UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

February 17, 2015

|

Genuine Parts Company

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Georgia

|

001-05690

|

58-0254510

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

2999 Circle 75 Pkwy, Atlanta, Georgia

|

|

30339

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

770.953.1700

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On February 17, 2015, Genuine Parts Company issued a press release announcing its results of operations for the fourth quarter and fiscal year ended December 31, 2014. A copy of the press release is furnished with this Current Report on Form 8-K as exhibit 99.1.

The information, including exhibit 99.1 attached hereto contained in this Item 2.02 of this Current Report on Form 8-K of Genuine Parts Company is being "furnished" and shall not be deemed "filed" for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. In accordance with General Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report and exhibit 99.1 attached hereto shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Securities Exchange Act of 1934, as amended, except as otherwise expressly stated in any such filing.

Item 8.01 Other Events.

On February 17, 2015, Genuine Parts Company announced a 7% increase in the regular quarterly cash dividend for 2015. The Board of Directors of Genuine Parts Company, at its February 16, 2015 Board meeting, increased the cash dividend payable to an annual rate of $2.46 per share compared with the previous dividend of $2.30 per share. The quarterly cash dividend of sixty-one and one-half cents ($.615) per share is payable April 1, 2015 to shareholders of record March 6, 2015. A copy of the press release announcing the foregoing is attached as Exhibit 99.2 to this Current Report on Form 8-K.

On February 17, 2015, Genuine Parts Company announced that the Board of Directors has elected three new corporate officers. Robert A. Milstead was named Senior Vice President Digital, Thomas K. Davis was named Vice President Supplier Business IT and Jennifer L. Ellis was named Corporate Secretary and Associate Counsel.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release dated February 17, 2015

99.2 Press Release dated February 17, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Genuine Parts Company

|

|

|

|

|

|

|

|

February 17, 2015

|

|

By:

|

|

Carol B. Yancey

|

|

|

|

|

|

|

|

|

|

|

|

Name: Carol B. Yancey

|

|

|

|

|

|

Title: Executive Vice President and CFO

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

99.1 Press Release dated February 17, 2015

|

|

99.2

|

|

Press Release dated February 17, 2015

|

GENUINE PARTS COMPANY

NEWS RELEASE

FOR IMMEDIATE RELEASE

GENUINE PARTS COMPANY

REPORTS FOURTH QUARTER AND FULL YEAR RESULTS FOR 2014

- 4th Quarter Sales up 9%; 4th Quarter EPS up 10% -

- Record Sales and Earnings for 2014 –

Atlanta, Georgia, February 17, 2015 — Genuine Parts Company (NYSE: GPC) announced today fourth

quarter results and record sales and earnings for the year ended December 31, 2014.

Sales in the fourth quarter ended December 31, 2014 increased 9% to $3.8 billion, compared to sales

of $3.5 billion for the same period in 2013. Net income in the fourth quarter was $166 million, or

$1.07 per share on a diluted basis, compared to $150 million, or $0.97 per diluted share, in 2013,

up 10%.

In review of the fourth quarter, Tom Gallagher, Chairman and Chief Executive Officer, commented,

“We are pleased to report another solid quarter of sales and earnings growth for Genuine Parts

Company. Our 9% total sales increase includes approximately 7.6% underlying sales growth and a

2.7% contribution from acquisitions, offset by a currency headwind of approximately 1.6%. Our

overall sales growth was supported by increases in each of our four business segments. Sales for

the Automotive Group were up 4%, consisting of core automotive growth of 6% and a 0.5% contribution

from acquisitions. These items were offset by a 2.5% negative impact of currency. Sales at Motion

Industries, our Industrial Group, were up 10%, including 9% underlying growth and 2% from

acquisitions offset by a currency headwind of approximately 1%. Sales at EIS, our

Electrical/Electronic Group, increased by 23% and include a 20% contribution from acquisitions and

3% underlying growth. Sales for S. P. Richards, our Office Products Group, were up 22%, consisting

of 14% underlying growth and 8% from acquisitions.”

