By Rachel Louise Ensign, Emily Glazer and Dana Cimilluca

KeyCorp said Friday that it has agreed to acquire First Niagara

Financial Group Inc. in a deal valued at about $4.1 billion,

producing a tie-up of two regional banks at a time when such firms

are grappling with low interest rates and burgeoning regulatory

costs.

It is one of the biggest bank tie-ups of the year and further

solidifies 2015 as the biggest year for bank deals since the

financial crisis.

The deal values the Buffalo, N.Y.-based First Niagara at a

modest premium to its market capitalization of just under $4

billion. The price represents more of a premium over where First

Niagara shares traded in September, before reports first surfaced

that the bank might be for sale.

First Niagara shareholders will receive 0.68 KeyCorp shares and

$2.30 in cash for each First Niagara common share, representing a

per share value of $11.40 based on the closing price of KeyCorp

common stock Thursday.

The deal is expected to close by the third quarter of 2016.

Bank deals are slowly coming back as larger lenders try to

become more efficient by getting bigger and as smaller banks with

struggling businesses put themselves up for sale. But bank mergers

still face some hurdles--such as tough regulatory scrutiny--and the

biggest U.S. banks are effectively prohibited from doing deals.

U.S. bank deal activity in 2015 hit the highest level since the

financial crisis Thursday, when the announcement of New York

Community Bancorp Inc.'s purchase of Astoria Financial Corp.

brought the volume of deals in the sector to $28.4 billion for the

year, according to Dealogic.

New York Community said it agreed to buy Astoria in a

stock-and-cash transaction valued at $2 billion. This year's total

is now the highest since 2009, when according to Dealogic $65

billion worth of deals were announced as the financial crisis led

to a number of big mergers.

Shares of the banks involved in the deals reacted negatively to

the news of the deals Thursday. Key shares closed down 3.7%, while

First Niagara shares fell 4.2%. New York Community's share price

dropped 12%, and Astoria stock fell more than 7%.

Regional lenders such as Cleveland-based Key and First Niagara

have been under pressure from low interest rates that make lending

less profitable and that now are anticipated to drag on longer than

many had expected. But the two banks have had divergent fortunes of

late. Key's per-share profit has been on the rise as fee revenue

has climbed, while First Niagara's per-share earnings have fallen

after a series of troubled acquisitions.

The two banks operate in some similar areas but deploy different

business models. First Niagara is a community-focused bank known

for its strong deposit base, while Key has bolstered its

investment-banking business.

A merger would boost Key's branch count in New York state,

according to SNL Financial. In the Buffalo area, where both banks

have just over 50 branches each, the combined bank would have a 35%

market share of deposits.

First Niagara, which has about 390 branches in New York,

Pennsylvania, Connecticut and Massachusetts, last year recorded an

$800 million goodwill write-down as it reduced the value of four

acquisitions it made from 2009 to 2011. Shares plummeted on the

news at the time.

Several banks were interested in buying First Niagara, although

the number has winnowed in recent days, people familiar with the

deal discussions said. Huntington Bancshares Inc. was in advanced

deal talks as recently as Monday, but Key emerged as the most

likely suitor by midweek, some of these people said.

Mergers often allow banks to boost revenue faster than expenses

climb. For instance, they can help a bank spread the increasingly

expensive costs of complying with government regulations across a

broader revenue base. That has led to deals cropping up around

regulatory thresholds that kick in when banks hit a certain

size.

First Niagara has $39 billion in assets, putting it not far from

the $50 billion threshold that would make the bank a systemically

important financial institution and subject it to the Federal

Reserve's stress tests. Key, meanwhile, has nearly $95 billion in

assets, making it one of the smaller banks subject to the stress

tests.

Similar considerations were in play in New York Community's

announced deal for Astoria. New York Community was right below the

$50 billion threshold but will now go over with the purchase.

Key has been trying to become more efficient, and a deal for

First Niagara could help the bank do that in the long run. In the

third quarter, Key's efficiency ratio, a measure of costs as a

percentage of revenue where lower is better, declined to 66.9% from

69.7% a year earlier. Chief Financial Officer Don Kimble said on

the third-quarter earnings call that Key still thinks it can get

its efficiency ratio to the low-60s range.

But Key has remained under pressure from low interest rates that

have made lending less profitable. KeyCorp's net interest margin,

an important gauge that measures how much a bank earns from the

difference between what it pays on deposits and what it takes in on

loans and investments, declined slightly in the third quarter. The

metric edged down to 2.87% from 2.88% in the second quarter and

fell from 2.96% a year earlier.

Another recent development has paved the way for more bank

deals: A prominent long-stalled bank acquisition was finally

approved by the Fed last month, and the Fed in its approval

reassured banks such a delay won't happen again.

The Fed took more than three years to approve M&T Bank

Corp.'s acquisition of Hudson City Bancorp Inc., making it the

longest delay ever for a U.S. deal valued at more than $1 billion.

The delay was caused by the Fed's concerns about M&T's internal

controls.

In its approval order, the Fed said banks with compliance issues

will be expected to withdraw their merger applications until they

are resolved. Guggenheim analyst Jaret Seiberg said in a note at

the time that the new guidance provides more clarity; "a road map

on how to ensure a deal can secure Federal Reserve approval."

Write to Rachel Louise Ensign at rachel.ensign@wsj.com, Emily

Glazer at emily.glazer@wsj.com and Dana Cimilluca at

dana.cimilluca@wsj.com

(END) Dow Jones Newswires

October 30, 2015 07:42 ET (11:42 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

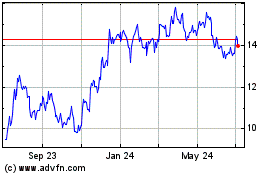

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Apr 2023 to Apr 2024