now "expects to expand on that platform" due to

the "very successful" early results from the Reno project, Mr.

Miller said. He didn't provide additional details on the call.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com and Kris Hudson

at kris.hudson@wsj.com

Access Investor Kit for "D.R. Horton, Inc."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US23331A1097

(END) Dow Jones Newswires

September 21, 2015 15:56 ET (19:56 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

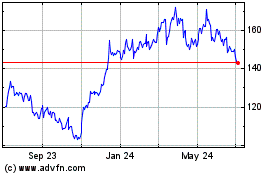

Lennar (NYSE:LEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

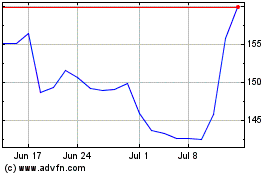

Lennar (NYSE:LEN)

Historical Stock Chart

From Apr 2023 to Apr 2024