Record sales and growing cash result in a

stronger balance sheet

Hecla Mining Company (NYSE:HL) today announced second quarter

2016 financial and operating results.

SECOND QUARTER HIGHLIGHTS AND SIGNIFICANT ITEMS (compared to

Q2 2015)

- Net income applicable to common

shareholders of $24.0 million, or $0.06 per share.

- Sales of $171.3 million, up 64% on

higher production, a record.

- Adjusted EBITDA of $77.8 million, up

164%.1

- Silver production of 4.2 million

ounces, up 71%.

- Gold production of 62,965 ounces, up

41%.

- Cash and cash equivalents and

short-term investments of $159 million, up $25 million over first

quarter.

- Increased estimated 2016 (i) silver

production to 15.75 million ounces (from 15.0 million) at a cash

cost, after by-product credits, of $4.75 per ounce (from $5.00 per

ounce) and (ii) exploration and pre-development expenditures by 27%

to $19.0 million.2

- #4 Shaft at Lucky Friday reached its

final depth, expected to be operational by year end.

“Hecla's industry-leading production growth of 71% for silver

and 41% for gold is due to our organic growth acceleration

strategy,” said Phillips S. Baker, Jr. “The result is the highest

sales in our history and our second highest adjusted EBITDA. With

current prices even higher than the second quarter and continued

strong performance from Casa Berardi and San Sebastian, we expect

even better results in the future.”

FINANCIAL OVERVIEW

Second Quarter Ended Six Months

Ended HIGHLIGHTS June 30, 2016 June

30, 2015

June 30, 2016 June 30, 2015

FINANCIAL DATA

Sales (000)

$ 171,302 $ 104,197

$ 302,319 $ 223,289 Gross profit (000)

$ 58,452 $ 9,464

$ 89,274 $ 29,337

Income (loss) applicable to common shareholders (000)

$

23,978 $ (26,805 )

$ 23,222 $ (14,391 )

Basic and diluted income (loss) per common

share

$ 0.06 $ (0.07 )

$ 0.06 $ (0.04 ) Net

income (loss) (000)

$ 24,116 $ (26,667 )

$

23,498 $ (14,115 )

Cash provided by operating activities

(000)

$ 67,390 $ 30,754

$ 86,138 $ 52,173

Net income applicable to common shareholders for the second

quarter 2016 was $24.0 million, or $0.06 per share, compared to a

net loss applicable to common shareholders of $26.8 million, or

$0.07 per share, for the same period in 2015, the result mainly due

to the following items:

- Sales were 64% higher than the second

quarter 2015, mainly due to 71% increased silver production and 41%

increased gold production as well as higher silver and gold

prices.

- Cost of sales and other direct

production costs and depreciation, depletion and amortization of

$112.9 million was higher by 19% mainly due to San Sebastian being

in commercial production.

- Cash cost, after by-product credits,

decreased 32% per silver ounce and 28% per gold ounce from the

second quarter 2015.4,5

- A $7.8 million lower provision for

closed operations and environmental matters recorded in 2016, as

compared to the same period in 2015.

- Income tax provision of $11.5 million

for the second quarter of 2016 compared to an income tax benefit of

$0.1 million for the same period in 2015 primarily due to higher

net income before taxes, partially offset by a decrease in the

valuation allowance on deferred tax assets in Mexico in the second

quarter of 2016.

Higher production resulted in operating cash flow of $67.4

million, $36.6 million higher than the second quarter 2015.

Capital expenditures (excluding capitalized interest) at the

operations totaled $42.3 million for the second quarter.

Expenditures consisted of $17.2 million at Casa Berardi, $14.7

million at Greens Creek, $10.2 million at Lucky Friday, and $0.2

million at San Sebastian. The company continues to estimate 2016

capital spending will total $150 million, unchanged from previous

estimates.

Metals Prices

The average realized silver price in the second quarter was

$17.26 per ounce, 6% higher than the $16.32 average realized silver

price in the second quarter of 2015. The average realized gold

price was $1,254 per ounce, an increase of 5%, from $1,194 in the

second quarter 2015. Realized lead prices of $0.79/lb were down

16%, and realized zinc prices of $0.89/lb were down 7% from the

second quarter of 2015.

Base Metals Forward Sales Contracts

There is no quantity of base metals committed under financially

settled forward sales contracts for forecasted future sales at

June 30, 2016.

OPERATIONS OVERVIEW

Overview

The following table provides the production, cost of sales, and

cash cost, after by-product credits, per silver and gold ounce

summary for the second quarter and six months ended June 30, 2016

and 2015:

Second Quarter and

Six Months Ended

Greens Creek Lucky

Friday Casa Berardi San Sebastian

June 30, 2016 Silver

Gold Silver Gold

Silver Gold Silver

Silver Gold Production (ounces)

Q2 4,241,398 62,965 2,117,084 11,528 857,543

41,955 8,668 1,258,103 9,482

6 Mos 8,884,102 118,653

4,575,360 27,509 1,834,627

72,333 15,673 2,458,442

18,811

Increase/(decrease) over Q2 2015 Q2 71

% 41 % 14 % (16 )% 40 % 36 % 15 % N/A N/A

6 Mos

66 % 39 % 18 % (5 )% 27 %

28 % 16 % N/A N/A

Cost of sales and other

direct production costs and depreciation, depletion and

amortization Q2 $ 71,667 $ 41,183 $ 43,734 N/A $ 18,708

$ 41,183 N/A $ 9,225 N/A

6 Mos $ 142,702

$ 70,343 $ 88,587 N/A

$ 37,212 $ 70,343 N/A $

16,903 N/A

Cash costs, after by-product credits,

per silver or gold ounce4,5 Q2 $ 3.80 $ 601 $

5.38 N/A $ 9.94 $ 601 N/A $ (3.05 ) N/A

6 Mos

$ 3.46 $ 676 $ 4.61 N/A

$ 9.47 $ 676 N/A $ (3.15

) N/A

Second Quarter and

Six Months Ended

Greens Creek Lucky Friday Casa

Berardi San Sebastian June 30, 2015

Silver Gold Silver

Gold Silver Gold

Silver Silver Gold Production

(ounces) Q2 2,477,150 44,692 1,856,125 13,753 613,474

30,939 7,551 — —

6 Mos 5,355,747

85,342 3,892,091 28,992

1,450,193 56,350 13,463 —

—

Cost of sales and other direct production costs

and depreciation, depletion and amortization Q2 $ 57,965

$ 36,769 $ 42,815 N/A $ 15,150 $ 36,769 N/A N/A N/A

6

Mos $ 126,012 $ 67,940 $

94,522 N/A $ 31,490 $ 67,940

N/A N/A N/A

Cash costs, after

by-product credits, per silver or gold ounce4,5

Q2 $ 5.61 $ 832 $ 3.30 N/A $ 12.58 $ 832 N/A N/A N/A

6 Mos $ 5.24 $ 896 $ 3.27

N/A $ 10.55 $ 896

N/A N/A N/A

The following table provides the production summary on a

consolidated basis for the second quarter and six months ended

June 30, 2016 and 2015:

Second Quarter Ended Six Months

Ended June 30, 2016 June 30, 2015

June

30, 2016 June 30, 2015

PRODUCTION SUMMARY Silver

- Ounces produced

4,241,398 2,477,150

8,884,102 5,355,747 Payable ounces sold

4,141,427 1,986,407

7,937,242 4,912,942 Gold - Ounces

produced

62,965 44,692

118,653 85,342 Payable ounces

sold

64,609 40,237

110,869 80,032 Lead - Tons

produced

10,391 9,525

21,429 19,403 Payable tons sold

9,663 7,128

18,413 15,753 Zinc - Tons produced

18,132 17,515

35,496 33,602 Payable tons sold

10,010 12,191

24,352 23,334

Greens Creek Mine - Alaska

Silver production of 2.1 million ounces increased 14% and gold

production of 11,528 ounces decreased 16% over the prior year

period. Increased silver production resulted from higher grades as

well as slightly higher throughput. Gold production was impacted

due to a one-time adjustment in the gravity circuit. The mill

operated at an average of 2,235 tons per day (tpd) in the second

quarter.

The cost of sales was $43.7 million, and the cash cost, after

by-product credits, per silver ounce of $5.38 increased from $3.30

in the second quarter 2015.2 The increase was due to lower

by-product credits as a result of lower reported gold production,

partially offset by higher silver production.

The estimated 2016 silver production is increased to 8.3 million

ounces and gold production is slightly higher at 53,000 ounces.

