UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 11-K

| x | ANNUAL REPORT PURSUANT TO SECTION 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31,

2014

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from _______________

to _______________

Commission file number 1-8974

Honeywell Savings and Ownership Plan

(Full Title of Plan)

Honeywell International Inc.

101 Columbia Road

Morris Township, NJ 07962

(Name of Issuer of Securities Held Pursuant

to the Plan and

the Address of its Principal Executive Office)

Honeywell Savings and Ownership Plan

Index

* Other schedules required by Section 2520.103-10 of the Department

of Labor Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been

omitted as the conditions under which they are required are not present.

Report of Independent Registered Public

Accounting Firm

To the Administrator of

Honeywell Savings and Ownership Plan

In our opinion, the accompanying statements of net assets available

for benefits and the related statement of changes in net assets available for benefits present fairly, in all material respects,

the net assets available for benefits of Honeywell Savings and Ownership Plan (the “Plan”)

at December 31, 2014 and December 31, 2013, and the changes in net assets available for benefits

for the year ended December 31, 2014 in conformity with accounting principles generally accepted in the United States of America.

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express

an opinion on these financial statements based on our audits. We conducted our audits of these statements in accordance with

the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and

perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An

audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing

the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation.

We believe that our audits provide a reasonable basis for our opinion.

The supplemental schedule of assets

(held at end of year) at December 31, 2014 has been subjected to audit procedures performed in conjunction with the audit of the

Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our

audit procedures included determining whether the supplemental schedule reconciles to the

financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness

and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we

evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of

Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974.

In our opinion, the schedule of assets (held at end of year) is fairly stated, in all material respects, in relation

to the financial statements as a whole.

/s/ PricewaterhouseCoopers LLP

New York, New York

June 24, 2015

Honeywell Savings and Ownership Plan

Statements of Net Assets Available for Benefits

at December 31, 2014 and 2013

| | |

2014 | |

2013 |

| | |

(dollars in millions) | |

| Plan interest in Honeywell Savings and Ownership Plan Master Trust, at fair value | |

| $12,881 | | |

| $12,351 | |

| | |

| | | |

| | |

| Notes receivable from participants | |

| 30 | | |

| 52 | |

| | |

| | | |

| | |

| Net assets available for benefits | |

| $12,911 | | |

| $12,403 | |

The accompanying notes are an integral part

of these financial statements.

Honeywell Savings and Ownership Plan

Statement of Changes in Net Assets Available for Benefits

for the Year Ended December 31, 2014

| | |

2014 |

| | |

(dollars in millions) | |

| Additions to net assets attributable to: | |

| | |

| Interest income from notes receivable from participants | |

$ | 3 | |

Investment gain from Plan interest in Honeywell Savings and Ownership

Plan Master Trust | |

| 929 | |

| Contributions: | |

| | |

| Participating employees | |

| 370 | |

| The Company, net of forfeitures | |

| 169 | |

| Roll-over contributions | |

| 14 | |

| Total contributions | |

| 553 | |

| | |

| | |

| Total additions | |

| 1,485 | |

| | |

| | |

| Deductions from net assets attributable to: | |

| | |

| Benefits paid to participants | |

| (960 | ) |

| Plan expenses | |

| (17 | ) |

| Total deductions | |

| (977 | ) |

| | |

| | |

| Net increase in net assets during the year | |

| 508 | |

| | |

| | |

| Net assets available for benefits: | |

| | |

| Beginning of year | |

| 12,403 | |

| End of year | |

$ | 12,911 | |

The accompanying notes are an integral part

of these financial statements.

Honeywell Savings and Ownership Plan

Notes to Financial Statements

| 1. | Description of the Plan |

General

The Honeywell Savings and Ownership

Plan (the “Plan”) is a defined contribution plan for certain employees of Honeywell International Inc. (the “Company”).

