FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

Dated August 13, 2015

Commission File Number 1-14878

GERDAU S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

Av. Farrapos 1811

Porto Alegre, Rio Grande do Sul - Brazil CEP 90220-005

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused the Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: August 13, 2015 |

|

|

|

|

|

|

|

|

|

GERDAU S.A. |

|

|

|

|

|

|

|

|

By: |

/s/ Harley Lorentz Scardoelli |

|

|

Name: |

Harley Lorentz Scardoelli |

|

|

Title: |

Investor Relations Director |

2

EXHIBIT INDEX

|

Exhibit |

|

Description of Exhibit |

|

99.1 |

|

Quarterly Results—2Q 15 Gerdau S.A. and Subsidiaries August 12, 2015 |

3

Exhibit 99.1

Highlights in the second quarter of 2015

2Q15 Highlights

· Consolidated EBITDA and EBITDA margin were flat, despite oversupply in the world steel industry and adverse economic conditions in Brazil.

· Higher shipments and a better metal spread at the North America Business Operation in 2Q15 partially offset the weaker performance of the Brazil Business Operation, when compared to 1Q15.

· Reduction of 6.4% in selling, general and administrative expenses in the first six months of 2015 compared to the same period last year.

· Net Debt/EBITDA ratio stable at 3.1 times, compared to March 2015.

· Reduction of nine days in the cash conversion cycle compared to March 2015, mainly due to the reduction in inventories and the effects from exchange variation.

|

Key Information |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

Steel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production of Crude Steel (1,000 tonnes) |

|

4,431 |

|

4,668 |

|

-5.1 |

% |

4,341 |

|

2.1 |

% |

8,772 |

|

9,225 |

|

-4.9 |

% |

|

Shipments (1,000 tonnes) |

|

4,271 |

|

4,524 |

|

-5.6 |

% |

4,143 |

|

3.1 |

% |

8,414 |

|

8,911 |

|

-5.6 |

% |

|

Net Sales (R$ million) |

|

10,759 |

|

10,443 |

|

3.0 |

% |

10,447 |

|

3.0 |

% |

21,206 |

|

20,997 |

|

1.0 |

% |

|

SG&A (R$ million) |

|

(637 |

) |

(679 |

) |

-6.2 |

% |

(660 |

) |

-3.5 |

% |

(1,297 |

) |

(1,386 |

) |

-6.4 |

% |

|

EBITDA (R$ million) |

|

1,184 |

|

1,170 |

|

1.2 |

% |

1,089 |

|

8.7 |

% |

2,273 |

|

2,366 |

|

-3.9 |

% |

|

Net Income (R$ million) |

|

265 |

|

393 |

|

-32.6 |

% |

267 |

|

-0.7 |

% |

532 |

|

833 |

|

-36.1 |

% |

|

Gross margin |

|

11.0 |

% |

12.1 |

% |

|

|

10.6 |

% |

|

|

10.8 |

% |

12.3 |

% |

|

|

|

EBITDA Margin |

|

11.0 |

% |

11.2 |

% |

|

|

10.4 |

% |

|

|

10.7 |

% |

11.3 |

% |

|

|

|

Shareholders’ equity (R$ million) |

|

35,462 |

|

31,706 |

|

|

|

36,440 |

|

|

|

35,462 |

|

31,706 |

|

|

|

|

Total Assets (R$ million) |

|

68,778 |

|

57,894 |

|

|

|

70,843 |

|

|

|

68,778 |

|

57,894 |

|

|

|

|

Gross debt / Total capitalization (1) |

|

38.0 |

% |

34.0 |

% |

|

|

39.0 |

% |

|

|

38.0 |

% |

34.0 |

% |

|

|

|

Net debt(2) / EBITDA(3) |

|

3.1 |

x |

2.4 |

x |

|

|

3.2 |

x |

|

|

3.1 |

x |

2.4 |

x |

|

|

(1) - Total capitalization = shareholders’ equity + gross debt - interest on debt

(2) - Net debt = gross debt - interest on debt - cash, cash equivalents and short-term investments

(3) - EBITDA in the last 12 months.

World Steel Market

· On April 20, 2015, World Steel Association released its latest Short Range Outlook containing forecasts for global apparent steel consumption in 2015 and 2016, in which it estimated growth of 0.5% and 1.4%, respectively. The association expects moderate demand growth, which is explained by deceleration in China and the influence of structural adjustments in most economies due to limited investment growth post-2008. Apparent steel consumption in China is projected to contract by 0.5% in both 2015 and 2016, given the rebalancing of the economy for a new stage of development. Demand growth in emerging and developing economies (excluding China) should remain weak in 2015, though positive growth is expected in certain economies, such as India, Indonesia, Vietnam and Egypt, where local steel markets are still developing. In these economies, apparent steel consumption should grow by 2.4% in 2015 and 4.0% in 2016. Growth in developed economies should be moderate in 2015, due to the strong base and the less favorable environment for steel in certain countries. The recovery in the European Union remains moderate, given the low investment activity and high unemployment. Apparent steel consumption in developed economies is expected to grow by 0.2% in 2015 and 1.8% in 2016.

1

Consolidated Information

Gerdau’s performance in the second quarter of 2015

The Consolidated Financial Statements of Gerdau S.A. are presented in accordance with the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB) and the accounting practices adopted in Brazil, which are fully aligned with the international accounting standards issued by the Accounting Pronouncement Committee (CPC).

