UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 11-K

| þ |

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the Fiscal Year Ended December 31, 2014

or

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From

To

Commission File Number 001-11302

KeyCorp

401(k) Savings Plan

(Full title of the plan)

KEYCORP

127 PUBLIC

SQUARE

CLEVELAND, OHIO 44114

(Name of issuer of the securities held

pursuant to the plan and the address

of its principal executive office)

KeyCorp

401(k) Savings Plan

FORM

11-K

REQUIRED INFORMATION

Item 4. Financial

Statements and Supplemental Schedule for the Plan.

The KeyCorp 401(k) Savings Plan (“Plan”) is subject to the Employee Retirement Income

Security Act of 1974 (“ERISA”). In lieu of the requirements of Items 1-3 of this Form, the Plan is filing financial statements and supplemental schedule prepared in accordance with the financial reporting requirements of ERISA. The Plan

financial statements and supplemental schedule for the fiscal year ended December 31, 2014, are included as Exhibit 99.1 to this report on Form 11-K and are incorporated herein by reference. The Plan financial statements and supplemental

schedule have been examined by Meaden & Moore, Ltd. Independent Registered Public Accounting Firm, and their report is included therein.

EXHIBITS

| 23.1 |

Consent of Independent Registered Public Accounting Firm, Meaden & Moore, Ltd. |

| 99.1 |

Financial statements and supplemental schedule of the KeyCorp 401(k) Savings Plan for the fiscal year ended December 31, 2014, prepared in accordance with the financial reporting requirements of ERISA.

|

SIGNATURES

Pursuant to the

requirements of the Securities Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

KeyCorp 401(k) Savings Plan

Date: June 25,

2015

|

|

|

| By: |

|

/s/ Cathleen M. Fyffe |

|

|

Cathleen M. Fyffe, signing on behalf of

KeyCorp as sponsor of the KeyCorp 401(k) Savings Plan

Vice President, Retirement Plan Manager KeyBank National

Association |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

KeyCorp, as Plan Sponsor for the KeyCorp 401(k) Savings Plan

We consent to the incorporation by reference in a Registration Statement on Form S-8 (File Numbers 333-49609 and 333-112225) with respect to the KeyCorp

401(k) Savings Plan (the “Plan”) of our audit report dated June 25, 2015 with respect to the Plan’s financial statements and supplemental schedule, included in Form 11-k for the Plan’s years ended December 31, 2014 and

2013, and all references to our firm included in or made a part of the Registration Statement.

/s/ Meaden & Moore, Ltd.

Cleveland, Ohio

June 25, 2015

Exhibit 99.1

KEYCORP

401(k) SAVINGS PLAN

FINANCIAL STATEMENTS

WITH

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

December 31, 2014

KeyCorp

401(k) Savings Plan

INDEX

|

|

|

| |

|

Page |

|

|

| Report of Independent Registered Public Accounting Firm |

|

|

|

|

| Financial Statements: |

|

|

|

|

| Statement of Net Assets Available for Benefits |

|

2 |

|

|

| Statement of Changes in Net Assets Available for Benefits |

|

3 |

|

|

| Notes to Financial Statements |

|

4-15 |

|

|

| Supplemental Schedule: |

|

|

|

|

| Schedule of Assets (Held at End of Year) |

|

16 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

KeyCorp, as Plan Sponsor for the KeyCorp 401(k) Savings Plan

Cleveland, Ohio

We have audited the accompanying Statement of

Net Assets Available for Benefits of the KeyCorp 401(k) Savings Plan (the “Plan”) as of December 31, 2014 and 2013, and the related Statements of Changes in Net Assets Available for Benefits for the years then ended. These financial

statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we

plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial

reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of

the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also

includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of

December 31, 2014 and 2013, and the changes in net assets available for benefits of the Plan for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

The supplemental Schedule of Assets (Held at End of Year) as of December 31, 2014 has been subjected to audit procedures performed in conjunction with

the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or

the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated

whether the supplemental schedule, including its form and content, is presented in conformity with Department of Labor’s (DOL) Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our

opinion, the supplemental schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Meaden &

Moore, Ltd.

Certified Public Accountants

Cleveland, Ohio

June 25, 2015

STATEMENT OF NET ASSETS AVAILABLE FOR BENEFITS

KeyCorp

401(k) Savings Plan

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Investments: |

|

|

|

|

|

|

|

|

| KeyCorp common stock (cost $176,113,911 and $203,983,386 at 2014 and 2013, respectively) |

|

$ |

237,380,683 |

|

|

$ |

265,450,915 |

|

| Interest in mutual funds and collective trusts at fair value |

|

|

1,609,539,444 |

|

|

|

1,518,534,788 |

|

| Plan interest in KeyCorp 401(k) Savings Plan Cash Balance Pension Plan Master Trust |

|

|

21,568,427 |

|

|

|

17,700,994 |

|

|

|

|

|

|

|

|

|

|

| Total Investments |

|

|

1,868,488,554 |

|

|

|

1,801,686,697 |

|

|

|

|

| Receivables: |

|

|

|

|

|

|

|

|

| Notes receivable from participants |

|

|

40,893,871 |

|

|

|

38,304,941 |

|

| Receivable — Employer contributions |

|

|

20,180,835 |

|

|

|

20,331,501 |

|

| Receivable — Interest and dividends |

|

|

392,829 |

|

|

|

257,291 |

|

| Securities sold, not settled |

|

|

407,310 |

|

|

|

319,078 |

|

|

|

|

|

|

|

|

|

|

| Total Receivables |

|

|

61,874,845 |

|

|

|

59,212,811 |

|

|

|

|

| Cash |

|

|

884,032 |

|

|

|

804,280 |

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

|

1,931,247,431 |

|

|

|

1,861,703,788 |

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

| Payables – administrative and other expenses |

|

|

97,830 |

|

|

|

— |

|

| Securities purchased, not settled |

|

|

— |

|

|

|

300,591 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

97,830 |

|

|

|

300,591 |

|

|

|

|

|

|

|

|

|

|

| Net Assets Available for Benefits at Fair Value |

|

|

1,931,149,601 |

|

|

|

1,861,403,197 |

|

|

|

|

| Adjustment from fair value to contract value for fully benefit-responsive investment contracts |

|

|

(1,786,396 |

) |

|

|

(1,230,004 |

) |

|

|

|

|

|

|

|

|

|

| Net Assets Available for Benefits |

|

$ |

1,929,363,205 |

|

|

$ |

1,860,173,193 |

|

|

|

|

|

|

|

|

|

|

See accompanying notes.

