Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

April 10 2015 - 9:49AM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

|

Free Writing Prospectus Dated April 9, 2015

Filed Pursuant to Rule 433

Reg. Statement No. 333-202880 |

ING Groep N.V.

$1,000,000,000 6.000% Perpetual Additional Tier 1 Contingent Convertible Capital

Securities

$1,250,000,000 6.500% Perpetual

Additional Tier 1 Contingent Convertible Capital

Securities

Pricing Term Sheet

|

|

|

| Issuer |

|

ING Groep N.V. |

|

|

| Securities |

|

$1,000,000,000 6.000% Perpetual Additional Tier 1 Contingent Convertible Capital Securities (the “6.000% Securities”)

$1,250,000,000 6.500% Perpetual Additional Tier 1 Contingent Convertible Capital Securities (the

“6.500% Securities” and, together with the 6.000% Securities, the “Securities”) |

|

|

| Expected Issue Ratings |

|

Ba2 (Moody’s) / BB (Fitch)1 |

|

|

| Status |

|

Perpetual Contingent Convertible Securities |

|

|

| Legal Format |

|

SEC Registered |

|

|

| Trade Date |

|

April 9, 2015 |

|

|

| Settlement Date |

|

April 16, 2015 (T+5) |

|

|

| Maturity Date |

|

Perpetual, with no fixed maturity or fixed redemption date |

|

| Terms Specific to the 6.000% Securities and Other Transaction Details |

|

|

| Principal Amount |

|

$1,000,000,000 |

|

|

| Reoffer Yield |

|

6.000% |

|

|

| Price to Public |

|

100.000% |

|

|

| Underwriting Fees and Commissions |

|

0.750% |

|

|

| Net Price |

|

99.250% |

|

|

| Net Proceeds to Issuer (before Issuer expenses) |

|

$992,500,000 |

|

|

| Optional Call Dates |

|

April 16, 2020 and on any five-year anniversary thereof |

|

|

| ISIN / CUSIP |

|

US456837AE31 / 456837AE3 |

|

|

| Initial Interest Period |

|

|

|

|

| Initial Fixed Rate |

|

6.000%, from and including April 16, 2015 to, but excluding, April 16, 2020 |

|

|

| Initial Reset Date |

|

April 16, 2020 |

|

|

| Initial Interest Payment Dates |

|

Semi-annually in arrear on April 16 and October 16 of each year up to and including April 16, 2020, commencing on October 16, 2015, subject to cancellation or deemed cancellation and applicable restrictions on interest payments

as described in the preliminary prospectus supplement dated April 6, 2015 (the “preliminary prospectus supplement”), supplementing the prospectus dated March 19, 2015 |

| 1 |

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. See also the risk factors related to securities ratings on pages S-42 and S-43

of the preliminary prospectus supplement. |

-1-

|

|

|

|

|

| Day Count |

|

30/360, following, unadjusted |

|

|

| Benchmark |

|

UST 1.375% due March 31, 2020 |

|

|

| Spread to Benchmark |

|

460.2 bps |

|

|

| Reference Mid Market Swap Rate |

|

1.555% |

|

|

| Spread to Reference Mid Market Swap Rate |

|

444.5 bps |

|

| Interest Periods Following Any Reset Date |

|

|

| Interest Rate Following Any Reset Date |

|

The applicable Mid Market Swap Rate on the relevant Reset Determination Date plus 4.445%, from and including the relevant Reset Date to (but excluding) the next following Reset Date |

|

|

| Reset Dates |

|

April 16, 2020 and each fifth anniversary date thereafter |

|

|

| Interest Payment Dates Following Any Reset Date |

|

Semi-annually in arrear on April 16 and October 16 of each year commencing on October 16, 2020, subject to cancellation or deemed cancellation and applicable restrictions on interest payments as described in the preliminary

prospectus supplement |

|

|

| Day Count |

|

30/360, following, unadjusted |

|

| Terms Specific to the 6.500% Securities and Other Transaction Details |

|

|

| Principal Amount |

|

$1,250,000,000 |

|

|

| Reoffer Yield |

|

6.500% |

|

|

| Price to Public |

|

100.000% |

|

|

| Underwriting Fees and Commissions |

|

0.750% |

|

|

| Net Price |

|

99.250% |

|

|

| Net Proceeds to Issuer (before Issuer expenses) |

|

$1,240,625,000 |

|

|

| Optional Call Dates |

|

April 16, 2025 and on any five-year anniversary thereof |

|

|

| ISIN / CUSIP |

|

US456837AF06 / 456837AF0 |

|

|

| Initial Interest Period |

|

|

|

|

| Initial Fixed Rate |

|

6.500%, from and including April 16, 2015 to, but excluding, April 16, 2025 |

|

|

| Initial Reset Date |

|

April 16, 2025 |

|

|

| Initial Interest Payment Dates |

|

Semi-annually in arrear on April 16 and October 16 of each year up to and including April 16, 2025, commencing on October 16, 2015, subject to cancellation or deemed cancellation and applicable restrictions on interest payments

as described in the preliminary prospectus supplement |

|

|

| Day Count |

|

30/360, following, unadjusted |

|

|

| Benchmark |

|

UST 2.000% due February 15, 2025 |

|

|

| Spread to Benchmark |

|

454.0 bps |

|

|

| Reference Mid Market Swap Rate |

|

2.054% |

|

|

| Spread to Reference Mid Market Swap Rate |

|

444.6 bps |

|

| Interest Periods Following Any Reset Date |

|

|

| Interest Rate Following |

|

The applicable Mid Market Swap Rate on the relevant Reset Determination Date plus |