The information in this report does not include data for jointly controlled entities and associate companies, except where stated otherwise.

Consolidated Results

Production and shipments

|

Consolidated

(1,000 tonnes) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

Production of crude steel |

|

4,431 |

|

4,668 |

|

-5.1 |

% |

4,341 |

|

2.1 |

% |

8,772 |

|

9,225 |

|

-4.9 |

% |

|

Shipments of steel |

|

4,271 |

|

4,524 |

|

-5.6 |

% |

4,143 |

|

3.1 |

% |

8,414 |

|

8,911 |

|

-5.6 |

% |

· Consolidated crude steel production decreased in 2Q15 in relation to 2Q14, mainly in the North America and Special Steel Business Operations, due to the adjustment of inventories in the period.

· Consolidated shipments decreased in 2Q15 compared to 2Q14, reflecting lower shipments, particularly in the North America and Special Steel Business Operations. Compared to 1Q15, shipments increased, mainly due to the better performance of the North America Business Operation.

Net sales, cost and gross margin

|

Consolidated

(R$ million) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

Net Sales |

|

10,759 |

|

10,443 |

|

3.0 |

% |

10,447 |

|

3.0 |

% |

21,206 |

|

20,997 |

|

1.0 |

% |

|

Cost of Goods Sold |

|

(9,578 |

) |

(9,179 |

) |

4.3 |

% |

(9,335 |

) |

2.6 |

% |

(18,913 |

) |

(18,417 |

) |

2.7 |

% |

|

Gross profit |

|

1,181 |

|

1,264 |

|

-6.6 |

% |

1,112 |

|

6.2 |

% |

2,293 |

|

2,580 |

|

-11.1 |

% |

|

Gross margin (%) |

|

11.0 |

% |

12.1 |

% |

|

|

10.6 |

% |

|

|

10.8 |

% |

12.3 |

% |

|

|

· Consolidated net sales increased in 2Q15 compared to 2Q14, reflecting the effects from exchange variation, despite the lower shipments in the period. Compared to 1Q15, consolidated net sales increased, mainly due to higher shipments.

· On a consolidated basis, gross profit and gross margin decreased in 2Q15 compared to 2Q14, due to the weaker performance of the Brazil BO, which was partially offset by the better performance of the North America BO, reflecting the Company’s geographic diversification. Compared to 1Q15, consolidated gross profit and gross margin increased, mainly due to the better performance of the North America BO, which more than offset the lower gross margin at the Brazil BO.

Operating expenses

|

Consolidated

(R$ million) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half

2015 |

|

1st Half

2014 |

|

Variation

1H15/1H14 |

|

|

SG&A |

|

(637 |

) |

(679 |

) |

-6.2 |

% |

(660 |

) |

-3.5 |

% |

(1,297 |

) |

(1,386 |

) |

-6.4 |

% |

|

Selling expenses |

|

(185 |

) |

(180 |

) |

2.8 |

% |

(180 |

) |

2.8 |

% |

(365 |

) |

(353 |

) |

3.4 |

% |

|

General and administrative expenses |

|

(452 |

) |

(499 |

) |

-9.4 |

% |

(480 |

) |

-5.8 |

% |

(932 |

) |

(1,033 |

) |

-9.8 |

% |

|

Other operating income (expenses) |

|

6 |

|

17 |

|

-64.7 |

% |

27 |

|

-77.8 |

% |

33 |

|

36 |

|

-8.3 |

% |

|

Equity in earnings of unconsolidated companies |

|

7 |

|

27 |

|

-74.1 |

% |

7 |

|

0.0 |

% |

14 |

|

54 |

|

-74.1 |

% |

· General and administrative expenses decreased in 2Q15 compared to 2Q14 and 1Q15, demonstrating the Company’s efforts over the course of the periods to rationalize these expenses and despite the effects from

2

exchange variation in the comparison periods. These efforts led to a reduction in selling, general and administrative expenses as a ratio of net sales, from 6.5% in 2Q14 to 6.3% in 1Q15 and 5.9% in 2Q15.

EBITDA

|

Breakdown of Consolidated EBITDA (1)

(R$ million) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

Net income |

|

265 |

|

393 |

|

-32.6 |

% |

267 |

|

-0.7 |

% |

532 |

|

833 |

|

-36.1 |

% |

|

Net financial result |

|

207 |

|

211 |

|

-1.9 |

% |

898 |

|

-76.9 |

% |

1,105 |

|

312 |

|

254.2 |

% |

|

Provision for income and social contribution taxes |

|

86 |

|

25 |

|

244.0 |

% |

(680 |

) |

— |

|

(594 |

) |

138 |

|

— |

|

|

Depreciation and amortization |

|

626 |

|

541 |

|

15.7 |

% |

604 |

|

3.6 |

% |

1,230 |

|

1,083 |

|

13.6 |

% |

|

EBITDA (1) |

|

1,184 |

|

1,170 |

|

1.2 |

% |

1,089 |

|

8.7 |

% |

2,273 |

|

2,366 |

|

-3.9 |

% |

|

EBITDA Margin |

|

11.0 |

% |

11.2 |

% |

|

|

10.4 |

% |

|

|

10.7 |

% |

11.3 |

% |

|

|

(1) - Non-accounting measurement calculated pursuant to Instruction 527 of the CVM.

