Horizon Holders Approve Stock Issuance for Depomed Bid

November 13 2015 - 3:00PM

Dow Jones News

Horizon Pharma PLC's hostile bid for Depomed Inc. came a step

closer to fruition on Friday as shareholders approved the

authorization of a huge share issuance to support the

biopharmaceutical company's $1.01 billion all-stock public

takeover.

Horizon stockholders voted to issue up to 81.7 million shares to

help fund the deal, and Chief Executive Timothy Walbert said the

vote shows the confidence shareholders have in the value of a

potential Depomed acquisition.

He noted that the company looks forward to "continued engagement

with Depomed shareholders as we work towards achieving this

important merger."

Shares of Horizon rose 6.6% while shares of Depomed shrunk 3.3%

in midday trading Friday.

Proxy advisers ISS and Glass Lewis had urged Horizon investors

to reject the share issuance.

Horizon's latest takeover proposal for Depomed offered 0.95 of a

Horizon share for each Depomed share held, which valued the company

at $16.73 a share as of Thursday's close.

Depomed's board has urged its stakeholders to refuse the

unsolicited bid, saying it significantly undervalued the

company.

Horizon is a biopharmaceutical company that focuses on

treatments for orphan diseases. Depomed, based in California,

specializes in products that treat pain and central nervous system

disorders.

Horizon first made an all-stock offer to buy Depomed in a letter

sent May 27, and then went public with an increased proposal

mid-July after the previous offer was rejected by Depomed's

board.

Horizon has also been seeking to replace the Depomed board.

Depomed's board has repeatedly said Horizon's takeover attempt

is "not in the best interest" of the company, given that it is in a

period of significant growth and is expected to benefit from its

recent acquisition of the U.S. rights to pain killer Nucynta from

Janssen Pharmaceuticals Inc., a unit of Johnson & Johnson.

In July, Depomed adopted a poison-pill plan that would be

triggered by a person or group acquiring a more than 10% stake in

the company, in an effort to stave off a takeover. The exchange

offer is contingent on, among other things, the withdrawal of the

poison-pill plan.

Write to Anne Steele at Anne.Steele@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 13, 2015 14:45 ET (19:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

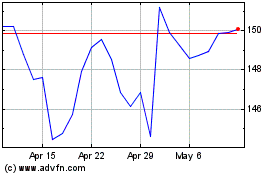

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

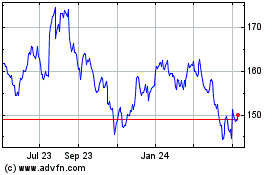

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024