Report of Foreign Issuer (6-k)

March 04 2016 - 12:13PM

Edgar (US Regulatory)

FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

Dated March 4, 2016

Commission File Number 1-14878

GERDAU S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

Av. Farrapos 1811

Porto Alegre, Rio Grande do Sul - Brazil CEP 90220-005

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused the Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 4, 2016

|

|

GERDAU S.A. |

|

|

|

|

|

|

|

|

By: |

/s/ Harley Lorentz Scardoelli |

|

|

Name: |

Harley Lorentz Scardoelli |

|

|

Title: |

Investor Relations Director |

2

EXHIBIT INDEX

|

Exhibit |

|

Description of Exhibit |

|

|

|

|

|

99.1 |

|

Notice to the Market, March 4, 2016 |

3

Exhibit 99.1

NOTICE TO THE MARKET

Gerdau hereby informs the market that it received a letter from the New York Stock Exchange (NYSE) on February 4, stating that Gerdau ADR (“GGB”) was below US$ 1.00 considering the average closing price over a consecutive 30 trading-day period, which is under the NYSE criteria. Under NYSE rules, the company has six months from the date of the NYSE notice to regain compliance. During this period the company’s American Depositary Receipt, each representing one preferred share, will continue to be listed and traded on the NYSE, subject to the company’s compliance with other NYSE continued listing requirements.

Even though the steel sector is currently going through a highly volatile and challenging environment, the Company has been working on a series of initiatives, including the focus on free cash flow generation through restrictive Capex investments and a reduction in working capital, which could effectively unlock value in the short term. The Company believes these actions can recover the average share price to above US$ 1.00 during the cure period.

If the share price does not recover during that period, management will propose to the Gerdau S.A. Board a change in the GGBR4:GGB ratio from 1:1 to 3:1 or 4:1 before the end of the cure period.

Porto Alegre, March 04, 2016.

Harley Lorentz Scardoelli

Executive Vice President

Investor Relations Director

Gerdau (NYSE:GGB)

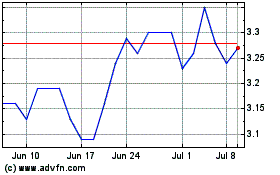

Historical Stock Chart

From Mar 2024 to Apr 2024

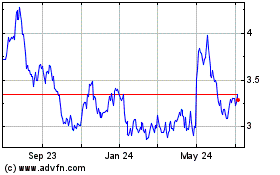

Gerdau (NYSE:GGB)

Historical Stock Chart

From Apr 2023 to Apr 2024