Note: EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is not a method used in accounting practices, does not represent cash flow for the periods in question and should not be considered an alternative to cash flow as an indicator of liquidity. The Company’s EBITDA is already calculated pursuant to Instruction 527 of the CVM.

|

Conciliation of Consolidated EBITDA

(R$ million) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

1st Quarter

2015 |

|

1st Half 2015 |

|

1st Half 2014 |

|

|

EBITDA (1) |

|

1,184 |

|

1,170 |

|

1,089 |

|

2,273 |

|

2,366 |

|

|

Depreciation and amortization |

|

(626 |

) |

(541 |

) |

(604 |

) |

(1,230 |

) |

(1,083 |

) |

|

OPERATING INCOME BEFORE FINANCIAL RESULT AND TAXES (2) |

|

558 |

|

629 |

|

485 |

|

1,043 |

|

1,283 |

|

(1) - Non-accounting measure calculated pursuant to Instruction 527 of the CVM.

(2) - Accounting measurement disclosed in consolidated Statements of Income.

Consolidated EBITDA (R$ million) and EBITDA Margin (%)

· EBITDA and EBITDA margin were flat in 2Q15 compared to 2Q14, due to the reduction in selling, general and administrative expenses and despite the reduction in gross margin, which was also affected by the higher depreciation. Specifically in the comparison with 1Q15, EBITDA and EBITDA margin increased, accompanying the performance of gross profit and gross margin.

Net financial result and net income

|

Consolidated

(R$ million) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

Income before financial income (expenses) and taxes (1) |

|

558 |

|

629 |

|

-11.3 |

% |

485 |

|

15.1 |

% |

1,043 |

|

1,283 |

|

-18.7 |

% |

|

Financial Result |

|

(207 |

) |

(211 |

) |

-1.9 |

% |

(898 |

) |

-76.9 |

% |

(1,105 |

) |

(312 |

) |

254.2 |

% |

|

Financial income |

|

95 |

|

89 |

|

6.7 |

% |

109 |

|

-12.8 |

% |

204 |

|

151 |

|

35.1 |

% |

|

Financial expenses |

|

(394 |

) |

(371 |

) |

6.2 |

% |

(372 |

) |

5.9 |

% |

(766 |

) |

(660 |

) |

16.1 |

% |

|

Exchange variation, net |

|

94 |

|

76 |

|

23.7 |

% |

(651 |

) |

— |

|

(557 |

) |

204 |

|

— |

|

|

Exchange variation on net investment hedge |

|

111 |

|

63 |

|

76.2 |

% |

(575 |

) |

— |

|

(464 |

) |

146 |

|

— |

|

|

Exchange variation - other lines |

|

(17 |

) |

13 |

|

— |

|

(76 |

) |

-77.6 |

% |

(93 |

) |

58 |

|

— |

|

|

Gains (losses) on financial instruments, net |

|

(2 |

) |

(5 |

) |

-60.0 |

% |

16 |

|

— |

|

14 |

|

(7 |

) |

— |

|

|

Income before taxes (1) |

|

351 |

|

418 |

|

-16.0 |

% |

(413 |

) |

— |

|

(62 |

) |

971 |

|

— |

|

|

Income and social contribution taxes |

|

(86 |

) |

(25 |

) |

244.0 |

% |

680 |

|

— |

|

594 |

|

(138 |

) |

— |

|

|

On net investment hedge |

|

(111 |

) |

(63 |

) |

76.2 |

% |

575 |

|

— |

|

464 |

|

(146 |

) |

— |

|

|

Other lines |

|

25 |

|

38 |

|

-34.2 |

% |

105 |

|

-76.2 |

% |

130 |

|

8 |

|

1525.0 |

% |

|

Consolidated Net Income (1) |

|

265 |

|

393 |

|

-32.6 |

% |

267 |

|

-0.7 |

% |

532 |

|

833 |

|

-36.1 |

% |

(1) - Includes the results from jointly controlled entities and associate companies based on the equity income method.

· In 2Q15 compared to 2Q14, the relative stability in the financial result reflects the positive exchange variation on liabilities contracted in U.S. dollar (appreciation in the end-of-period price of the Brazilian real against the U.S.

3

dollar of 3.3% in 2Q15, versus appreciation of 2.7% in 2Q14) and the higher financial expenses resulting from the increase in gross debt in the comparison periods.

· The lower negative financial result in 2Q15 compared to 1Q15, is mainly explained by the higher negative exchange variation in 1Q15 (appreciation in the end-of-period price of the Brazilian real against the U.S. dollar of 3.3% in 2Q15 versus depreciation of 20.8% in 1Q15).

· Note that, in accordance with IFRS, the Company designated the bulk of its debt in foreign currency contracted by companies in Brazil as hedge for a portion of the investments in subsidiaries located abroad. As a result, only the effect from exchange variation on the portion of debt not linked to investment hedge is recognized in the financial result, with this effect neutralized by the line “Income and Social Contribution taxes on net investment hedge.”

· Consolidated net income decreased in 2Q15 compared to 2Q14, mainly due to lower operating income and higher financial expenses. Compared to 1Q15, the relative stability in net income was due to the operating income growth offsetting the higher income tax.

