Kimberly-Clark's Earnings Rise on Cost Cuts, Lower Tax Rate -- Update

April 22 2016 - 12:10PM

Dow Jones News

By Sharon Terlep

The battle for the Chinese shopper has created a price war among

companies that sell consumer staples from paper towels to diapers,

making it even harder for businesses to wring a profit out of the

critical market.

Kimberly-Clark Corp., the maker of Huggies diapers and Kleenex

tissues, on Friday reported lower first-quarter sales around the

globe despite higher volumes in many regions and categories.

Currency volatility due to the strong dollar was the biggest drag

in most regions outside the U.S.

In China, the Dallas-based company lowered prices to combat

competition from local firms as well as rivals from Japan and other

nations.

"More and more people are coming into the middle class and

parents really invest in their children," Kimberly-Clark Chief

Executive Thomas Falk said in an interview. "At the same time, it's

a competitive market. Everyone in the world sees that billion-plus

population and is moving in."

China helped fuel a 2% increase in sales volume of personal-care

goods, such as baby wipes and feminine hygiene products, in

emerging markets. But while prices for those products rose in Latin

America and Eastern Europe, Kimberly-Clark relied on profit-eroding

promotions in China to hang on to market share.

"It got a little more expensive there," Mr. Falk said.

Shares of Kimberly-Clark fell 4.4% in morning trading Friday.

Rival Procter & Gamble Co. is slated to report its latest

results Tuesday, and analysts expect the company to report lower

profit and sales.

Competition in China was particularly evident in the lucrative

diaper market where Kimberly-Clark's organic sales, which strips

out the effects of currency moves and acquisitions, rose 5% for the

period compared with a 35% increase a year ago.

Elsewhere around the world, Kimberly-Clark benefited from an

improving U.S. economy, noting that American consumers have been

willing to shell out more for items like improved diapers. Strength

in U.S. has helped offset weakness abroad, where the stronger

dollar makes U.S. goods more expensive and where economies have

been softer.

In the first quarter, U.S. sales increased 3%, driven by higher

volumes across the company's product lines. Total sales slipped

4.6% from a year earlier to $4.48 billion, falling short of the

$4.54 billion analysts projected.

Despite the sales decline, profit rose as the company took down

expenses and benefited from lower commodity prices and a lower tax

rate. Kimberly-Clark reported a profit of $545 million, or $1.50 a

share, up from $468 million, or $1.27 a share, a year earlier.

Mr. Falk said he sees more opportunities to cut costs,

particularly through increasing the efficiency of its manufacturing

operations. "There is still a big difference in the productivity of

our weakest performing plants and the best performing plants," he

said.

The company brought overhead expenses down by 2.8% to $825

million and lifted its gross margin to 36.6% from 35.4%.

Kimberly-Clark's tax rate was 28.3% during the quarter, down from

33.8% a year earlier.

For the year, the company backed its previously-issued

forecast.

Lisa Beilfuss contributed to this article.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

April 22, 2016 11:55 ET (15:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

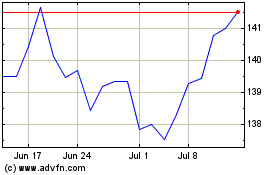

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Aug 2024 to Sep 2024

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Sep 2023 to Sep 2024