Sales for the year ended December 31, 2014 were $15.3 billion, up 9% compared to 2013. Net income

for the year was $711 million, an increase of 4% compared to $685 million in 2013. Earnings per

share on a diluted basis were $4.61, up 5% compared to $4.40 in 2013.

As previously disclosed, in association with the April 1, 2013 acquisition of GPC Asia Pacific, the

Company’s initial investment was remeasured and, net of certain one-time purchase accounting costs,

amounted to a pre-tax income adjustment of approximately $36 million, or $0.22 diluted earnings per

share, in the second quarter of 2013. Additionally, a pre-tax expense adjustment of $3 million, or

$0.01 diluted earnings per share, was recorded in the third quarter of 2013.

Before the one-time adjustment in 2013, net income for the full year in 2014 of $711 million, was

up 9% compared to the previous year. Earnings per share on a diluted basis of $4.61 were up 10%

compared to the same period in 2013 excluding the adjustment.

Mr. Gallagher stated, “2014 was another year of record sales and earnings, and we are especially

pleased that each of our four business segments contributed to these records. We also improved our

operating margin for the year and further improved our financial strength with effective asset

management and solid cash flows.”

Mr. Gallagher added, “Industry fundamentals were favorable in the automotive aftermarket during

2014, and we also experienced improving industry conditions across our non-automotive businesses

during the year. These factors, combined with our internal sales initiatives, drove sales growth

of approximately 5% for the year, while acquisitions also contributed approximately 5% to sales.

These items were offset by a currency headwind of approximately 1%. Automotive sales were up 8%

for the year, including approximately 6% underlying sales growth and a 4% contribution from

acquisitions, offset by a currency headwind of approximately 2%. Industrial Group sales increased

by 8%, consisting of 6% underlying growth and 3% from acquisitions, offset by the negative impact

of currency of approximately 1%. Electrical/Electronic sales increased by 30% for the year,

primarily due to acquisitions. Sales for the Office Products business were up 10%, with

approximately 5% coming from underlying growth and another 5% from acquisitions.”

Mr. Gallagher concluded, “The Company showed progress in a number of key areas in 2014 and we are

proud of the GPC Team’s accomplishments. With that said, we recognize there is still room for

further improvement in our operations as we move forward. To this end, we remain committed to our

core objectives of growing sales and earnings, showing continued operating margin improvement,

generating solid cash flows and maintaining a strong balance sheet. Progress in each of these

important areas will keep the Company moving ahead and will help to ensure another successful year

in 2015.”

Conference Call

Genuine Parts Company will hold a conference call today at 11:00 a.m. EST to discuss the results of

the quarter, the year and the future outlook. Interested parties may listen to the call on the

Company’s website, www.genpt.com, by clicking “Investors”, or by dialing 844-857-1770, conference

ID 66755202. A replay will also be available on the Company’s website or at 855-859-2056,

conference ID 66755202, two hours after the completion of the call until 12:00 a.m. Eastern time on

March 4, 2015.

Forward Looking Statements

Some statements in this report, as well as in other materials we file with the Securities and

Exchange Commission (SEC) or otherwise release to the public and in materials that we make

available on our website, constitute forward-looking statements that are subject to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995. Senior officers may also make

verbal statements to analysts, investors, the media and others that are forward-looking.