Lucky Friday Mine - Idaho

Silver production of 857,543 ounces was 40% higher than the

second quarter of 2015 due to higher grades in the current period

and ventilation repairs made in the prior year period. The mill

operated at an average of 745 tpd in the second quarter.

The cost of sales was $18.7 million, and the cash cost, after

by-product credits, per silver ounce of $9.94, decreased from

$12.58 per ounce in the second quarter of 2015.2 This decrease was

principally due to higher silver production as a result of mining

higher-grade material.

The excavation of the #4 Shaft from the 4,400 level to the 8,600

level is complete and should be operational by year end. Once

operational, work will begin on the lateral development necessary

to provide access to higher-grade material.

The estimated 2016 silver production remains at 3.1 million

ounces.

Casa Berardi - Quebec

Gold production of 41,955 ounces was 36% higher than the second

quarter of 2015 due to higher gold grades. The mill operated at an

average of 2,398 tpd in the second quarter.

The cost of sales was $41.2 million, and the cash cost, after

by-product credits, per gold ounce of $601, decreased from $832 in

the second quarter of 2015 due to higher gold production.2

The estimated 2016 gold production is increased to 145,000

ounces (surface and underground).

Development of the East Mine Crown Pillar (EMCP) pit continues,

and the vein has been exposed closer to surface than expected.

Processing of EMCP ore began on July 22, 2016, and the pit is

expected to add 5,000 ounces of gold production in 2016.

San Sebastian - Mexico

Silver production was 1,258,103 ounces at a cost of sales of

$9.2 million, or cash cost, after by-product credits, of negative

$3.05 per ounce in the second full quarter of production since

reopening.2 The strong cash cost, after by-product credit,

performance was due to the production of 9,482 ounces of gold,

which is used as a by-product credit. At quarter-end there were

approximately 161,000 silver ounces in inventory, down from 320,000

ounces in the first quarter. The mill operated at an average of 411

tpd in the second quarter.

Should resource conversion be successful, the Company has an

option to process ore at the Velardeña mill until the end of

2018.

The estimated 2016 silver production is increased to 4.35

million ounces and gold production to be 35,000 ounces.

EXPLORATION AND PRE-DEVELOPMENT

Expenditures

Exploration and pre-development expenses were $3.4 million and

$0.5 million, respectively, decreases of about $1.2 million and

$1.1 million compared to the second quarter 2015 as a result of

reduced discretionary spending in exploration and pre-development

expenses. Estimated full year exploration and pre-development

expenses have increased by $4 million to $19 million.

The Company’s exploration efforts are focused on discovering

high-grade deposits near its existing operations, particularly at

San Sebastian, where the results are encouraging. As a result of

consistent exploration success over the last ten years across all

projects, the level of reserves have shown a remarkable resilience

despite changes in commodity prices; production has been replaced

and reserves have grown steadily. A summary of this activity in the

quarter is provided below.

San Sebastian - Mexico

Exploration activities at San Sebastian are focused on defining

extensions to the current open pits and identifying new resources

that could prolong high-margin precious metals production. Shallow

drilling up to 200 feet west of the Middle Vein pit cut vein

extensions that graded 26.7 oz/ton silver and 0.26 oz/ton gold over

4.3 feet and 9.3 oz/ton silver and 0.12 oz/ton gold over 9.8 feet.

Drill intersections of similar veins up to 125 feet east of the pit

graded 2.7 oz/ton silver and 0.48 oz/ton gold over 1.8 feet. These

intersections in combination with past drilling show intervals of

good, near-surface mineralization in the Middle Vein beyond the

current open pit and may represent an opportunity to expand the

pit.

In addition, shallow drilling of the Middle Vein approximately

1,200 to 2,000 feet west from the current Middle Vein pit included

an intersection of 9.7 oz/ton silver and 0.05 oz/ton gold over 7.2

feet of oxide mineralization. Deeper drilling in this area has

returned some spectacular results including 65.1 oz/ton silver

and 0.68 oz/ton gold over 7.8 feet and 57.7 oz/ton silver and 0.28

oz/ton gold over 6.1 feet. This mostly horizontal zone is

dominantly oxide with some supergene mineralization that varies in

depth from 200 to 500 feet from surface. This new area now defines

over 850 feet of continuous vein mineralization that is located at

potentially open pit mining or shallow underground depths.

Drilling also continues on a new target area referred to as the

West Francine Vein that is about 3,000 feet west of previous

mining at the Francine Vein. Drilling has defined a continuous vein

with over 1,600 feet of strike length that varies in thickness from

2 to 16-feet wide and the vein is open in all

directions. Recent drill holes intersected mineralized zones

at a depth of 50 to 250 feet from surface and include 13.4 oz/ton

silver and 0.05 oz/ton gold over 3.5 feet. Step-out drilling

continues to the east and at depth where mineralization appears

stronger. Most of the additional 2016 exploration spending at San

Sebastian is expected to follow up on these results on the Middle

and West Francine veins.

Drilling commenced in June in areas directly to the east and

southeast of the East Francine pit on possible extensions of

the East Francine Vein. These targets are based on results from the

RAB (rotary air blast) drilling program and surface trenching from

last year. Preliminary drilling has intersected quartz veins and

breccias and assays are pending for these holes. Further drilling

of a 6 to 12-foot wide vein/breccia zone that can be traced for 800

feet by trenching is currently planned for the third quarter.

Casa Berardi - Quebec

During the second quarter, drilling at Casa Berardi focused on

targets both underground, - the 118, 121, 123 and Lower Inter

zones, and on or near surface (i.e. open pitable) - the 124 and 134

zones. Up to six drills have been operating underground and two on

surface.

Drilling of the upper 118 Zone from the 490 level down to

the 570 level defines multiple shear zones that extend for over

1,000 feet down-plunge and include a series of continuous

mineralized intervals of over 0.4 oz/ton gold with good mining

widths. This zone continues to plunge to the west at depth and

recent intercepts include 0.44 oz/ton gold over 26.6 feet. Drilling

of the 121 Zone, which is about 400 feet west and a

continuation of the high-grade 123 Zone, has returned 0.56 oz/ton

gold over 8.9 feet and has been identified for over 800 feet along

strike and about 700 feet up dip. Drilling of the 123 Zone

from the 490 and 870 levels continue to intercept high-grade

mineralization, including 0.53 oz/ton gold over 16.1 feet along

eastern vein extensions. Deeper drilling shows that the stacked

lenses of the 123 Zone define an almost constant down-plunge

mineralization for over 3,500 vertical feet from surface and many

of the lenses have strike lengths up to 600 feet. Recent drilling

shows these lenses are open along strike to the east and at depth.

The close proximity of these new lenses to mine infrastructure

should enable near-term production.

At the west end of the mine drilling has started on the Lower

Inter off the 300 and 360 levels. Drilling from the 300 level

has successfully defined the up dip extension of the Lower Inter

Zone, including an intersection of 0.95 oz/ton gold over 17.4 feet.

Deeper drilling off the 360 level has intersected a new, broad

mineralized zone just south of the Casa Berardi Fault referred to

as the 104 Zone and two new mineralized lenses north of the fault.

Initial drill results define a broad, 102 foot-wide zone of 0.05

oz/ton gold including 0.29 oz/ton gold over 3.3 feet and 0.16

oz/ton gold over 3.2 feet.

Surface and underground drilling of the 124 Zone below

and to both the west and east of the Principal area has defined a

near-surface, 15 to 60-foot thick, quartz-bearing zone with over

2,000 feet of strike length. Within this wide mineralized zone are

high-grade lenses that have continuity up to 300 feet of strike

length. Recent drilling of the 124 Zone included intersections of

0.70 oz/ton gold over 20.3 feet and 0.41 oz/ton gold over 24.9

feet. Further refinement of this near-surface target with drilling

may outline a resource suitable for open pit mining.

Surface drilling further east of the Principal area is testing

the shallow 124 and 134 zones along the Casa Berardi Fault.

Drilling in this area within 500 feet of surface has defined a 150

to 300-foot thick mineralized shear zone with vein-bearing zones

from 5 to 20-foot thick. Recent intersections of the 134 Zone

include 0.09 oz/ton gold over 49.2 feet. Successful drilling on

surface continues to define new resources and additional 2016

spending will be focused on expanding the near-surface resources

that should sustain open pit mine production at Casa Berardi in the

coming years.