Dividends

· Gerdau S.A., based on the results in 2Q15, approved the prepayment of the minimum mandatory dividend, in the form of interest on capital, of R$ 84.3 million (R$ 0.05 per share).

Payment date: September 4, 2015

Record date: close of trading on August 24, 2015

Ex-dividend date: August 25, 2015

· In the first six months of 2015, Gerdau S.A. distributed R$ 185.5 million in the form of interest on capital.

Investments

· In 2Q15, investments in CAPEX amounted to R$ 648.2 million. Of the amount invested in the quarter, 41.2% was allocated to the Brazil BO, 27.8% to the Latin America BO, 15.1% to the Special Steel BO, 12.6% to the North America BO and 3.3% to the Iron Ore BO.

Working Capital and Cash Conversion Cycle

· In June 2015, the cash conversion cycle (working capital divided by daily net sales in the quarter) decreased in relation to March 2015, reflecting the 6.0% decrease in working capital, mainly due to the reduction in inventories and the effects from exchange variation, which compares with the 3.0% increase in net sales.

4

Financial Liabilities

|

Debt composition

(R$ million) |

|

06.30.2015 |

|

03.31.2015 |

|

12.31.2014 |

|

|

Short Term |

|

2,584 |

|

2,366 |

|

2,038 |

|

|

Long Term |

|

19,982 |

|

20,916 |

|

17,484 |

|

|

Gross Debt |

|

22,566 |

|

23,282 |

|

19,522 |

|

|

Cash, cash equivalents and short-term investments |

|

5,690 |

|

5,847 |

|

5,849 |

|

|

Net Debt |

|

16,876 |

|

17,435 |

|

13,673 |

|

· On June 30, 2015, 11.5% of gross debt was short term and 88.5% long term. Gross debt was 17.9% denominated in Brazilian real, 76.0% in U.S. dollar and 6.1% in other currencies. The R$ 716 million decrease in gross debt between March 2015 and June 2015 is mainly explained by the effects from exchange variation in the period.

· On June 30, 2015, 47.9% of the cash was held by Gerdau companies abroad and denominated mainly in U.S. dollar.

· The decrease in net debt on June 30, 2015 compared to March 31, 2015, was due to the effects on gross debt from exchange variation in the period.

· On June 30, 2015, the nominal weighted average cost of gross debt was 6.7%, or 10.8% for the portion denominated in Brazilian real, 6.0% plus exchange variation for the portion denominated in U.S. dollar contracted by companies in Brazil and 5.9% for the portion contracted by subsidiaries abroad. On June 30, 2015, the average gross debt term was 6.6 years, with 70% maturing only as of 2018.

· The Company’s main debt indicators are shown below:

|

Indicators |

|

06.30.2015 |

|

03.31.2015 |

|

12.31.2014 |

|

|

Gross debt / Total capitalization (1) |

|

38 |

% |

39 |

% |

36 |

% |

|

Net debt(2) / EBITDA (3) |

|

3.1 |

x |

3.2 |

x |

2.4 |

x |

(1) - Total capitalization = shareholders’ equity + gross debt- interest on debt

(2) - Net debt = gross debt - interest on debt - cash, cash equivalents and short-term investments

(3) - EBITDA in the last 12 months.

Indebtedness

(R$ billion)

· On June 30, 2015, the payment schedule for long-term gross debt (principal) was as follows:

|

Long Term |

|

R$ million |

|

|

2016 |

|

439 |

|

|

2017 |

|

3,726 |

|

|

2018 |

|

1,169 |

|

|

2019 |

|

877 |

|

|

2020 |

|

2,738 |

|

|

2021 and after |

|

11,033 |

|

|

Total |

|

19,982 |

|

5

Business Operations (BO)

The information in this report is divided into five Business Operations (BO), in accordance with Gerdau’s corporate governance, as follows:

· Brazil BO — includes the steel operations in Brazil (except special steel) and the metallurgical and coking coal operation in Colombia;

· North America BO — includes all North American operations, except Mexico and special steel;

· Latin America BO — includes all Latin American operations, except the operations in Brazil and the metallurgical and coking coal operation in Colombia;

· Special Steel BO — includes the special steel operations in Brazil, Spain, United States and India;

· Iron Ore BO — includes the iron ore operations in Brazil.

On July 14, 2015, the Company announced a new structure of the Business Operations, which will take effect as of the third quarter of 2015. The earnings release for 2Q15 is presented still in accordance with the structure described above.

Net Sales

6

EBITDA and EBITDA Margin

Brazil BO

Production and shipments

|

Brazil BO

(1,000 tonnes) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

Production of crude steel |

|

1,660 |

|

1,621 |

|

2.4 |

% |

1,528 |

|

8.6 |

% |

3,188 |

|

3,230 |

|

-1.3 |

% |

|

Shipments of steel |

|

1,568 |

|

1,588 |

|

-1.3 |

% |

1,557 |

|

0.7 |

% |

3,125 |

|

3,185 |

|

-1.9 |

% |

|

Domestic Market |

|

1,091 |

|

1,372 |

|

-20.5 |

% |

1,252 |

|

-12.9 |

% |

2,343 |

|

2,814 |

|

-16.7 |

% |

|

Exports |

|

477 |

|

216 |

|

120.8 |

% |

305 |

|

56.4 |

% |

782 |

|

371 |

|

110.8 |

% |

· Crude steel production increased in 2Q15 compared to both 2Q14 and 1Q15, reflecting the higher production of semi-finished products for export. On the other hand, rolled steel production declined in both comparison periods, reflecting the adjustment to the weaker level of demand in the Brazilian steel market.

