Johnson & Johnson to Cut 6% of Medical Device Jobs--4th Update

January 19 2016 - 2:13PM

Dow Jones News

By Jonathan D. Rockoff and Chelsey Dulaney

Johnson & Johnson said Tuesday it would cut about 3,000 jobs

in its medical-devices division, the company's latest step to

revive the struggling business.

The eliminated positions represent 2.5% of the health-care

company's 127,000 employees world-wide and as much as 6% of its

medical-device segment. J&J expects the cuts will save between

$800 million and $1 billion a year before taxes, some of which will

be invested in new-product development.

J&J's medical-device business had been the company's

largest, and its relatively fast-growing sales of artery-opening

stents, knee-replacement parts and other surgical tools once fueled

the company's sales growth while its prescription-drugs and

consumer-health businesses flagged.

But the overall market has slowed because surgeons have lost

much of their buying power as they became salaried employees of

health-care systems and the consolidating hospital systems began

exerting stronger pressure on prices.

The $320 billion market for medical devices world-wide is

growing 4% a year now, down from a double-digit rate in the early

2000s, according to Venkat Rajan, a medical-device industry analyst

at research and consulting firm Frost & Sullivan.

J&J's medical-device sales have slowed even more than the

overall market's the past few years, growing just 1% operationally

in the third quarter, according to Wells Fargo Securities.

In response, J&J has exited from the stents business it had

pioneered and has been selling small, slower-growing units. In

addition, it has been rejiggering how it sells devices and focusing

on high-growth categories like surgical robotics and staplers as

well as key markets such as the U.S., Japan and China.

The company has also struck new partnerships, such as a

collaboration with International Business Machines Corp. to create

virtual coaching services for patients, and another with Google

Inc. to develop surgical tools that take advantage of imaging

technology advances.

In October, J&J said it planned more than 14 product

launches over the next 18 to 24 months. J&J will use some of

the savings from the restructuring to accelerate new-product

development, Gary Pruden, the J&J executive in charge of

medical devices, said in an interview.

The layoffs are "an opportunity to reshape our business to

accelerate growth through meaningful innovation," Mr. Pruden

said.

As part of the restructuring, J&J said it would book $2

billion to $2.4 billion in charges, starting with a restructuring

charge of $600 million in the fourth quarter of 2015.

Excluding those charges and other special items, J&J backed

its 2015 forecasts. The company said it also doesn't expect the

restructuring to affect its plans to buy back $10 billion in stock

or any future acquisitions.

"Be they large or small, we are open to those kinds of

opportunities," Mr. Pruden said.

In addition to its medical device business, J&J also has

been a stronger dollar, patent expirations and increased

competition for many of its prescription drugs, especially its

hepatitis C treatment Olysio.

At midday, shares of J&J had gained 0.6% to $97.55 in

trading on the New York Stock Exchange.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com and

Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

January 19, 2016 13:58 ET (18:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

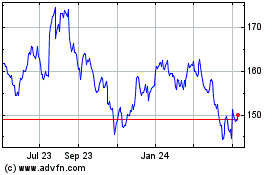

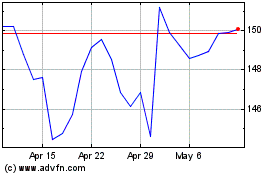

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Aug 2024 to Sep 2024

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Sep 2023 to Sep 2024