Greens Creek - Alaska

At Greens Creek, definition drilling is refining the resources

of the 9A and NWW zones for conversion to reserves. Recent

definition drilling of the 9A Zone confirmed continuity of

the mineralization and refined the geometry of a mostly vertical

eastern limb of mineralization. Drill intersections include

20.4 oz/ton silver, 0.09 oz/ton gold, 16.2% zinc, and 5.2%

lead over 17.5 feet and 15.1 oz/ton silver, 0.08 oz/ton gold,

11.2% zinc, and 4.1% lead over 15.6 feet. Drilling of the northern

most targets of the NWW Zone defined mineralization of

similar overall geometry of the resource model but thinner and

slightly lesser extents in places. Recent drill intersections

include 76.4 oz/ton silver, 0.17 oz/ton gold, 19.9% zinc, and 4.4%

lead over 10.2 feet and 56.1 oz/ton silver, 0.13 oz/ton gold, 3.3%

zinc, and 0.8% lead over 10.2 feet. Revised resource models

for the 5250, 9A, West Wall, NWW and Deep 200 South zones are

expected by the end of the year.

Exploration drilling has tested the down plunge projection of

the 5250 trend of mineralization and attempted to locate the

upper shear which defines the upper limit to mineralization at

Greens Creek. This drilling is showing semi-continuous

mineralization along the 5250 and Deep 200 South trends in the

southern part of the mine that require additional drilling to

refine new resources.

More complete drill assay highlights from San Sebastian, Casa

Berardi, and Greens Creek can be found in Table A at the end of the

release.

Other Properties

Summer fieldwork on the Opinaca-Wildcat project near Goldcorp’s

Eleonore Mine in northern Quebec is underway and will include

prospecting of numerous electromagnetic (EM) anomalies lying on the

Opinaca property. So far, the fieldwork revealed three new

mineralized zones directly east of the Eleonore Mine and two

further south along the Claude structure that is directly east of

the Cheechoo discovery by Sirios Resources. At the Rock Creek

project in Montana, validation and check assay work includes the

integration of data for revised resource models and future

exploration programs.

2016 ESTIMATES

For the full year 2016, the Company increased its production

estimates at Greens Creek, San Sebastian and Casa Berardi and

lowered its estimate for total cash cost, after by-product credits,

per silver ounce and increased its estimate for exploration

expenditures. The Company currently estimates:

Mine 2016E Silver

Production (Moz)6

Prior

2016E Silver

Production (Moz)6

2016E Gold

Production (oz)

Prior

2016E Gold

Production (oz)

Cash cost, after by-product credits, per silver/gold

ounce3 Prior cash cost, after by-product credits,

per silver/gold ounce3

Greens Creek 8.30

8.1

53,000 52,000

$5.00/silver oz $5.00/silver oz

Lucky Friday

3.10 3.1

$9.00/silver oz $9.00/silver oz

San

Sebastian 4.35 3.8

35,000 20,000

$1.00/silver

oz $1.00/silver oz

Casa Berardi 145,000 135,000

$700/gold oz $700/gold oz

Total 15.75 15.0

233,000 207,000

$4.75/silver oz $5.00/silver oz

AgEq Production7: 44.0 41.0

AuEq

Production7: 576,000 540,500

2016E capital expenditures (excluding

capitalized interest)

$150 million 2016E pre-development and exploration

expenditures $19 million [prior $15 million]

DIVIDENDS

The Board of Directors declared a quarterly cash dividend of

$0.0025 per share of common stock, payable on or about August 31,

2016, to stockholders of record on August 23, 2016. The

realized silver price was $17.26 in the second quarter and

therefore did not satisfy the criteria for a larger dividend under

the Company's dividend policy.

The Board of Directors also declared the regular quarterly

dividend of $0.875 per share on the 157,816 outstanding shares of

Series B Cumulative Convertible Preferred Stock. This represents a

total amount to be paid of approximately $138,000. The cash

dividend is payable October 3, 2016, to shareholders of record on

September 15, 2016.

CONFERENCE CALL AND WEBCAST

A conference call and webcast will be held Thursday, August 4,

at 10:00 a.m. Eastern Time to discuss these results. You may join

the conference call by dialing toll-free 1-855-760-8158 or for

international dialing 1-720-634-2922. The participant passcode is

HECLA. Hecla's live and archived webcast can be accessed at

www.hecla-mining.com under Investors

or via Thomson StreetEvents Network.

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE:HL) is a leading

low-cost U.S. silver producer with operating mines in Alaska and

Idaho, and is a growing gold producer with an operating mine in

Quebec, Canada. The Company also has exploration and

pre-development properties in six world-class silver and gold

mining districts in the U.S., Canada and Mexico, and an exploration

office and investments in early-stage silver exploration projects

in Canada.

NOTES

(1) Adjusted EBITDA is a non-GAAP measurement, a reconciliation

of which to net income (loss), the most comparable GAAP measure,

can be found at the end of the release.

(2) Cash cost, after by-product credits, per silver and gold

ounce represents a non-GAAP measurement. The most comparable GAAP

measure is cost of sales and other direct production costs and

depreciation, depletion and amortization, and is sometimes referred

to as "cost of sales" in this release.

(3) The estimates of future cash cost, after by-product credits,

per silver ounce or gold ounce (non-GAAP) are made applying

management’s judgment and experience to forecasted metals and

prices, inventory changes, performance year to date and

expectations for the remainder of the year. It is not calculated

from the GAAP measure of costs of sales, which is not available,

and therefore providing a reconciliation to it requires an

unreasonable effort.

(4) Cash cost, after by-product credits, per silver and gold

ounce represents a non-GAAP measurement, a reconciliation of which

to cost of sales and other direct production costs and

depreciation, depletion and amortization, the most comparable GAAP

measures, can be found at the end of the release.

(5) Cash cost, after by-product credits, per gold ounce is only

applicable to Casa Berardi production. Gold produced from Greens

Creek is treated as a by-product credit against the silver cash

cost.

(6) 2016E refers to the Company's estimates for 2016.

(7) All metal equivalent production of 44 million silver oz or

576,000 gold oz includes silver, gold, lead and zinc production

from Lucky Friday, Greens Creek, San Sebastian and Casa Berardi

converted using the following metal price assumptions: Au

$1,150/oz, Ag $15/oz, Zn $0.75/lb, Pb $0.80/lb; USD/CAD assumed at

0.75, USD/MXN at $0.06.

Cautionary Statements to Investors on Forward-Looking

Statements

This news release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws. Such

forward-looking statements may include, without limitation: (i)

estimates of future production and sales; (ii) estimates of future

costs and cash cost, after by-product credits per ounce of

silver/gold; (iii) guidance for 2016 for silver and gold

production, cash cost, after by-product credits, capital

expenditures and pre-development and exploration expenditures

(which assumes metal prices of gold at $1,150/oz, silver at $15/oz,

zinc at $0.75/lb, lead at $0.80/lb and USD/CAD assumed at $0.75),

USD/MXN at $0.06; (iv) expectations regarding the development,

growth and exploration potential of the Company’s projects; (v)

expectations of growth; (vi) the ability to convert resources to

reserves at Greens Creek; (vii) expectations of #4 Shaft being

operational by year end and total estimated cost of the project,

and (viii) possible strike extensions of veins at the San Sebastian

project, the ability to extend the mine life. Estimates or

expectations of future events or results are based upon certain

assumptions, which may prove to be incorrect. Such assumptions,

include, but are not limited to: (i) there being no significant

change to current geotechnical, metallurgical, hydrological and

other physical conditions; (ii) permitting, development, operations

and expansion of the Company’s projects being consistent with

current expectations and mine plans; (iii) political/regulatory

developments in any jurisdiction in which the Company operates

being consistent with its current expectations; (iv) the exchange

rate for the Canadian dollar to the U.S. dollar, being

approximately consistent with current levels; (v) certain price

assumptions for gold, silver, lead and zinc; (vi) prices for key

supplies being approximately consistent with current levels; (vii)

the accuracy of our current mineral reserve and mineral resource

estimates; and (viii) the Company’s plans for development and

production will proceed as expected and will not require revision

as a result of risks or uncertainties, whether known, unknown or

unanticipated. Where the Company expresses or implies an

expectation or belief as to future events or results, such

expectation or belief is expressed in good faith and believed to

have a reasonable basis. However, such statements are subject to

risks, uncertainties and other factors, which could cause actual

results to differ materially from future results expressed,

projected or implied by the “forward-looking statements.” Such

risks include, but are not limited to gold, silver and other metals

price volatility, operating risks, currency fluctuations, increased

production costs and variances in ore grade or recovery rates from

those assumed in mining plans, community relations, conflict

resolution and outcome of projects or oppositions, litigation,

political, regulatory, labor and environmental risks, and

exploration risks and results, including that mineral resources are

not mineral reserves, they do not have demonstrated economic

viability and there is no certainty that they can be upgraded to

mineral reserves through continued exploration. For a more detailed

discussion of such risks and other factors, see the Company’s 2015

Form 10-K, filed on February 23, 2016 with the Securities and

Exchange Commission (SEC), as well as the Company’s other SEC

filings. The Company does not undertake any obligation to release

publicly revisions to any “forward-looking statement,” including,

without limitation, outlook, to reflect events or circumstances

after the date of this news release, or to reflect the occurrence

of unanticipated events, except as may be required under applicable

securities laws. Investors should not assume that any lack of

update to a previously issued “forward-looking statement”

constitutes a reaffirmation of that statement. Continued reliance

on “forward-looking statements” is at investors’ own risk.