· Shipments in the domestic market in 2Q15 decreased compared to both 2Q14 and 1Q15, reflecting the weaker growth in the construction and manufacturing industries due to economic uncertainties. Higher exports offset the lower shipments in the domestic market in the comparison periods.

Operating result

|

Brazil BO

(R$ million) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

Net Sales |

|

3,199 |

|

3,446 |

|

-7.2 |

% |

3,266 |

|

-2.1 |

% |

6,465 |

|

7,101 |

|

-9.0 |

% |

|

Domestic Market |

|

2,544 |

|

3,105 |

|

-18.1 |

% |

2,776 |

|

-8.4 |

% |

5,320 |

|

6,465 |

|

-17.7 |

% |

|

Exports(1) |

|

655 |

|

341 |

|

92.1 |

% |

490 |

|

33.7 |

% |

1,145 |

|

636 |

|

80.0 |

% |

|

Cost of Goods Sold |

|

(2,779 |

) |

(2,852 |

) |

-2.6 |

% |

(2,763 |

) |

0.6 |

% |

(5,542 |

) |

(5,758 |

) |

-3.8 |

% |

|

Gross profit |

|

420 |

|

594 |

|

-29.3 |

% |

503 |

|

-16.5 |

% |

923 |

|

1,343 |

|

-31.3 |

% |

|

Gross margin (%) |

|

13.1 |

% |

17.2 |

% |

|

|

15.4 |

% |

|

|

14.3 |

% |

18.9 |

% |

|

|

|

EBITDA |

|

446 |

|

598 |

|

-25.4 |

% |

515 |

|

-13.4 |

% |

961 |

|

1,328 |

|

-27.6 |

% |

|

EBITDA margin (%) |

|

13.9 |

% |

17.4 |

% |

|

|

15.8 |

% |

|

|

14.9 |

% |

18.7 |

% |

|

|

(1) - Includes coking coal and coke net sales.

· The lower net sales in 2Q15 compared to both 2Q14 and 1Q15 was mainly due to lower shipments in the domestic market, despite the improvement in net sales per tonne sold. The increase in export shipments did not offset the reduction in net sales from the domestic market, given the lower prices practiced in the international market.

7

· Cost of goods sold decreased in 2Q15 compared to 2Q14, accompanying the lower shipments in the period. The decrease in net sales at a faster pace than the decrease in cost of goods sold led to gross margin compression in the period. Compared to 1Q15, the decrease in gross margin is mainly explained by the lower margins on exports.

· EBITDA and EBITDA margin in 2Q15 accompanied the declines in gross profit and gross margin in comparison with both 2Q14 and 1Q15.

EBITDA (R$ million) and EBITDA Margin (%)

8

North America BO

Production and shipments

|

North America BO

(1,000 tonnes) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production of crude steel |

|

1,588 |

|

1,787 |

|

-11.1 |

% |

1,546 |

|

2.7 |

% |

3,134 |

|

3,436 |

|

-8.8 |

% |

|

Shipments of steel |

|

1,547 |

|

1,652 |

|

-6.4 |

% |

1,393 |

|

11.1 |

% |

2,940 |

|

3,104 |

|

-5.3 |

% |

· Production decreased in 2Q15 compared to 2Q14, due to the lower shipments and efforts to optimize inventories. Compared to 1Q15, the increase in production was mainly due to the higher shipments.

· Shipments decreased in 2Q15 compared to 2Q14, due to strong shipments recorded in 2Q14 (pent-up volumes in 1Q14 due to the severe winter) and the pressure from imported products in the region. Compared to 1Q15, the growth in shipments mainly reflects the ongoing improvement in demand from the non-residential construction industry.

Operating result

|

North America BO

(R$ million) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

Net Sales |

|

4,118 |

|

3,581 |

|

15.0 |

% |

3,648 |

|

12.9 |

% |

7,766 |

|

6,839 |

|

13.6 |

% |

|

Cost of Goods Sold |

|

(3,700 |

) |

(3,304 |

) |

12.0 |

% |

(3,423 |

) |

8.1 |

% |

(7,123 |

) |

(6,463 |

) |

10.2 |

% |

|

Gross profit |

|

418 |

|

277 |

|

50.9 |

% |

225 |

|

85.8 |

% |

643 |

|

376 |

|

71.0 |

% |

|

Gross margin (%) |

|

10.2 |

% |

7.7 |

% |

|

|

6.2 |

% |

|

|

8.3 |

% |

5.5 |

% |

|

|

|

EBITDA |

|

413 |

|

281 |

|

47.0 |

% |

226 |

|

82.7 |

% |

639 |

|

351 |

|

82.1 |

% |

|

EBITDA margin (%) |

|

10.0 |

% |

7.8 |

% |

|

|

6.2 |

% |

|

|

8.2 |

% |

5.1 |

% |

|

|

· Net sales increased in 2Q15 compared to 2Q14, mainly due to the effect from exchange variation (37.8% depreciation in the average price of the Brazilian real against the U.S. dollar), despite the lower shipments. Compared to 1Q15, net sales increased, due to higher shipments and the effect from exchange variation in the period (7.1% depreciation in the average price of the Brazilian real against the U.S. dollar), despite the lower net sales per tonne sold in U.S. dollar.

