Poland Raises EUR1.5 Billion in Dual-Tranche Bond Issuance -- 2nd Update

March 16 2017 - 2:17PM

Dow Jones News

By Emese Bartha

Poland raised 1.5 billion euros ($1.59 billion) in a

dual-tranche euro bond transaction Thursday, selling a new

2027-dated issue, plus another tranche of its existing January 2036

bond, via a syndicate of banks, said one of the banks working on

the transaction.

The EUR1 billion issue in the 1.375% October 2027-dated bond was

priced at 99.068 to yield at 1.471%, while the EUR500 million

tranche in the 2.375% January 2036-dated bond was priced at 102.701

to yield at 2.198%, said one of the banks.

Books closed in excess of EUR2.5 billion for the two bonds, with

demand skewed toward the 10-year bond.

Lead managers of the transaction were Barclays, BNP Paribas,

Commerzbank, ING and J.P. Morgan.

-Write to Emese Bartha at emese.bartha@wsj.com

(END) Dow Jones Newswires

March 16, 2017 14:02 ET (18:02 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

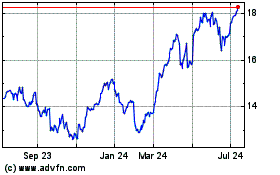

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Mar 2024 to Apr 2024

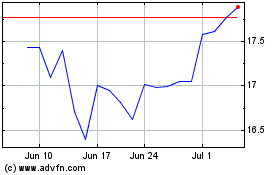

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Apr 2023 to Apr 2024