Qualified Person (QP) Pursuant to Canadian National

Instrument 43-101

Dean McDonald, PhD. P.Geo., Senior Vice President - Exploration

of Hecla Mining Company, who serves as a Qualified Person under

National Instrument 43-101("NI 43-101"), supervised the preparation

of the scientific and technical information concerning Hecla’s

mineral projects in this news release. Information regarding data

verification, surveys and investigations, quality assurance program

and quality control measures and a summary of sample, analytical or

testing procedures for the Greens Creek Mine are contained in a

technical report prepared for Hecla and Aurizon Mines Ltd. titled

“Technical Report for the Greens Creek Mine, Juneau, Alaska, USA”

effective date March 28, 2013, and for the Lucky Friday Mine are

contained in a technical report prepared for Hecla titled

“Technical Report on the Lucky Friday Mine Shoshone County, Idaho,

USA” effective date April 2, 2014, and for the Casa Berardi Mine

are contained in a technical report prepared for Hecla titled

"Technical Report on the Mineral Resource and Mineral Reserve

Estimate for the Casa Berardi Mine, Northwestern Quebec, Canada"

effective date March 31, 2014 (the "Casa Berardi Technical

Report")and for the San Sebastian Mine are contained in a technical

report prepared for Hecla titled “Technical Report for the San

Sebastian Ag-Au Property, Durango, Mexico" effective date September

8, 2015. Also included in these four technical reports is a

description of the key assumptions, parameters and methods used to

estimate mineral reserves and resources and a general discussion of

the extent to which the estimates may be affected by any known

environmental, permitting, legal, title, taxation, socio-political,

marketing or other relevant factors. Copies of these technical

reports are available under Hecla's profile on SEDAR at

www.sedar.com.

Cautionary Statements to Investors on Reserves and

Resources

Reporting requirements in the United States for disclosure of

mineral properties are governed by the SEC and included in the

SEC's Securities Act Industry Guide 7, entitled “Description of

Property by Issuers Engaged or to be Engaged in Significant Mining

Operations” (“Guide 7”). However, the Company is also a "reporting

issuer" under Canadian securities laws, which require estimates of

mineral resources and reserves to be prepared in accordance with

Canadian National Instrument 43-101 (“NI 43-101”). NI 43-101

requires all disclosure of estimates of potential mineral resources

and reserves to be disclosed in accordance with its requirements.

Such Canadian information is being included here to satisfy the

Company's “public disclosure” obligations under Regulation FD of

the SEC and to provide U.S. holders with ready access to

information publicly available in Canada.

Reporting requirements in the United States for disclosure of

mineral properties under Guide 7 and the requirements in Canada

under NI 43-101 standards are substantially different. This

document contains a summary of certain estimates of the Company,

not only of proven and probable reserves within the meaning of

Guide 7, which requires the preparation of a “final” or “bankable”

feasibility study demonstrating the economic feasibility of mining

and processing the mineralization using the three-year historical

average price for any reserve or cash flow analysis to designate

reserves and that the primary environmental analysis or report be

filed with the appropriate governmental authority, but also of

mineral resource and mineral reserve estimates estimated in

accordance with the definitional standards of the Canadian

Institute of Mining, Metallurgy and Petroleum referred to in NI

43-101. The terms “measured resources”, "indicated resources," and

"inferred resources" are Canadian mining terms as defined in

accordance with NI 43-101. These terms are not defined under Guide

7 and are not normally permitted to be used in reports and

registration statements filed with the SEC in the United States,

except where required to be disclosed by foreign law.

Investors are cautioned not to assume that any part or all of the

mineral deposits in such categories will ever be converted into

proven or probable reserves. “Resources” have a great amount of

uncertainty as to their existence, and great uncertainty as to

their economic and legal feasibility. It cannot be assumed that all

or any part of such a "resource” will ever be upgraded to a higher

category or will ever be economically extracted. Investors are

cautioned not to assume that all or any part of a "resource” exists

or is economically or legally mineable. Investors are also

especially cautioned that the mere fact that such resources may be

referred to in ounces of silver and/or gold, rather than in tons of

mineralization and grades of silver and/or gold estimated per ton,

is not an indication that such material will ever result in mined

ore which is processed into commercial silver or gold.

HECLA MINING COMPANY

Condensed Consolidated Statements of

Income (Loss)

(dollars and shares in thousands, except

per share amounts - unaudited)

Second Quarter Ended Six Months Ended

June

30, 2016 June 30, 2015

June 30, 2016 June

30, 2015 Sales of products

$ 171,302 $ 104,197

$ 302,319 $ 223,289 Cost of

sales and other direct production costs

82,953 67,567

157,273 141,532 Depreciation, depletion and amortization

29,897 27,166

55,772 52,420

112,850 94,733

213,045

193,952 Gross profit

58,452 9,464

89,274 29,337 Other operating expenses:

General and administrative

10,359 8,296

20,573 17,016

Exploration

3,362 4,592

6,312 9,208 Pre-development

521 1,618

925 2,138 Other operating expense

622 766

1,262 1,394 Provision for closed operations

and environmental matters

1,576 9,335

2,617 9,802

Acquisition costs

402 2,147

402

2,147

16,842 26,754

32,091

41,705 Income (loss) from operations

41,610

(17,290 )

57,183 (12,368 ) Other income

(expense): Loss on disposition of investments

— (166 )

— (166 ) Unrealized gain (loss) on investments

1,150

(117 )

439 (2,960 ) Gain (loss) on derivative contracts

(6 ) (887 )

(6 ) 4,905 Interest and

other income

113 35

201 73 Net foreign exchange gain

(loss)

(1,885 ) (1,833 )

(10,088 )

10,441 Interest expense, net of amount capitalized

(5,370

) (6,541 )

(11,081 ) (12,733 )

(5,998

) (9,509 )

(20,535 ) (440 ) Income (loss)

before income taxes

35,612 (26,799 )

36,648 (12,808 )

Income tax benefit (provision)

(11,496 ) 132

(13,150 ) (1,307 ) Net income (loss)

24,116

(26,667 )

23,498 (14,115 ) Preferred stock dividends

(138 ) (138 )

(276 ) (276 ) Income

(loss) applicable to common shareholders

$ 23,978

$ (26,805 )

$ 23,222 $ (14,391 ) Basic

and diluted income (loss) per common share after preferred

dividends

$ 0.06 $ (0.07 )

$

0.06 $ (0.04 ) Weighted average number of common

shares outstanding - basic and diluted

383,790

371,295

381,389 370,042

HECLA

MINING COMPANY

Condensed Consolidated Balance Sheets

(dollars and shares in thousands -

unaudited)

June 30, 2016 December 31, 2015

ASSETS Current assets:

Cash and cash equivalents

$ 143,613 $ 155,209

Short-term investments and securities

15,070 — Accounts

receivable: Trade

25,667 13,490 Other, net

45,094

27,859 Inventories

51,406 45,542 Current deferred income

taxes

18,386 17,980 Current restricted cash

3,900 —

Other current assets

7,999 9,453 Total current

assets

311,135 269,533 Non-current investments

4,453

1,515 Non-current restricted cash and investments

999 999

Properties, plants, equipment and mineral interests, net

1,926,158 1,896,811 Non-current deferred income taxes

24,427 36,589 Reclamation insurance asset

— 13,695

Other non-current assets and deferred charges

3,638

2,783

Total assets $ 2,270,810 $

2,221,925

LIABILITIES Current liabilities:

Accounts payable and accrued liabilities

$ 57,702 $

51,277 Accrued payroll and related benefits

23,712 27,563

Accrued taxes

4,344 8,915 Current portion of capital leases

7,761 8,735 Current portion of debt

1,852 2,721 Other

current liabilities

10,290 6,884 Current portion of accrued

reclamation and closure costs

24,127 20,989

Total current liabilities

129,788 127,084 Capital leases

7,316 8,841 Accrued reclamation and closure costs

73,019 74,549 Long-term debt

500,354 500,199

Non-current deferred tax liability

127,413 119,623

Non-current pension liability

47,880 46,513 Other

non-current liabilities

5,362 6,190

Total

liabilities 891,132 882,999

SHAREHOLDERS’ EQUITY

Preferred stock

39 39 Common stock

97,207 95,219 Capital surplus

1,538,148 1,519,598

Accumulated deficit

(211,258 ) (232,565 ) Accumulated

other comprehensive loss

(30,327 ) (32,631 ) Treasury

stock

(14,131 ) (10,734 )

Total shareholders’

equity 1,379,678 1,338,926

Total

liabilities and shareholders’ equity $ 2,270,810

$ 2,221,925 Common shares outstanding

385,067

378,113

HECLA MINING COMPANY

Condensed Consolidated Statements of Cash

Flows

(dollars in thousands - unaudited)

Six Months Ended

June 30, 2016

June 30, 2015

OPERATING ACTIVITIES

Net income (loss)

$ 23,498 $

(14,115 ) Non-cash elements included in net income (loss):

Depreciation, depletion and amortization

56,968 52,966

Unrealized (gain)/loss on investments

(439 ) 3,043

Loss (gain) on disposition of properties, plants, equipment and

mineral interests

(311 ) 190 Provision for

reclamation and closure costs

2,005 10,256 Stock

compensation

3,467 2,261 Deferred income taxes

10,652

(705 ) Amortization of loan origination fees

926 910 Loss

(gain) on derivative contracts

5,419 7,812 Foreign exchange

gain

9,721 (9,672 ) Other non-cash charges, net

17 25

Change in assets and liabilities: Accounts receivable

(15,910 ) 2,469 Inventories

(5,802 )

(3,417 ) Other current and non-current assets

268 (3,904 )

Accounts payable and accrued liabilities

(3,820 )

(4,210 ) Accrued payroll and related benefits

3,135 803

Accrued taxes

(4,591 ) (1,938 ) Accrued reclamation

and closure costs and other non-current liabilities

935

9,399

Cash provided by operating

activities 86,138 52,173

INVESTING ACTIVITIES

Additions to properties, plants,

equipment and mineral interests

(76,960 ) (58,272 )

Acquisition of Revett, net of cash acquired

— (809 )

Proceeds from sale of investments

— — Proceeds from

disposition of properties, plants and equipment

317 153

Purchases of investments

(16,088 ) (947 ) Changes in

restricted cash and investment balances

(3,900 ) —

Maturities of investments

840 —

Net

cash used in investing activities (95,791 )

(59,875 )

FINANCING ACTIVITIES Proceeds

from issue of stock, net of related costs

8,121 —

Acquisition of treasury shares

(3,384 ) (941 )

Dividends paid to common shareholders

(1,914 ) (1,850

) Dividends paid to preferred shareholders

(276 )

(276 ) Credit availability and debt issuance fees paid

(83

) (123 ) Repayments of debt

(1,339 ) —

Repayments of capital leases

(4,356 ) (4,940 )

Net cash used in financing activities (3,231 )

(8,130 ) Effect of exchange rates on cash

1,288 (2,259 ) Net decrease in cash and cash equivalents

(11,596 ) (18,091 ) Cash and cash equivalents at

beginning of period

155,209 209,665

Cash and cash equivalents at end of period

$ 143,613

$ 191,574

HECLA MINING COMPANY

Metal Prices

Three Months Ended Six Months Ended

June 30, 2016 June 30, 2015

June 30,

2016 June 30, 2015

AVERAGE METAL PRICES

Silver - London PM Fix

($/oz)

$ 16.78 $ 16.41

$

15.81 $ 16.56 Realized price per ounce

$

17.26 $ 16.32

$ 16.15 $ 16.83 Gold - London PM

Fix ($/oz)

$ 1,259 $ 1,193

$ 1,220 $

1,206 Realized price per ounce

$ 1,254 $ 1,194

$ 1,226 $ 1,208 Lead - LME Cash ($/pound)

$

0.78 $ 0.88

$ 0.79 $ 0.85 Realized price per

pound

$ 0.79 $ 0.94

$ 0.79 $ 0.89 Zinc

- LME Cash ($/pound)

$ 0.87 $ 1.00

$

0.82 $ 0.97 Realized price per pound

$ 0.89 $

0.96

$ 0.83 $ 0.95

Production Data

Three Months Ended Six Months Ended

June 30, 2016 June 30, 2015

June 30,

2016 June 30, 2015

GREENS CREEK UNIT

Tons of ore milled

203,388 199,694 408,356 395,163 Mining cost

per ton $ 71.01 $ 73.60 $ 68.98 $ 73.64 Milling cost per ton $

30.67 $ 30.31 $ 30.83 $ 29.53 Ore grade milled - Silver (oz./ton)

13.25 12.33 14.22 13.05 Ore grade milled - Gold (oz./ton) 0.088

0.106 0.098 0.112 Ore grade milled - Lead (%) 3.20 3.36 3.12 3.31

Ore grade milled - Zinc (%) 8.70 8.93 8.42 8.64 Silver produced

(oz.) 2,117,084 1,856,125 4,575,360 3,892,091 Gold produced (oz.)

11,528 13,753 27,509 28,992 Lead produced (tons) 5,346 5,393 10,433

10,323 Zinc produced (tons) 15,575 15,462 30,186 29,382 Total cash

cost, net of by-product credits, per silver ounce (1) $ 5.38 $ 3.30

$ 4.61 $ 3.27 Capital additions (in thousands) $ 14,661

$ 12,056 $ 21,037 $ 18,400

LUCKY FRIDAY UNIT

Tons of ore processed 67,829 72,059 141,850 146,304

Mining cost per ton $ 100.77 $ 99.14 $ 99.34 $

91.80

Milling cost per ton $ 24.97 $ 20.53 $ 24.13 $ 20.40 Ore grade

milled - Silver (oz./ton) 13.09 8.98 13.39 10.38 Ore grade milled -

Lead (%) 7.76 6.10 8.07 6.56 Ore grade milled - Zinc (%) 4.02 3.10

4.00 3.14 Silver produced (oz.) 857,543 613,474 1,834,627 1,450,193

Lead produced (tons) 5,045 4,132 10,996 9,080 Zinc produced (tons)

2,557 2,053 5,310 4,220 Total cash cost, net of by-product credits,

per silver ounce (1) $ 9.94 $ 12.58 $ 9.47 10.55 Capital additions

(in thousands) $ 10,227 $ 11,352 $ 22,493 $ 25,060 Three

Months Ended Six Months Ended

June 30,

2016 June 30, 2015

June 30, 2016

June 30, 2015

CASA BERARDI UNIT

Tons of ore processed 218.226 219,002

435,188 407,097 Mining cost per ton $ 91.56 $ 95.88 $ 89.55 $

100.33 Milling cost per ton $ 19.82 $ 18.95 $ 19.36 $ 20.33 Ore

grade milled - Gold (oz./ton) 0.217 0.165 0.19 0.16 Ore grade

milled - Silver (oz./ton) 0.04 0.04 0.04 0.04 Gold produced (oz.)

41,955 30,939 72,333 56,350 Total cash cost, net of by-product

credits, per gold ounce (1) $ 601 $ 832 $ 676 $ 896 Capital

additions (in thousands) $ 17,171 $ 8,601

$ 32,782 $ 16,198

SAN SEBASTIAN

Tons of ore

processed 37,400 — 68,558 — Mining cost per ton $ 91.89 $ — $ 97.27

$ — Milling cost per ton $ 69.35 $ — $ 69.48 $ — Ore grade milled -

Silver (oz./ton) 35.83 — 38.3 — Ore grade milled - Gold (oz./ton)

0.269 — 0.294 — Silver produced (oz.) 1,258,103 — 2,458,442 — Gold

produced (oz.) 9,482 — 18,811 — Total cash cost, net of by-product

credits, per silver ounce (1) $ (3.05 ) $ — $ (3.15 ) $ — Capital

additions (in thousands) $ 203 $ — $ 693 $ —

(1) Cash cost, after by-product credits, per ounce represents a

non-U.S. Generally Accepted Accounting Principles (GAAP)

measurement. A reconciliation of cost of sales and other direct

production costs and depreciation, depletion and amortization

(GAAP) to cash cost, after by-product credits can be found in the

cash cost per ounce reconciliation section of this news release.

Gold, lead and zinc produced have been treated as by-product

credits in calculating silver costs per ounce. The primary metal

produced at Casa Berardi is gold, with a by-product credit for the

value of silver production.

