Kimberly-Clark Beats Expectations Despite Currency Volatility--Update

October 21 2015 - 4:26PM

Dow Jones News

By Serena Ng And Chelsey Dulaney

American consumers' frugal streak is showing few signs of

fading.

Kimberly-Clark Corp., the maker of Huggies diapers and Kleenex

tissues, Wednesday reported higher North American sales volumes,

thanks in large part to promotional activities and coupons that

drew more shoppers to its brands.

Chief Executive Tom Falk said shoppers responded well to digital

coupons and price promotions on bulk purchases of items like paper

towels and facial tissue. "If you have more paper towels and

tissues in your pantry you're likely to consume more," he said.

The Dallas-based company's overall third-quarter sales fell 7%

to $4.7 billion, mainly the result of many foreign currencies

weakening against the U.S. dollar. But the decline was less than

Wall Street analysts forecast, and Kimberly-Clark's organic sales,

which exclude acquisitions, divestments and the impact of currency

moves, grew 5% on the back of growth from emerging markets and

North America.

The results helped send Kimberly-Clark shares up 1% to $118.19

in late Wednesday trading. So far this year, the stock is up

2.3%.

Currency swings, however, are likely to reduce the company's

bottom line by as much as 25% this year, a bigger hit than

previously anticipated, Chief Financial Officer Maria Henry said.

For the third quarter, Kimberly-Clark reported an 8% decline in net

profit to $517 million, while over the first nine months of 2015

profit was down 58% from a year ago to $680 million.

In the baby diaper business, Huggies has been trying over the

past year to claw back U.S. market share it lost last year to its

chief rival, Pampers, made by Procter & Gamble Co.

Third-quarter sales volumes of Huggies diapers rose in low

double-digit terms following the relaunch this year of the brand's

mainline Snug and Dry diapers at slightly lower prices.

Mr. Falk said Huggies's share has improved modestly by about 1

percentage point in the year to date, but Kimberly-Clark in the

recent quarter shipped higher volumes of diapers to retailers who

wanted to stock more merchandise after some of their stores ran

out.

The company also sold more Kleenex during the recent

back-to-school shopping season, thanks to the brand's popularity on

school-supply lists distributed by teachers across the U.S.

Through the first nine months of 2015, Kimberly-Clark's sales

were up 4.5% organically. The company narrowed its full-year

organic sales growth forecast to between 4% and 5%, from a previous

range of between 3% and 5%.

The company also sees currency declines cutting between 10% and

11% off sales for the year, compared with its previous guidance for

a 10% impact.

Write to Serena Ng at serena.ng@wsj.com and Chelsey Dulaney at

Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 21, 2015 16:11 ET (20:11 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

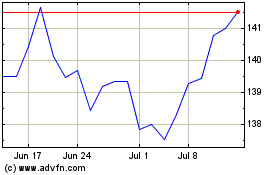

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Aug 2024 to Sep 2024

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Sep 2023 to Sep 2024