Forward-looking statements may relate, for example, to future operations, prospects, strategies,

financial condition, economic performance (including growth and earnings), industry conditions and

demand for our products and services. The Company cautions that its forward-looking statements

involve risks and uncertainties, and while we believe that our expectations for the future are

reasonable in view of currently available information, you are cautioned not to place undue

reliance on our forward-looking statements. Actual results or events may differ materially from

those indicated as a result of various important factors. Such factors may include, among other

things, slowing demand for the Company’s products, changes in general economic conditions,

including, unemployment, inflation or deflation, high energy costs, uncertain credit markets and

other macro-economic conditions, the ability to maintain favorable vendor arrangements and

relationships, disruptions in our vendors’ operations, competitive product, service and pricing

pressures, the Company’s ability to successfully implement its business initiatives in each of its

four business segments, the Company’s ability to successfully integrate its acquired businesses,

the uncertainties and costs of litigation, as well as other risks and uncertainties discussed in

the Company’s Annual Report on Form 10-K for 2013 and from time to time in the Company’s subsequent

filings with the SEC.

Forward-looking statements are only as of the date they are made, and the Company undertakes no

duty to update its forward-looking statements except as required by law. You are advised, however,

to review any further disclosures we make on related subjects in our subsequent Forms 10-K, 10-Q,

8-K and other reports to the SEC.

About Genuine Parts Company

Genuine Parts Company is a distributor of automotive replacement parts in the U.S., Canada, Mexico

and Australasia. The Company also distributes industrial replacement parts in the U.S., Canada and

Mexico through its Motion Industries subsidiary. S. P. Richards Company, the Office Products

Group, distributes business products in the U.S. and Canada. The Electrical/Electronic Group, EIS,

Inc., distributes electrical and electronic components throughout the U.S., Canada and Mexico.

Contacts

Carol B. Yancey, Executive Vice President and CFO – (770) 612-2044

Sidney G. Jones, Vice President — Investor Relations – (770) 818-4628

1

GENUINE PARTS COMPANY and SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended Dec. 31, |

|

Year Ended Dec. 31, |

| |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

| |

|

(in thousands, except per share data) |

Net sales |

|

$ |

3,822,454 |

|

|

$ |

3,517,801 |

|

|

$ |

15,341,647 |

|

|

$ |

14,077,843 |

|

Cost of goods sold |

|

|

2,675,913 |

|

|

|

2,425,660 |

|

|

|

10,747,886 |

|

|

|

9,857,923 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

1,146,541 |

|

|

|

1,092,141 |

|

|

|

4,593,761 |

|

|

|

4,219,920 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, administrative & other expenses |

|

|

841,546 |

|

|

|

820,563 |

|

|

|

3,327,709 |

|

|

|

3,041,659 |

|

Depreciation and amortization |

|

|

39,691 |

|

|

|

35,885 |

|

|

|

148,313 |

|

|

|

133,957 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

881,237 |

|

|

|

856,448 |

|

|

|

3,476,022 |

|

|

|

3,175,616 |

|

Income before income taxes |

|

|

265,304 |

|

|

|

235,693 |

|

|

|

1,117,739 |

|

|

|

1,044,304 |

|

Income taxes |

|

|

99,745 |

|

|

|

85,226 |

|

|

|

406,453 |

|

|

|

359,345 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

165,559 |

|

|

$ |

150,467 |

|

|

$ |

711,286 |

|

|

$ |

684,959 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per common share |

|

$ |

1.08 |

|

|

$ |

0.98 |

|

|

$ |

4.64 |

|

|

$ |

4.43 |

|

Diluted net income per common share |

|

$ |

1.07 |

|

|

$ |

0.97 |

|

|

$ |

4.61 |

|

|

$ |

4.40 |

|

Weighted average common shares outstanding |

|

|

152,996 |

|

|

|

154,047 |

|

|

|

153,299 |

|

|

|

154,636 |

|

Dilutive effect of stock options and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

non-vested restricted stock awards |

|

|

1,088 |

|

|

|

1,075 |

|

|

|

1,076 |

|

|

|

1,078 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding – |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