- 2 -

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

KeyCorp

401(k) Savings Plan

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, |

|

| |

|

2014 |

|

|

2013 |

|

| Additions to Net Assets Attributed to: |

|

|

|

|

|

|

|

|

| Contributions: |

|

|

|

|

|

|

|

|

| Employer |

|

$ |

69,343,068 |

|

|

$ |

70,457,498 |

|

| Participants |

|

|

74,762,455 |

|

|

|

75,695,623 |

|

| Rollovers |

|

|

4,119,664 |

|

|

|

4,373,677 |

|

|

|

|

|

|

|

|

|

|

| Total Contributions |

|

|

148,225,187 |

|

|

|

150,526,798 |

|

|

|

|

| Interest on participant notes receivable |

|

|

1,538,166 |

|

|

|

1,462,329 |

|

|

|

|

| Investment Income (Loss): |

|

|

|

|

|

|

|

|

| Common stock dividends |

|

|

4,544,562 |

|

|

|

4,630,680 |

|

| Net investment income from mutual funds and collective trusts |

|

|

20,129,397 |

|

|

|

15,648,178 |

|

| Net realized gain and unrealized appreciation |

|

|

83,871,447 |

|

|

|

372,799,006 |

|

| Plan interest in KeyCorp 401(k) Savings Plan Cash Balance Pension Plan Master Trust investment income (loss) |

|

|

1,274,744 |

|

|

|

(1,481,145 |

) |

| Other receipts |

|

|

4,524 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Total Investment Income |

|

|

109,824,674 |

|

|

|

391,596,719 |

|

|

|

|

| Deductions from Net Assets Attributed to: |

|

|

|

|

|

|

|

|

| Participant withdrawals |

|

|

187,327,138 |

|

|

|

201,881,870 |

|

| Administrative and other expenses |

|

|

3,070,877 |

|

|

|

2,760,396 |

|

|

|

|

|

|

|

|

|

|

| Total Deductions |

|

|

190,398,015 |

|

|

|

204,642,266 |

|

|

|

|

| Net Increase |

|

|

69,190,012 |

|

|

|

338,943,580 |

|

|

|

|

| Net Assets Available for Benefits: |

|

|

|

|

|

|

|

|

| Beginning of Year |

|

|

1,860,173,193 |

|

|

|

1,521,229,613 |

|

|

|

|

|

|

|

|

|

|

| End of Year |

|

$ |

1,929,363,205 |

|

|

$ |

1,860,173,193 |

|

|

|

|

|

|

|

|

|

|

See accompanying notes.

- 3 -

NOTES TO FINANCIAL STATEMENTS

KeyCorp

401(k) Savings Plan

The following description of the KeyCorp 401(k) Savings Plan (Plan)

provides only general information. Participants should refer to the Summary Plan Description or Plan document for a more complete description of the Plan’s provisions.

General:

The Plan

consists of a profit sharing plan with a cash or deferred arrangement, as authorized under Section 401(k) of the Internal Revenue Code of 1986, as amended (Code), and an employee stock ownership plan (ESOP), as authorized under the provisions

of Section 4975(e)(7) of the Code. As of January 1, 2011, the Plan was amended and restated to close the KeyCorp Common Stock Fund to new investments effective January 1, 2012, with the exception of KeyCorp dividend reinvestments, and

make other administrative modifications and changes as required by law or to facilitate the administration of the Plan.

The portion of the

Plan that is attributable to participant contributions invested in the Plan’s various investment funds (other than the Plan’s KeyCorp Common Stock Fund) constitutes a profit sharing plan. The portion of the Plan that is attributable to

participant contributions, employer contributions, profit sharing contributions, after-tax contributions, and rollover contributions invested primarily in KeyCorp common shares constitutes an ESOP. The Plan is intended to be qualified under

Section 401(a) of the Code and the provisions of Titles I, II, and III of the Employee Retirement Income Security Act of 1974, as amended (ERISA).

Dividends paid on those KeyCorp common shares maintained in the ESOP, at the participant’s election, may automatically be reinvested in

the Plan’s Common Stock Fund or paid directly to the participant. In 2014 and 2013, dividends of $639,592 and $668,114, respectively, were paid directly to participants in connection with this election and are reflected in the Statement of

Changes in Net Assets Available for Benefits as participant withdrawals.

Eligibility:

All regular full-time and part-time employees of KeyCorp and its participating subsidiaries (Employer or Key) are eligible to participate in

the Plan as of their first day of employment with the Employer for purposes of making pre-tax contributions, Roth contributions, Plan transfer contributions, and rollover contributions. Employees are eligible to participate in receiving employer

contributions and profit sharing contributions in accordance with the following eligibility requirements: for employees whose employment commencement date is July 1, 2006, or after, participants can receive these contributions after completing

one year of service. Seasonal and on-call employees are required to complete 1,000 hours of service prior to becoming eligible to participate in the Plan.

Contributions:

Contributions are subject to limitations on annual additions and other limitations imposed by the Code as defined in the Plan agreement.

Employee 401(k) Deferral:

In years in which the safe harbor provisions of Section 401(k)(12) of the Code are not utilized, employees who have met the eligibility

requirements and have elected to participate may contribute from 1% to 100% of their compensation on a pre-tax basis to the Plan, and highly compensated employees (as that term is defined in accordance with Section 414(n) of the Code) may

contribute from 1% to 6% of their compensation to the Plan. For the 2014 and 2013 Plan years, the Plan utilized the safe harbor provisions of Section 401(k)(12) of the Code, which permits the Plan to automatically satisfy certain

nondiscrimination requirements of the Code without undergoing the necessity of discrimination testing. In years in which the safe harbor provisions of Section 401(k)(12) of the Code are utilized (2014 and 2013), all eligible employees may

contribute up to 100% of their compensation to the Plan. For Plan years commencing on or after January 1, 2014, the Plan provides a qualified Roth contribution program.

