By Benoît Faucon

Ahead of an expected lifting of sanctions, several U.S.

corporate giants including personal-computer seller HP Inc. and

General Electric Inc.'s oil-services unit are actively exploring a

market entry.

U.S. companies other than food, aircraft-parts and medicine

suppliers are still banned from conducting direct transactions with

Iran. But last week Maryland Sen. Ben Cardin, the top Democrat on

the Senate Foreign Relations Committee, said at a hearing that

sanctions relief on Tehran could start in January, when an

agreement with world powers over Iran's controversial nuclear

program is implemented.

On the nuclear agreement's "implementation day," the U.S.

Treasury's Office of Foreign Assets Control will issue a general

license authorizing foreign-based arms of U.S. corporations to

engage in activities involving Iran, a U.S. official said.

Worried they could be left behind their European and Asian peers

in the race to do business with a country of over 77 million

people, some American companies have prepared to go as soon as the

sanctions lift, drafting contracts and sending envoys to Iran as

the country gets set to break decades of isolation.

"Major U.S. companies do not seem worried anymore with covering

their tracks in Iran, suggesting a high degree of confidence in the

end of the embargo," said Denis Florin, head of Paris-based energy

consultancy Lavoisier Conseil, who advises foreign companies

seeking to enter the Islamic Republic. But with sanctions slated to

end soon, looking at Iranian opportunities is no longer as

politically charged as it used to be, he said.

The opportunity could be massive. Iran's market for computers,

gaming devices and handsets is set to rise to $13 billion within

four years, from $9.5 billion in 2014, according to U.K.-based

consultancy BMI Research.

Foreign companies still have to tread carefully.

An official at the U.S. Treasury said only "non-U. S. companies

and individuals will not be subject to U.S. sanctions if they

engage in initial discussions about potential business

opportunities or travel to Iran to examine the possibilities of

business relationships after sanctions are lifted."

"Entering into contracts involving Iran before Implementation

Day may be sanctionable," the Treasury says on its website, except

for specifically allowed trades such as food, medicine and aircraft

spare parts.

U.S. companies have been consulting with the State Department

and Treasury to ensure conversations held by their non-American

subsidiaries remain compliant, according to a U.S. State Department

official and other people familiar with the matter. "People are

exchanging draft contracts but nothing has been signed," the U.S.

official said.

As a result, U.S. companies are sending non-American

subsidiaries to test the waters.

In one recent example, Hewlett-Packard (Suisse) Sarl, the Swiss

subsidiary of Palo Alto, Calif.-based HP, last month circulated

draft agreements with Iranian distributors to resell its consumer

products, such as tablets and laptops, in Tehran, according to

people familiar with the prospective contracts.

Non-U.S. HP staffers met the potential distributors in Dubai and

Tehran, and last month held an internal meeting to discuss the

opportunity, the people said.

To keep confidentiality tight, HP exchanged only hard copies of

the documents with its prospective partners and asked them to sign

the documents and return them by post, according to one person

familiar with the matter.

The U.S. computer giant also has told its prospective partners

in Tehran that no deals would be signed by HP or announced until

the nuclear agreement with Iran is completed, the people familiar

with the draft contracts said.

An HP spokeswoman said "business activities, including those

undertaken in the Middle East, are conducted in full compliance

with U.S. and other applicable global trade requirements," but

declined to comment further.

HP has been particularly unsettled by early forays by some of

its competitors into Iran's technology sector, according to people

familiar with its internal discussions.

Earlier this year, Lenovo Group Ltd., the world's largest PC

maker by volume, said it was exploring Iranian opportunities and

invited dozens of Iranian retailers to an event at a plush Tehran

hotel to drum up interest for its latest laptops. The Hong

Kong-based company, which bought International Business Machines

Corp.'s PC business in 2004, retains strong American connections;

it has a second headquarters in Raleigh, N.C. But its Chinese

ownership made the Iranian entry easier, people familiar with the

matter say.

Last year, Apple Inc. started contacts with Iranian distributors

about possibly entering the country with the full gamut of its

business activities, including selling its iPhones, desktop

computers, laptops and even opening Apple stores, should Western

sanctions ease sufficiently.

Talks have continued with local distributors, though they have

been slowed by issues such as Iran's lax intellectual-property

protection, according to people familiar with the matter.

Apple declined to comment on Tuesday.

Other U.S.-registered companies are testing the waters. A

spokesman for international oil-services giant Schlumberger Ltd.,

based and registered in Houston, Paris, London and The Hague, said

its representatives attended a conference in Tehran where oil

contracts were presented last month. He declined to comment

further.

Iran expects to attract $30 billion in investment in oil and gas

fields after offering new, more attractive contracts, its oil

minister, Bijan Zanganeh, has said.

Representatives from Nuovo Pignone, an Italian oil and gas

subsidiary of GE, visited Iran last month as part of an Italian

government delegation to the country, said a spokeswoman for the

U.S. industrial-equipment maker, which is based in Fairfield,

Conn.

"GE and its subsidiaries operate in full compliance with all

applicable sanctions laws," the spokeswoman said. "Like many

companies, we are following the regulatory and commercial

landscapes that may unfold with respect to Iran going forward."

Write to Benoît Faucon at benoit.faucon@wsj.com

(END) Dow Jones Newswires

December 23, 2015 14:10 ET (19:10 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

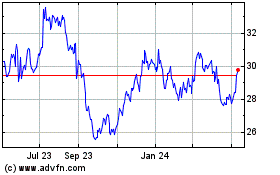

HP (NYSE:HPQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

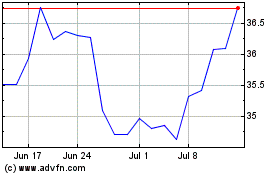

HP (NYSE:HPQ)

Historical Stock Chart

From Apr 2023 to Apr 2024