J&J Stalks Swiss Drug Company -- WSJ

November 26 2016 - 3:02AM

Dow Jones News

By Jonathan D. Rockoff

Johnson & Johnson said Friday it is in "preliminary

discussions" with Swiss drug company Actelion Pharmaceuticals Ltd.,

a deal that would help the health-products company overcome any

lost momentum for its top-selling drug.

J&J, which is based in New Brunswick, N.J., has been trying

to reassure Wall Street that it can withstand looming competition

to its drug Remicade, an autoimmune therapy that had $4.5 billion

in U.S. sales last year. Pfizer Inc. has said it plans to start

selling its copy, Inflectra, in the U.S. this month.

J&J says it has several new drugs in development whose

launch could make up for any revenue loss.

A deal for Actelion, however, would help J&J quickly plug

the lost sales, which analysts estimate could amount to $1 billion

in 2017. Actelion sells drugs for rare diseases, such as an artery

disorder that affects the lung and heart known as pulmonary

arterial hypertension. The company reported about 1.785 billion

Swiss francs ($1.8 billion) in sales for the first nine months of

this year.

A deal for all of Actelion would come at a steep price.

Bloomberg reported J&J's interest in the Swiss company on

Thursday. Applying a typical takeover premium of 25% or more to its

market capitalization at Wednesday's market close, Actelion could

fetch more than $20 billion.

Shares of Actelion rose nearly 17% to 182.50 Swiss francs

($184.03) on the SIX Swiss Exchange on Friday, after the company

confirmed J&J had approached it about a possible

transaction.

With a market value of more than $300 billion and nearly $40

billion in cash overseas, J&J could afford the high price.

J&J's biggest deal to date was the $21 billion acquisition of

trauma-device maker Synthes in 2011.

Both J&J and Actelion cautioned in their statements that a

transaction wouldn't necessarily happen.

It wasn't clear where talks between the companies stand or

whether Actelion is receptive.

Actelion was founded in 1997 by husband-and-wife team Jean-Paul

and Martine Clozel and other former Roche Holding Ltd. employees

who left the Swiss drug firm after it decided not to pursue a

project their group was working on, according to Actelion's

website.

In 2000, Actelion went public and its valuation has climbed

sharply since then. Last year, the company reported revenue of 2.05

billion Swiss francs and a profit of 551.9 million Swiss

francs.

This year, it averted a decline in revenue after its

best-selling drug, Tracleer, lost patent protection, thanks to

swift sales gains for new pulmonary arterial hypertension drugs

Opsumit and Uptravi.

Johnson & Johnson makes an array of products, from baby soap

to Tylenol pills and devices that manage diabetes care. In

September, it reached a deal to buy Abbott Laboratories'

eye-surgery equipment business for $4.3 billion.

Rare diseases aren't an area of focus for the company. Yet

Actelion's top-selling drugs could complement J&J's portfolio

of heart drugs.

Big drug companies such as Pfizer and Sanofi SA have prioritized

rare diseases, because advances in understanding the molecular

roots of disease have led to new treatments and health insurers

have been willing to pay the high costs because few of their

members require such treatments.

Shares of J&J rose nearly 1% to close at $114.13 Friday on

the New York Stock Exchange.

--Austen Hufford and Denise Roland contributed to this

article

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com

(END) Dow Jones Newswires

November 26, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

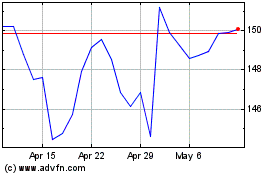

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

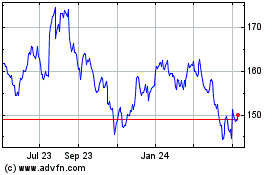

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024