- 4 -

NOTES TO FINANCIAL STATEMENTS

KeyCorp

401(k) Savings Plan

| 1 |

Description of Plan, Continued |

Employee 401(k) Deferral, Continued:

Commencing January 1, 2010, an automatic enrollment feature was added to the Plan for

all new regular full-time and part-time employees of the Employer (Covered Employees). The initial default contribution percentage for Covered Employees is 2% and will increase by 1% at the beginning of each Plan year until the default percentage is

10% for Plan years on and after January 1, 2012. The Covered Employee may request a distribution of his or her default elective deferrals no later than 90 days after default elective deferrals are first withheld from a Covered Employee’s

pay.

Employer Matching Contributions:

After satisfying the eligibility requirements, Key matches up to the first 6% of the participant’s contributions to the Plan. Default

elective deferrals will be eligible for matching contributions after the Covered Employee satisfies the Eligibility Requirements for receiving a matching contribution. Commencing for Plan years on and after January 1, 2012, the KeyCorp Common

Stock Fund was closed to new investments, and matching contributions became subject to the investment direction of the participant.

Effective for Plan years commencing on or after January 1, 2013, the Employer Matching Contribution for each participant is based on the

participant’s eligible annual compensation. For the 2014 and 2013 Plan years, the Plan utilized the safe harbor provisions of Section 401(k)(12) of the Code, which permits the Plan to automatically satisfy certain nondiscrimination

requirements of the Code without undergoing the necessity of discrimination testing.

Employer Discretionary Contributions:

Key may also make additional contributions as approved by the Board of Directors. Commencing January 1, 2010, and thereafter,

profit sharing contributions may be made, allocated, and credited to the accounts of participants employed on the last business day of the Plan year as a flat percentage of eligible compensation for the participants entitled to receive an

allocation, based on the further terms and conditions set forth in the Plan. For Plan years beginning on and after January 1, 2012, participants will share in profit sharing contributions for the applicable year if the participant experienced a

Termination Under Limited Circumstances, as defined by the Plan, during the Plan year. Key contributed a 2% profit sharing allocation for 2014 and 2013 on eligible compensation for employees eligible on the last business day of the respective Plan

years.

Rollover Contributions:

Rollover contributions from other plans are also accepted, providing certain specified conditions are met.

Participant’s Accounts:

Each participant’s account is credited with the participant’s elective contributions, employer matching contributions, employer

discretionary contributions, and earnings and losses thereon.

Vesting:

All participants are 100% vested in elective deferrals (pre-tax and Roth) and rollover contributions made to the Plan. In years in which the

safe harbor provisions of Section 401(k)(12) of the Code are not utilized, participants are 100% vested in Key matching contributions after three years of service. Contributions subject to the safe harbor provisions of Section 401(k)(12)

are 100% vested. Participants are 100% vested in Key discretionary contributions after three years of service.

- 5 -

NOTES TO FINANCIAL STATEMENTS

KeyCorp

401(k) Savings Plan

| 1 |

Description of Plan, Continued |

Forfeitures:

Under the terms of the Plan, forfeited nonvested participant amounts may be used to pay Plan administrative expenses and to offset

Employer contributions to the Plan. At December 31, 2014, and December 31, 2013, the Plan’s investments included $1,275,507 and $920,373 of Plan forfeitures. Plan forfeitures were not used to pay Plan administrative expenses or offset

Employer contributions to the Plan in 2014 or 2013.

Notes Receivable from Participants:

Loans are permitted under certain circumstances and are subject to limitations. Participants may borrow from their fund accounts up to a

maximum equal to the lesser of $50,000 or 50% of their vested account balance. Loans are repaid over a period not to exceed five years with exceptions for the purchase of a primary residence.

The loans are secured by the balance in the participant’s account. The interest rate is currently established by the terms of the Loan

Policy as Prime plus 1.

Loans to Plan participants are valued at their unpaid principal balance plus accrued but unpaid interest, which

approximates fair value.

Payment of Benefits:

Distribution of participant contributions and matching contributions are subject to the distribution limitations outlined in

Section 401(k) of the Code (i.e., attainment of age 59 1/2, severance from employment, retirement, death, or disability, subject to special grandfathered distribution provisions). Upon termination, participants may receive a distribution of

their vested account balance in cash or may elect to have their interest in the KeyCorp Common Stock Fund distributed to them in common shares of KeyCorp. Participants may leave their balance in the Plan if their balance is greater than $1,000. Upon

retirement, participants may elect to receive their Plan distribution as a lump sum payment or as a monthly, quarterly, or annual installment payment.

Hardship Withdrawals:

Hardship withdrawals are permitted in accordance with Internal Revenue Service guidelines.

Investment Options:

Upon enrollment in the Plan, a participant may direct his or her employee contribution in any of the investment options offered by the Plan. As

discussed above, the KeyCorp Common Stock Fund was closed to new investments effective January 1, 2012.

- 6 -

NOTES TO FINANCIAL STATEMENTS

KeyCorp

401(k) Savings Plan

| 2 |

Summary of Significant Accounting Policies |

Basis of Accounting:

The Plan’s transactions are reported on the accrual basis of accounting.

Investment Valuation:

Investments are stated at aggregate fair value, which is determined based on the closing price reported on the last business day of the Plan

year as follows:

KeyCorp Common Stock

Closing market price as quoted on the New York Stock Exchange as of December 31, 2014, and December 31, 2013. The closing market

price of KeyCorp’s Common Stock at December 31, 2014, and December 31, 2013, was $13.90 and $13.42, respectively.

Mutual Funds

Closing

market price as quoted per a third-party valuation service as of December 31, 2014, and December 31, 2013.

