UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 27, 2015

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

(Exact name of registrant as specified in its charter)

|

| | | |

| | | |

Delaware | | 001-13958 | 13-3317783 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | (IRS Employer Identification No.) |

| |

The Hartford Financial Services Group, Inc. One Hartford Plaza Hartford, Connecticut | 06155 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (860) 547-5000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

| |

Item 2.02 | Results of Operations and Financial Condition |

On April 27, 2015, The Hartford Financial Services Group, Inc. (the "Company") issued (i) a press release announcing its financial results for the quarterly period ended March 31, 2015, and (ii) its Investor Financial Supplement (“IFS”) relating to its financial results for the quarterly period ended March 31, 2015. Copies of the press release and the IFS are furnished herewith as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

The information furnished pursuant to this Item 2.02, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

|

| |

Item 9.01 | Financial Statements and Exhibits |

|

| | | |

Exhibit No. | | |

| | |

99.1 |

| Press Release of The Hartford Financial Services Group, Inc. dated April 27, 2015 | |

| | |

99.2 |

| Investor Financial Supplement of The Hartford Financial Services Group, Inc. for the quarterly period ended March 31, 2015 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

Date: | April 27, 2015 | By: | /s/ Scott R. Lewis |

| | Name: | Scott R. Lewis |

| | Title: | Senior Vice President and Controller |

NEWS RELEASE

The Hartford Reports First Quarter 2015 Core Earnings* Of $452 Million, $1.04 Per Diluted Share, And Net Income Of $467 Million, $1.08 Per Diluted Share

| |

• | First quarter 2015 core earnings per diluted share* of $1.04 declined 1% from $1.05 in first quarter 2014, which included a $0.07 benefit per diluted share from New York State Workers' Compensation Board assessments |

| |

• | First quarter 2015 net income per diluted share of $1.08 rose 5% from first quarter 2014 |

| |

• | Property & Casualty (Combined) first quarter 2015 combined ratio before catastrophes and prior year favorable loss reserve development* was 91.7, essentially flat with first quarter 2014, excluding the 2.0 point benefit from New York State Workers' Compensation Board assessments |

| |

• | Standard Commercial renewal written price increases averaged 3% |

| |

• | Book value per diluted share, excluding accumulated other comprehensive income*, was $41.47, up 3% over March 31, 2014 |

| |

• | Common share repurchases totaled $250 million for 6.1 million shares in first quarter 2015, contributing to the 9% reduction in weighted average diluted common shares outstanding since March 31, 2014 |

HARTFORD, Conn., April 27, 2015 – The Hartford (NYSE:HIG) reported core earnings of $452 million for the three months ended March 31, 2015 (first quarter 2015), down $49 million, or 10%, from $501 million in first quarter 2014. The decrease from first quarter 2014 was primarily due to a $32 million, after-tax, benefit for New York State Workers' Compensation Board assessments (NY Assessments) in first quarter 2014 and a $25 million, after-tax, reduction in favorable property and casualty (P&C) prior year loss and loss adjustment expense reserve development (PYD). Catastrophe losses did not have a material impact on the change in core earnings, totaling $54 million, after-tax, in first quarter 2015 and $56 million, after-tax, in first quarter 2014.

First quarter 2015 core earnings per diluted share were $1.04, a 1% decrease from $1.05 in first quarter 2014, as the accretive impact of the 9% decrease in weighted average diluted common shares outstanding largely offset the core earnings decrease.

*Denotes financial measure not calculated in accordance with generally accepted accounting principles (non-GAAP).

The decrease in weighted average common shares outstanding resulted from the company's repurchase of 46.8 million shares since March 31, 2014, including 6.1 million shares in first quarter 2015. As of March 31, 2015, the company had $729 million of remaining share repurchase authorization through Dec. 31, 2015 under its current capital management plan.

First quarter 2015 net income totaled $467 million, down $28 million, or 6%, from $495 million in first quarter 2014, due principally to the $49 million decrease in core earnings that was largely offset by a $36 million reduction in net realized capital losses, after-tax and deferred acquisition costs (DAC), excluded from core earnings compared with first quarter 2014. In addition, first quarter 2014 included $29 million of income from discontinued operations earned by the Japan annuity business that was sold in June 2014; first quarter 2015 did not have any income from discontinued operations.

First quarter 2015 net income per diluted share was $1.08, up 5% from $1.03 per diluted share in first quarter 2014 as the decrease in net income was more than offset by the accretive impact of share repurchases.

"The Hartford is off to a good start in 2015, and all our businesses performed well from a growth and earnings perspective," said The Hartford's Chairman and CEO Christopher Swift. "We continue to execute on our strategy and our businesses are delivering against their operating and financial goals, despite continued low interest rates and a U.S. P&C pricing cycle that is increasingly competitive. We are well-positioned to navigate these challenges, as we remain a disciplined underwriter committed to creating shareholder value."

"Our P&C and Group Benefits businesses started 2015 with solid results and steady operating performance," said The Hartford's President Doug Elliot. "The combined ratio was 91.7 before catastrophes and PYD, while Group Benefits after-tax core earnings margin* rose to 5.9%. The marketplace has grown more competitive over the last quarter, and we are very focused on core metrics and key performance indicators as we continue to balance margins and growth. Our operating focus and investments in product, underwriting and technology provide us a strong foundation moving forward.”

CONSOLIDATED FINANCIAL RESULTS

|

| | | |

($ in millions except per share data) | Three Months Ended |

Mar 31 2015 | Mar 31 2014 | Change2 |

Core earnings (loss): | | |

|

Commercial Lines | $234 | $264 | (11)% |

Personal Lines | $75 | $101 | (26)% |

P&C Other Operations | $20 | $21 | (5)% |

Property & Casualty (Combined) | $329 | $386 | (15)% |

Group Benefits | $52 | $45 | 16% |

Mutual Funds | $22 | $21 | 5% |

Sub-total | $403 | $452 | (11)% |

Talcott Resolution | $111 | $112 | (1)% |

Corporate | $(62) | $(63) | 2% |

Core earnings | $452 | $501 | (10)% |

Net income | $467 | $495 | (6)% |

Weighted average diluted common shares outstanding | 433.7 | 478.6 | (9)% |

Core earnings available to common shareholders per diluted share¹ | $1.04 | $1.05 | (1)% |

Net income available to common shareholders per diluted share¹ | $1.08 | $1.03 | 5% |

| |

[1] | Includes dilutive potential common shares |

| |

[2] | The Hartford defines increases or decreases greater than or equal to 200%, or changes from a net gain to a net loss position, or vice versa, as "NM" or not meaningful |

COMMERCIAL LINES

First Quarter 2015 Highlights:

| |

• | Core earnings were essentially flat with first quarter 2014, excluding the $32 million, after-tax, NY Assessments benefit recognized in first quarter 2014 |

| |

• | Combined ratio before catastrophes and PYD of 92.4 improved 0.4 point over first quarter 2014, excluding the 3.2 point benefit from NY Assessments |

| |

• | Catastrophes and PYD were slightly higher than first quarter 2014 |

|

| | | |

COMMERCIAL LINES | | | |

($ in millions) | Three Months Ended |

| Mar 31 2015 | Mar 31 2014 | Change |

Core earnings¹ | $234 | $264 | (11)% |

Net income¹ | $240 | $242 | (1)% |

Underwriting gain¹* | $65 | $107 | (39)% |

Net investment income | $257 | $256 | — |

Combined ratio² | 95.9 | 93.1 | (2.8) |

Catastrophes and PYD | 3.6 | 3.4 | (0.2) |

Combined ratio before catastrophes and PYD² | 92.4 | 89.6 | (2.8) |

Small Commercial: | | | |

Combined ratio before catastrophes and PYD² | 89.6 | 85.9 | (3.7) |

New business premium | $140 | $131 | 7% |

Policy count retention | 85% | 83% | 2.0 |

Middle Market: | | | |

Combined ratio before catastrophes and PYD² | 93.7 | 92.2 | (1.5) |

New business premium | $124 | $110 | 13% |

Policy count retention | 81% | 81% | — |

Written premiums | $1,722 | $1,669 | 3% |

Standard Commercial renewal written pricing increases | 3% | 6% | (3.0) |

[1] Includes $32 million, after-tax expense benefit in first quarter 2014 from NY Assessments

[2] Commercial Lines, Small Commercial and Middle Market combined ratios include an expense ratio benefit of 3.2 point, 3.3 point and 2.6 point, respectively, in first quarter 2014 from NY Assessments

Core earnings in Commercial Lines decreased 11% in first quarter 2015 to $234 million from $264 million in first quarter 2014 largely due to an expense benefit in first quarter 2014 of $32 million, after-tax, from NY Assessments. Excluding this benefit, first quarter 2015 core earnings were essentially flat to the prior year period. An improvement in underwriting margins on workers’ compensation due to earned pricing increases and moderate loss costs was offset by higher expenses, excluding NY Assessments, due to higher underwriting expenses. Net investment income was essentially flat at $257 million, before tax, as both periods reflected strong investment income on limited partnerships and other alternative investments (LPs).