It is subject to the provisions of the Employee Retirement Income Security Act of 1974 as amended (“ERISA”) and the

Internal Revenue Code (“Code”). The following represents a summary of key provisions of the Plan but does not purport

to be complete and is qualified in its entirety by the terms of the Plan. Participants should refer to the Plan document for a

more complete description of the Plan’s provisions.

Administration

The Company’s Vice President of Compensation

and Benefits is the Plan Administrator and has full discretionary authority to manage and control the operation and administration

of Plan, including the power to interpret provisions of the Plan and to promulgate policies and procedures for the Plan’s

administration and to delegate administration of the Plan. The Savings Plan Investment Committee has the power and authority to

enter into agreements with trustees to provide for the investment of Plan assets and to appoint investment managers to direct such

trustees, as appropriate. The day to day administration of the Plan is handled by Voya Financial (formerly known as ING Institutional

Plan Services). The trustee and custodian of the Plan is State Street Bank and Trust Company (the “Trustee”). In 2014,

a decision was made to change custodians for the Master Trust, effective June 1, 2015, from State Street to Northern Trust Company.

Contributions and Vesting

Participants are permitted to

contribute from 1 percent to 30 percent of their “base pay” as defined in the Plan during each pay period, subject

to certain restrictions for “highly compensated employees”, as defined in the Plan. Participants may elect to make

contributions to the Plan in any combination of before-tax, after-tax and Roth 401(k) contributions and may direct those contributions

into any investment option available within the Plan. The combined before-tax and Roth 401(k) contributions may not exceed $17,500.

In addition to regular before-tax, after-tax or Roth 401(k) contributions, eligible participants may also contribute up to $5,500

per year in catch-up contributions if they are or will attain age 50 by December 31st and are contributing at least 8 percent before-tax

in contributions and/or Roth contributions to the Plan or have contributed the maximum regular before-tax contributions to the

Plan.

Generally, the Company matching

contribution does not begin until the first pay period following the employee’s completion of one year of service with the

Company. The Company matching contributions are made to the eligible participants’ accounts each pay period that employee

contributions are made to the Plan. Depending on the rate designated for the participant’s Participating Unit, as defined

below, the Company makes contributions with respect to a participant’s contributions up to a maximum of 8 percent of a participant’s

base pay. The Company does not match catch-up contributions. All of the Company’s matching contributions are initially invested

in the Honeywell Common Stock Fund.

A Participating Unit is a group

of employees which has been designated as participating in the Plan. The Company may contribute on behalf of each participant between

0 percent and 75 percent of such participant’s contribution to the Plan, depending upon the rate designated for the participant’s

Participating Unit.

There are two forms of Company

matching contributions as follows: (i) variable Company matching contributions and (ii) non-variable Company matching contributions.

Participating Units whose employees are covered by collective bargaining agreements or government contracts, the terms of which

may change the Company match from time to time, receive the variable company matching

Honeywell Savings and Ownership Plan

Notes to Financial Statements

contributions, unless the collective

bargaining agreement or government contract provides that the employees are eligible for the non-variable company matching contributions.

Participating Units whose employees are not covered by collective bargaining agreements or government contracts (unless the collective

bargaining agreement or government contract provides otherwise) are generally eligible for the non-variable company matching contributions.

Participating Units covered by

a non-variable match receive basic matching contributions whereby the Company matches 37.5 percent of the first 8 percent of base

pay that the participant contributes to the Plan (excluding rollover and catch-up contributions). Once the participant participates

in the Plan for 60 months after completing one year of vesting service, the Company makes matching contributions in the amount

of 75 percent of the first 8 percent of base pay that the participant contributes to the Plan (excluding rollover and catch-up

contributions).

Effective January 1, 2014, certain

individuals who became Honeywell employees via acquisitions prior to January 1, 2013, will receive basic Company matching contributions

whereby the Company matches 75 percent of the first 8 percent of base bay that the participant contributes to the Plan (excluding

rollover and catch-up contributions) once the participant has completed one year of vesting service.