assuming dilution |

|

|

154,084 |

|

|

|

155,122 |

|

|

|

154,375 |

|

|

|

155,714 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

GENUINE PARTS COMPANY and SUBSIDIARIES

SEGMENT INFORMATION AND FINANCIAL HIGHLIGHTS

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended Dec. 31, |

|

Year Ended Dec. 31, |

| |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

| |

|

(in thousands) |

Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automotive |

|

$ |

1,988,448 |

|

|

$ |

1,916,771 |

|

|

$ |

8,096,877 |

|

|

$ |

7,489,186 |

|

Industrial |

|

|

1,198,032 |

|

|

|

1,085,555 |

|

|

|

4,771,080 |

|

|

|

4,429,976 |

|

Office Products |

|

|

469,299 |

|

|

|

385,761 |

|

|

|

1,802,754 |

|

|

|

1,638,618 |

|

Electrical/Electronic Materials |

|

|

177,433 |

|

|

|

143,899 |

|

|

|

739,119 |

|

|

|

568,872 |

|

Other (1) |

|

|

(10,758 |

) |

|

|

(14,185 |

) |

|

|

(68,183 |

) |

|

|

(48,809 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net sales |

|

$ |

3,822,454 |

|

|

$ |

3,517,801 |

|

|

$ |

15,341,647 |

|

|

$ |

14,077,843 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automotive |

|

$ |

150,335 |

|

|

$ |

153,901 |

|

|

$ |

700,386 |

|

|

$ |

641,492 |

|

Industrial |

|

|

96,303 |

|

|

|

73,338 |

|

|

|

370,043 |

|

|

|

320,720 |

|

Office Products |

|

|

35,280 |

|

|

|

31,438 |

|

|

|

133,727 |

|

|

|

122,492 |

|

Electrical/Electronic Materials |

|

|

15,126 |

|

|

|

12,287 |

|

|

|

64,884 |

|

|

|

47,584 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating profit |

|

|

297,044 |

|

|

|

270,964 |

|

|

|

1,269,040 |

|

|

|

1,132,288 |

|

Interest expense, net |

|

|

(5,479 |

) |

|

|

(6,094 |

) |

|

|

(24,192 |

) |

|

|

(24,330 |

) |

Intangible amortization |

|

|

(10,546 |

) |

|

|

(8,500 |

) |

|

|

(36,867 |

) |

|

|

(28,987 |

) |

Other, net |

|

|

(15,715 |

) |

|

|

(20,677 |

) |

|

|

(90,242 |

) |

|

|

(34,667 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

$ |

265,304 |

|

|

$ |

235,693 |

|

|

$ |

1,117,739 |

|

|

$ |

1,044,304 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

$ |

33,897 |

|

|

$ |

39,917 |

|

|

$ |

107,681 |

|

|

$ |

124,063 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

$ |

39,691 |

|

|

$ |

35,885 |

|

|

$ |

148,313 |

|

|

$ |

133,957 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Represents the net effect of discounts, incentives and freight billed reported as a component

of net sales.

3

GENUINE PARTS COMPANY and SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| |

|

|

|

|

|

|

|

|

| |

|

Dec. 31, |

|

Dec. 31, |

| |

|

2014 |

|

2013 |

| |

|

(in thousands) |

ASSETS |

|

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

137,730 |

|

|

$ |

196,893 |

|

Trade accounts receivable, net |

|

|

1,872,365 |

|

|

|

1,664,819 |

|

Merchandise inventories, net |

|

|

3,043,848 |

|

|

|

2,946,021 |

|

Prepaid expenses and other current assets |

|

|

538,582 |

|

|

|

413,758 |

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT ASSETS |

|

|

5,592,525 |

|

|

|

5,221,491 |

|

Goodwill and other intangible assets, less accumulated amortization |

|

|

1,386,590 |

|

|

|

1,289,356 |

|

Deferred tax assets |

|

|

145,331 |

|

|

|

97,555 |

|

Other assets |

|

|

451,690 |

|

|

|

401,834 |

|

Net property, plant and equipment |

|

|

670,102 |

|

|

|

670,061 |

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

8,246,238 |

|

|

$ |

7,680,297 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Trade accounts payable |

