Current Report Filing (8-k)

November 09 2015 - 5:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report: November 9, 2015

(Date of earliest event reported)

IDEX CORPORATION

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 1-10235 | | 36-3555336 |

(State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

of incorporation) | | | | Identification No.) |

1925 W. Field Court

Lake Forest, Illinois 60045

(Address of principal executive offices, including zip code)

(847) 498-7070

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure

On November 9, 2015 IDEX Corporation (the "Company") presented at the Baird Analyst Day. A copy of the slide presentation used by the Company is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Exhibit 99.1 contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. These statements may relate to, among other things, capital expenditures, cost reductions, cash flow, and operating improvements and are indicated by words or phrases such as “anticipate,” “estimate,” “plans,” “expects,” “projects,” “should,” “will,” “management believes,” “the company believes,” “the company intends,” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this news release. The risks and uncertainties include, but are not limited to, the following: economic and political consequences resulting from terrorist attacks and wars; levels of industrial activity and economic conditions in the U.S. and other countries around the world; pricing pressures and other competitive factors, and levels of capital spending in certain industries - all of which could have a material impact on order rates and IDEX’s results, particularly in light of the low levels of order backlogs it typically maintains; its ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the company operates; interest rates; capacity utilization and the effect this has on costs; labor markets; market conditions and material costs; and developments with respect to contingencies, such as litigation and environmental matters. The forward-looking statements included here are only made as of the date of this news release, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here.

The information in this Current Report furnished pursuant to Items 7.01 and 9.01, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. This information shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933, as amended. The furnishing of the information in Items 7.01 and 9.01 of this Current Report is not intended to, and does not, constitute a representation that such furnishing is required by Regulation FD or that the information contained in Items 7.01 or 9.01 of this Current Report is material investor information that is not otherwise publicly available.

Item 9.01 - Financial Statements and Exhibits.

| |

99.1 | IDEX Corporation presentation dated November 9, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

IDEX CORPORATION |

| | |

| By: | /s/ HEATH A. MITTS |

| | Heath A. Mitts |

| | Senior Vice President and Chief Financial Officer |

November 9, 2015 | | |

EXHBIT INDEX

|

| | |

Exhibit Number | | Description |

| | |

99.1 | | IDEX Corporation presentation dated November 9, 2015 |

| | |

Baird Analyst Day 2015 HEATH MITTS SVP, CFO

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries • Overview of IDEX Growth Strategies and Levers Andrew Silvernail, IDEX Chairman and CEO • IDEX’s Winning Playbook Eric Ashleman, IDEX SVP, COO • IDEX’s Approach to Acquisitions Dan Salliotte, IDEX SVP, Strategy, Acquisitions & Treasury • Q&A 1 Today’s Discussion Topics

Overview of Growth Strategies and Levers ANDREW SILVERNAIL CHAIRMAN & CEO

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries $2 billion supplier of highly engineered industrial & technology solutions for niche markets worldwide 3 IDEX Corporate Overview FMT HST FSD Segments North America Europe Emerging Mkts. Other Geographic Chem/ Industrial HST Instrument Fire& Rescue Water Energy Coatings Other End Markets

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries 4 History of Superior Profitability and Performance 50.0% 100.0% 150.0% 200.0% 250.0% 300.0% 350.0% Aug-05 Aug-06 Aug-07 Aug-08 Aug-09 Aug-10 Aug-11 Aug-12 Aug-13 Aug-14 Aug-15 IEX S&P 500 • Objectives: Double–digit EPS CAGR, outstanding cash conversion and superior returns • Accelerate growth by aligning faster growing end markets and geographies • Strategic platforms focused on growing in protectable “moats” and executing proven IDEX Operating Model • Strong balance sheet, cash flow and capital deployment to maximize TSR

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries We generate double-digit compound earnings growth through a cycle by delivering highly engineered applications that solve mission critical problems within superior niche markets. We empower engaged, outstanding teams who leverage our operating model and deploy capital with discipline. 5 Strategy

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries We generate double-digit compound earnings growth through a cycle by delivering highly engineered applications that solve mission critical problems within superior niche markets. We empower engaged, outstanding teams who leverage our operating model and deploy capital with discipline. 6 Strategy

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries We generate double-digit compound earnings growth through a cycle by delivering highly engineered applications that solve mission critical problems within superior niche markets. We empower engaged, outstanding teams who leverage our operating model and deploy capital with discipline. 7 Strategy

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries We generate double-digit compound earnings growth through a cycle by delivering highly engineered applications that solve mission critical problems within superior niche markets. We empower engaged, outstanding teams who leverage our operating model and deploy capital with discipline. 8 Strategy