· Cost of goods sold increased in 2Q15 compared to both 2Q14 and 1Q15 at a slower pace than the increase in net sales, due to lower scrap costs, which supported gross margin expansion in the comparison periods. Specifically compared to 1Q15, the growth in shipments and resulting dilution of fixed costs also supported gross margin expansion in 2Q15.

· The higher EBITDA recorded in 2Q15 compared to both 2Q14 and 1Q15 is explained by the increase in gross profit, which supported EBITDA margin expansion.

EBITDA (R$ million) and EBITDA Margin (%)

9

Latin America BO

Production and shipments

|

Latin America BO

(1,000 tonnes) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

Production of crude steel |

|

415 |

|

399 |

|

4.0 |

% |

408 |

|

1.7 |

% |

823 |

|

840 |

|

-2.0 |

% |

|

Shipments of steel |

|

634 |

|

631 |

|

0.5 |

% |

634 |

|

0.0 |

% |

1,268 |

|

1,312 |

|

-3.4 |

% |

· Production and shipments in 2Q15 remained relatively flat compared to both 2Q14 and 1Q15, with performances varying in the countries where Gerdau operates, despite the high level of imports into the region.

Operating result

|

Latin America BO

(R$ million) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

Net Sales |

|

1,429 |

|

1,302 |

|

9.8 |

% |

1,509 |

|

-5.3 |

% |

2,938 |

|

2,701 |

|

8.8 |

% |

|

Cost of Goods Sold |

|

(1,280 |

) |

(1,154 |

) |

10.9 |

% |

(1,341 |

) |

-4.5 |

% |

(2,621 |

) |

(2,368 |

) |

10.7 |

% |

|

Gross profit |

|

149 |

|

148 |

|

0.7 |

% |

168 |

|

-11.3 |

% |

317 |

|

333 |

|

-4.8 |

% |

|

Gross margin (%) |

|

10.4 |

% |

11.4 |

% |

|

|

11.1 |

% |

|

|

10.8 |

% |

12.3 |

% |

|

|

|

EBITDA |

|

118 |

|

109 |

|

8.3 |

% |

140 |

|

-15.7 |

% |

258 |

|

252 |

|

2.4 |

% |

|

EBITDA margin (%) |

|

8.3 |

% |

8.4 |

% |

|

|

9.3 |

% |

|

|

8.8 |

% |

9.3 |

% |

|

|

· Net sales and cost of goods sold increased in 2Q15 compared to 2Q14, which is explained by the effect from exchange variation resulting from the depreciation in the average price of the Brazilian real against the currencies of the countries where Gerdau operates. Compared to 1Q15, the decrease in net sales and cost of goods sold was also due to the effects from exchange variation, though, in this case, due to the appreciation in the average price of the Brazilian real against the other currencies.

· Gross margin decreased in 2Q15 compared to both 2Q14 and 1Q15, mainly due to the decline in international prices.

· EBITDA and EBITDA margin remained relatively flat in 2Q15 compared to 2Q14, despite the decrease in gross margin, by the reduction on operating expenses. Compared to 1Q15, EBITDA and EBITDA margin decreased, accompanying the performance of gross profit and gross margin.

EBITDA (R$ million) and EBITDA Margin (%)

10

Special Steel BO

Production and shipments

|

Special Steel BO

(1,000 tonnes) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

Production of crude steel |

|

768 |

|

861 |

|

-10.8 |

% |

859 |

|

-10.6 |

% |

1,627 |

|

1,719 |

|

-5.4 |

% |

|

Shipments of steel |

|

700 |

|

749 |

|

-6.5 |

% |

696 |

|

0.6 |

% |

1,396 |

|

1,507 |

|

-7.4 |

% |

· Crude steel production decreased in 2Q15 compared to both 2Q14 and 1Q15, due to the adjustment of inventories in Brazil and the United States.

· Shipments decreased in 2Q15 compared to 2Q14, which is explained by the sharp drop in demand in Brazil and by the learning curve of the new rolling mill in Monroe, United States.

Operating result

|

Special Steel BO

(R$ million) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

Net Sales |

|

2,257 |

|

2,182 |

|

3.4 |

% |

2,246 |

|

0.5 |

% |

4,503 |

|

4,445 |

|

1.3 |

% |

|

Cost of Goods Sold |

|

(2,102 |

) |

(1,989 |

) |

5.7 |

% |

(2,036 |

) |

3.2 |

% |

(4,138 |

) |

(4,090 |

) |

1.2 |

% |

|

Gross profit |

|

155 |

|

193 |

|

-19.7 |

% |

210 |

|

-26.2 |

% |

365 |

|

355 |

|

2.8 |

% |

|

Gross margin (%) |

|

6.9 |

% |

8.8 |

% |

|

|

9.3 |

% |

|

|

8.1 |

% |

8.0 |

% |

|

|

|

EBITDA |

|

215 |

|

230 |

|

-6.5 |

% |

260 |

|

-17.3 |

% |

475 |

|

433 |

|

9.7 |

% |

|

EBITDA margin (%) |

|

9.5 |

% |

10.5 |

% |

|

|

11.6 |

% |

|

|

10.5 |

% |

9.7 |

% |

|

|

· Net sales increased in 2Q15 compared to 2Q14, despite lower shipments, due to the effects from exchange variation on shipments at the units abroad and the increase in net sales per tonne sold at the units in Brazil. Compared to 1Q15, net sales remained relatively flat, with varying performances in the different regions in which Gerdau has operations.

