Kimberly-Clark Hit by Currency Impacts

October 21 2015 - 9:20AM

Dow Jones News

Kimberly-Clark Corp.'s revenue slid less than Wall Street

expected in the third quarter, while profit came in above forecasts

despite the continued impact of currency volatility.

The Dallas-based company lifted the bottom end of its earnings

guidance for the year by 5 cents a share, to a range of $5.70 to

$5.80 a share.

But the maker of Huggies diapers, Kleenex tissue and Scott

toilet paper said it now sees currency cutting 10% to 11% off sales

for the year, compared with its previous guidance for a 10%

impact.

Excluding currency rates, Kimberly-Clark expects organic sales

to be up 4% to 5%, compared with its previous call for 3% to 5%

growth.

Kimberly-Clark has said it is trying to raise prices in some

countries to make up for the currency impacts.

In the third quarter, organic sales—which exclude acquisitions,

divestments and the effect of currency moves—grew 5%, driven by

growth in developing and emerging markets and an improvement in the

company's North American personal-care business.

In all, Kimberly-Clark reported a profit of $517 million, or

$1.41 a share, down from $562 million, or $1.50 a share, a year

earlier.

Excluding special items, per-share earnings ticked up to $1.51

from $1.50 a year earlier, helped by fewer shares outstanding.

Sales fell 6.7% to $4.72 billion.

Analysts polled by Thomson Reuters forecast $1.49 a share in

earnings on $4.68 billion in revenue.

In the U.S., Kimberly-Clark has struggled over the past year to

claw back market share in Huggies diapers, which have lost ground

to Procter & Gamble Co.'s Pampers and Luvs brands.

The company's adult-incontinence products, sold under the Depend

and Poise brands, also have been under assault from P&G, which

last year re-entered the incontinence business

In the latest quarter, sales at Kimberly Clark's personal-care

segment, which includes both baby and adult diapers, slid 5% to

$2.4 billion, as a 13% currency impact offset 7% volume growth.

Sales at the consumer-tissue segment, which includes Cottonelle

and Kleenex, fell 10% to $1.5 billion. An 11% currency impact

offset 2% volume growth.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 21, 2015 09:05 ET (13:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

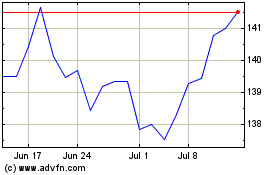

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Apr 2023 to Apr 2024