|

$ |

2,554,759 |

|

|

$ |

2,269,671 |

|

Current portion of debt |

|

|

265,466 |

|

|

|

264,658 |

|

Dividends payable |

|

|

88,039 |

|

|

|

82,746 |

|

Other accrued expenses |

|

|

675,851 |

|

|

|

565,969 |

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT LIABILITIES |

|

|

3,584,115 |

|

|

|

3,183,044 |

|

Long-term debt |

|

|

500,000 |

|

|

|

500,000 |

|

Pension and other post-retirement benefit liabilities |

|

|

329,531 |

|

|

|

140,171 |

|

Deferred tax liabilities |

|

|

72,479 |

|

|

|

83,316 |

|

Other long-term liabilities |

|

|

447,749 |

|

|

|

414,998 |

|

Common stock |

|

|

153,113 |

|

|

|

153,773 |

|

Retained earnings |

|

|

3,868,346 |

|

|

|

3,592,956 |

|

Accumulated other comprehensive loss |

|

|

(720,211 |

) |

|

|

(397,655 |

) |

|

|

|

|

|

|

|

|

|

TOTAL PARENT EQUITY |

|

|

3,301,248 |

|

|

|

3,349,074 |

|

Noncontrolling interests in subsidiaries |

|

|

11,116 |

|

|

|

9,694 |

|

|

|

|

|

|

|

|

|

|

TOTAL EQUITY |

|

|

3,312,364 |

|

|

|

3,358,768 |

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

$ |

8,246,238 |

|

|

$ |

7,680,297 |

|

|

|

|

|

|

|

|

|

|

4

GENUINE PARTS COMPANY and SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| |