Collective Trust

Funds

Market values of units held in collective trust funds are determined daily by the trustee of the funds based on reported

redemption values received from a third-party valuation service.

KeyCorp 401(k) Savings Plan Cash Balance Pension Plan Master Trust

(Master Trust)

Market values of units held in the Master Trust are determined daily by the trustee of the Master Trust based on

reported redemption values received from a third-party valuation service.

Fully Benefit-Responsive Investment Contracts

As described in the accounting guidance applicable to reporting of fully benefit-responsive investment contracts held by certain investment

companies subject to the AICPA Investment Company Guide and defined-contribution health and welfare and pension plans, investment contracts held by a defined-contribution plan are required to be reported at fair value. However, contract value is the

relevant measurement attribute for that portion of the net assets available for benefits of a defined-contribution plan attributable to fully benefit-responsive investment contracts because contract value is the amount participants would receive if

they were to initiate permitted transactions under the terms of the Plan. As required by the applicable accounting guidance, the Statement of Net Assets Available for Benefits presents the fair value of the investment contracts as well as the

adjustment of the fully benefit-responsive investment contracts from fair value to contract value. The Statement of Changes in Net Assets Available for Benefits is prepared on a contract value basis.

The fair value is based on various valuation approaches dependent on the underlying investments of the contract.

The change in the difference between fair value (contract value for fully benefit-responsive investment contracts) and the cost of investments

is reflected in the Statements of Changes in Net Assets Available for Benefits as a component of net realized gain and unrealized appreciation.

- 7 -

NOTES TO FINANCIAL STATEMENTS

KeyCorp

401(k) Savings Plan

| 2 |

Summary of Significant Accounting Policies, Continued |

Investment Transactions:

Purchases and sales of securities are reflected on a trade-date basis. Gains or losses on sales of KeyCorp Common Stock are based on the

specific cost of units sold. Gains or losses on sales of mutual funds, collective trust funds, and the Master Trust are based on the average cost per share or per unit at the time of the sale. In the case of KeyCorp Common Stock, brokerage

commissions are added to the cost of shares purchased and subtracted from the proceeds of shares sold. No direct brokerage commissions are incurred by the Plan on purchases and sales of shares or units in mutual funds and collective trust funds.

Investment Income:

Dividend income is recorded on the ex-dividend date. Income from other investments is recorded as earned on the accrual basis.

Fair Value Measurement:

Accounting guidance defines fair value as the price to sell an asset or transfer a liability in an orderly transaction between market

participants in the principal market. In other words, fair value represents an exit price at the measurement date. Market participants are buyers and sellers who are independent, knowledgeable, and willing and able to transact in the principal (or

most advantageous) market for the asset or liability being measured. Current market conditions, including imbalances between supply and demand, are considered in determining fair value.

The Plan’s assets are valued based on the principal market where each would be sold. The principal market is the forum with the greatest

volume and level of activity. In the absence of a principal market, valuation is based on the most advantageous market (i.e., the market where the asset could be sold at a price that maximizes the amount to be received).

There are three acceptable techniques for measuring fair value: the market approach, the income approach, and the cost approach. The

appropriate technique for valuing a particular asset depends on the exit market, the nature of the asset being valued, and how a market participant would value the same asset. Ultimately, selecting the appropriate valuation method requires

significant judgment, and applying the valuation technique requires sufficient knowledge and expertise.

Valuation inputs refer to the

assumptions market participants would use in pricing a given asset. Inputs can be observable or unobservable. Observable inputs are assumptions based on market data obtained from an independent source. Unobservable inputs are assumptions based on

the Trustee’s own information or assessment of assumptions used by other market participants in pricing the asset. Unobservable inputs are based on the best and most current information available on the measurement date.

All inputs, whether observable or unobservable, are ranked in accordance with a prescribed fair value hierarchy that gives the highest ranking

to quoted prices in active markets for identical assets (Level 1) and the lowest ranking to unobservable inputs (Level 3). Fair values for assets classified as Level 2 are based on one or a combination of the following factors: (a) quoted

market prices for similar assets in active markets; (b) quoted prices for identical or similar assets in inactive markets; (c) observable inputs, such as interest rates or yield curves; or (d) inputs derived principally from or

corroborated by observable market data. The level in the fair value hierarchy ascribed to a fair value measurement in its entirety is based on the lowest level input that is significant to the measurement. The Plan considers an input to be

significant if it drives 10% or more of the total fair value of a particular asset. Assets may transfer between levels based on the observable and unobservable inputs used at the valuation date, as the inputs may be influenced by certain market

conditions. Transfers between levels of the fair value hierarchy are recognized at the end of the reporting period.

- 8 -

NOTES TO FINANCIAL STATEMENTS

KeyCorp

401(k) Savings Plan

| 2 |

Summary of Significant Accounting Policies, Continued |

Fair Value Measurement, Continued:

Typically, assets are considered to be fair valued on a recurring basis if fair value is measured regularly. Additional information regarding

fair value measurements and disclosures is provided in Note 6 (“Fair Value Measurements”).

Use of Estimates:

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual

results could differ from those estimates.

Administrative Fees:

Substantially all administrative fees are paid by the Plan.

Plan Termination:

Although it has not expressed any intent to do so, Key has the right under the Plan to discontinue its contributions at any time and to

terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, participants will become 100% vested in their accounts.

Risks and Uncertainties:

The Plan invests in various investments, including KeyCorp common stock and interests in mutual funds, collective trusts (including fully

benefit-responsive investment contracts), and the Master Trust. These investments are exposed to various risks such as interest rate, market, and credit risks. Due to the level of risk associated with certain investments, it is at least reasonably

possible that changes in values of investments will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the Statement of Net Assets Available for Benefits.

Subsequent Events:

In preparing these financial statements, subsequent events were evaluated through the time the financial statements were issued. Financial

statements are considered issued when they are widely distributed to all shareholders and other financial statement users, or filed with the SEC. In compliance with applicable accounting standards, all material subsequent events have been either

recognized in the financial statements or disclosed in the notes to the financial statements.