Effective January 1, 2013, eligible

employees who are employed by a Participating Unit covered by a non-variable match and who are hired on or after January 1, 2013,

will receive basic matching contributions whereby the Company matches 75 percent of the first 8 percent of base pay that the participant

contributes to the Plan (excluding rollover and catch-up contributions) once the participant has completed one year of vesting

service.

Participants have a full and

immediate vested interest in the portion of their accounts contributed by them and the earnings on such contributions. A participant

will become 100 percent vested in any Company contributions upon completion of three years of vesting service or upon attainment

of age 65 while an employee of the Company or an affiliated company. In addition, a participant’s account will become 100

percent vested if the participant’s termination with the Company or an affiliated company was due to any one of the following

(i) retirement under the terms of a Honeywell pension plan in which the participant participates; (ii) disability (as defined under

the plan provisions); (iii) death; (iv) a reduction in force or layoff (as determined by the Company); or (v) a participant’s

business unit is sold or divested. A participant will also become 100 percent vested in any Company contributions in the event

the Company terminates or permanently discontinues contributions to the Plan.

Participant Accounts

Each participant’s account

is credited with the participant’s contribution and allocations of (1) the Company’s matching contribution, if applicable,

and (2) investment earnings, and charged with an allocation of investment losses and administrative expenses. The allocation is

based on participants’ account balances as defined in the Plan document. The benefit to which a participant is entitled is

the benefit that can be provided from the participant’s vested account.

Notes Receivable from Participants

Since July 1, 2011, no new loans

were permitted from the Plan. Interest rates for loans outstanding at December 31, 2014 and 2013 were between 4.25% and 10.5%.

Honeywell Savings and Ownership Plan

Notes to Financial Statements

Termination

Although it has not expressed

intent to do so, the Company has the right under the Plan document to discontinue its contributions at any time and to terminate

the Plan subject to the provisions of ERISA. In the event of a partial or full Plan termination, all Plan funds must be used in

accordance with the terms of the Plan.

Distribution of Benefits

Upon termination of service with

the Company, if a participant’s vested account balance is $1,000 or less (including any rollover contributions), the entire

vested amount in the participant’s account can be distributed to the participant in a single payment, without his or her

consent, unless the participant affirmatively elects to have the benefit rolled over to an eligible retirement plan.

If the vested amount in a participant’s

account is greater than $1,000 but less than $5,000 (excluding any rollover contributions), the participant’s account will

be automatically rolled over to a traditional IRA with the Voya Life Insurance and Annuity Company, unless the participant affirmatively

elects to receive the amount in a single payment or have it rolled over to an eligible retirement plan.

If the participant’s vested

account balance exceeds $5,000 (excluding any rollover contributions), the balance in the account will remain in the Plan and shall

be distributed (1) at the participant’s request, (2) when the participant attains age seventy and one-half (70-1/2), through

the payment of minimum required distributions, as defined by the Plan, or (3) upon the participant’s death, whichever is

earliest. When a participant dies, if his or her spouse is the beneficiary, the spouse may remain in the Plan under the same conditions

as previously described for the participant. Otherwise, the entire amount in the participant’s account is distributed in

a single payment to the participant’s beneficiary (ies).

Forfeitures

Forfeitures of the Company’s

contributions and earnings thereon due to terminations and withdrawals reduce contributions otherwise due from the Company. Company

contributions made to the Plan were reduced by $1 million due to forfeited nonvested accounts for each of the years ended December

31, 2014 and 2013.

| 2. | Significant Accounting Policies |

Basis of

Accounting

The financial

statements of the Plan are prepared in accordance with accounting principles generally accepted in the United States of America

(“U.S. GAAP”) using the accrual basis of accounting.

Use of Estimates

The preparation of financial

statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts

of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ

from those estimates.

Investment Valuation

For investment

and administrative purposes, the Plan’s assets are held in the Honeywell Savings and Ownership Plan Master Trust (“Master

Trust”) along with the assets of the Honeywell Puerto Rico Savings and Ownership Plan and the Honeywell Secured Benefit Plan.

