Asian Shares Broadly Lower on Fed Comments, ECB Tapering Talk

October 05 2016 - 12:20AM

Dow Jones News

Asian shares traded slightly lower early Wednesday, as concern

shifted to the likelihood of a U.S. Federal Reserve rate increase

by the year's end.

Australia's S&P/ASX 200 was down 0.5%, Korea's Kospi

declined 0.1%, Singapore's FTSE Straits Times Index was off 0.2%

and Taiwan's Taiex was off 0.1%.

In Hong Kong, the Hang Seng Index reversed early losses and was

last up 0.5% amid light trading volumes, with mainland Chinese

markets shut for the week.

The broad weakness in Asian stocks followed comments overnight

by a Fed official stating that the central bank should

pre-emptively raise short-term interest rates to stave off

accelerating inflation.

"While inflation pressures may seem a distant and theoretical

concern right now, prudent pre-emptive action can help us avoid the

hard-to-predict emergence of a situation that requires more drastic

action after the fact," said Federal Reserve Bank of Richmond

President Jeffrey Lacker.

Mr. Lacker's remarks helped boost the U.S. dollar, though it was

relatively stable against most Asian currencies on Wednesday.

"The Fed is obviously the main game in town," said Chris Weston,

chief market strategist at IG. "All these central banks have been

doing a great job in subduing volatility," but investors are

looking to position portfolios beyond central-bank policy.

Overnight, Bloomberg reported that policy makers at the European

Central Bank reached an informal consensus to wind down bond buying

gradually.

The ECB subsequently denied that the governing council had

discussed the subject.

In Japan, however, investors appeared to brush aside the

tapering concerns, with the Nikkei Stock Average last trading up

0.6%.

Among big caps, Toyota Motor rose 1.3%, while Nissan Motor added

2.1% and Honda Motor gained 2.5%, thanks to a slightly weaker yen

against the dollar.

Japanese financial stocks rose, too, with expectations that

higher interest rates would boost yields. Sumitomo Mitsui Financial

Group rose 1.3% and Dai-ichi Life Holdings added 2.6%.

Meanwhile, gold prices remain well below a key psychological

level of $1,300 per troy ounce in Asia trade, after falling below

the level overnight due to a stronger dollar.

"In the past four months, gold always rebounded whenever prices

came close to $1,300 per ounce," said Gnanasekar Thiagarajan, a

director of Commtrendz Risk Management. He said low prices will

likely drive Indian festival buying this month.

"In a way, the price fall now is a blessing in disguise," he

said. Gold was last up $4.29 at $1,272.44 an ounce.

Looking ahead this week, investors in Asia will be eyeing ISM

nonmanufacturing data and jobs figures from the U.S., the strength

of which will further support the case for an interest-rate

increase soon.

-Biman Mukherji and Kosaku Narioka contributed to this

article.

Write to Willa Plank at willa.plank@wsj.com

(END) Dow Jones Newswires

October 05, 2016 00:05 ET (04:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

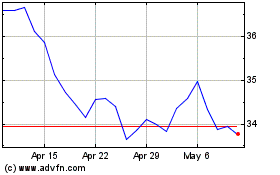

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2024 to May 2024

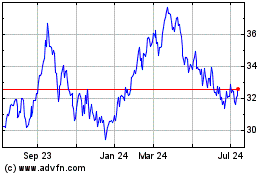

Honda Motor (NYSE:HMC)

Historical Stock Chart

From May 2023 to May 2024