Accounting Guidance Pending Adoption:

In April 2015, the Financial Accounting Standards Board (FASB) issued new accounting guidance that eliminates the requirement to

categorize investments in the fair value hierarchy if their fair value is measured at net asset value per share (or its equivalent) using the practical expedient in the FASB’s fair value measurement guidance. An entity must disclose the amount

of investments measured at net asset value per share (or its equivalent) under the practical expedient to allow reconciliation of total investments in the fair value hierarchy to total investments measured at fair value in the statement of changes

in net assets. This accounting guidance will be effective for interim and annual reporting periods beginning after December 15, 2015 (effective January 1, 2016, for the Plan) and should be implemented using a retrospective approach. Early

adoption is permitted. The adoption of this accounting guidance is not expected to have a material effect on the Plan’s financial condition or results of operations.

- 9 -

NOTES TO FINANCIAL STATEMENTS

KeyCorp

401(k) Savings Plan

The Internal Revenue Service has determined and informed Key by letter dated

September 22, 2013, that the Plan and related trust as of the January 1, 2011 Restatement are designed in accordance with applicable sections of the Internal Revenue Code.

The Plan has been amended since receiving the determination letter. However, the Plan Administrator and tax counsel believe that the Plan is

currently designed and being operated in compliance with the applicable requirements of the Internal Revenue Code. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

Accounting principles generally accepted in the United States of America (U.S. GAAP) requires plan management to evaluate tax positions taken

by the Plan and recognize a tax liability if the Plan has taken uncertain tax positions that more-likely-than-not would not be sustained upon examination by applicable taxing authorities. The Plan administrator has analyzed tax positions taken by

the Plan and has concluded that, as of December 31, 2014, there are no uncertain tax positions taken, or expected to be taken, that would require recognition of a liability or that would require disclosure in the financial statements. The Plan

is subject to routine audits by taxing jurisdictions. However, currently no audits for any tax periods are in progress.

| 4 |

Collective Trust Fund with Fully Benefit-Responsive Investment Contracts |

The

Plan’s investment in the KeyBank EB Magic Fund (Fund) as of December 31, 2014, and December 31, 2013, principally consists of fully benefit-responsive synthetic guaranteed investment contracts (GICs). At December 31, 2014, the

Plan’s investment in the KeyBank EB Magic Fund had a fair value of $117,577,300 and contract value of $115,790,904. At December 31, 2013, the Plan’s investment in the KeyBank EB Magic Fund had a fair value of $122,899,414 and contract

value of $121,669,410. The GIC investments held by the Fund represent arrangements, which guarantee a stated interest rate for the term of the contracts.

Traditional GICs are unsecured, general obligations of insurance companies. The obligation is backed by the general account assets of the

insurance company that writes the investment contract. The interest crediting rate on the contract is typically fixed for the life of the investment. Separate account GICs are investments in a segregated account of assets maintained by an insurance

company for the benefit of the investors. The total return of the segregated account assets supports the separate account GIC’s return. The credited rate on this product will reset periodically and it will have an interest rate of not less than

0%.

General fixed maturity synthetic GICs consist of an asset or collection of assets that are owned by the Fund and a benefit-responsive,

book value wrap contract purchased for the portfolio. The crediting rate of the contract is set at the start of the contract and typically resets every quarter. The initial crediting rate for the contract is established based on the market interest

rates at the time the initial asset is purchased and it will have an interest crediting rate of not less than 0%.

Constant duration

synthetic GICs consist of a portfolio of securities owned by the Fund and a benefit-responsive, book value wrap contract purchased for the portfolio. The crediting rate on a constant duration synthetic GIC resets every quarter based on the book

value of the contract, the market yield of the underlying assets, the market value of the underlying assets, and the average duration of the underlying assets. The initial crediting rate for the contract is established based on the market interest

rates at the time the underlying portfolio is first put together and it will have an interest crediting rate of not less than 0%.

The

average market yield of the KeyBank EB Magic Fund for 2014 and 2013 was 1.86% and 1.69%, respectively. This yield is calculated based on actual investment income from the underlying investments for the last month of the year, annualized and divided

by the fair value of the investment portfolio on the respective balance sheet date. The average yield of the Fund with an adjustment to reflect the actual interest rate credited to participants in the Fund was 1.79% and 1.60% for 2014 and 2013,

respectively.

- 10 -

NOTES TO FINANCIAL STATEMENTS

KeyCorp

401(k) Savings Plan

During the years ended December 31, 2014, and December 31, 2013,

the Plan’s investments (including realized gains and losses on investments held for any portion of the Plan year) appreciated in fair market value (contract value for fully benefit-responsive investment contracts) by the net amount of

$83,871,447 and $372,799,006, respectively, as follows:

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

| Net appreciation (depreciation) in fair value (contract value for fully benefit-responsive investment contracts) during the