The Plan’s investment in the Master Trust represents the Plan’s interest in the net assets of the Master Trust. The

Plan’s investment is stated at fair value and is based on the beginning of year value of the Plan’s interest in the

Master Trust plus actual Plan contributions and allocated investment income less actual Plan distributions, and allocated investment

losses.

Honeywell Savings and Ownership Plan

Notes to Financial Statements

Notes Receivable

from Participants

Notes receivable

from participants are valued at cost plus accrued unpaid interest.

Payment

of Benefits

Withdrawals

and distributions to participants are recorded when paid.

Expenses

All external

third party expenses and internal expenses relating to the administration of the Master Trust and managing the funds established

thereunder are borne by the participating plans.

Recent Accounting Pronouncements

In May 2015, the Financial Accounting

Standards Board (“FASB”) issued ASU 2015-07, Disclosures for Investments in Certain Entities That Calculate Net Asset

Value per Share (or Its Equivalent). ASU 2015-07 removes the requirement to categorize within the fair value hierarchy all investments

for which fair value is measured using the net asset value per share practical expedient. It also removes the requirement to make

certain disclosures for all investments that are eligible to be measured at fair value using the net asset value per share practical

expedient. Rather, those disclosures are limited to investments for which the entity has elected to measure the fair value using

that practical expedient. ASU 2015-07 will be effective for the Plan beginning in the first quarter of 2016, with early adoption

permitted, and will be applied retrospectively. The Plan Administrator is currently evaluating the standard and does not believe

it will have a material impact on the Plan’s financial statements.

| 3. | Interest in Honeywell Savings and Ownership Plan Master Trust |

The Plan’s investment is

held in the Master Trust, which is commingled with the assets of the Honeywell Puerto Rico Savings and Ownership Plan and the Honeywell

Secured Benefit Plan. Each participating plan has an undivided interest in the Master Trust. The assets of the Master Trust are

held by the Trustee. At December 31, 2014 and 2013, the Plan’s, Honeywell Puerto Rico Savings and Ownership Plan’s

and the Honeywell Secured Benefit Plan’s interest in the net assets of the Master Trust were 99.289%, 0.571%, and 0.140%

and 99.166%, 0.115%, and 0.719%, respectively. Investment income or loss is allocated based on participant balances, and administrative

expenses relating to the Master Trust are allocated to certain plans based upon the net asset value balances invested by each plan.

The Master Trust is comprised

of the following types of investments, at fair value, as of December 31, 2014 and 2013:

| | |

2014 | |

2013 |

| | |

(dollars in millions) |

| | |

|

| Common and Collective Trusts and Commingled Funds | |

$ | 5,641 | | |

$ | 4,974 | |

| Honeywell Common Stock | |

| 3,853 | | |

| 3,693 | |

| Short Term Investments | |

| 800 | | |

| 1,022 | |

| Common/Preferred Stocks (Separately Managed Portfolios) | |

| 1,073 | | |

| 1,421 | |

| Fixed Income Investments | |

| 1,606 | | |

| 1,341 | |

| Total Investments, at fair value | |

$ | 12,973 | | |

$ | 12,451 | |

Honeywell Savings and Ownership Plan

Notes to Financial Statements

The Master Trust’s investment income for the

year ended December 31, 2014 is presented in the following table. The net appreciation/(depreciation) consists of both realized

gains/(losses) on investments bought, sold and matured, as well as the change in unrealized gains/(losses) on investments held

during the year by the Master Trust.