Non-GAAP Measures(Unaudited)

Reconciliation of Generally Accepted Accounting Principles

(GAAP) measure to Cash Cost, Before By-product Credits, per Ounce

and Cash Cost, After By-product Credits, per Ounce

This release contains references to a non-GAAP measure of cash

cost, before by-product credits, per ounce and cash cost, after

by-product credits, per ounce. Cash cost, before by-product

credits, per ounce and cash cost, after by-product credits, per

ounce represent non-U.S. Generally Accepted Accounting Principles

(GAAP) measurements that the Company believes provide management

and investors an indication of net cash flow. Management also uses

this measurement for the comparative monitoring of performance of

mining operations period-to-period from a cash flow perspective.

Cash cost, before by-product credits, per ounce and Cash cost,

after by-product credits, per ounce are measures developed by gold

companies and used by silver companies in an effort to provide a

comparable standard; however, there can be no assurance that our

reporting of these non-GAAP measures is similar to those reported

by other mining companies. Cost of sales and other direct

production costs and depreciation, depletion and amortization are

the most comparable financial measures calculated in accordance

with GAAP to cash cost, before by-product credits cash cost, after

by-product credits.

As depicted in the Greens Creek, Lucky Friday, and San Sebastian

Unit tables below, by-product credits comprise an essential element

of our silver unit cost structure. By-product credits constitute an

important competitive distinction for our silver operations due to

the polymetallic nature of their orebodies. By-product credits

included in our presentation of cash cost, after by-product

credits, per silver ounce include:

In thousands (except per ounce amounts) Total, Greens Creek,

Lucky Friday and San Sebastian Three Months EndedJune 30,

Six Months EndedJune 30, 2016 2015 2016 2015

By-product value, all silver properties: Zinc $

22,618 $ 25,224 $ 41,435 $ 46,914 Gold 23,794 13,487 51,250 28,995

Lead 14,165 14,472 29,222 28,365 Total by-product credits $ 60,577

$ 53,183 $ 121,907 $ 104,274 By-product credits per silver

ounce, all silver properties Zinc $ 5.34 $ 10.22 $ 4.67 $ 8.78 Gold

5.62 5.46 5.78 5.43 Lead 3.35 5.86 3.30 5.31 Total by-product

credits $ 14.31 $ 21.54 $ 13.75 $ 19.52

By-product credits included in our presentation of Cash Cost,

After By-product Credits, per Gold Ounce for our Casa Berardi Unit

include:

In thousands (except per ounce amounts) Casa Berardi Unit

Three Months EndedJune 30, Six Months EndedJune 30, 2016

2015 2016 2015 Silver by-product value $ 144 $

123 $ 247 $ 220 Silver by-product credits per gold ounce $

3.41 $ 3.96 $ 3.41 $ 3.90

The following tables calculates cash cost, before by-product

credits, per Silver ounce and cash cost, after by-product credits,

per Silver ounce (in thousands, except ounce and per ounce

amounts):

In thousands (except per ounce amounts) Total, Greens Creek,

Lucky Friday and San Sebastian Three Months EndedJune 30,

Six Months EndedJune 30,

2016 2015

2016

2015 Cost of sales and other direct production costs and

depreciation, depletion and amortization (GAAP)

$

71,667 $ 57,965

$ 142,702 $ 126,012

Depreciation, depletion and amortization

(16,300 )

(16,451 )

(33,674 ) (33,063 ) Treatment costs

20,527 19,305

41,912 39,226 Change in product

inventory

2,122 6,119

4,081 401 Reclamation and other

costs

(1,369 ) 96

(2,395 ) (296

) Cash Cost, Before By-product Credits (1)

76,647 67,034

152,626 132,280 By-product credits

(60,577 )

(53,183 )

(121,907 ) (104,273 ) Cash Cost, After

By-product Credits

$ 16,070 $ 13,851

$ 30,719 $ 28,007 Divided by silver

ounces produced

4,233 2,469

8,868 5,342 Cash Cost,

Before By-product Credits, per Silver Ounce

$ 18.11 $

27.15

$ 17.21 $ 24.76 By-product credits per Silver

Ounce

$ (14.31 ) $ (21.54 )

$

(13.75 ) $ (19.52 ) Cash Cost, After By-product

Credits, per Silver Ounce

$ 3.80 $ 5.61

$ 3.46 $ 5.24 In thousands

(except per ounce amounts) Greens Creek Unit Three Months EndedJune

30, Six Months EndedJune 30,

2016 2015

2016 2015 Cost of sales and other direct production

costs and depreciation, depletion and amortization (GAAP)

$

43,734 $ 42,815

$ 88,587 $ 94,522

Depreciation, depletion and amortization

(12,413 )

(13,775 )

(26,014 ) (27,521 ) Treatment costs

15,317 15,639

30,955 30,872 Change in product

inventory

2,684 4,775

4,324 (919 ) Reclamation and

other costs

(169 ) 86

(566 )

(301 ) Cash Cost, Before by-Product Credits (1)

49,153

49,540

97,286 96,653 By-product credits

(37,773

) (43,409 )

(76,181 ) (83,940 ) Cash Cost,

After By-product Credits

$ 11,380 $ 6,131

$ 21,105 $ 12,713 Divided by

silver ounces produced

2,117 1,856

4,575 3,892 Cash

Cost, Before By-product Credits, per Silver Ounce

$

23.22 $ 26.69

$ 21.26 $ 24.84 By-product

credits per Silver Ounce

$ (17.84 ) $ (23.39 )

$ (16.65 ) $ (21.57 ) Cash Cost, After

By-product Credits, per Silver Ounce

$ 5.38 $

3.30

$ 4.61 $ 3.27 In

thousands (except per ounce amounts) Lucky Friday Unit Three Months

EndedJune 30, Six Months EndedJune 30,

2016

2015

2016 2015 Cost of sales and other direct

production costs and depreciation, depletion and amortization

(GAAP)

$ 18,708 $ 15,150

$ 37,212 $

31,490 Depreciation, depletion and amortization

(2,825

) (2,676 )

(5,829 ) (5,542 ) Treatment costs

4,778 3,666

10,112 8,354 Change in product inventory

(1,035 ) 1,344

(1,056 ) 1,320

Reclamation and other costs

(221 ) 10

(386 ) 5 Cash Cost, Before By-product Credits

(1)

19,405 17,494

40,053 35,627 By-product credits

(10,880 ) (9,774 )

(22,686 ) (20,333 )

Cash Cost, After By-product Credits

$ 8,525 $

7,720

$ 17,367 $ 15,294 Divided

by silver ounces produced

858 613

1,835 1,450 Cash

Cost, Before By-product Credits, per Silver Ounce

$

22.63 $ 28.51

$ 21.84 $ 24.57 By-product

credits per silver ounce

$ (12.69 ) $ (15.93 )

$ (12.37 ) $ (14.02 ) Cash Cost, After

By-product Credits, per Silver Ounce

$ 9.94 $

12.58

$ 9.47 $ 10.55 In

thousands (except per ounce amounts) San Sebastian Unit Three

Months EndedJune 30, Six Months EndedJune 30,

2016

2015

2016

2015 Cost of sales and other direct production costs and

depreciation, depletion and amortization (GAAP)

$

9,225 $ —

$ 16,903 $ — Depreciation, depletion

and amortization

(1,062 ) —

(1,831 ) —

Treatment costs

432 —

845 — Change in product

inventory

473 —

813 — Reclamation and other costs

(979 ) —

(1,443 ) — Cash Cost, Before

By-product Credits (1)

8,089 $ —

15,287 $ —

By-product credits

(11,924 ) —

(23,040

) — Cash Cost, After By-product Credits

$

(3,835 ) —

$ (7,753 ) — Divided

by silver ounces produced

1,258 —

2,458 — Cash Cost,

Before By-product Credits, per Silver Ounce

$ 6.43 $

—

$ 6.22 $ — By-product credits per silver ounce

$ (9.48 ) $ —

$ (9.37

) $ — Cash Cost, After By-product Credits, per Silver Ounce

$ (3.05 ) $ —

$ (3.15

) $ —

The following table calculates cash cost, before by-product

credits, per gold ounce and cash cost, after by-product credits,

per Gold ounce (in thousands, except ounce and per ounce

amounts):

In thousands (except per ounce amounts) Casa Berardi Unit

Three Months EndedJune 30, Six Months EndedJune 30,

2016 2015

2016 2015 Cost of sales and

other direct production costs and depreciation, depletion and

amortization (GAAP)

$ 41,183 $ 36,769

$

70,343 $ 67,940 Depreciation, depletion and amortization

(13,597 ) (10,714 )