year: |

|

|

|

|

|

|

|

|

| KeyCorp Common Stock Fund |

|

$ |

8,626,745 |

|

|

$ |

110,009,546 |

|

| BlackRock LifePath Index 2015 NL CIT Fund |

|

|

(1,160,763 |

) |

|

|

1,256,742 |

|

| BlackRock LifePath Index 2020 NL CIT Fund |

|

|

1,790,411 |

|

|

|

2,914,943 |

|

| BlackRock LifePath Index 2025 NL CIT Fund |

|

|

2,003,734 |

|

|

|

3,375,414 |

|

| BlackRock LifePath Index 2030 NL CIT Fund |

|

|

1,779,857 |

|

|

|

3,434,323 |

|

| BlackRock LifePath Index 2035 NL CIT Fund |

|

|

1,443,289 |

|

|

|

3,062,437 |

|

| BlackRock LifePath Index 2040 NL CIT Fund |

|

|

1,248,614 |

|

|

|

2,601,039 |

|

| BlackRock LifePath Index 2045 NL CIT Fund |

|

|

964,334 |

|

|

|

1,948,947 |

|

| BlackRock LifePath Index 2050 NL CIT Fund |

|

|

834,258 |

|

|

|

1,731,991 |

|

| BlackRock LifePath Index 2055 NL CIT Fund |

|

|

552,407 |

|

|

|

1,120,401 |

|

| BlackRock LifePath Index Retirement NL CIT Fund |

|

|

2,378,895 |

|

|

|

410,625 |

|

| Dodge & Cox International Stock Fund |

|

|

(2,584,147 |

) |

|

|

20,473,240 |

|

| Harding Loevner International Equity Collective Fund |

|

|

(79,259 |

) |

|

|

479,127 |

|

| Jennison Large Cap Growth Equity Fund |

|

|

13,091,092 |

|

|

|

35,771,924 |

|

| KeyBank EB MaGIC Fund |

|

|

2,008,755 |

|

|

|

2,163,126 |

|

| Lord Abbett Developing Growth Fund |

|

|

1,275,149 |

|

|

|

19,813,329 |

|

| PIMCO Total Return Fund |

|

|

489,082 |

|

|

|

(4,379,796 |

) |

| Robeco Large Cap Value Equity Fund |

|

|

10,732,531 |

|

|

|

26,208,340 |

|

| Vanguard Total Bond Market Index Fund |

|

|

1,319,134 |

|

|

|

(1,747,362 |

) |

| Vanguard Developed Markets Index Fund |

|

|

(10,031,232 |

) |

|

|

14,144,640 |

|

| Vanguard Extended Market Index Plus Fund |

|

|

8,042,938 |

|

|

|

33,748,249 |

|

| Vanguard Institutional Index Plus Fund |

|

|

27,177,095 |

|

|

|

51,407,858 |

|

| Victory Institutional Diversified Stock Fund |

|

|

8,540,360 |

|

|

|

27,838,747 |

|

| Victory Small Company Opportunity Fund |

|

|

3,428,168 |

|

|

|

15,011,176 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

83,871,447 |

|

|

$ |

372,799,006 |

|

|

|

|

|

|

|

|

|

|

- 11 -

NOTES TO FINANCIAL STATEMENTS

KeyCorp

401(k) Savings Plan

The Plan’s funds are invested in the various investments, including the KeyCorp Common

Stock Fund and interests in mutual funds and collective trusts, through The Bank of New York Mellon. Investments that constitute more than 5% of the Plan’s net assets are as follows:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| KeyCorp Common Stock Fund |

|

$ |

237,380,683 |

|

|

$ |

265,450,915 |

|

| Dodge & Cox International Stock Fund |

|

$ |

110,944,153 |

|

|

$ |

106,125,286 |

|

| Jennison Large Cap Growth Equity Fund |

|

$ |

132,591,594 |

|

|

$ |

128,768,611 |

|

| KeyBank EB Magic Fund |

|

$ |

117,577,300 |

|

|

$ |

122,899,414 |

|

| Robeco Large Cap Value Equity Fund |

|

$ |

101,759,450 |

|

|

$ |

96,535,810 |

|

| Vanguard Developed Markets Index Fund |

|

$ |

100,170,791 |

|

|

$ |

97,268,599 |

|

| Vanguard Extended Market Index Plus Fund |

|

$ |

138,873,605 |

|

|

$ |

131,412,042 |

|

| Vanguard Institutional Index Plus Fund |

|

$ |

270,469,228 |

|

|

$ |

229,337,249 |

|

| Victory Institutional Diversified Stock Fund |

|

$ |

100,022,937 |

|

|

$ |

102,589,087 |

|

- 12 -

NOTES TO FINANCIAL STATEMENTS

KeyCorp

401(k) Savings Plan

| 6 |

Fair Value Measurements |

The following is a description of the valuation methodologies

used to measure the fair value of assets held in the Plan:

KeyCorp Common Stock. Investments in KeyCorp Common Stock are

valued at their official closing price on the New York Stock Exchange and are classified as Level 1.

Mutual Funds, Collective Trust

Funds, and Money Market Funds. Investments in mutual funds, collective trust funds, and money market funds are valued at their closing net asset value. Exchange-traded mutual funds are valued using quoted prices and, therefore, are

classified as Level 1. Because net asset values for the collective trust funds and money market funds are based primarily on observable inputs, most notably quoted prices for the underlying assets, these investments are classified as Level 2.

The investment strategies for the collective trust funds are varied, and they may invest directly and indirectly in a broad range of equities,

debt, and derivative instruments with the objective of mirroring or exceeding the total return of certain market indices. Strategies may vary based on global macroeconomic views, expected directional movements in the financial markets, market

capitalization, and other strategies. Participant transactions (purchases and sales) occur daily. However, in high volume liquidation demand periods, the Trustee may, at their discretion, delay liquidation requests so that it is in the best

interest of all participants in the fund.

Plan assets are measured at fair value on a recurring basis in accordance with U.S. GAAP. The

following tables present the Plan’s assets measured at fair value on a recurring basis at December 31, 2014, and December 31, 2013. The following tables do not include the Plan’s interest in the Master Trust because that

information is presented in separate tables (see Note 7).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| December 31, 2014 |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Common Stock — U.S. |

|

$ |

237,380,683 |

|

|

|

— |

|

|

|

— |

|

|

$ |

237,380,683 |

|

| Mutual Funds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. equity |

|

|

620,284,326 |

|

|

|

— |

|

|

|

— |

|

|

|

620,284,326 |

|

| International equity |

|

|

211,114,944 |

|

|

|

— |

|

|

|

— |

|

|

|

211,114,944 |

|

| Fixed income |

|

|

133,755,634 |

|

|

|

— |

|

|

|

— |

|

|

|

133,755,634 |

|

| Collective Trust Funds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. equity |

|

|

— |

|

|

$ |

234,351,044 |

|

|

|

— |

|

|

|

234,351,044 |

|

| International equity |

|

|

— |

|

|

|

4,861,867 |

|

|

|

— |

|

|

|

4,861,867 |

|

| Target maturity |

|

|

— |

|

|

|

217,236,251 |

|

|

|

— |

|

|

|

217,236,251 |

|

| Guaranteed investment contract |

|

|

— |

|

|

|

117,577,300 |

|

|

|

— |

|

|

|

117,577,300 |

|

| Money Market Funds |

|

|

— |

|

|

|

70,358,078 |

|

|

|

— |

|

|

|

70,358,078 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

1,202,535,587 |

|

|

$ |

644,384,540 |

|

|

|

— |

|

|

$ |

1,846,920,127 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| December 31, 2013 |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Common Stock — U.S. |