Commercial Lines underwriting gain totaled $65 million, before tax, in first quarter 2015 for a 95.9 combined ratio compared with a first quarter 2014 underwriting gain of $107 million, before tax, for a 93.1 combined ratio. The decrease in underwriting gain and increase in combined ratio was principally due to the $49 million, before tax, favorable benefit of NY Assessments in first quarter 2014. Excluding the impact of NY Assessments, first quarter 2015 underwriting gain and

combined ratio improved by $7 million and 0.4 point, respectively, over the prior year period. In addition to NY Assessments, favorable PYD decreased in Commercial Lines in first quarter 2015 to $2 million, before tax, compared with net favorable PYD of $7 million, before tax, in first quarter 2014. The favorable PYD in first quarter 2015 was primarily driven by the professional and general liability lines, and was largely offset by commercial auto liability strengthening. Catastrophe losses were essentially flat between the two periods at $58 million, before tax, compared with $60 million, before tax, in first quarter 2014.

First quarter 2015 combined ratio before catastrophes and PYD was 92.4, a 0.4 point improvement over first quarter 2014 excluding the 3.2 point expense ratio benefit from NY Assessments in first quarter 2014. The improvement was largely driven by Middle Market, which had a 93.7 combined ratio before catastrophes and PYD, a 1.1 point improvement over first quarter 2014 excluding the NY Assessments. The improvement in Middle Market combined ratio before catastrophes and PYD resulted from pricing and underwriting initiatives over the past several years, as well as continued modest loss cost inflation. Excluding NY Assessments, Small Commercial's combined ratio before catastrophes and PYD rose 0.4 point to 89.6, reflecting increased underwriting expenses as a result of business investments and higher agency supplemental compensation as a result of loss ratio improvements.

First quarter 2015 written premiums in Commercial Lines grew 3% to $1,722 million over first quarter 2014, reflecting renewal written price increases and strong retention in Small Commercial and Middle Market, which together comprise 87% of Commercial Lines written premiums. Policy count retention in Small Commercial increased 2.0 points over first quarter 2014 to 85%, while in Middle Market retention remained stable at 81%. First quarter 2015 renewal written price increases averaged 3% in Standard Commercial, which included 3% in Small Commercial and 2% in Middle Market, exclusive of specialty programs and livestock. Written premiums also benefited from increased new business premiums, rising 7% over first quarter 2014 in Small Commercial and 13% in Middle Market.

PERSONAL LINES

First Quarter 2015 Highlights:

| |

• | Written premiums rose 1% over first quarter 2014 due to continued strong renewal written price increases |

| |

• | Combined ratio before catastrophes and PYD of 89.9 increased 1.2 points compared with 88.7 in first quarter 2014 due to higher automobile liability losses and physical damage severity |

| |

• | Underwriting gain of $75 million decreased from $113 million in first quarter 2014 primarily due to less favorable PYD |

|

| | | |

PERSONAL LINES | | | |

($ in millions) | Three Months Ended |

| Mar 31 2015 | Mar 31 2014 | Change |

Core earnings | $75 | $101 | (26)% |

Net income | $76 | $99 | (23)% |

Underwriting gain | $75 | $113 | (34)% |

Net investment income | $35 | $35 | — |

Combined ratio | 92.1 | 87.8 | (4.3) |

Catastrophes and PYD | 2.2 | (0.9) | (3.1) |

Combined ratio before catastrophes and PYD | 89.9 | 88.7 | (1.2) |

Automobile | 94.6 | 92.8 | (1.8) |

Homeowners | 79.7 | 78.8 | (0.9) |

Written premiums | $939 | $927 | 1% |

Core earnings in Personal Lines decreased 26% in first quarter 2015 over the prior year quarter primarily due to a lower underwriting gain. Personal Lines underwriting gain decreased $38 million, before tax, to $75 million in first quarter 2015 compared with $113 million in first quarter 2014 primarily due to less favorable PYD, which declined from favorable PYD of $34 million, before tax, in first quarter 2014 to favorable PYD of $4 million, before tax in first quarter 2015. Catastrophes were essentially flat between the two periods, totaling $25 million, before tax, in first quarter 2015 compared with $26 million, before tax, in first quarter 2014.

First quarter 2015 combined ratio increased 4.3 points to 92.1 from 87.8 in first quarter 2014 largely due to less favorable PYD. Catastrophes and PYD were a net benefit of 0.9 point on the first quarter 2014 combined ratio versus a net 2.2 point expense in first quarter 2015. First quarter 2015 combined ratio before catastrophes and PYD increased 1.2 points to 89.9 due to higher automobile liability losses and physical damage severity compared with first quarter 2014.

First quarter 2015 Personal Lines written premiums rose 1% over first quarter 2014 as higher first quarter 2015 renewal written price increases were offset by lower retention compared to first quarter 2014. Renewal written price increases in first quarter 2015 were 7% in automobile and 8% in homeowners to address rate needs in certain segments. First quarter 2015 automobile premium retention declined to 87%, down 2 points compared with first quarter 2014, while homeowners premium retention declined 3 points to 90%. New business premium in first quarter 2015 was impacted by underwriting actions in certain segments, declining 6% to $128 million over first quarter 2014 with decreases of 3% in automobile and 16% in homeowners.

GROUP BENEFITS

First Quarter 2015 Highlights:

| |

• | Core earnings of $52 million increased 16% over first quarter 2014 with improved group disability and group life results, excluding Association-Financial Institutions business |

| |

• | After-tax core earnings margin* increased to 5.9% from 5.1% in first quarter 2014 |

| |

• | Total fully insured ongoing sales rose 67%, up 40% for group disability and 87% for group life, over first quarter 2014 |

|

| | | |

GROUP BENEFITS | | | |

($ in millions) | Three Months Ended |

| Mar 31 2015 | Mar 31 2014 | Change |

Core earnings1 | $52 | $45 | 16% |

Net income | $52 | $51 | 2% |

Fully insured ongoing premiums, excluding A-FI2 | $763 | $732 | 4% |

Loss ratio, excluding A-FI | 76.7% | 77.6% | 0.9 |

Expense ratio, excluding A-FI | 26.7% | 27.4% | 0.7 |

Net investment income | $97 | $96 | 1% |

After-tax core earnings margin* | 5.9% | 5.1% | 0.8 |

| |

[1] | Includes $0 and $1 from A-FI in the three months ended March 31, 2015 and March 31, 2014, respectively |

| |

[2] | Fully insured ongoing premiums excludes buyout premiums and premium equivalents; excludes A-FI premiums of $0 million and $44 million in first quarter 2015 and 2014, respectively |

First quarter 2015 Group Benefits core earnings totaled $52 million, a 16% increase from $45 million in first quarter 2014, primarily due to improved group disability and group life loss ratios as well as a lower expense ratio compared with first quarter 2014, excluding the Association-Financial Institutions (A-FI) book of business. The A-FI book, which was in the group life business, is now fully in runoff and does not impact 2015 results, although it did impact the 2014 group life loss and expense ratios in 2014. The after-tax core earnings margin increased to 5.9% in first quarter 2015 from 5.1% in first quarter 2014.

The first quarter 2015 total loss ratio, excluding A-FI, was 76.7%, a 0.9 point improvement, reflecting a 0.6 point improvement in group disability and 0.8 point improvement in group life compared with first quarter 2014. The expense ratio, excluding A-FI, also improved, declining 0.7 point to 26.7% in first quarter 2015.

First quarter 2015 fully insured ongoing premiums were $763 million, up 4% from first quarter 2014, excluding A-FI, reflecting increased sales, higher persistency and improved pricing. Fully insured ongoing sales totaled $300 million in first quarter 2015, up 67% over first quarter 2014. Group disability sales increased 40% to $123 million and group life sales rose 87% to $148 million reflecting strong January 2015 sales, including several large accounts that returned to the company after having moved to competitors in prior years.

MUTUAL FUNDS

First Quarter 2015 Highlights:

| |

• | Mutual Fund sales of $4.7 billion increased 28% compared with first quarter 2014 |

| |

• | Mutual Fund net flows, which exclude Talcott Resolution assets under management (AUM), were $529 million |

| |

• | Mutual Fund core earnings rose 5% over first quarter 2014 to $22 million |

|

| | | |

MUTUAL FUNDS | | | |

($ in millions) | Three Months Ended |

| Mar 31 2015 | Mar 31 2014 | Change |

Core earnings | $22 | $21 | 5% |

Net income | $22 | $21 | 5% |

Mutual Fund sales | $4,710 | $3,692 | 28% |

Mutual Fund net flows | $529 | $18 | NM |

Mutual Fund AUM | $75,696 | $73,346 | 3% |

Talcott AUM | $20,240 | $24,957 | (19)% |

Total Mutual Funds segment AUM | $95,936 | $98,303 | (2)% |

Core earnings for the Mutual Funds segment rose 5% to $22 million in first quarter 2015 compared with first quarter 2014 due to increased revenues resulting from higher Mutual Fund AUM compared with first quarter 2014. During the quarter, Mutual Fund net flows were $529 million, benefiting from a 28% increase in sales during the quarter.