(22,098 ) (19,357 )

Treatment costs

238 144

409 297 Change in product

inventory

(2,366 ) (206 )

752 2,066

Reclamation and other costs

(116 ) (117 )

(228

) (235 ) Cash Cost, Before By-product Credits (1)

25,342 25,876

49,178 50,711 By-product credits

(144 ) (123 )

(247 ) (220 ) Cash Cost,

After by-product credits

$ 25,198 $ 25,753

$ 48,931 $ 50,491 Divided by

gold ounces produced

41,955 30,939

72,333 56,350 Cash

Cost, Before By-product Credits, per Gold Ounce

$

604.01 $ 836.36

$ 679.38 $ 899.93 By-product

credits per gold ounce

$ (3.41 ) $ (3.96 )

$ (3.41 ) $ (3.90 ) Cash Cost, After

By-product Credits, per Gold Ounce

$ 600.60 $

832.40

$ 675.97 $ 896.03

In thousands Total, All Locations Three Months EndedJune 30,

Six Months EndedJune 30,

2016 2015

2016

2015 Cost of sales and other direct production costs and

depreciation, depletion and amortization (GAAP)

$

112,851 $ 94,733

$ 213,045 $ 193,952

Depreciation, depletion and amortization

(29,897 )

(27,166 )

(55,772 ) (52,420 ) Treatment costs

20,765 19,449

42,321 39,523 By-product credits

(60,721 ) (53,306 )

(122,154 ) (104,493

) Change in product inventory

(244 ) 5,913

4,833 2,467 Reclamation and other costs

(1,486

) (19 )

(2,623 ) (531 ) Cash

Cost, After By-product Credits

$ 41,268 $

39,604

$ 79,650 $ 78,498

(1) Includes all direct and indirect operating cash costs

related directly to the physical activities of producing metals,

including mining, processing and other plant costs, third-party

refining and marketing expense, on-site general and administrative

costs, royalties and mining production taxes, before by-product

revenues earned from all metals other than the primary metal

produced at each unit.

Reconciliation of Net Loss Applicable to Common Shareholders

(GAAP) to Adjusted Net Income (Loss) Applicable to Common

Stockholders

This release refers to a non-GAAP measure of adjusted net income

(loss) applicable to common stockholders and adjusted net income

(loss) per share, which are indicators of our performance. They

exclude certain impacts which are of a nature which we believe are

not reflective of our underlying performance. Management believes

that adjusted net income (loss) per common share provides investors

with the ability to better evaluate our underlying operating

performance.

Dollars are in thousands (except per share amounts) Three

Months Ended June 30, Six Months Ended June 30,

2016

2015

2016 2015 Net income (loss)

applicable to common shareholders (GAAP)

$ 23,978

$ (26,805 )

$ 23,222 $ (14,391 )

Adjusting items: Losses (gains) on derivatives contracts

6

887

6 (4,905 ) Provisional price (gains) losses

(1,011 ) 601

(1,517 ) (1,524 )

Environmental accruals

662 8,700

662 8,700 Foreign

exchange loss (gain)

1,885 1,833

10,088 (10,441 )

Acquisition costs

402 2,147

402 2,147 Income tax

effect of above adjustments

(24 ) (4,934 )

179

(1,767 ) Adjusted net income (loss) applicable to common

shareholders

$ 25,898 $ (17,571 )

$

33,042 $ (22,181 ) Weighted average shares - basic

383,790 371,295

381,389 370,042 Weighted average

shares - diluted

387,512 371,295

384,685 370,042

Basic adjusted net income (loss) per common share

$

0.07 $ (0.05 )

$ 0.09 $ (0.06 ) Diluted

adjusted net income (loss) per common share

$ 0.07 $

(0.05 )

$ 0.09 $ (0.06 )

Reconciliation of Net Loss (GAAP) to Adjusted EBITDA

This release refers to a non-GAAP measure of adjusted earnings

before interest, taxes, depreciation and amortization ("Adjusted

EBITDA"), which is a measure of our operating performance. Adjusted

EBITDA is calculated as net income before the following items:

interest expense, income tax provision, depreciation, depletion,

and amortization expense, exploration expense, pre-development

expense, Aurizon acquisition costs, Lucky Friday suspension-related

costs, interest and other income (expense), foreign exchange gains

and losses, gains and losses on derivative contracts, unrealized

gains on investments, provisions for environmental matters,

stock-based compensation, and provisional price gains and losses .

Management believes that, when presented in conjunction with

comparable GAAP measures, Adjusted EBITDA is useful to investors in

evaluating our operating performance. The following table

reconciles net loss to Adjusted EBITDA:

Dollars are in thousands Three Months Ended Six

Months Ended

June 30, 2016 June 30, 2015

June 30, 2016 June 30, 2015 Net income (loss)

$ 24,116 $ (26,667 )

$

23,498 $ (14,115 ) Plus: Interest expense, net of

amount capitalized

5,370 6,541

11,081 12,733

Plus/(Less): Income taxes

11,496 (132 )

13,150 1,307

Plus: Depreciation, depletion and amortization

29,897 27,166

55,772 52,420 Plus: Exploration expense

3,362 4,592

6,312 9,208 Plus: Pre-development expense

521 1,618

925 2,138 Foreign exchange loss (gain)

1,885 1,833

10,088 (10,441 ) Plus: Acquisition costs

402 2,147

402 2,147 Plus: Stock-based compensation

2,042 1,201

3,214 2,261 Plus/(Less): Losses (gains) on derivative

contracts

6 887

6 (4,905 ) Plus: Provisional price

(gain) loss

(1,011 ) 601

(1,517 )

(1,524 ) Plus: Provision for closed operations and environmental

matters

1,006 9,478

2,005 10,256 Other

(1,263

) 248

(640 ) 3,053 Adjusted

EBITDA

$ 77,829 $ 29,513

$

124,296 $ 64,538

Table A - Assay

Results - Q2 2016 San Sebastian (Mexico) Zone

Drill Hole Number Sample From (ft) Sample To

(ft) Width (feet) True Width (feet) Gold

(oz/ton) Silver (oz/ton) West Francine Vein SS-1040

337.80 342.30 4.5 3.5 0.05

13.37 West Francine Vein SS-1049 411.6

418.0 6.4 4.9 0.11 0.31 Middle Vein

SS-1054 58.5 60.8 2.3 2.2

0.02 7.54 Middle Vein SS-1062 159.0

167.1 8.1 7.2 0.05 9.74 Middle Vein

SS-1064 128.0 133.5 5.6 5.5

0.19 2.96 Middle Vein SS-1071 114.6

115.4 0.8 1.8 0.48 2.65 Middle

Vein SS-1077 58.1 62.2 4.1 4.1

0.22 2.70 Middle Vein SS-1085 46.1

55.9 9.8 9.8 0.12 9.33 Middle

Vein SS-1088 35.5 39.8 4.3 4.3

0.26 26.69 Middle Vein SS-1091 60.7

62.8 2.1 2.1 0.02 3.62 Middle

Vein SS-1103 459.70 468.2 8.5

7.8 0.68 65.05 Middle Vein SS-1114

441.79 448.4 6.6 6.1 0.28 57.70

Casa Berardi (Quebec)

Zone Drill Hole Number Drill Hole Section

Drill Hole Azm/Dip Sample From Sample To

True Width (feet) Gold

(oz/ton)