|

$ |

265,450,915 |

|

|

|

— |

|

|

|

— |

|

|

$ |

265,450,915 |

|

| Mutual Funds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. equity |

|

|

578,226,361 |

|

|

|

— |

|

|

|

— |

|

|

|

578,226,361 |

|

| International equity |

|

|

203,393,885 |

|

|

|

— |

|

|

|

— |

|

|

|

203,393,885 |

|

| Fixed income |

|

|

119,713,230 |

|

|

|

— |

|

|

|

— |

|

|

|

119,713,230 |

|

| Collective Trust Funds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. equity |

|

|

— |

|

|

$ |

225,304,421 |

|

|

|

— |

|

|

|

225,304,421 |

|

| International equity |

|

|

— |

|

|

|

4,443,526 |

|

|

|

— |

|

|

|

4,443,526 |

|

| Target maturity |

|

|

— |

|

|

|

187,317,772 |

|

|

|

— |

|

|

|

187,317,772 |

|

| Guaranteed investment contract |

|

|

— |

|

|

|

122,899,414 |

|

|

|

— |

|

|

|

122,899,414 |

|

| Money Market Funds |

|

|

— |

|

|

|

77,236,179 |

|

|

|

— |

|

|

|

77,236,179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

1,166,784,391 |

|

|

$ |

617,201,312 |

|

|

|

— |

|

|

$ |

1,783,985,703 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 13 -

NOTES TO FINANCIAL STATEMENTS

KeyCorp

401(k) Savings Plan

| 7 |

Interest in Master Trust |

A portion of the Plan’s investments are in the Master

Trust, which was established in 2012 for the investment of assets of the Plan and the KeyCorp Cash Balance Pension Plan. Each participating retirement plan has an undivided interest in the Master Trust. The assets of the Master Trust are held by The

Bank of New York Mellon (Trustee). At December 31, 2014, and December 31, 2013, the Plan’s interest in the net assets of the Master Trust was approximately 16% and 14%, respectively. Investment income (loss) and administrative

expenses relating to the Master Trust are allocated to the individual plans based on the relationship of the interest of each plan to the total interests of the participating plans. Participant transactions are completed daily.

The following table presents the fair values of the assets, including investments, of the Master Trust at December 31, 2014, and

December 31, 2013.

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

| PIMCO Diversified Real Asset Strategy Separate Account |

|

$ |

130,809,470 |

|

|

$ |

128,141,957 |

|

|

|

|

|

|

|

|

|

|

| Total KeyCorp 401(k) Savings Plan Cash Balance Pension Plan Master Trust |

|

$ |

130,809,470 |

|

|

$ |

128,141,957 |

|

|

|

|

|

|

|

|

|

|

| Plan interest in KeyCorp 401(k) Savings Plan Cash Balance Pension Plan Master Trust |

|

$ |

21,568,427 |

|

|

$ |

17,700,994 |

|

|

|

|

|

|

|

|

|

|

Investment income (loss) for the Master Trust for the years ended December 31, 2014, and December 31,

2013, is as follows:

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

| Net appreciation (depreciation) in fair value of investments: |

|

|

|

|

|

|

|

|

| PIMCO Diversified Real Asset Strategy Separate Account |

|

$ |

11,448,219 |

|

|

$ |

(8,160,410 |

) |

|

|

|

|

|

|

|

|

|

All of the investments of the Master Trust are presented in the following tables and are valued at fair value

(see Note 6). Investments in separately managed accounts are valued at their closing net asset value. Because net asset values for the separately managed accounts are based primarily on observable inputs, most notably quoted prices for the

underlying assets, these investments are classified as Level 2.

The PIMCO Diversified Real Asset Strategy Separate Account is an actively

managed portfolio designed to provide strategic exposure to three core real assets: Treasury Inflation-Protected Securities, commodities, and real estate.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| December 31, 2014 |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| PIMCO Diversified Real Asset Strategy Separate Account |

|

|

— |

|

|

$ |

130,809,470 |

|

|

|

— |

|

|

$ |

130,809,470 |

|

|

|

|

|

|

| December 31, 2013 |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| PIMCO Diversified Real Asset Strategy Separate Account |

|

|

— |

|

|

$ |

128,141,957 |

|

|

|

— |

|

|

$ |

128,141,957 |

|

- 14 -

NOTES TO FINANCIAL STATEMENTS

KeyCorp

401(k) Savings Plan

| 8 |

Party-in-Interest Transactions |

During 2014 and 2013, the Plan received $4,544,562 and

$4,630,680, respectively, in KeyCorp common stock dividends. The Plan’s investments in mutual funds and collective trusts received $20,129,397 and $15,648,178 in investment income and capital gains distributions in 2014 and 2013, respectively.

Victory Capital Management, Inc. (Victory), a former affiliate of KeyCorp, serves as an investment advisor to some of the Plan’s investment funds. KeyCorp completed the sale of Victory to a non-related private equity fund on July 31, 2013.

During the year ended December 31, 2014, the Plan did not purchase KeyCorp common stock, and 2,381,390 shares of common stock of

KeyCorp were sold by the Plan for $32,404,801. During the year ended December 31, 2013, the Plan did not purchase KeyCorp common stock, and 3,976,419 shares of common stock of KeyCorp were sold by the Plan for $42,625,172. The sales of KeyCorp

common stock were completed in the open market.