Total AUM for the segment declined 2% due to the continued runoff of Talcott Resolution AUM, which decreased 19% over the last twelve months to $20.2 billion at March 31, 2015. Mutual Fund AUM increased to $75.7 billion at March 31, 2015 from $73.3 billion at March 31, 2014 primarily due to higher market levels and strong sales over the period.

TALCOTT RESOLUTION

First Quarter 2015 Highlights:

| |

• | Core earnings decreased 1% to $111 million due to the continued runoff of the variable annuity block, partially offset by lower expenses |

| |

• | Variable annuity contract counts declined 3% and 13% from Dec. 31, 2014 and March 31, 2014, respectively |

| |

• | Fixed annuity contract counts declined 1% and 16% from Dec. 31, 2014 and March 31, 2014, respectively |

|

| | | |

TALCOTT RESOLUTION | | | |

($ in millions) | Three Months Ended |

| Mar 31 2015 | Mar 31 2014 | Change |

Core earnings | $111 | $112 | (1)% |

Net income | $111 | $145 | (23)% |

VA contract count (in thousands) | 653 | 747 | (13)% |

Fixed annuity and other contract count (in thousands) | 137 | 163 | (16)% |

Talcott Resolution first quarter 2015 core earnings were $111 million, a 1% decrease from first quarter 2014, due to the decrease in variable annuity (VA) fees as a result of the runoff of the block, largely offset by lower expenses, including lower costs related to contract holder initiatives.

VA and fixed annuity contract counts as of March 31, 2015 declined 3% and 1%, respectively, from Dec. 31, 2014 and 13% and 16%, respectively, from March 31, 2014.

INVESTMENTS

First Quarter 2015 Highlights:

| |

• | Annualized investment yield, excluding LPs, before tax, was 4.1%, down from 4.2% in first quarter 2014, primarily due to lower reinvestment rates over the 12 months |

| |

• | Annualized investment yield on LPs, before tax, was 14%, up from 13% in first quarter 2014 and above the company's outlook of 6% |

| |

• | Net impairment losses, including mortgage loan loss reserves, totaled $15 million, before tax |

|

| | | | |

INVESTMENTS | | | |

($ in millions) | Three Months Ended |

Amounts presented before tax | Mar 31 2015 | Mar 31 2014 | Change |

Total investments excluding equity securities, trading | $76,565 | $79,666 | (4 | )% |

Net investment income on LPs | $99 | $97 | 2 | % |

Net investment income | $809 | $824 | (2 | )% |

Net impairment losses, including mortgage loan loss reserves | $15 | $22 | (32 | )% |

Annualized investment yield1 | 4.5% | 4.5% | — |

|

Annualized investment yield on LPs | 13.7% | 13.0% | 0.7 |

|

Annualized investment yield, excluding LPs | 4.1% | 4.2% | (0.1 | ) |

| |

[1] | Yields, before tax, calculated using annualized net investment income divided by the monthly average invested assets at cost, amortized cost, or adjusted carrying value, as applicable, excluding repurchase agreement collateral, if any, and derivatives book value. |

First quarter 2015 net investment income totaled $809 million, before tax, a 2% decrease from first quarter 2014 due to a decrease in total investments excluding equity securities, trading. The carrying value of total invested assets, excluding equity securities, trading, declined to $76.6 billion at March 31, 2015 compared with $79.7 billion at March 31, 2014 largely due to the runoff of Talcott Resolution, including the sale of the Japan annuity business in second quarter 2014. LPs did not have a material impact on the change in net investment income in the quarter, with first quarter 2015 net investment income on LPs of $99 million, before tax, compared with $97 million, before tax, in first quarter 2014.

Excluding the impact of lower invested assets, investment income remained relatively consistent with first quarter 2014 as annualized yield, before tax, was 4.5% in both periods. Annualized yield, before tax, on LPs increased to 13.7% compared with 13.0% in first quarter 2014. Annualized investment yield excluding LPs, before tax, declined slightly from 4.2% in first quarter 2014 to 4.1%, primarily due to lower reinvestment rates over the past 12 months.

The credit performance of the company's general account assets remained strong. Net impairment losses in first quarter 2015, including changes in mortgage loan loss reserves, totaled $15 million, before tax, down from $22 million, before tax, in first quarter 2014.

STOCKHOLDERS’ EQUITY

First Quarter 2015 Highlights:

| |

• | Book value per diluted share, excluding accumulated other comprehensive income (AOCI)*, of $41.47 rose 2% over Dec. 31, 2014 and 3% over March 31, 2014 |

| |

• | Company share repurchases totaled $250 million during first quarter 2015 and $1.746 billion over the past four quarters |

| |

• | Weighted average diluted common shares outstanding decreased 2% from Dec. 31, 2014 and 9% from March 31, 2014 |

|

| | | |

($ in millions) | As of |

| Mar 31, 2015 | Dec 31 2014 | Change |

Stockholders' equity | $19,077 | $18,720 | 2% |

Stockholders' equity (ex. AOCI) | $17,927 | $17,792 | 1% |

Book value per diluted share | $44.13 | $42.84 | 3% |

Book value per diluted share (ex. AOCI) | $41.47 | $40.71 | 2% |

Weighted average common shares outstanding | 422.6 | 429.6 | (2)% |

Weighted average diluted common shares outstanding | 433.7 | 442.6 | (2)% |

The Hartford’s stockholders’ equity was $19.1 billion as of March 31, 2015, a 2% increase from $18.7 billion as of Dec. 31, 2014, primarily due to net income of $467 million and a $222 million increase in AOCI, partially offset by common share repurchases of $250 million and common dividends of $75 million.

Book value per diluted common share was $44.13 as of March 31, 2015, an increase of 3% from Dec. 31, 2014, as a result of the 2% increase in shareholders' equity and the impact of share repurchases on weighted average diluted common shares outstanding. Excluding AOCI, book value per diluted common share was up 2% to $41.47 as of March 31, 2015 compared with $40.71 at Dec. 31, 2014.

Weighted average common shares outstanding and weighted average diluted common shares outstanding both decreased by 2% to 422.6 million and 433.7 million, respectively, at March 31, 2015 from Dec. 31, 2014 as a result of the company's repurchase of 6.1 million common shares for $250 million, at an average price of $40.82 per share. Under the capital management plan announced in 2014, the company has $2.775 billion of equity repurchase authorization for the period Jan. 1, 2014 through Dec. 31, 2015. As of April 24, 2015, the company has spent $2.119 billion for equity repurchases under this program, including $73 million since March 31, 2014.

On April 24, 2015 the company announced that it will redeem for cash the entire $296 million aggregate principal amount outstanding of 4.0% senior notes due Oct. 15, 2017 on May 27, 2015. The notes will be redeemed at an estimated redemption price of approximately $320 million including a make-whole premium and any interest accrued and unpaid to the redemption date. The company expects to use cash on hand to finance the redemption. The company expects to use an additional $180 million for other debt repayment actions, depending on market conditions.

CONFERENCE CALL

The Hartford will discuss its first quarter 2015 financial results in a webcast on Tuesday, April 28, 2015, at 9 a.m. EDT. The webcast can be accessed live or as a replay through the investor relations section of The Hartford's website at http://ir.thehartford.com.

More detailed financial information can be found in The Hartford's Quarterly Report on Form 10-Q, the Investor Financial Supplement for March 31, 2015, and the First Quarter 2015 Financial Results Presentation, which includes the company's outlook for second quarter 2015 financial results, all of which are available at http://ir.thehartford.com.

ABOUT THE HARTFORD

With more than 200 years of expertise, The Hartford (NYSE:HIG) is a leader in property and casualty insurance, group benefits and mutual funds. The company is widely recognized for its service excellence, sustainability practices, trust and integrity. More information on the company and its financial performance is available at www.thehartford.com.

From time to time, The Hartford uses its website to disseminate material company information. Financial and other important information regarding The Hartford is routinely accessible through and posted on our website at http://ir.thehartford.com. In addition, you may automatically receive email alerts and other information about The Hartford when you enroll your email address by visiting the “Email Alerts” section at http://ir.thehartford.com.