| | |

2014 |

| | |

(dollars in millions) |

| | |

| | |

| Net appreciation(depreciation) in fair value of investments: | |

| | |

| Honeywell Common Stock | |

| $348 | |

| Common/Preferred Stocks (Separately Managed Portfolios) | |

| 102 | |

| Fixed Income Investments | |

| (1 | ) |

| Common and Collective Trusts and Commingled Funds | |

| 388 | |

| Net appreciation | |

| 837 | |

| | |

| | |

| Dividend Income | |

| 76 | |

| Interest Income | |

| 17 | |

| Total investment income | |

| $930 | |

Investment Valuation and Income

Recognition – Master Trust

Master Trust

investments are stated at fair value. Investments in common and collective trusts and commingled funds are valued at the net asset

value of units held at year-end. Common stocks, including Honeywell Common Stock, traded on a national securities exchange, are

valued at the last reported sales price or close price at the end of the year. Fixed income securities traded in the over-the-counter

market are valued at the evaluated bid. Short term securities are valued at amortized cost, which includes cost plus accrued interest,

which approximates fair value.

Interest income

is recorded on the accrual basis, and dividend income is recorded on the ex-dividend date. Purchases and sales of securities are

recorded on a trade-date basis.

From time to time, investment

managers may use derivative financial instruments including foreign exchange forward and futures contracts. Derivative instruments

are used primarily to mitigate exposure to foreign exchange rate and interest rate fluctuations as well as manage the investment

composition in the portfolio. The Master Trust held no derivative instruments as of December 31, 2014 and 2013.

The Plan’s interest in

the Master Trust represents more than 5 percent of the Plan’s net assets at December 31, 2014 and 2013.

Determination of Fair Value

The accounting guidance defines

fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants at the measurement date, and establishes a framework for measuring fair value.

The Plan or Master Trust valuation

methodologies for assets and liabilities measured at fair value are described above within – “Investment Valuation

and Income Recognition – Master Trust”. The methods described as follows may produce a fair value calculation that

may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation

methods are appropriate and consistent with other market participants, the use of different

Honeywell Savings and Ownership Plan

Notes to Financial Statements

methodologies or assumptions

to determine the fair value of certain financial instruments could result in a different estimate of fair value at the reporting

date.

Valuation Hierarchy

The accounting guidance establishes

a three-level valuation hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency

of inputs to the valuation of an asset or liability as of the measurement date. The three levels are defined as follows:

· Level

1 — inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

· Level

2 — inputs to the valuation methodology include quoted prices for similar assets or liabilities in active markets, and inputs

that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial

instrument.

· Level

3 — inputs to the valuation methodology are unobservable and significant to the fair value measurement.

A financial instrument’s

categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs. The hierarchy

gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurements)

and the lowest priority to unobservable inputs (level 3 measurements).

The following is a description

of the valuation methodologies used for financial instruments measured at fair value. There have been no changes in the methodologies

used at December 31, 2014 and 2013.

Honeywell International

Inc. common stock and other common stocks

Honeywell International Inc.

common stock is valued at the closing price reported on the New York Stock Exchange Composite Transaction Tape. Other common stocks

are valued at the closing price reported on the principal market on which the respective securities are traded. Honeywell International

Inc. common stock and other common stocks are all classified within level 1 of the valuation hierarchy.

Common and Collective Trusts

and Commingled and Short Term Investment Funds

Common and Collective Trusts

and Commingled and Short Term Investment funds are investment vehicles utilized within the target date funds, equity index funds,

investment grade bond fund, global REIT fund and short term investment fund. These funds permit daily subscriptions and redemption

of units. These investments are valued using the NAV provided by the administrator of the underlying fund. The NAV is based on

the value of the underlying assets owned by the fund, less its liabilities, divided by the number of units outstanding. The NAV

is a quoted price in a market that is not active and classified within level 2 of the valuation hierarchy.

Fixed Income Investments

Fixed income securities (other

than certain short term investments and commercial mortgage backed securities) are valued at the regular close of trading on each

valuation date at the evaluated bid prices supplied by a pricing agent or brokers, if any, whose prices reflect broker/dealer supplied

valuations and electronic data processing techniques. Commercial mortgage backed securities are valued using pool-specific pricing.

