Current Report Filing (8-k)

May 20 2016 - 8:18AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 20, 2016

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

New Jersey

|

|

I-3215

|

|

22-1024240

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

One Johnson & Johnson Plaza

New Brunswick, New Jersey

|

|

08933

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (732) 524-0400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

On May 11, 2016, Johnson & Johnson, a New Jersey corporation

(the “Company”), entered into an underwriting agreement (the “Underwriting Agreement”) with Deutsche Bank AG, London Branch, Merrill Lynch International, Citigroup Global Markets Limited, Goldman, Sachs & Co. and J.P.

Morgan Securities plc, as managers of the several Underwriters named therein (the “Underwriters”), pursuant to which the Company agreed to issue and sell to the Underwriters:

|

|

(1)

|

€1,000,000,000 aggregate principal amount of 0.250% Notes due 2022;

|

|

|

(2)

|

€750,000,000 aggregate principal amount of 0.650% Notes due 2024;

|

|

|

(3)

|

€750,000,000 aggregate principal amount of 1.150% Notes due 2028; and

|

|

|

(4)

|

€1,500,000,000 aggregate principal amount of 1.650% Notes due 2035;

|

(collectively, the

“Notes”) under the Company’s Registration Statement on Form S-3, Reg. No. 333-194146. The issuance and sale of the Notes closed on May 20, 2016.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated May 11, 2016, relating to the €1,000,000,000 0.250% notes due 2022, the €750,000,000 0.650% notes due 2024, €750,000,000 1.150% notes due 2028 and €1,500,000,000 1.650% notes due

2035.

|

|

|

|

|

4.1

|

|

Company Order establishing the terms of the Notes.

|

|

|

|

|

4.2

|

|

Form of 0.250% Note due 2022.

|

|

|

|

|

4.3

|

|

Form of 0.650% Note due 2024.

|

|

|

|

|

4.4

|

|

Form of 1.150% Note due 2028.

|

|

|

|

|

4.5

|

|

Form of 1.650% Note due 2035.

|

|

|

|

|

5.1

|

|

Opinion of Thomas J. Spellman III, Assistant General Counsel and Corporate Secretary of the Company.

|

|

|

|

|

5.2

|

|

Opinion of Covington & Burling LLP.

|

|

|

|

|

23.1

|

|

Consent of Thomas J. Spellman III, Assistant General Counsel and Corporate Secretary of the Company (included in Exhibit 5.1 of this current report).

|

|

|

|

|

23.2

|

|

Consent of Covington & Burling LLP (included in Exhibit 5.2 of this current report).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

Johnson & Johnson

|

|

|

|

|

By:

|

|

/s/ Thomas J. Spellman III

|

|

|

|

Thomas J. Spellman III

|

|

|

|

Assistant General Counsel and Corporate Secretary

|

May 20, 2016

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated May 11, 2016, relating to the €1,000,000,000 0.250% notes due 2022, the €750,000,000 0.650% notes due 2024, €750,000,000 1.150% notes due 2028 and €1,500,000,000 1.650% notes due

2035.

|

|

|

|

|

4.1

|

|

Company Order establishing the terms of the Notes.

|

|

|

|

|

4.2

|

|

Form of 0.250% Note due 2022.

|

|

|

|

|

4.3

|

|

Form of 0.650% Note due 2024.

|

|

|

|

|

4.4

|

|

Form of 1.150% Note due 2028.

|

|

|

|

|

4.5

|

|

Form of 1.650% Note due 2035.

|

|

|

|

|

5.1

|

|

Opinion of Thomas J. Spellman III, Assistant General Counsel and Corporate Secretary of the Company.

|

|

|

|

|

5.2

|

|

Opinion of Covington & Burling LLP.

|

|

|

|

|

23.1

|

|

Consent of Thomas J. Spellman III, Assistant General Counsel and Corporate Secretary of the Company (included in Exhibit 5.1 of this current report).

|

|

|

|

|

23.2

|

|

Consent of Covington & Burling LLP (included in Exhibit 5.2 of this current report).

|

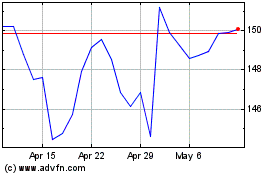

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

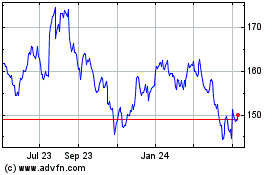

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024