HIG-F

Media Contacts Investor Contacts

Shannon Lapierre Sabra Purtill, CFA

860-547-5624 860-547-8691

shannon.lapierre@thehartford.com sabra.purtill@thehartford.com

Thomas Hambrick Sean Rourke

860-547-9746 860-547-5688

thomas.hambrick@thehartford.com sean.rourke@thehartford.com

|

| | | | | | | | | | | | | | | | | | |

THE HARTFORD FINANCIAL SERVICES GROUP, INC. |

CONSOLIDATING INCOME STATEMENTS |

Three Months Ended March 31, 2015 |

($ in millions) |

| Property & Casualty | Group Benefits | Mutual Funds | Talcott Resolution | Corporate | Consolidated |

Earned premiums | $ | 2,535 |

| $ | 763 |

| $ | — |

| $ | 24 |

| $ | — |

| $ | 3,322 |

|

Fee income | — |

| 17 |

| 179 |

| 261 |

| 2 |

| 459 |

|

Net investment income | 327 |

| 97 |

| — |

| 382 |

| 3 |

| 809 |

|

Other revenues | 22 |

| — |

| — |

| — |

| — |

| 22 |

|

Net realized capital gains (losses) | 13 |

| (1 | ) | — |

| (25 | ) | 18 |

| 5 |

|

Total revenues | 2,897 |

| 876 |

| 179 |

| 642 |

| 23 |

| 4,617 |

|

Benefits, losses, and loss adjustment expenses | 1,627 |

| 598 |

| — |

| 338 |

| — |

| 2,563 |

|

Amortization of deferred policy acquisition costs | 324 |

| 8 |

| 5 |

| 50 |

| — |

| 387 |

|

Insurance operating costs and other expenses | 470 |

| 200 |

| 140 |

| 121 |

| 7 |

| 938 |

|

Interest expense | — |

| — |

| — |

| — |

| 94 |

| 94 |

|

Restructuring and other costs | — |

| — |

| — |

| — |

| 10 |

| 10 |

|

Total benefits and expenses | 2,421 |

| 806 |

| 145 |

| 509 |

| 111 |

| 3,992 |

|

Income (loss) from continuing operations, before income taxes | 476 |

| 70 |

| 34 |

| 133 |

| (88 | ) | 625 |

|

Income tax expense (benefit) | 137 |

| 18 |

| 12 |

| 22 |

| (31 | ) | 158 |

|

Net income (loss) | 339 |

| 52 |

| 22 |

| 111 |

| (57 | ) | 467 |

|

Less: Unlock charge, after-tax | — |

| — |

| — |

| 19 |

| — |

| 19 |

|

Less: Net realized capital gains (losses), after-tax and DAC, excluded from core earnings | 10 |

| — |

| — |

| (19 | ) | 11 |

| 2 |

|

Less: Restructuring and other costs, after-tax | — |

| — |

| — |

| — |

| (6 | ) | (6 | ) |

Core earnings (losses) | $ | 329 |

| $ | 52 |

| $ | 22 |

| $ | 111 |

| $ | (62 | ) | $ | 452 |

|

|

| | | | | | | | | | | | |

THE HARTFORD FINANCIAL SERVICES GROUP, INC. |

PROPERTY & CASUALTY |

CONSOLIDATING INCOME STATEMENTS |

Three Months Ended March 31, 2015 |

($ in millions) |

| Commercial Lines | Personal Lines | P&C Other | Property & Casualty (Combined) |

Written premiums | $ | 1,722 |

| $ | 939 |

| $ | — |

| $ | 2,661 |

|

Change in unearned premium reserve | 139 |

| (13 | ) | — |

| 126 |

|

Earned premiums | 1,583 |

| 952 |

| — |

| 2,535 |

|

Losses and loss adjustment expenses |

|

|

|

|

|

Current accident year before catastrophes | 928 |

| 618 |

| — |

| 1,546 |

|

Current accident year catastrophes | 58 |

| 25 |

| — |

| 83 |

|

Prior year development | (2 | ) | (4 | ) | 4 |

| (2 | ) |

Total losses and loss adjustment expenses | 984 |

| 639 |

| 4 |

| 1,627 |

|

Amortization of DAC | 234 |

| 90 |

| — |

| 324 |

|

Underwriting expenses | 295 |

| 148 |

| 6 |

| 449 |

|

Dividends to policyholders | 5 |

| — |

| — |

| 5 |

|

Underwriting gain (loss) | 65 |

| 75 |

| (10 | ) | 130 |

|

Net investment income | 257 |

| 35 |

| 35 |

| 327 |

|

Net realized capital gains | 8 |

| 1 |

| 4 |

| 13 |

|

Net servicing and other income | 5 |

| — |

| 1 |

| 6 |

|

Income from continuing operations before income taxes | 335 |

| 111 |

| 30 |

| 476 |

|

Income tax expense | 95 |

| 35 |

| 7 |

| 137 |

|

Net income | 240 |

| 76 |

| 23 |

| 339 |

|

Less: Net realized capital gains, after-tax and DAC, excluded from core earnings | 6 |

| 1 |

| 3 |

| 10 |

|

Core earnings | $ | 234 |

| $ | 75 |

| $ | 20 |

| $ | 329 |

|

|

| | | | | | | | | | | | | | | | | | |

THE HARTFORD FINANCIAL SERVICES GROUP, INC. |

CONSOLIDATING INCOME STATEMENTS |

Three Months Ended March 31, 2014 |

($ in millions) |

| Property & Casualty | Group Benefits | Mutual Funds | Talcott Resolution | Corporate | Consolidated |

Earned premiums | $ | 2,469 |

| $ | 784 |

| $ | — |

| $ | 49 |

| $ | — |

| $ | 3,302 |

|

Fee income | — |

| 15 |

| 174 |

| 304 |

| 3 |

| 496 |

|

Net investment income | 326 |

| 96 |

| — |

| 400 |

| 2 |

| 824 |

|

Other revenues | 25 |

| — |

| — |

| — |

| — |

| 25 |

|

Net realized capital gains (losses) | (37 | ) | 8 |

| — |

| 3 |

| (9 | ) | (35 | ) |

Total revenues | 2,783 |

| 903 |

| 174 |

| 756 |

| (4 | ) | 4,612 |

|

Benefits, losses, and loss adjustment expenses | 1,570 |

| 597 |

| — |

| 409 |

| — |

| 2,576 |

|

Amortization of deferred policy acquisition costs | 311 |

| 9 |

| 9 |

| 67 |

| — |

| 396 |

|

Insurance operating costs and other expenses | 396 |

| 228 |

| 132 |

| 148 |

| 12 |

| 916 |

|

Interest expense | — |

| — |

| — |

| — |

| 95 |

| 95 |

|

Restructuring and other costs | — |

| — |

| — |

| — |

| 20 |

| 20 |

|

Total benefits and expenses | 2,277 |

| 834 |

| 141 |

| 624 |

| 127 |

| 4,003 |

|

Income (loss) from continuing operations before income taxes | 506 |

| 69 |

| 33 |

| 132 |

| (131 | ) | 609 |

|

Income tax expense (benefit) | 143 |

| 18 |

| 12 |

| 16 |

| (46 | ) | 143 |

|

Income (loss) from continuing operations, after tax | 363 |

| 51 |

| 21 |

| 116 |

| (85 | ) | 466 |

|

Income from discontinued operations, after-tax | — |

| — |

| — |

| 29 |

| — |

| 29 |

|

Net income (loss) | 363 |

| 51 |

| 21 |

| 145 |

| (85 | ) | 495 |

|

Less: Unlock charge, after-tax | — |

| — |

| — |

| 12 |

| — |

| 12 |

|

Less: Net realized capital gains (losses) and other, after-tax and DAC, excluded from core earnings | (23 | ) | 6 |

| — |

| (8 | ) | (9 | ) | (34 | ) |

Less: Restructuring and other costs, after-tax | — |

| — |

| — |

| — |

| (13 | ) | (13 | ) |

Less: Income from discontinued operations, after-tax | — |

| — |

| — |

| 29 |

| — |

| 29 |

|

Core earnings (losses) | $ | 386 |

| $ | 45 |

| $ | 21 |

| $ | 112 |

| $ | (63 | ) | $ | 501 |

|

|

| | | | | | | | | | | | |

THE HARTFORD FINANCIAL SERVICES GROUP, INC. |

PROPERTY & CASUALTY |

CONSOLIDATING INCOME STATEMENTS |

Three Months Ended March 31, 2014 |

($ in millions) |

| Commercial Lines | Personal Lines | P&C Other | Property & Casualty (Combined) |