The pool-specific pricing is provided by the pricing vendors and typically they use IDC for these investments. Fixed income securities,

including corporate bonds,

Honeywell Savings and Ownership Plan

Notes to Financial Statements

U.S. government and federal agencies,

municipal bonds, asset-backed securities and commercial mortgage backed securities are classified within Level 2 of the valuation

hierarchy.

Short term investments

Short term investments are valued

at quoted prices when available in an active market or are valued at amortized cost; such investments are classified within level

1 of the valuation hierarchy. If quoted market prices are not available for the specific security, then fair values are estimated

by using pricing models, bids provided by brokers or dealers, or quoted prices of securities with similar characteristics. When

quoted market prices for the specific security are not available in an active market, they are classified within level 2 of the

valuation hierarchy.

The following tables present

the Master Trust’s assets measured at fair value as of December 31, 2014 and 2013, by the fair value hierarchy.

| | |

| |

2014 | |

|

| | |

Level 1 | |

Level 2 | |

Total |

| Common/Preferred Stocks: | |

(dollars in millions) |

| Honeywell Common Stock | |

| $3,853 | | |

| $- | | |

| $3,853 | |

| Large Cap Value | |

| 379 | | |

| - | | |

| 379 | |

| Large Cap Growth | |

| 489 | | |

| - | | |

| 489 | |

| Small-to-Mid Cap Value | |

| 205 | | |

| - | | |

| 205 | |

| Total Common/Preferred Stocks | |

| 4,926 | | |

| - | | |

| 4,926 | |

| Fixed Income Investments: | |

| | | |

| | | |

| | |

| Asset Backed Securities | |

| - | | |

| 274 | | |

| 274 | |

| Commercial Mortgage Backed Securities | |

| - | | |

| 44 | | |

| 44 | |

| Corporate Bonds | |

| - | | |

| 781 | | |

| 781 | |

| U.S. Government and Federal Agencies | |

| - | | |

| 393 | | |

| 393 | |

| Municipal Bonds | |

| - | | |

| 114 | | |

| 114 | |

| Total Fixed Income Investments | |

| - | | |

| 1,606 | | |

| 1,606 | |

| Common and Collective Trusts and Commingled Funds: | |

| | | |

| | | |

| | |

| Target Date Funds | |

| - | | |

| 1,730 | | |

| 1,730 | |

| Equity Index Funds | |

| - | | |

| 3,911 | | |

| 3,911 | |

| Total Common and Collective Trusts and Commingled Funds | |

| - | | |

| 5,641 | | |

| 5,641 | |

| Short Term Investments: | |

| | | |

| | | |

| | |

| Short Term Investment Fund | |

| - | | |

| 392 | | |

| 392 | |

| Short Term Investments | |

| 4 | | |

| 404 | | |

| 408 | |

| Total Short Term Investments | |

| 4 | | |

| 796 | | |

| 800 | |

| Total Investments, at fair value | |

| $4,930 | | |

| $8,043 | | |

| $12,973 | |

Honeywell Savings and Ownership Plan

Notes to Financial Statements

| | |

| |

2013 | |

|

| | |

Level 1 | |

Level 2 | |

Total |

| | |

| | | (dollars in millions) |

| | |

| Common/Preferred Stocks: | |

| | | |

| | | |

| | |

| Honeywell Common Stock | |

| $3,693 | | |

| $- | | |

| $3,693 | |

| Large Cap Value | |

| 466 | | |

| - | | |

| 466 | |

| Large Cap Growth | |

| 621 | | |

| - | | |

| 621 | |

| Small-to-Mid Cap Value | |

| 334 | | |

| - | | |

| 334 | |

| Total Common/Preferred Stocks | |

| 5,114 | | |

| - | | |

| 5,114 | |

| Fixed Income Investments: | |

| | | |

| | | |

| | |

| Asset Backed Securities | |

| - | | |

| 283 | | |

| 283 | |

| Commercial Mortgage Backed Securities | |

| - | | |

| 6 | | |

| 6 | |

| Corporate Bonds | |

| - | | |

| 692 | | |

| 692 | |

| U.S. Government and Federal Agencies | |

| - | | |

| 313 | | |

| 313 | |

| Municipal Bonds | |

| - | | |

| 47 | | |

| 47 | |

| Total Fixed Income Investments | |

| - | | |

| 1,341 | | |

| 1,341 | |

| Common and Collective Trusts and Commingled Funds: | |

| | | |

| | | |

| | |

| Target Date Funds | |

| - | | |

| 1,562 | | |