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries Portfolio Management: Niche Market Leadership Great Teams: Living IDEX Values and Op Model Disciplined Capital Deployment M&A: Idea to Integration 9 Strategic Capabilities Superior Total Shareholder Return

IDEX Proprietary & Confidential Growth Levers Elements of Value Financial Impact Sales • Organic 2–3 pts above IDP 2–4% • M&A 3–5% Total Top Line Goal 5–9% OP Margin • 30–35% incremental on organic 50–80 bps per yr EPS • Organic + M&A+ Repurchase 10–15% Dividend • ~30% of Net Income 1.5–2% Yield | 10

A Winning Playbook ERIC ASHLEMAN SVP, COO

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries 12 IDEX Values – Our Compass The IDEX Values guide our actions in all macro environments. TRUST TEAM EXCELLENCE • Operate with integrity • Collaborate enthusiastically • Make and keep commitments • Invest at a high level • Practice servant based leadership • Win together • Drive disciplined and focused results • Set foundational performance The IDEX Values guide our actions in all macro environments

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries 13 Teams and Talent – IDEX Learning Academy • Advanced leadership concepts • Target: GM’s, top functional leaders, high-potentials • Status: 41 graduates with 12 active now • Basics of management in an IDEX environment • Target: Promotable functional management • Status: 157 graduates as of December 2015 • General management concepts at the business line level • Target: GM pipeline candidates • Status: 50 graduates • Basic leadership concepts within IDEX emerging markets • India: 36 graduates • China: 19 graduates Emerging Markets Leadership Four levels of curriculum to teach the IDEX Leadership playbook

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries 14 IDEX Operating Model – The Playbook • Optimization & • Transformational bursts • What game are we playing? • How do we win? • Talent as a competitive weapon • The basics • Strong foundation • Identify the critical levers Our Operating Model provides a proven roadmap to drive sustainable results

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries 15 Breakthrough – Growth in Emerging Markets at Dispensing Strategy & Innovation Teams & Talent • Leveraging our site in Vadodara, India − Doubled capacity in 2015 − Highly engaged employees • Global virtual development team The Basics Launch on time and on budget Bullet-proof quality World-class lead times Minimal complexity Ongoing productivity Mature Market – Feature Rich Emerging Markets – Specific Purpose $15M product line with excellent margins in Year 3 of launch

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries 16 Breakthrough – Growth in Bio at Health & Science Strategy & Innovation Fluidics & Optical Components Fluidics & Optical Subsystems Teams & Talent • 3 Segment Leaders are LEP graduates • Site leader is LEP graduate • 25 MEP graduates across two platforms The Basics Overserving OEM partners Rapid development time Dynamic resource deployment Outstanding profitable growth to $25M+ in revenue within Bio segment

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries 17 Breakthrough – Growth with e–Technology at Rescue Strategy & Innovation Teams & Talent The Basics • GM is LEP first wave graduate • 3 MEP graduates on leadership team • Top quartile in IDEX engagement score Hydraulic Hoses Battery – No Hoses Smaller– Hand held Unmatched reliability Best in class lead times Effective channel partners Result: 7% CAGR & 900 bps EBITDA expansion from ‘10 to ‘15

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries 18 Basic Blocking & Tackling – FMT • Each GM is an IDEX Leader Excellence Program graduate • Smart deployment of focused innovation o LACT Skids at Viking o Data acquisition software o Motor speed pumps • Excellent ability to execute o Lead time compression o Facility consolidations o Complexity reduction Aggregate EBITDA expansion of 650bps from ‘10 to ‘15

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries 19 Winning in All Environments Today’s Examples • Consumer–facing business that is holding up well • Action: Maximize global growth potential • Municipal spending drives business • Some regions better than others • Action: Move resources from cold zones to hot zones • Action: Launch disruptive innovation • Health & Science doing well • Action: Invest with long term vision and perspective • Tougher climate due to O&G and Industrial exposure • Action: Grow opportunistically • Action: Focus on cost containment and productivity Business Course When times get tough we make harder choices and dynamically adjust resources

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries 20 Foundation for the Future – Complexity Reduction •Focus on critical customers and products •Simplify organizations •Deploy modular product frameworks •Improve flow of products and information through Lean •Acquire businesses that fit our model Attack Plan Complexity reduction helps promote scalability of our playbook

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries 21 Summary – Our Playbook Great companies in superior market niches A simple set of guiding principles A proven operating model A unique and simple formula that drives powerful results

Approach to Acquisitions DAN SALLIOTTE SVP, STRATEGY, ACQUISITIONS & TREASURY

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries • Our 10 Year growth / Why acquisitions matters • Our disciplined approach to screening acquisition targets & value creation • Five year enterprise growth; role of M&A going forward • Summary 23 Today’s Discussion Topics