Written premiums | $ | 1,669 |

| $ | 927 |

| $ | 1 |

| $ | 2,597 |

|

Change in unearned premium reserve | 128 |

| (1 | ) | 1 |

| 128 |

|

Earned premiums | 1,541 |

| 928 |

| — |

| 2,469 |

|

Losses and loss adjustment expenses | | | | |

Current accident year before catastrophes | 934 |

| 590 |

| — |

| 1,524 |

|

Current accident year catastrophes | 60 |

| 26 |

| — |

| 86 |

|

Prior year development | (7 | ) | (34 | ) | 1 |

| (40 | ) |

Total losses and loss adjustment expenses | 987 |

| 582 |

| 1 |

| 1,570 |

|

Amortization of DAC | 226 |

| 85 |

| — |

| 311 |

|

Underwriting expenses | 217 |

| 148 |

| 7 |

| 372 |

|

Dividends to policyholders | 4 |

| — |

| — |

| 4 |

|

Underwriting gain (loss) | 107 |

| 113 |

| (8 | ) | 212 |

|

Net investment income | 256 |

| 35 |

| 35 |

| 326 |

|

Net realized capital losses | (32 | ) | (5 | ) | — |

| (37 | ) |

Net servicing and other income | 1 |

| 4 |

| — |

| 5 |

|

Income from continuing operations before income taxes | 332 |

| 147 |

| 27 |

| 506 |

|

Income tax expense | 90 |

| 48 |

| 5 |

| 143 |

|

Net income | 242 |

| 99 |

| 22 |

| 363 |

|

Less: Net realized capital gains (losses), after-tax and DAC, excluded from core earnings | (22 | ) | (2 | ) | 1 |

| (23 | ) |

Core earnings | $ | 264 |

| $ | 101 |

| $ | 21 |

| $ | 386 |

|

DISCUSSION OF NON-GAAP FINANCIAL MEASURES

The Hartford uses non-GAAP financial measures in this press release to assist investors in analyzing the company's operating performance for the periods presented herein. Because The Hartford's calculation of these measures may differ from similar measures used by other companies, investors should be careful when comparing The Hartford's non-GAAP financial measures to those of other companies. Definitions and calculations of other financial measures used in this press release can be found below and in The Hartford's Investor Financial Supplement for first quarter 2015, which is available on The Hartford's website, http://ir.thehartford.com.

Book value per diluted common share excluding accumulated other comprehensive income ("AOCI”): Book value per diluted common share excluding AOCI is a non-GAAP financial measure based on a GAAP financial measure. It is calculated by dividing (a) common stockholders' equity excluding AOCI, after-tax, by (b) common shares outstanding and dilutive potential common shares. The Hartford provides book value per diluted common share excluding AOCI to enable investors to analyze the company’s stockholders’ equity excluding the effect of changes in the value of the company’s investment portfolio and other assets due to interest rates, currency and other factors. The Hartford believes book value per diluted common share excluding AOCI is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period, primarily based on changes in market value. Book value per diluted common share is the most directly comparable GAAP measure. A reconciliation of book value per diluted common share, including AOCI to book value per diluted common share, excluding AOCI is set forth below.

|

| | | |

| As of |

| Mar 31 2015 | Dec 31 2014 | Change |

Book value per diluted common share, including AOCI | $44.13 | $42.84 | 3% |

Less: Per diluted share impact of AOCI | $2.66 | $2.13 | 25% |

Book value per diluted common share, excluding AOCI | $41.47 | $40.71 | 2% |

Core Earnings: The Hartford uses the non-GAAP measure core earnings as an important measure of the company’s operating performance. The Hartford believes that the measure core earnings provides investors with a valuable measure of the performance of the company’s ongoing businesses because it reveals trends in our insurance and financial services businesses that may be obscured by including the net effect of certain realized capital gains and losses, certain restructuring charges, pension settlements, loss on extinguishment of debt, reinsurance gains and losses on business disposition transactions, income tax benefit from reduction in valuation allowance, discontinued operations, and the impact of Unlocks to deferred policy acquisition costs ("DAC"), sales inducement assets ("SIA"), unearned revenue reserves ("URR") and death and other insurance benefit reserve balances. Some realized capital gains and losses are primarily driven by investment decisions and external economic developments, the nature and timing of which are unrelated to the insurance and underwriting aspects of our business.

Accordingly, core earnings excludes the effect of all realized gains and losses (net of tax and the effects of DAC) that tend to be highly variable from period to period based on capital market conditions. The Hartford believes, however, that some realized capital gains and losses are integrally related to our insurance operations, so core earnings includes net realized gains and losses such as net periodic settlements on credit derivatives and net periodic settlements on the Japan fixed annuity cross-currency swap. These net realized gains and losses are directly related

to an offsetting item included in the income statement such as net investment income. Net income (loss) is the most directly comparable U.S. GAAP measure. Core earnings should not be considered as a substitute for net income (loss) and does not reflect the overall profitability of the company’s business. Therefore, the Hartford believes that it is useful for investors to evaluate both net income (loss) and core earnings when reviewing the company’s performance.

A reconciliation of core earnings to net income (loss) for the quarterly periods ended March 31, 2015 and 2014, is included in this press release. A reconciliation of core earnings to net income (loss) for individual reporting segments can be found in this press release under the heading "The Hartford Financial Services Group, Inc. Consolidating Income Statements" and in The Hartford's Investor Financial Supplement for the quarter ended March 31, 2015.

Core earnings available to common shareholders per diluted share: Core earnings available to common shareholders per diluted share is calculated based on the non-GAAP financial measure core earnings. It is calculated by dividing (a) core earnings, by (b) diluted common shares outstanding. The Hartford believes that the measure core earnings available to common shareholders per diluted share provides investors with a valuable measure of the company's operating performance for the same reasons applicable to its underlying measure, core earnings. Net income (loss) per diluted common share is the most directly comparable GAAP measure. Core earnings available to common shareholders per diluted share should not be considered as a substitute for net income (loss) per diluted share and does not reflect the overall profitability of the company's business.

Therefore, The Hartford believes that it is useful for investors to evaluate both net income (loss)per diluted share and core earnings available to common shareholders per diluted share when reviewing the company's performance. A reconciliation of core earnings available to common shareholders per diluted share to net income (loss) per diluted common share for the quarterly periods ended March 31, 2015 and 2014 is provided in the table below.

|

| | | | | | | | |

| Three Months Ended |

| Mar 31 2015 | Mar 31 2014 | Change |

PER SHARE DATA | | | |

Diluted earnings (losses) per common share: | | | |

Core earnings available to common shareholders | $ | 1.04 |

| $ | 1.05 |

| (1 | )% |

Add: Unlock charge, after-tax | 0.04 |

| 0.03 |

| 33 | % |

Add: Net realized capital gains (losses), after-tax and DAC, excluded from core earnings | 0.01 |

| (0.08 | ) | (113 | )% |

Add: Restructuring and other costs, after-tax | (0.01 | ) | (0.03 | ) | (67 | )% |

Add: Loss from discontinued operations, after-tax | — |

| 0.06 |

| (100 | )% |

Net income available to common shareholders | $ | 1.08 |

| $ | 1.03 |

| 5 | % |

After-tax core earnings margin: The Hartford uses the non-GAAP measure after-tax core earnings margin, excluding buyouts, to evaluate, and believes it is an important measure of, the Group Benefits segment's operating performance. After-tax margin is the most directly comparable U.S. GAAP measure. The Company believes that after-tax core earnings margin, excluding buyouts, provides investors with a valuable measure of the performance of Group Benefits because it reveals trends in the business that may be obscured by the effect of buyouts. After-tax core earnings margin, excluding buyouts, should not be considered as a substitute for after-tax margin and does not reflect the overall profitability of Group Benefits. Therefore, the Company believes it is important for investors to evaluate both after-tax core earnings margin, excluding buyouts, and after-tax margin when reviewing performance. After-tax core earnings margin, excluding buyouts, is calculated by dividing core earnings, excluding buyouts, by revenues, excluding buyouts and realized gains (losses). A reconciliation of after-tax margin to after-tax core earnings margin, excluding buyouts, for the quarterly periods ended March 31, 2015 and 2014, is set forth below.

|

| | | | | | |

| Three Months Ended March 31, |

After-tax margin | 2015 | 2014 | Change |

After-tax margin (excluding buyouts) | 5.9 | % | 5.7 | % | 0.2 |

|

Effect of net capital realized gains (losses), net of tax on after-tax margin | — | % | 0.6 | % | (0.6 | ) |

After-tax core earnings margin (excluding buyouts) | 5.9 | % | 5.1 | % | 0.8 |

|

Underwriting gain (loss): The Hartford's management evaluates profitability of the Commercial and Personal Lines segments primarily on the basis of underwriting gain or loss. Underwriting gain (loss) is a before-tax measure that represents earned premiums less incurred losses, loss adjustment expenses and underwriting expenses. Net income (loss) is the most directly comparable GAAP measure. Underwriting gain (loss) is influenced significantly by earned premium growth and the adequacy of The Hartford's pricing. Underwriting profitability over time is also greatly influenced by The Hartford's underwriting discipline, as management strives to manage exposure to loss through favorable risk selection and diversification, effective management of claims, use of reinsurance and its ability to manage its expenses. The Hartford believes that the measure underwriting gain (loss) provides investors with a valuable measure of profitability, before tax, derived from underwriting activities, which are managed separately from the company's investing activities. A reconciliation of underwriting results to net income for the quarterly periods ended March 31, 2015 and 2014, is set forth below.