-2-

|

|

|

|

|

| Any Reset Date |

|

4.446%, from and including the relevant Reset Date to (but excluding) the next following Reset Date |

|

|

| Reset Dates |

|

April 16, 2025 and each fifth anniversary date thereafter |

|

|

| Interest Payment Dates Following Any Reset Date |

|

Semi-annually in arrear on April 16 and October 16 of each year commencing on October 16, 2025, subject to cancellation or deemed cancellation and applicable restrictions on interest payments as described in the preliminary

prospectus supplement |

|

|

| Day Count |

|

30/360, following, unadjusted |

|

| Certain Other Information Applicable to Both Series of Securities |

|

|

| Denominations |

|

$200,000 and integral multiples of $1,000 in excess thereof |

|

|

| Business Days |

|

London, New York and Amsterdam |

|

|

| Governing Law |

|

New York law, except for subordination provisions and waiver of set-off provisions which will be governed by Dutch law |

|

|

| Risk Factors |

|

An investment in the Securities involves significant risks. As part of making an investment decision, investors should make sure they thoroughly understand the Securities’ terms, such as the provisions governing Conversion

(including, in particular, the circumstances under which a Trigger Event may occur), the agreement by investors to be bound by the exercise of any Dutch Bail-in Power by the relevant resolution authority, that interest is due and payable only at the

sole discretion of the Issuer and may be cancelled at the sole discretion of the Issuer, and that there is no scheduled repayment date for the principal of the Securities. See “Risk Factors” in the preliminary prospectus supplement for

more information. |

|

|

| Joint Lead Managers and Joint Bookrunners |

|

Citigroup Global Markets Inc., ING Financial Markets LLC, J.P. Morgan Securities LLC and UBS Securities LLC |

|

|

| Joint Structuring Coordinators |

|

ING Financial Markets LLC and J.P. Morgan |

|

|

| Joint Lead Managers |

|

Barclays Capital Inc., Commerz Markets LLC, HSBC Securities (USA) Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated, Natixis Securities Americas LLC and Société Générale |

|

|

| Documentation |

|

To be documented under the Issuer’s SEC registered shelf dated March 19, 2015 |

|

|

| Clearing |

|

DTC |

|

|

| Listing |

|

Application has been made to list the Securities on the Global Exchange Market of the Irish Stock Exchange |

|

|

| Trustee and Paying Agent |

|

The Bank of New York Mellon, London Branch |

|

|

| Interest Calculation Agent |

|

The Bank of New York Mellon, London Branch |

|

|

| Conversion Calculation Agent |

|

Conv-Ex Advisors Limited |

|

|

| Definitions |

|

Unless otherwise defined herein, all capitalized terms have the meaning set forth in the preliminary prospectus supplement |

|

|

| Selling Restrictions |

|

The Securities are not intended to be sold and should not be sold to retail clients in the European Economic Area (the “EEA”), within the meaning of the rules set out in the Temporary Marketing Restriction

(Contingent Convertible Securities) Instrument 2014 (as amended or replaced from time to time) other than in circumstances that do not and will not give rise to a contravention of those rules by any person. Prospective investors are referred to the

section headed “Marketing Restrictions” on the inside cover page of the prospectus supplement for further information. See also “Underwriting—Selling Restrictions” in the prospectus supplement for certain other

restrictions. |

-3-

The Issuer has filed a registration statement, including a prospectus and the preliminary prospectus supplement, with the

U.S. Securities and Exchange Commission (the “SEC”) for this offering. Before you invest, you should read each of these documents and the other documents the Issuer has filed with the SEC for more complete information about the

Issuer and this offering. You may get these documents for free by searching the SEC online database (EDGAR) at www.sec.gov. Alternatively, you may obtain a copy of the prospectus and the preliminary prospectus supplement by calling Citigroup Global

Markets Inc. toll-free at 1-800-831-9146, ING Financial Markets LLC toll-free at 1-877-446-4930, J.P. Morgan Securities LLC collect at 1-212-834-4533 and UBS Securities LLC toll-free at 1-888-827-7275.

-4-

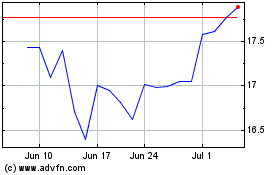

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Mar 2024 to Apr 2024

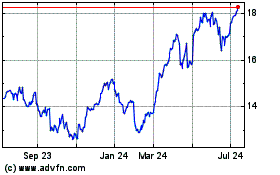

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Apr 2023 to Apr 2024