Depth From Mine Surface (feet) 118-06 CBP-0530-314

12281 E 16/-37 262.5 288.7 20.3

0.29 -1934.5 118-06 CBP-0530-313 12221

E 324/-24 221.5 252.0 26.6 0.44

-1863.0 118-63 CBP-0530-320 12350 E

154/28 421.9 426.5 3.9 0.20

-1590.7 Lower-Inter Upper (118-64) CBP-0530-319 12339

E 154/15 226.4 249.3 21.3 0.16

-1652.2 121 CBP-0790-114 12145 E 141/3

54.1 101.7 20.0 0.23 -2522.9 121

CBP-0790-115 12139 E 141/36 36.7

80.1 39.0 0.22 -2489.6 121 CBP-0790-117

12154 E 141/-19 126.0 147.6 21.7

0.24 -2572.1 121 CBP-0790-116 12132 E

143/75 37.1 45.9 8.9 0.56

-2478.6 121 CBP-0790-118 12129 E 141/90

43.0 65.6 22.6 0.23 -2460.5 123-02

CBP-0870-053 12330 E 172/-1 226.0

232.6 6.6 0.27 -2850.8 123-03

CBP-0870-054 12324 E 172/9 110.2 123.7

12.8 0.21 -2829.4 123-03 CBP-0870-055

12269 E 198/-25 54.1 74.5 18.0

0.19 -2878.4 123-04 CBP-0870-054 12327

E 172/9 228.0 244.4 16.1 0.53

-2808.3 123-04 CBP-0870-052 12329 E

172/-12 249.3 258.5 8.9 0.92

-2894.2 123-05 CBP-0490-014 12494 E 180/-6

183.1 217.5 30.5 0.22 -1619.6

123-05 CBP-0490-015 12495 E 180/8 167.3

199.1 29.2 0.17 -1574.3 123-05

CBP-0490-012 12480 E 180/2 149.3 200.1

50.2 0.31 -1591.9 123-05 CBP-0490-011

12481 E 180/-11 169.6 191.9 22.3

0.22 -1632.5 123-05 CBP-0490-013 12481

E 180/18 146.0 184.4 37.1 0.25

-1549.5 123-05 CBP-0490-041 12480 E

181/33 144.4 190.3 42.3 0.24

-1507.2 124-13 CBP-0210-019 12649 E 204/12

383.9 404.2 15.1 0.97 -572.2

124-13 CBP-0210-020 12678 E 189/6 364.2

384.5 20.3 0.70 -608.7 124-22

CBP-0530-318 12352 E 154/40 527.6 553.1

24.9 0.41 -1391.1 124-22 CBP-0250-085

12466 E 23/5 120.7 125.3 4.3

1.02 -800.4 124-22 CBP-0250-086 12468 E

24/51 190.0 194.2 3.0 1.03

-663.1 124-30 CBP-0290-281 12779 E

168/-7 225.4 231.0 5.2 0.49

-947.7 124-30 CBP-0290-295 12734 E 180/-21

380.6 394.7 13.5 0.20 -1061.0

124-30 CBP-0290-283 12717 E 180/-17

311.7 329.7 17.4 0.21 -1005.6 124-85

CBP-0330-028 12515 E 134/-38 262.8

274.3 7.9 0.31 -1198.6 104

CBW-1086 10380 E 325/-75 1031.8 1133.9

102.0 0.05 -2831.4 104 CBW-1085

10381 E 325/-64 766.7 805.0 33.5

0.04 -1870.1 LOWER INTER CBW-0300-042 10737 E

0/-37 564.3 574.1 9.8 0.94

-1313.1 LOWER INTER CBW-0300-039 10775 E

358/-45 564.6 587.9 21.7 1.27

-1383.0 LOWER INTER CBW-0300-044 10751 E

360/-38 565.0 587.3 17.4 0.95

-1349.2 LOWER INTER CBW-1085 10381 E

325/-64 629.9 639.8 9.5 0.10

-1731.6 134 (Surface) CBS-16-676 10069 E

360/-50 311.7 354.3 31.5 0.06

26996.2 134 (Surface) CBS-16-674 10112 E

360/-46 137.8 189.0 45.3 0.03

27146.0 134 (Surface) CBS-16-671 10136 E

360/-54 626.3 651.6 22.1 0.18

27518.1 134 (Surface) CBS-16-676 10053 E

360/-50 221.1 284.4 49.2 0.09

26996.6 134 (Surface) CBS-16-675 10097 E

360/-48 433.1 471.1 36.1 0.02

27146.0 134 (Surface) CBS-16-675 10109 E

360/-48 473.8 541.3 49.2 0.04

27145.9 134 (Surface) CBS-16-671 10120 E

360/-54 538.1 595.5 47.6 0.05

27516.1

Greens Creek (Alaska)

Zone Drill Hole Number Drillhole Azm/Dip

Sample From Sample To True Width (feet)

Silver

(oz/ton)

Gold (oz/ton) Zinc (%) Lead (%) Depth

From Mine Portal (feet) 9A Exploration GC4267 063/32

432.20 479.00 17.5 20.43 0.09

16.24 5.21 185

482.50 488.00 2.1 14.09

0.06 13.57 5.90 198 GC4273

081/29 501.00 508.00 2.5 17.79

0.01 13.24 4.38 183

513.00 516.00 1.7

12.39 0.02 22.64 9.20 189

519.00 525.50 2.4

24.08 0.02 37.77 10.00 192

535.70 540.00 1.1

11.01 0.01 8.96 3.68 201

559.00 563.70 3.4

16.10 0.01 6.24 2.28 213 9A

Definition GC4297 071/27 462.00 465.50

2.0 15.68 0.04 7.76 2.71

154 GC4302 071/32 455.20 459.00

3.3 10.54 0.05 18.01 3.76

183 GC4305 071/37 511.50 531.70

15.6 15.14 0.08 11.04 4.11

253 GC4317 063/26 374.50

383.50 7.9 10.60 0.03 13.22 7.21

109 409.20

418.00 8.2 16.12 0.03 10.61 3.06

124 GC4320 063/18 420.00

425.00 4.3 12.96 0.00 3.01 1.55

71 GC4323 063/24 338.80

346.50 2.5 16.80 0.02 12.99 6.91

78 371.10

376.80 2.5 15.46 0.03 4.86 2.19

90 East Definition GC4323 063/24 788.20

818.20 7.5 35.20 0.41 7.77

2.82 243

828.20 830.30 1.0 136.91 0.14

13.29 4.30 255 GC4328 063/18

806.60 813.00 2.6 12.13 0.05

8.42 2.42 195

818.00 823.00 1.6 13.86

0.01 5.57 0.76 200 D200S Definition

GC4269 063/-86 610.50 612.50 1.7

12.89 0.22 0.56 0.23 -1893

618.00 628.00 8.3

21.06 0.18 1.84 0.89 -1900

733.90 748.30

5.9 29.99 0.90 12.03 6.04

-2012 GC4271 063/-77 339.50

344.00 4.0 10.70 0.08 0.55 0.30

-1607 GC4272 063/-69 430.80

433.70 2.9 12.81 0.09 1.23

0.64 -1680

575.50 587.00 8.9 20.17 0.04

3.03 1.54 -1821 GC4279 243/-84

253.90 256.10 2.2 18.41 0.05

1.54 0.89 -1527 GC4286

243/-51 200.90 203.90 3.0 38.40

0.05 3.31 1.73 -1431

324.00 337.60 10.1 23.66

0.03 2.76 1.29 -1528

GC4303 063/-71 378.30 393.30 7.9

20.61 0.02 1.22 0.53 -1636

402.30 405.80 3.2

21.98 0.01 2.55 1.28 -1654

GC4306 063/-63 470.00 472.30

2.3 15.47 0.03 9.78 6.30

-1693 GC4311 243/-46 205.60

208.20 2.5 27.05 0.04 0.49 0.30

-1422 GC4316 243/-69 264.80

269.00 4.0 35.59 0.06 0.60

0.28 -1523 LNWW Definition GC4280

063/-62 518.80 521.80 3.0 20.72

0.20 3.61 0.73 -635 GC4281

063/-32 502.00 508.60 6.5 8.23

0.14 9.59 3.21 -448

GC4285 063/-34 586.00

592.50

6.3 4.92 0.05 17.63 2.45

-527 GC4287 063/-50 574.20

577.10 2.8 6.23 0.02 18.82 3.37

-622 GC4304 063/-32 622.80

639.70 16.8 5.69 0.10 24.01

5.20 -554 GC4321 063/-50

343.00 347.20 4.1 5.75 0.04

12.61 4.58 -429

352.30 361.00 8.5 8.68 0.04

4.85 2.23 -438 GC4322

063/-72 465.70 469.80 3.9 5.76

0.04 14.95 2.51 -608 GC4324

063/-40 381.80 384.10 2.3 21.41

0.06 4.52 2.43 -416

388.60 390.60 2.0

10.09 0.26 4.01 2.01 -421

GC4326 040/-64 346.00 356.70 10.2

76.40 0.17 19.90 4.38 -465

GC4327 021/-74 332.00 346.60

14.5 56.07 0.13 3.29 0.81

-469

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160804005371/en/

Hecla Mining CompanyVice President – Investor RelationsMike

Westerlund, 800-HECLA91

(800-432-5291)hmc-info@hecla-mining.comhttp://www.hecla-mining.com

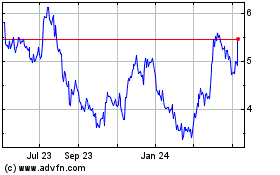

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Mar 2024 to Apr 2024

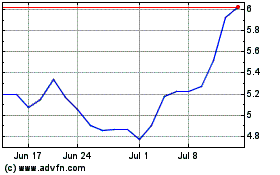

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Apr 2023 to Apr 2024