Robbins Arroyo LLP: Gerdau S.A. (GGB) Misled Shareholders According to a Recently Filed Class Action

June 02 2016 - 6:22PM

Business Wire

Shareholder rights law firm Robbins Arroyo LLP announces that a

class action complaint was filed against Gerdau S.A. (NYSE: GGB) in

the U.S. District Court for the Southern District of New York. The

complaint is brought on behalf of all purchasers of Gerdau American

depositary receipts ("ADRs") between June 2, 2011 and May 15, 2016,

for alleged violations of the Securities Exchange Act of 1934 by

Gerdau's officers and directors. Gerdau produces and commercializes

steel products worldwide.

View this information on the law firm's Shareholder Rights

Blog:www.robbinsarroyo.com/shareholders-rights-blog/gerdau-s-a

Gerdau Accused of Engaging in Bribery and Money

Laundering

According to the complaint, throughout the class period, Gerdau

submitted multiple filings with the U.S. Securities and Exchange

Commission stating that the financial information was accurate and

disclosed any material changes to the company's internal controls

over financial reporting. However, the complaint alleges that

Gerdau officials failed to disclose adverse facts about the

company's business, operations, and prospects, including that: (i)

the company was engaged in a bribery scheme in collusion with

Brazil's Board of Tax Appeals ("CARF"), a body within the Ministry

of Finance that hears appeals on tax disputes; (ii) Gerdau had

defrauded Brazilian tax authorities of roughly $429 million in

taxes; and (iii) Gerdau's Chief Executive Officer and other

executives, directors, and employees of the company engaged in

bribery, money laundering, and influence peddling.

On March 26, 2015, Brazilian authorities announced that a

federal police investigation had uncovered a multibillion-dollar

tax fraud scheme at the Ministry of Finance, reporting that as many

as 70 companies had bribed members of the CARF to obtain favorable

rulings that recused or waived the amounts the companies owed. On

March 29, 2015, it was reported that Gerdau was among the companies

under investigation. Then, on February 25, 2016, Brazilian police

raided Gerdau offices, carrying out 20 court orders for testimony

and 18 search warrants. On February 29, 2016, Gerdau announced that

it would delay the release of its fourth quarter financial results

as the company analyzed the case records involving Gerdau in the

recent phase of the investigation. On May 16, 2016, various news

outlets reported that Brazil's federal police had accused Gerdau of

evading $429 million in taxes and indicted a total of 19 Gerdau

personnel on corruption related charges. On this news, Gerdau's ADR

price fell $0.13, or over 7%, to close at $1.72 on May 16,

2016.

Gerdau Shareholders Have Legal Options

Concerned shareholders who would like more information about

their rights and potential remedies can contact attorney Darnell R.

Donahue at (800) 350-6003, DDonahue@robbinsarroyo.com, or via the

shareholder information form on the firm's website.

Robbins Arroyo LLP is a nationally recognized leader in

shareholder rights law. The firm represents individual and

institutional investors in shareholder derivative and securities

class action lawsuits, and has helped its clients realize more than

$1 billion of value for themselves and the companies in which they

have invested.

Attorney Advertising. Past results do not guarantee a similar

outcome.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160602006659/en/

Robbins Arroyo LLPDarnell R. Donahue619-525-3990 or Toll Free

800-350-6003DDonahue@robbinsarroyo.comwww.robbinsarroyo.com

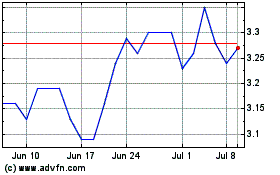

Gerdau (NYSE:GGB)

Historical Stock Chart

From Mar 2024 to Apr 2024

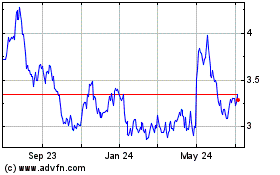

Gerdau (NYSE:GGB)

Historical Stock Chart

From Apr 2023 to Apr 2024