· Cost of goods sold increased in 2Q15 compared to 2Q14, mainly due to the effects from exchange variation on special steel operations at the units abroad, despite the lower shipments. The decrease in gross margin was mainly due to the lower dilution of fixed costs and the less favorable geographic mix. Compared to 1Q15, cost of goods sold increased, mainly due to the effects from exchange variation. The decrease in gross margin in 2Q15 compared to 1Q15 is mainly explained by the less favorable geographic mix.

· EBITDA and EBITDA margin decreased in 2Q15 compared to both 2Q14 and 1Q15, accompanying the performance of gross profit and gross margin.

EBITDA (R$ million) and EBITDA Margin (%)

11

Iron Ore BO

Production and shipments

|

Iron Ore BO

(1,000 tonnes) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half 2015 |

|

1st Half 2014 |

|

Variation

1H15/1H14 |

|

|

Production |

|

2,060 |

|

1,988 |

|

3.6 |

% |

1,481 |

|

39.1 |

% |

3,541 |

|

3,724 |

|

-4.9 |

% |

|

Shipments |

|

1,965 |

|

1,735 |

|

13.3 |

% |

1,463 |

|

34.3 |

% |

3,428 |

|

3,735 |

|

-8.2 |

% |

|

Gerdau units |

|

1,394 |

|

1,020 |

|

36.7 |

% |

1,164 |

|

19.8 |

% |

2,558 |

|

1,832 |

|

39.6 |

% |

|

Third parties |

|

571 |

|

715 |

|

-20.1 |

% |

299 |

|

91.0 |

% |

870 |

|

1,903 |

|

-54.3 |

% |

· Production increased in 2Q15 compared to 2Q14, though at a slower pace than the increase in shipments, reflecting the adjustment in inventories. Compared to 1Q15, production increased in line with shipments in the period.

· Shipments increased in 2Q15 compared to 2Q14, mainly due to the higher volumes shipped to Gerdau units. Compared to 1Q15, the increase in shipments is explained by higher shipments to Gerdau units, as well as the opportunities for iron ore shipments to third parties in the domestic market.

Operating result

|

Iron Ore BO

(R$ million) |

|

2nd Quarter

2015 |

|

2nd Quarter

2014 |

|

Variation

2Q15/2Q14 |

|

1st Quarter

2015 |

|

Variation

2Q15/1Q15 |

|

1st Half

2015 |

|

1st Half

2014 |

|

Variation

1H15/1H14 |

|

|

Net Sales |

|

170 |

|

216 |

|

-21.3 |

% |

125 |

|

36.0 |

% |

295 |

|

532 |

|

-44.5 |

% |

|

Gerdau units |

|

108 |

|

118 |

|

-8.5 |

% |

76 |

|

42.1 |

% |

184 |

|

223 |

|

-17.5 |

% |

|

Third parties |

|

62 |

|

98 |

|

-36.7 |

% |

49 |

|

26.5 |

% |

111 |

|

309 |

|

-64.1 |

% |

|

Cost of Goods Sold |

|

(127 |

) |

(165 |

) |

-23.0 |

% |

(119 |

) |

6.7 |

% |

(246 |

) |

(362 |

) |

-32.0 |

% |

|

Gross profit |

|

43 |

|

51 |

|

-15.7 |

% |

6 |

|

616.7 |

% |

49 |

|

170 |

|

-71.2 |

% |

|

Gross margin (%) |

|

25.3 |

% |

23.6 |

% |

|

|

4.8 |

% |

|

|

16.6 |

% |

32.0 |

% |

|

|

|

EBITDA |

|

44 |

|

53 |

|

-17.0 |

% |

6 |

|

633.3 |

% |

50 |

|

174 |

|

-71.3 |

% |

|

EBITDA margin (%) |

|

25.9 |

% |

24.5 |

% |

|

|

4.8 |

% |

|

|

16.9 |

% |

32.7 |

% |

|

|

· Net sales decreased in 2Q15 compared to 2Q14, which is explained by lower prices and lower iron ore shipments to third parties. Compared to 1Q15, the increase in net sales was mainly due to higher shipments.

· Cost of goods sold decreased in 2Q15 compared to 2Q14, due to lower shipments to third parties. Gross margin increased due to the better sales mix, with higher shipments to Gerdau units, and due to better cost of good sold. Compared to 1Q15, the gross margin expansion reflects the higher shipments to Gerdau units and opportunities for shipments to third parties in the domestic market.

· The variations in EBITDA and EBITDA margin in 2Q15 compared to both 2Q14 and 1Q15 accompanied the performance of gross profit and gross margin in the comparison periods.