Acquisitions: A Key IDEX Growth Driver Acquisitions have been critical to our success. Transactions completed over the last 10 years represent ~40% of IDEX revenue • 29 Completed acquisitions over past decade • $800M Revenue • $175M EBITDA

IDEX Proprietary & Confidential 25 Core Competencies Shape Our M&A Strategy M a n a g em en t ca p a b ili ti es O p er a ti n g ca p a b ili ti es P ro pr ie ta ry as se ts Supply Chain and Logistics Production and Operations Go-to-Market Organic Innovation & Commercialization Customer Intimacy Technology and IP Scale Brand Customer Stickiness (Switching Barriers ) Financial Controls and Management M&A, Joint Ventures and Partnering Strategy & Priorities Driving BU and Portfolio Regulatory Performance Maximizing Human Capital Tangible Assets Back-office Customer facing Our M&A strategy starts with an honest understanding of our competencies… = Our Top Competencies Graphic courtesy of Bain & Company

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries Our Rigorous Selection Criteria We then utilize a rigorous methodology to screen all acquisition targets globally…. Markets Solutions Portfolio Company 1 Niche markets ($200M - $1.5B) 1 Critical to customer application 1 Large installed base with significant replacement volume 2 Fragmented, few large multi national competitors 2 Low cost product relative to customer process or application 2 Strong brand 3 GDP growth + 200 bp potential across cycle 3 Engineered product or proprietary design 3 High relative market share 4 Balanced customer / supplier bargaining power 4 Difficult to replace / specified into process 4 Limited manufacturing complexity (1 or 2 sites) 5 Low production volume / highly configurable manufacturing model 5 Material margins >45% 6 Components focused rather than end product or service focused 6 High cash generation model 7 Solutions justify premium pricing policy 7 Core health / business vitality stable or improving 26

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries How We Create Excess Returns Value Creation 10% 15% 20% 25% 30% Starting EBITDA Op Model Mgmt Controls Talent Where / How IDEX Creates Value: Ability to apply the right operating tool to each business Ability to gauge leadership and manage appropriately Deliver incremental improvement to solid businesses Improved operating performance over the medium term Better talent & mgmt. of niche businesses vs. small private competitors EBIT D A Ma rgi n Value Drivers The end result is excess M&A returns when market niches, target companies, our core competencies and our operating approach are all tightly aligned....

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries Five Year Growth Plan; How M&A Fits 28 • Continued investment across growth portions of portfolio • Highest risk adjusted return • Differentiator in slower growth macro environment • Clear line of site on core M&A targets • Focus on larger ideas w/ tight fit to M&A criteria & op model • Enhanced actionability directly tied to our valuation willingness • Perpetual ongoing screening for attractive spaces • Open mindset beyond fluidics • Likely necessary to achieve growth objectives • Only pursue short list of highly desirable targets • Willing to engage when targets become actionable • Opportunistic approach…not expected or required for success Adjacency M&A Opportunistic Larger M&A Core Bolt- on M&A Core Adjacency Adjacency Core M&A Organic Growth Multi–pronged acquisition strategy complements our organic growth initiatives Pr ima ry F ocu s

IDEX Proprietary & Confidential 29 Enterprise Growth Thru 2020 ($ in M) $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2015 2020 Flow H&S F&R Diversified Adjacency • Fiscal 2015; Rev~$2.0B & EBITDA~$0.5B • Primary M/A focus: Severe Duty Flow Health & Science Fluidics Core Fire & Rescue • Niche M/A adjacencies: Lab Automation Safety Products Engineered Products • Opportunistic larger scale M&A, as available • Selective divestitures to free up resources • Maintain top quartile TSR Clear path to scale IDEX by 2020 in a risk appropriate and sequential manner 29

Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries • Significant & consistent 10 year track record of growth via M&A •We have a disciplined approach to M&A that has been well developed over the last 10 – 20 years •We understand deeply where and how we add value on M&A (as well as where and how we don’t add value) • M&A complements our organic efforts; it is essential for achieving double digit earnings growth in a lower organic growth environment •We have a focused and achievable path to doubling our enterprise by 2020 30 IDEX M&A Summary

Q&A

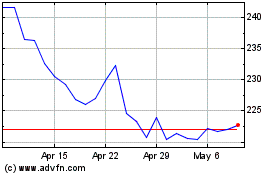

IDEX (NYSE:IEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

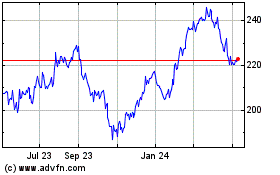

IDEX (NYSE:IEX)

Historical Stock Chart

From Apr 2023 to Apr 2024