|

| | |

| Three Months Ended |

| Mar 31 2015 | Mar 31 2014 |

Commercial Lines | | |

Net income | $240 | $242 |

Add: Income tax expense | 95 | 90 |

Less: Other expenses (income) | 1 | (2) |

Less: Net realized capital gains (losses) | 8 | (32) |

Less: Net investment income | 257 | 256 |

Less: Net servicing income | 4 | 3 |

Underwriting gain | $65 | $107 |

| |

|

Personal Lines | | |

Net income | $76 | $99 |

Add: Income tax expense | 35 | 48 |

Less: Other expenses | (1) | 4 |

Less: Net realized capital gains (losses) | 1 | (5) |

Less: Net investment income | 35 | 35 |

Less: Net servicing income | 1 | — |

Underwriting gain | $75 | $113 |

Combined ratio before catastrophes and prior year development: Combined ratio before catastrophes and prior year development (PYD) is a non-GAAP financial measure. Combined ratio is the most directly comparable GAAP measure. The combined ratio is the sum of the loss and loss adjustment expense ratio, the expense ratio and the policyholder dividend ratio. This ratio measures the cost of losses and expenses for every $100 of earned premiums. A combined ratio below 100 demonstrates a positive underwriting result. A combined ratio above 100 indicates a negative underwriting result. The combined ratio before catastrophes and PYD represents the combined ratio for the current accident year, excluding the impact of current accident year catastrophes. The company believes this ratio is an important measure of the trend in profitability since it removes the impact of volatile and unpredictable catastrophe losses and prior accident year loss and loss adjustment expense reserve. A reconciliation of the combined ratio to the combined ratio before catastrophes and PYD for individual reporting segments can be found in this press release under the headings Commercial Lines and Personal Lines.

SAFE HARBOR STATEMENT

Some of the statements in this release should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “projects” and similar references to the future. Examples of forward-looking statements include, but are not limited to, statements the company makes regarding future results of operations. The Hartford cautions investors that these forward-looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ. These important risks and uncertainties include: challenges related to the Company’s current operating environment, including global political, economic and market conditions, and the effect of financial market disruptions, economic downturns or other potentially adverse

macroeconomic developments on the attractiveness of our products, the returns in our investment portfolios and the hedging costs associated with our variable annuities business; financial risk related to the continued reinvestment of our investment portfolios and performance of our hedge program for our runoff annuity block; market risks associated with our business, including changes in interest rates, credit spreads, equity prices, market volatility and foreign exchange rates, commodities prices and implied volatility levels, as well as continuing uncertainty in key sectors such as the global real estate market; the impact on our investment portfolio if our investment portfolio is concentrated in any particular segment of the economy; risk associated with the use of analytical models in making decisions in key areas such as underwriting, capital, hedging, reserving, and catastrophe risk management; the potential for further acceleration of deferred policy acquisition cost amortization; the potential for further impairments of our goodwill or the potential for changes in valuation allowances against deferred tax assets; the potential for differing interpretations of the methodologies, estimations and assumptions that underlie the valuation of the Company’s financial instruments that could result in changes to investment valuations; the difficulty in predicting the Company’s potential exposure for asbestos and environmental claims; the subjective determinations that underlie the Company’s evaluation of other-than-temporary impairments on available-for-sale securities; the impact on our statutory capital of various factors, including many that are outside the Company’s control, which can in turn affect our credit and financial strength ratings, cost of capital, regulatory compliance and other aspects of our business and results; risks to our business, financial position, prospects and results associated with negative rating actions or downgrades in the Company’s financial strength and credit ratings or negative rating actions or downgrades relating to our investments; losses due to nonperformance or defaults by others, including reinsurers, sourcing partners, derivative counterparties and other third parties; the potential for losses due to our reinsurers' unwillingness or inability to meet their obligations under reinsurance contracts and the availability, pricing and adequacy of reinsurance to protect us against losses; the possibility of unfavorable loss development including with respect to long-tailed exposures; the possibility of a pandemic, earthquake, or other natural or man-made disaster that may adversely affect our businesses; weather and other natural physical events, including the severity and frequency of storms, hail, winter storms, hurricanes and tropical storms, as well as climate change and its potential impact on weather patterns; the uncertain effects of emerging claim and coverage issues; the Company’s ability to effectively price its property and casualty policies, including its ability to obtain regulatory consents to pricing actions or to non-renewal or withdrawal of certain product lines; technology innovations, such as telematics and other usage-based methods of determining premiums, auto technology advancements that improve driver safety and technologies that facilitate ride or home sharing, that may alter demand for the Company’s products, impact the frequency or severity of losses and/or impact the way the Company markets, distributes and underwrites its products; the possible occurrence of terrorist attacks and the Company’s ability to contain its exposure, including limitations on coverage from the federal government under applicable reinsurance terrorism laws; volatility in our statutory and United States ("U.S.") GAAP earnings and potential material changes to our results resulting from our adjustment of our risk management program to emphasize protection of economic value; the cost and other effects of increased regulation as a result of the implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, and the potential effect of other domestic and foreign regulatory developments, including those that could adversely impact the demand for the Company’s products, operating costs and required capital levels; unfavorable judicial or legislative developments; regulatory limitations on the ability of the Company and certain of its subsidiaries to declare and pay dividends; the impact of changes in federal or state tax laws; the impact of potential changes in accounting principles and related financial reporting requirements; regulatory requirements that could delay, deter or prevent a takeover attempt that shareholders might consider in their best interests; the risks, challenges and uncertainties associated with our capital management plan,

expense reduction initiatives and other actions, which may include acquisitions, divestitures or restructurings; actions by our competitors, many of which are larger or have greater financial resources than we do; the Company’s ability to market, distribute and provide investment advisory services in relation to our products through current and future distribution channels and advisory firms; the Company’s ability to maintain the availability of its systems and safeguard the security of its data in the event of a disaster, cyber or other information security incident or other unanticipated event; the risk that our framework for managing operational risks may not be effective in mitigating material risk and loss to the Company; the potential for difficulties arising from outsourcing and similar third-party relationships; the Company’s ability to protect its intellectual property and defend against claims of infringement; and other factors described in such forward-looking statements and other factors described in such forward-looking statements or in The Hartford's 2014 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings The Hartford makes with the Securities and Exchange Commission.

Any forward-looking statement made by the company in this release speaks only as of the date of this release. Factors or events that could cause the company's actual results to differ may emerge from time to time, and it is not possible for the company to predict all of them. The company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise.

INVESTOR FINANCIAL SUPPLEMENT

March 31, 2015

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

|

| | | | | | | | |

| | | | | | | | |

| | As of April 23, 2015 | | | | | | |

Address: | | | | | | | | |

One Hartford Plaza | | | | A.M. Best | | Standard & Poor’s | | Moody’s |

Hartford, CT 06155 | | Insurance Financial Strength Ratings: | | | | | | |

| | Hartford Fire Insurance Company | | A | | A+ | | A1 |

| | Hartford Life and Accident Insurance Company | | A | | A | | A2 |

| | Hartford Life Insurance Company | | A- | | BBB+ | | Baa2 |

Internet address: | | Hartford Life and Annuity Insurance Company | | A- | | BBB+ | | Baa2 |

http://www.thehartford.com | | | | | | | | |

| | Other Ratings: | | | | | | |

| | The Hartford Financial Services Group, Inc.: | | | | | | |

| | Senior debt | | bbb+ | | BBB+ | | Baa2 |

Contacts: | | Commercial paper | | AMB-2 | | A-2 | | P-2 |

Sabra Purtill | | | | | | | | |

Senior Vice President | | |

Investor Relations | | |

Phone (860) 547-8691 | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Sean Rourke | | TRANSFER AGENT |

Assistant Vice President | | Shareholder correspondence should be mailed to: | | Overnight correspondence should be mailed to: |

Investor Relations | | Computershare | | Computershare |

Phone (860) 547-5688 | | P.O. Box 30170 | | 211 Quality Circle, Suite 210 |

| | College Station, TX 77842-3170 | | College Station, TX 77845 |

| | Phone (877) 272-7740 | | | | | | |

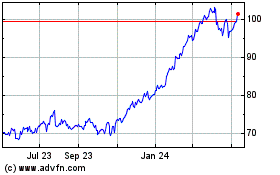

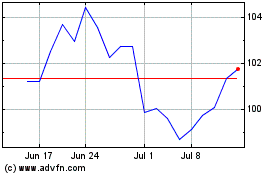

COMMON STOCK

Common stock and warrants of The Hartford Financial Services Group, Inc. are traded on the New York Stock Exchange under the symbols “HIG” and "HIG/WS", respectively.