Metyk litigation. Two putative class actions were filed

in September 2010 in the United States District Court for the Northern District of Ohio (Northern District). The plaintiffs in these cases sought to represent a class of all participants in the 401(k) Savings Plan and alleged that the defendants in

the lawsuit breached fiduciary duties owed to them under ERISA. These two putative class action lawsuits were substantively consolidated with each other in a proceeding styled Thomas Metyk, et al. v. KeyCorp, et al. (Metyk). In January 2013,

the Northern District entered an order granting the defendants’ motion to dismiss the plaintiffs’ consolidated complaint for failure to state a claim and entered its final judgment terminating the Metyk proceeding. Plaintiffs appealed both

the Northern District’s dismissal of the lawsuit and its denial of plaintiffs’ motion to set aside the judgment to the United States Court of Appeals for the Sixth Circuit (Sixth Circuit). The Sixth Circuit affirmed the Northern

District’s decision on both issues and denied plaintiffs’ petition for rehearing or rehearing en banc. Subsequently, plaintiffs filed a Petition for Writ of Certiorari with the Supreme Court of the United States, which the Supreme

Court denied on November 17, 2014.

- 15 -

SCHEDULE OF ASSETS (HELD AT END OF YEAR)

Form 5500, Schedule H, Part IV, Line 4i

KeyCorp

401(k) Savings Plan

EIN 34-6542451

Plan Number 002

December 31, 2014

|

|

|

|

|

|

|

|

|

|

|

| (a) |

|

(b)

Identity of Issue, Borrower,

Lessor, or Similar Party |

|

( c )

Description of Investment

Including Maturity Date, Rate of

Interest, Collateral, Par, or Maturity Value |

|

(d)

Cost |

|

(e)

Current Value |

|

|

|

KeyCorp Common Stock Fund |

|

|

|

|

|

|

|

|

| * |

|

KeyCorp Common Stock |

|

Common Stock |

|

|

|

$ |

237,380,683 |

|

|

|

Collective U.S. Government STIF |

|

Money Market Fund |

|

|

|

|

4,538,351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total KeyCorp Common Stock Fund |

|

|

|

|

|

|

241,919,034 |

|

|

|

|

|

|

|

|

BlackRock LifePath Index 2020 NL CIT Fund |

|

Target Maturity Fund |

|

|

|

|

33,593,213 |

|

|

|

BlackRock LifePath Index 2025 NL CIT Fund |

|

Target Maturity Fund |

|

|

|

|

38,170,982 |

|

|

|

BlackRock LifePath Index 2030 NL CIT Fund |

|

Target Maturity Fund |

|

|

|

|

32,337,768 |

|

|

|

BlackRock LifePath Index 2035 NL CIT Fund |

|

Target Maturity Fund |

|

|

|

|

25,561,125 |

|

|

|

BlackRock LifePath Index 2040 NL CIT Fund |

|

Target Maturity Fund |

|

|

|

|

22,534,595 |

|

|

|

BlackRock LifePath Index 2045 NL CIT Fund |

|

Target Maturity Fund |

|

|

|

|

17,374,611 |

|

|

|

BlackRock LifePath Index 2050 NL CIT Fund |

|

Target Maturity Fund |

|

|

|

|

14,718,281 |

|

|

|

BlackRock LifePath Index 2055 NL CIT Fund |

|

Target Maturity Fund |

|

|

|

|

10,244,091 |

|

|

|

BlackRock LifePath Index Retirement NL CIT Fund |

|

Target Maturity Fund |

|

|

|

|

22,701,585 |

|

|

|

Dodge & Cox International Stock Fund |

|

International Equity Fund |

|

|

|

|

110,944,153 |

|

|

|

Federated Government Obligations Fund |

|

Money Market Fund |

|

|

|

|

61,904,531 |

|

|

|

Harding Loevner International Equity Collective Fund |

|

International Equity Fund |

|

|

|

|

4,861,867 |

|

|

|

Jennison Large Cap Growth Equity Fund |

|

Large U.S. Equity Fund |

|

|

|

|

132,591,594 |

|

| *^^ |

|

KeyBank EB MaGIC Fund |

|

Stable Value Fund |

|

|

|

|

115,790,904 |

|

|

|

Lord Abbett Developing Growth Fund |

|

Small Cap Equity Fund |

|

|

|

|

56,131,764 |

|

|

|

PIMCO Total Return Fund |

|

Fixed Income Fund |

|

|

|

|

79,658,850 |

|

|

|

Robeco Large Cap Value Equity Fund |

|

Large U.S. Equity Fund |

|

|

|

|

101,759,450 |

|

|

|

Vanguard Total Bond Market Index Fund |

|

Fixed Income Fund |

|

|

|

|

54,096,784 |

|

|

|

Vanguard Extended Market Index Plus Fund |

|

Mid U.S Equity Fund |

|

|

|

|

138,873,605 |

|

|

|

Vanguard Institutional Index Plus Fund |

|

Large U.S. Equity Fund |

|

|

|

|

270,469,228 |

|

|

|

Vanguard Developed Markets Index Fund |

|

International Equity Fund |

|

|

|

|

100,170,791 |

|

|

|

Victory Institutional Diversified Stock Fund |

|

Large U.S. Equity Fund |

|

|

|

|

100,022,937 |

|

|

|

Victory Small Company Opportunity Fund |

|

Small U.S. Equity Fund |

|

|

|

|

54,786,792 |

|

|

|

Collective U.S. Government STIF |

|

Money Market Fund |

|

|

|

|

3,915,196 |

|

|

|

Plan interest in KeyCorp 401(k) Savings Plan Cash Balance Pension Plan Master Trust |

|

Master Trust |

|

|

|

|

21,568,427 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets held for investment purposes |

|

|

|

|

|

|

1,866,702,158 |

|

|

|

|

|

|

| * |

|

Participant notes receivable (interest rates from 4.25% to 9.50% with various maturities) |

|

|

|

|

|

|

40,893,871 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets held for investment purposes |

|

|

|

|

|

$ |

1,907,596,029 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

|

Party-in-interest to the Plan. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ^^ |

|

Amount reported at contract value. |

|

|

|

|

|

|

|

|

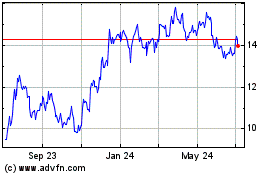

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Apr 2023 to Apr 2024