| 1,562 | |

| Equity Index Funds | |

| - | | |

| 3,412 | | |

| 3,412 | |

| Total Common and Collective Trusts and Commingled Funds | |

| - | | |

| 4,974 | | |

| 4,974 | |

| Short Term Investments: | |

| | | |

| | | |

| | |

| Short Term Investment Fund | |

| - | | |

| 562 | | |

| 562 | |

| Short Term Investments* | |

| - | | |

| 460 | | |

| 460 | |

| Total Short Term Investments | |

| - | | |

| 1,022 | | |

| 1,022 | |

| Total Investments, at fair value | |

| $5,114 | | |

| $7,337 | | |

| $12,451 | |

* Includes approximately $6 million of cash

overdrafts.

| 4. |

Nonparticipant-Directed Investments |

| Information about the net assets at December 31, 2014 and 2013 and the significant components of

the changes in net assets for the year ended December 31, 2014 relating to the nonparticipant-directed investments is as follows: |

Honeywell Savings and Ownership Plan

Notes to Financial Statements

| | |

2014 | |

2013 |

| | |

(dollars in millions) |

| | |

| | | |

| | |

| Honeywell common stock | |

| $3,848 | | |

| $3,689 | |

| Short-term investments | |

| 89 | | |

| 90 | |

| | |

| $3,937 | | |

| $3,779 | |

| | |

| | | |

| 2014 | |

| | |

| | | |

(dollars in millions) |

| Changes in net assets: | |

| | | |

| | |

| Contributions | |

| | | |

| $229 | |

| Net income | |

| | | |

| 56 | |

| Net appreciation | |

| | | |

| 347 | |

| Benefits paid to participants | |

| | | |

| (274 | ) |

| Transfers (to)/from participant directed investments | | |

| (200 | ) |

| | |

| | | |

| $158 | |

| 5. |

Related Party Transactions |

The Plan’s investment in the

Master Trust constitutes a related-party transaction because the Company is both the plan sponsor and a party to the Master Trust.

The Master Trust is invested in the Company’s common stock and the Plan holds notes receivable from participants, both of

which qualify as related-party transactions. During the year ended December 31, 2014, the Master Trust’s investment in the

Company’s common stock included purchases of approximately $336 million, sales of approximately $524 million, realized gains

of approximately $274 million, unrealized gains of approximately $72 million and dividend income of approximately $74 million.

The Master Trust invests in short

term investment funds managed by the Trustee. As described in Note 2 – “Expenses”, the Plan paid certain expenses

related to Plan operation and investment activity to the Trustee. These investments qualify as party-in-interest transactions.

| 6. |

Risks and Uncertainties |

The Plan provides for various investment

options which may invest in any combination of stocks, fixed income securities, mutual funds and other investment securities. Investment

securities are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with

certain investment securities, it is at least reasonably possible that changes in the value of investment securities will occur

in the near term and that such changes could materially affect participants’ account balances and the amounts reported in

the statements of net assets available for benefits and the statement of changes in net assets available for benefits.

On May 11, 2015, the Plan received

a favorable determination letter from the Internal Revenue Service indicating that the Plan satisfies the requirements of Section

401 (a) of the Code and that the Plan qualifies as an Employee Stock Ownership Plan as defined in Section 4975 (e)(7) of the Code.

The Plan previously received a favorable determination letter on April 14, 2003. The Plan’s administrator and counsel believe

that the Plan has been designed and is currently being operated in compliance with the applicable requirements of the Code. The

Master Trust under the Plan is intended to be exempt under Section 501 (a) of the Code. Accordingly, no provision for income

taxes has been made.