This report is for information purposes only. It should be read in conjunction with documents filed by The Hartford Financial Services Group, Inc. with the U.S. Securities and Exchange

Commission, including, without limitation, the most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

INVESTOR FINANCIAL SUPPLEMENT

TABLE OF CONTENTS |

| | |

CONSOLIDATED | Consolidated Financial Results | 1 |

| Operating Results by Segment | 2 |

| Consolidated Statements of Operations | 3 |

| Consolidating Balance Sheets | 4 |

| Capital Structure | 5 |

| Statutory Capital and Surplus to GAAP Stockholders’ Equity Reconciliation | 6 |

| Accumulated Other Comprehensive Income (Loss) | 7 |

| Deferred Policy Acquisition Costs | 8 |

| | |

PROPERTY & CASUALTY | Property & Casualty (Combined) Income Statements | 9 |

| Property & Casualty (Combined) Underwriting Ratios | 10 |

| Commercial Lines Underwriting Results | 11 |

| Commercial Lines Underwriting Ratios | 12 |

| Commercial Lines Supplemental Data | 13 |

| Personal Lines Underwriting Results | 14 |

| Personal Lines Underwriting Ratios | 15 |

| Personal Lines Supplemental Data | 16 |

| P&C Other Operations Underwriting Results | 17 |

| | |

GROUP BENEFITS | Income Statements | 18 |

| Supplemental Data | 19 |

| | |

MUTUAL FUNDS | Income Statements | 20 |

| Asset Value Rollforward - Assets Under Management By Asset Class | 21 |

| | |

TALCOTT RESOLUTION | Financial Highlights | 22 |

| Individual Annuity - Supplemental Data | 23 |

| Individual Annuity - Account Value Rollforward | 24 |

| | |

CORPORATE | Income Statements | 25 |

| | |

INVESTMENTS | Investment Earnings Before Tax - Consolidated | 26 |

| Investment Earnings Before Tax - Property & Casualty Combined | 27 |

| Net Investment Income by Segment | 28 |

| Components of Net Realized Capital Gains (Losses) | 29 |

| Composition of Invested Assets | 30 |

| Invested Asset Exposures | 31 |

| | |

APPENDIX | Basis of Presentation and Definitions | 32 |

| Discussion of Non-GAAP and Other Financial Measures | 32 |

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

CONSOLIDATED FINANCIAL RESULTS

|

| | | | | | | | | | | | | | | |

| THREE MONTHS ENDED |

| Mar 31 2015 | Dec 31 2014 | Sept 30 2014 | Jun 30 2014 | Mar 31 2014 |

HIGHLIGHTS | | | | | |

Net income (loss) | $ | 467 |

| $ | 382 |

| $ | 388 |

| $ | (467 | ) | $ | 495 |

|

Core earnings | $ | 452 |

| $ | 426 |

| $ | 477 |

| $ | 144 |

| $ | 501 |

|

Total revenues | $ | 4,617 |

| $ | 4,617 |

| $ | 4,769 |

| $ | 4,616 |

| $ | 4,612 |

|

Total assets | $ | 246,960 |

| $ | 245,013 |

| $ | 247,100 |

| $ | 254,713 |

| $ | 272,923 |

|

PER SHARE AND SHARES DATA | | | | | |

Basic earnings (losses) per common share | | | | | |

Net income (loss) available to common shareholders | $ | 1.11 |

| $ | 0.89 |

| $ | 0.89 |

| $ | (1.04 | ) | $ | 1.10 |

|

Core earnings available to common shareholders | $ | 1.07 |

| $ | 0.99 |

| $ | 1.09 |

| $ | 0.32 |

| $ | 1.11 |

|

Diluted earnings (losses) per common share [1] | | | | | |

Net income (loss) available to common shareholders | $ | 1.08 |

| $ | 0.86 |

| $ | 0.86 |

| $ | (1.00 | ) | $ | 1.03 |

|

Core earnings available to common shareholders | $ | 1.04 |

| $ | 0.96 |

| $ | 1.06 |

| $ | 0.31 |

| $ | 1.05 |

|

Weighted average common shares outstanding (basic) | 422.6 |

| 429.6 |

| 437.2 |

| 450.6 |

| 449.8 |

|

Dilutive effect of stock compensation | 5.5 |

| 6.8 |

| 5.9 |

| 6.3 |

| 6.2 |

|

Dilutive effect of warrants | 5.6 |

| 6.2 |

| 7.7 |

| 11.0 |

| 22.6 |

|

Weighted average common shares outstanding and dilutive potential common shares (diluted) | 433.7 |

| 442.6 |

| 450.8 |

| 467.9 |

| 478.6 |

|

Common shares outstanding | 421.4 |

| 424.4 |

| 433.6 |

| 450.8 |

| 452.5 |

|

Book value per common share | $ | 45.27 |

| $ | 44.11 |

| $ | 43.44 |

| $ | 43.10 |

| $ | 43.70 |

|

Per common share impact of accumulated other comprehensive income [2] | $ | 2.73 |

| $ | 2.19 |

| $ | 2.49 |

| $ | 2.58 |

| $ | 1.46 |

|

Book value per common share (excluding AOCI) | $ | 42.54 |

| $ | 41.92 |

| $ | 40.95 |

| $ | 40.52 |

| $ | 42.24 |

|

Book value per diluted share | $ | 44.13 |

| $ | 42.84 |

| $ | 42.23 |

| $ | 41.70 |

| $ | 41.56 |

|

Per diluted share impact of AOCI | $ | 2.66 |

| $ | 2.13 |

| $ | 2.41 |

| $ | 2.49 |

| $ | 1.39 |

|

Book value per diluted share (excluding AOCI) | $ | 41.47 |

| $ | 40.71 |

| $ | 39.82 |

| $ | 39.21 |

| $ | 40.17 |

|

Common shares outstanding and dilutive potential common shares | 432.3 |

| 437.0 |

| 446.0 |

| 465.9 |

| 475.8 |

|

RETURN ON EQUITY | | | | | |

ROE (net income last 12 months to stockholders' equity including AOCI) | 4.0 | % | 4.2 | % | 3.9 | % | 3.3 | % | 4.5 | % |

ROE (core earnings last 12 months to stockholders' equity excluding AOCI) | 8.1 | % | 8.4 | % | 8.2 | % | 7.8 | % | 8.0 | % |

| |

[1] | Weighted average common shares outstanding and dilutive potential common shares are used in the calculation of diluted earnings (losses) per common share in periods of losses when the impact is dilutive to income from continuing operations, net of tax, available to common shareholders. |

| |

[2] | Accumulated other comprehensive income ("AOCI") represents after-tax unrealized gain (loss) on available-for-sale securities, other than temporary impairment losses recognized in |

AOCI, net gain (loss) on cash-flow hedging instruments, foreign currency translation adjustments and pension and other postretirement adjustments.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

OPERATING RESULTS BY SEGMENT

|

| | | | | | | | | | | | | | | |

| THREE MONTHS ENDED |

| Mar 31 2015 | Dec 31 2014 | Sept 30 2014 | Jun 30 2014 | Mar 31 2014 |

Core earnings (losses): | | | | | |

Commercial Lines | $ | 234 |

| $ | 251 |

| $ | 268 |

| $ | 213 |

| $ | 264 |

|

Personal Lines | 75 |

| 65 |

| 71 |

| (27 | ) | 101 |

|

P&C Other Operations | 20 |

| — |

| 14 |

| (146 | ) | 21 |

|

Property & Casualty ("P&C") Combined | $ | 329 |

| $ | 316 |

| $ | 353 |

| $ | 40 |

| $ | 386 |

|

Group Benefits | 52 |

| 45 |

| 38 |

| 52 |

| 45 |

|

Mutual Funds | 22 |

| 27 |

| 22 |

| 21 |

| 21 |

|

Sub-total | 403 |

| 388 |

| 413 |

| 113 |

| 452 |

|

Talcott Resolution | 111 |

| 98 |

| 122 |

| 101 |

| 112 |

|

Corporate | (62 | ) | (60 | ) | (58 | ) | (70 | ) | (63 | ) |

CONSOLIDATED CORE EARNINGS | $ | 452 |

| $ | 426 |

| $ | 477 |

| $ | 144 |

| $ | 501 |

|

Add: Unlock benefit (charge), after-tax | $ | 19 |

| $ | 13 |

| $ | (102 | ) | $ | 15 |

| $ | 12 |

|

Add: Net realized capital gains (losses), after-tax and DAC, excluded from core earnings | 2 |

| (9 | ) | 27 |

| (4 | ) | (34 | ) |

Add: Restructuring and other costs, after-tax | (6 | ) | (17 | ) | (14 | ) | (5 | ) | (13 | ) |

Add: Pension settlement, after-tax [1] | — |

| (83 | ) | — |

| — |

| — |

|

Add: Net reinsurance gain on dispositions, after-tax [2] | — |

| 15 |

| — |

| — |

| — |

|

Add: Income (loss) from discontinued operations, after-tax [2] | — |

| 37 |

| — |

| (617 | ) | 29 |

|

Net income (loss) | $ | 467 |

| $ | 382 |

| $ | 388 |

| $ | (467 | ) | $ | 495 |

|

[1] Consists of a charge related to voluntary lump-sum settlements with vested participants in the Company's defined benefit pension plan who had separated from service, but who had not yet commenced annuity benefits.