|

|

|

|

|

|

|

|

| |

|

Year Ended Dec. 31, |

| |

|

2014 |

|

2013 |

| |

|

(in thousands) |

OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

Net income |

|

$ |

711,286 |

|

|

$ |

684,959 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

148,313 |

|

|

|

133,957 |

|

Share-based compensation |

|

|

16,239 |

|

|

|

12,648 |

|

Excess tax benefits from share-based compensation |

|

|

(17,766 |

) |

|

|

(12,905 |

) |

Gain on GPC Asia Pacific equity investment |

|

|

— |

|

|

|

(59,000 |

) |

Other |

|

|

50,600 |

|

|

|

(26,351 |

) |

Changes in operating assets and liabilities |

|

|

(118,527 |

) |

|

|

323,423 |

|

|

|

|

|

|

|

|

|

|

NET CASH PROVIDED BY OPERATING ACTIVITIES |

|

|

790,145 |

|

|

|

1,056,731 |

|

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

|

(107,681 |

) |

|

|

(124,063 |

) |

Acquisitions and other investing activities |

|

|

(279,034 |

) |

|

|

(701,516 |

) |

|

|

|

|

|

|

|

|

|

NET CASH USED IN INVESTING ACTIVITIES |

|

|

(386,715 |

) |

|

|

(825,579 |

) |

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Proceeds from debt |

|

|

2,727,924 |

|

|

|

3,019,931 |

|

Payments on debt |

|

|

(2,735,862 |

) |

|

|

(2,995,335 |

) |

Share-based awards exercised, net of taxes paid |

|

|

(22,051 |

) |

|

|

(15,728 |

) |

Excess tax benefits from share-based compensation |

|

|

17,766 |

|

|

|

12,905 |

|

Dividends paid |

|

|

(347,271 |

) |

|

|

(326,217 |

) |

Purchase of stock |

|

|

(95,946 |

) |

|

|

(120,673 |

) |

|

|

|

|

|

|

|

|

|

NET CASH USED IN FINANCING ACTIVITIES |

|

|

(455,440 |

) |

|

|

(425,117 |

) |

EFFECT OF EXCHANGE RATE CHANGES ON CASH |

|

|

(7,153 |

) |

|

|

(12,237 |

) |

|

|

|

|

|

|

|

|

|

NET DECREASE IN CASH AND CASH EQUIVALENTS |

|

|

(59,163 |

) |

|

|

(206,202 |

) |

CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR |

|

|

196,893 |

|

|

|

403,095 |

|

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS AT END OF YEAR |

|

$ |

137,730 |

|

|

$ |

196,893 |

|

|

|

|

|

|

|

|

|

|

5

GENUINE PARTS COMPANY

NEWS RELEASE

FOR IMMEDIATE RELEASE

GENUINE PARTS COMPANY

MARKS 59th CONSECUTIVE YEAR OF INCREASED DIVIDENDS

AND ANNOUNCES OFFICER CHANGES

- Dividend for 2015 Increased by 7% -

Atlanta, Georgia, February 17, 2015 –Genuine Parts Company (NYSE: GPC) announced today a 7%

increase in the regular quarterly cash dividend for 2015. The Board of Directors of the Company,

at its February 16, 2015 Board meeting, increased the cash dividend payable to an annual rate of

$2.46 per share compared with the previous dividend of $2.30 per share. The quarterly cash

dividend of sixty-one and one-half cents ($.615) per share is payable April 1, 2015 to shareholders

of record March 6, 2015. GPC has paid a cash dividend every year since going public in 1948, and

2015 marks the 59th consecutive year of increased dividends paid to shareholders.

Genuine Parts Company also announced today that the Board of Directors has elected three new

corporate officers. Robert A. Milstead was named Senior Vice President Digital, Thomas K. Davis

was named Vice President Supplier Business IT and Jennifer L. Ellis was named Corporate Secretary

and Associate Counsel.

Mr. Milstead joined the Company in January 2015 and brings with him over 18 years of experience in

digital marketing and eCommerce strategy and execution, most recently serving as Vice President and

Managing Director for Accenture. Mr. Davis was previously Director of Information Systems for the

Company’s Balkamp operations, and has been with the Company since 2012. Ms. Ellis has been with

the Company since 2008, most recently serving as Assistant Corporate Secretary and Associate

Counsel.

Tom Gallagher, Chairman and CEO of Genuine Parts Company, commented, “All three of these talented

individuals bring valuable experience and expertise to their new positions in the organization.

Rob’s leadership role is instrumental to our global digital strategy, Tom is a key leader within

our IT team and Jennifer’s leadership is essential in guiding our corporate governance practices.

We are pleased to have these officers on our corporate team and we look forward to their future

contributions.”

1

Genuine Parts Company plans to release Fourth Quarter and Year-End Earnings later this

morning. Management will also conduct a conference call at 11:00 a.m. Eastern time. The public

may access the call on the Company’s website, www.genpt.com, by clicking “Investors”, or by

dialing 844-857-1770. The conference ID is 66755202. If you are unable to participate during the

call, a replay of the call will be available on the Company’s website or toll-free at 855-859-2056,

ID 66755202, two hours after the completion of the conference call until 12:00 a.m. Eastern time on

March 4, 2015.

About Genuine Parts Company

Genuine Parts Company is a distributor of automotive replacement parts in the U.S., Canada, Mexico

and Australasia. The Company also distributes industrial replacement parts in the U.S., Canada and

Mexico through its Motion Industries subsidiary. S. P. Richards Company, the Office Products

Group, distributes business products in the U.S. and Canada. The Electrical/Electronic Group, EIS,

Inc., distributes electrical and electronic components throughout the U.S., Canada and Mexico.

Contacts

Carol B. Yancey, Executive Vice President and CFO – (770) 612-2044

Sidney G. Jones, Vice President — Investor Relations – (770) 818-4628

2

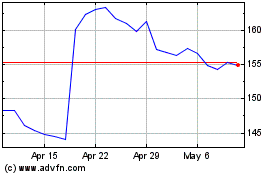

Genuine Parts (NYSE:GPC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Genuine Parts (NYSE:GPC)

Historical Stock Chart

From Sep 2023 to Sep 2024