Honeywell Savings and Ownership Plan

Notes to Financial Statements

U.S. GAAP requires plan management

to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more

likely than not would not be sustained upon examination by the Internal Revenue Service. As of December 31, 2014 and 2013 the Plan

Administrator has analyzed the tax positions by the Plan, and has concluded that there are no uncertain positions taken or expected

to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is no

longer subject to tax examinations for years prior to 2011.

| 8. |

Reconciliation of Financial Statements to Form 5500 |

The following is a reconciliation

of net assets available for benefits per the financial statements to Form 5500 at December 31, 2014 and 2013:

| | |

2014 | |

2013 |

| | |

(dollars in millions) |

| | |

| | | |

| | |

| Net assets available for benefits per the financial statements | |

$ | 12,911 | | |

$ | 12,403 | |

| Amounts allocated to withdrawing participants | |

| (2 | ) | |

| (3 | ) |

| Deemed distributions | |

| - | | |

| (1 | ) |

| Net assets available for benefits per the Form 5500 | |

$ | 12,909 | | |

$ | 12,399 | |

The following is a reconciliation

of benefits paid to participants per the financial statements to Form 5500 for the year ended December 31, 2014:

| | |

2014 |

| | |

(dollars in millions) |

| Benefits paid to participants per the financial statements | |

| $960 | |

| Add: Amounts allocated to withdrawing participants at December 31, 2014 | |

| 2 | |

| Less: Amounts allocated to withdrawing participants at December 31, 2013 | |

| (3 | ) |

| Benefits paid to participants per the Form 5500 | |

| $959 | |

The Company has evaluated subsequent events through the

date of issuance of the financial statements. Based on this evaluation, the Company has determined there are no events that require

disclosure in or adjustment to the financial statements.

Honeywell Savings and Ownership Plan

Schedule H, Line 4(i) –

Schedule of Assets (held at end of year)

December 31, 2014

| Identity of Issue |

|

Description |

|

Cost |

|

Current Value |

| |

|

|

|

|

|

|

*Interest in Honeywell Savings

and Ownership Plan Master Trust |

|

Various investments |

|

** |

|

$12,880,994,960 |

| |

|

|

|

|

|

|

| *Notes receivable from participants |

|

(Interest rates range from

4.25% - 10.5%, maturing

through May 30, 2036) |

|

** |

|

30,031,125 |

| |

|

|

|

|

|

|

| Total |

|

|

|

|

|

$12,911,026,085 |

* Party-in-interest.

** Interest in Honeywell Savings and Ownership Plan Master Trust

includes non-participant directed investments with a market value of $3,937,258,702 and a cost of $1,907,729,421.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Plan administrator has duly caused this Annual Report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Honeywell Savings and Ownership Plan |

| |

|

| |

By: |

/s/

Christopher Gregg |

|

| |

|

Christopher Gregg |

| |

|

Vice President, Compensation and Benefits |

Date: June 24, 2015

Exhibit

I

Consent

of Independent Registered Public Accounting Firm

We hereby consent to the incorporation by reference in the

Registration Statement on Form S-8 (No. 333-148995) of Honeywell International Inc. of our report dated June 24, 2015 relating

to the financial statements and supplemental schedule of the Honeywell Savings and Ownership Plan, which appears in this Form 11-K.

| /s/ PricewaterhouseCoopers LLP | |

PricewaterhouseCoopers LLP

New York, New York

June 24, 2015

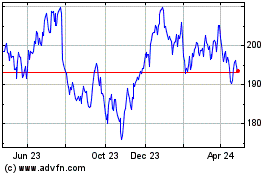

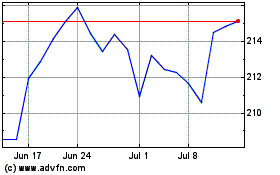

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024