[2] For further information, see footnotes [2] and [3] on page 22.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

|

| | | | | | | | | | | | | | | |

| THREE MONTHS ENDED |

| Mar 31 2015 | Dec 31 2014 | Sept 30 2014 | Jun 30 2014 | Mar 31 2014 |

Earned premiums | $ | 3,322 |

| $ | 3,378 |

| $ | 3,337 |

| $ | 3,319 |

| $ | 3,302 |

|

Fee income | 459 |

| 474 |

| 524 |

| 502 |

| 496 |

|

Net investment income | 809 |

| 752 |

| 810 |

| 768 |

| 824 |

|

Realized capital gains (losses): | | | | | |

Total other-than-temporary impairment (“OTTI”) losses | (12 | ) | (18 | ) | (15 | ) | (8 | ) | (23 | ) |

OTTI losses recognized in other comprehensive income | — |

| 2 |

| 1 |

| 1 |

| 1 |

|

Net OTTI losses recognized in earnings | (12 | ) | (16 | ) | (14 | ) | (7 | ) | (22 | ) |

Other net realized capital gains (losses) | 17 |

| 2 |

| 83 |

| 3 |

| (13 | ) |

Total net realized capital gains (losses) | 5 |

| (14 | ) | 69 |

| (4 | ) | (35 | ) |

Other revenues | 22 |

| 27 |

| 29 |

| 31 |

| 25 |

|

Total revenues | 4,617 |

| 4,617 |

| 4,769 |

| 4,616 |

| 4,612 |

|

Benefits, losses and loss adjustment expenses | 2,563 |

| 2,582 |

| 2,624 |

| 3,023 |

| 2,576 |

|

Amortization of DAC | 387 |

| 381 |

| 580 |

| 372 |

| 396 |

|

Insurance operating costs and other expenses [1] | 948 |

| 1,139 |

| 976 |

| 977 |

| 936 |

|

Reinsurance gain on dispositions | — |

| (23 | ) | — |

| — |

| — |

|

Interest expense | 94 |

| 94 |

| 93 |

| 94 |

| 95 |

|

Total benefits, losses and expenses | 3,992 |

| 4,173 |

| 4,273 |

| 4,466 |

| 4,003 |

|

Income from continuing operations before income taxes | 625 |

| 444 |

| 496 |

| 150 |

| 609 |

|

Income tax expense | 158 |

| 99 |

| 108 |

| — |

| 143 |

|

Income from continuing operations, after-tax | 467 |

| 345 |

| 388 |

| 150 |

| 466 |

|

Income (loss) from discontinued operations, after-tax [2] | — |

| 37 |

| — |

| (617 | ) | 29 |

|

Net income (loss) | $ | 467 |

| $ | 382 |

| $ | 388 |

| $ | (467 | ) | $ | 495 |

|

| |

[1] | The three months ended December 31, 2014 includes a pension settlement charge of $128, before tax, for voluntary lump-sum settlements with vested participants in the Company's defined benefit pension plan who had separated from service, but who had not yet commenced annuity benefits. |

| |

[2] | For further information related to the discontinued operations of the Japan annuity business, refer to Talcott Resolution Financial Highlights on page 22. |

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

CONSOLIDATING BALANCE SHEETS

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PROPERTY & CASUALTY | | GROUP BENEFITS | | MUTUAL FUNDS | | TALCOTT RESOLUTION | | CORPORATE | | CONSOLIDATED |

| Mar 31 2015 | Dec 31 2014 | | Mar 31 2015 | Dec 31 2014 | | Mar 31 2015 | Dec 31 2014 | | Mar 31 2015 | Dec 31 2014 | | Mar 31 2015 | Dec 31 2014 | | Mar 31 2015 | Dec 31 2014 |

Investments | | | | | | | | | | | | | | | | | |

Fixed maturities, available-for-sale, at fair value | $ | 25,450 |

| $ | 25,484 |

| | $ | 7,652 |

| $ | 7,323 |

| | $ | 38 |

| $ | 13 |

| | $ | 26,225 |

| $ | 25,468 |

| | $ | 1,190 |

| $ | 1,096 |

| | $ | 60,555 |

| $ | 59,384 |

|

Fixed maturities, at fair value using the fair value option | 205 |

| 126 |

| | 84 |

| 83 |

| | — |

| — |

| | 231 |

| 279 |

| | — |

| — |

| | 520 |

| 488 |

|

Equity securities, available-for-sale, at fair value | 603 |

| 240 |

| | 42 |

| 159 |

| | — |

| — |

| | 367 |

| 513 |

| | 136 |

| 135 |

| | 1,148 |

| 1,047 |

|

Mortgage loans | 1,811 |

| 1,693 |

| | 763 |

| 753 |

| | — |

| — |

| | 3,123 |

| 3,110 |

| | — |

| — |

| | 5,697 |

| 5,556 |

|

Policy loans, at outstanding balance | — |

| — |

| | 1 |

| 1 |

| | — |

| — |

| | 1,451 |

| 1,430 |

| | — |

| — |

| | 1,452 |

| 1,431 |

|

Limited partnerships and other alternative investments | 1,562 |

| 1,506 |

| | 209 |

| 183 |

| | — |

| — |

| | 1,152 |

| 1,253 |

| | — |

| — |

| | 2,923 |

| 2,942 |

|

Other investments | 99 |

| 73 |

| | 40 |

| 18 |

| | — |

| — |

| | 480 |

| 445 |

| | 11 |

| 11 |

| | 630 |

| 547 |

|

Short-term investments | 871 |

| 1,038 |

| | 285 |

| 372 |

| | 160 |

| 229 |

| | 1,480 |

| 2,252 |

| | 855 |

| 992 |

| | 3,651 |

| 4,883 |

|

Total investments | $ | 30,601 |

| $ | 30,160 |

| | $ | 9,076 |

| $ | 8,892 |

| | $ | 198 |

| $ | 242 |

| | $ | 34,509 |

| $ | 34,750 |

| | $ | 2,192 |

| $ | 2,234 |

| | $ | 76,576 |

| $ | 76,278 |

|

Cash | 184 |

| 119 |

| | 18 |

| 17 |

| | 2 |

| 2 |

| | 295 |

| 261 |

| | 1 |

| — |

| | 500 |

| 399 |

|

Premiums receivable and agents’ balances | 3,218 |

| 3,175 |

| | 251 |

| 227 |

| | — |

| — |

| | 28 |

| 27 |

| | — |

| — |

| | 3,497 |

| 3,429 |

|

Reinsurance recoverables | 2,682 |

| 2,730 |

| | 600 |

| 600 |

| | — |

| — |

| | 19,455 |

| 19,590 |

| | — |

| — |

| | 22,737 |

| 22,920 |

|

DAC | 586 |

| 576 |

| | 39 |

| 36 |

| | 12 |

| 11 |

| | 1,127 |

| 1,200 |

| | — |

| — |

| | 1,764 |

| 1,823 |

|

Deferred income taxes | 228 |

| 355 |

| | (195 | ) | (168 | ) | | 2 |

| 2 |

| | 872 |

| 938 |

| | 1,729 |

| 1,770 |

| | 2,636 |

| 2,897 |

|

Goodwill | 119 |

| 119 |

| | — |

| — |

| | 149 |

| 149 |

| | — |

| — |

| | 230 |

| 230 |

| | 498 |

| 498 |

|

Property and equipment, net | 696 |

| 670 |

| | 62 |

| 71 |

| | 1 |

| 1 |

| | 80 |

| 80 |

| | 9 |

| 9 |

| | 848 |

| 831 |

|

Other assets | 1,090 |

| 858 |

| | 178 |

| 11 |

| | 90 |

| 36 |

| | 638 |

| 253 |

| | 105 |

| 78 |

| | 2,101 |

| 1,236 |

|

Separate account assets [1] | — |

| — |

| | — |

| — |

| | — |

| — |

| | 135,803 |

| 134,702 |

| | — |

| — |

| | 135,803 |

| 134,702 |

|

Total assets | $ | 39,404 |

| $ | 38,762 |

| | $ | 10,029 |

| $ | 9,686 |

| | $ | 454 |

| $ | 443 |

| | $ | 192,807 |

| $ | 191,801 |

| | $ | 4,266 |

| $ | 4,321 |

| | $ | 246,960 |

| $ | 245,013 |

|

Future policy benefits, unpaid losses and loss adjustment expenses | 21,750 |

| 21,806 |

| | 6,507 |

| 6,540 |

| | — |

| — |

| | 13,266 |

| 13,098 |

| | — |

| $ | — |

| | $ | 41,523 |

| $ | 41,444 |

|

Other policyholder funds and benefits payable | — |

| — |

| | 514 |

| 518 |

| | — |

| — |

| | 31,587 |

| 32,014 |

| | — |

| — |

| | 32,101 |

| 32,532 |

|

Unearned premiums | 5,230 |

| 5,099 |

| | 43 |

| 45 |

| | — |

| — |

| | 110 |

| 111 |

| | — |

| — |

| | 5,383 |

| 5,255 |

|

Debt | — |