EBITDA (R$ million) and EBITDA Margin (%)

12

Gerdau Day - NYSE

· On June 12, 2015, Gerdau held its first Gerdau Day event on the New York Stock Exchange, which attracted 91 participants from various areas: investors, sell-side analysts, fixed income analysts, investment bankers, etc. During the event, the public had an opportunity to learn about the strategy of Gerdau’s management and to ask questions about the evolution in the company’s various markets.

Advances in simplifying processes and the ownership structure

· As part of the initiatives required to adapt Gerdau to today’s highly competitive environment and to make progress in simplifying processes and the ownership structure, on July 14, the Company announced the following decisions:

· Change in the structure of the Business Operations: (a) the operations in Mexico and the Joint Ventures in the Dominican Republic, Guatemala and Mexico will become part of the North America Business Operation, which is currently formed by the long steel operations in Canada and the United States; (b) creation of the South America Business Operation, which will be formed by the long steel operations in Argentina, Chile, Colombia, Peru, Venezuela and Uruguay; (c) the Iron Ore operations will become part of the Brazil Business Operation, which is currently formed by the long and flat steel operations in Brazil and the metallurgical coal and coke operations in Colombia; (d) the Special Steel Business Operation will remain unchanged, which is formed by the special steel operations in Brazil, Spain, United States and India. These changes will be presented as of the earnings release for 3Q15;

· Gerdau S.A. will analyze the mergers of Seiva S.A. Florestas e Indústrias, Gerdau América Latina Participações S.A. and Itaguaí Comércio, Importação e Exportação Ltda. during the second half of 2015;

· The acquisition of minority interests in operating companies to support their future merger, based on a long-term view,

· Acquisition of minority shares in operating companies to support their future merger, based on a long-term vision, with benefits from the consolidation including the receipt of dividends, lower costs due to the simpler corporate structure and improving the company’s agility in the capital markets, such as tapping the bond market as a registered issuer. By concentrating these companies in Gerdau S.A., which already reports quarterly financial statements, we will significantly increase the speed with which we carry out international debt placements, which, given the volatility in these markets, could represent an important long-term reduction in debt costs.

THE MANAGEMENT

This document contains forward-looking statements. These statements are based on estimates, information or methods that may be incorrect or inaccurate and that may not occur. These estimates are also subject to risk, uncertainties and assumptions that include, among other factors: general economic, political and commercial conditions in Brazil and in the markets where we operate and existing and future government regulations. Potential investors are cautioned that these forward-looking statements do not constitute guarantees of future performance, given that they involve risks and uncertainties. Gerdau does not undertake and expressly waives any obligation to update any of these forward-looking statements, which are valid only on the date on which they were made.

13

GERDAU S.A.

CONSOLIDATED BALANCE SHEETS

In thousands of Brazilian reais (R$)

(Unaudited)

|

|

|

June 30, 2015 |

|

December 31, 2014 |

|

|

CURRENT ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

3,790,520 |

|

3,049,971 |

|

|

Short-term investments |

|

|

|

|

|

|

Held for Trading |

|

1,899,070 |

|

2,798,834 |

|

|

Trade accounts receivable - net |

|

4,999,957 |

|

4,438,676 |

|

|

Inventories |

|

9,532,157 |

|

8,866,888 |

|

|

Tax credits |

|

754,599 |

|

686,958 |

|

|

Income and social contribution taxes recoverable |

|

377,633 |

|

468,309 |

|

|

Unrealized gains on financial instruments |

|

54,620 |

|

41,751 |

|

|

Other current assets |

|

488,019 |

|

331,352 |

|

|

|

|

21,896,575 |

|

20,682,739 |

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

|

Tax credits |

|

83,332 |

|

78,412 |

|

|

Deferred income taxes |

|

3,606,538 |

|

2,567,189 |

|

|

Related parties |

|

61,975 |

|

80,920 |

|

|

Judicial deposits |

|

1,573,254 |

|

1,430,865 |

|

|

Other non-current assets |

|

371,634 |

|

375,732 |

|

|

Prepaid pension cost |

|

136,133 |

|

196,799 |

|

|

Investments in associates and jointly-controlled entities |

|

1,561,457 |

|

1,394,383 |

|

|

Goodwill |

|

14,406,701 |

|

12,556,404 |

|

|

Other Intangibles |

|

1,637,074 |

|

1,547,098 |

|

|

Property, plant and equipment, net |

|

23,443,774 |

|

22,131,789 |

|

|

|

|

46,881,872 |

|

42,359,591 |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

68,778,447 |

|

63,042,330 |

|

14

GERDAU S.A.

CONSOLIDATED BALANCE SHEETS

In thousands of Brazilian reais (R$)

(Unaudited)

|

|

|

June 30, 2015 |

|

December 31, 2014 |

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

Trade accounts payable |

|

3,569,376 |

|

3,236,356 |

|

|

Short-term debt |

|

2,583,775 |

|

2,037,869 |

|

|

Taxes payable |

|

426,126 |

|

405,490 |

|

|

Income and social contribution taxes payable |

|

202,048 |

|

388,920 |

|

|

Payroll and related liabilities |

|

659,455 |

|

668,699 |

|

|

Dividends payable |

|

— |

|

119,318 |

|

|

Employee benefits |

|

32,754 |

|

34,218 |

|

|

Environmental liabilities |

|

21,367 |

|

23,025 |

|

|

Other current liabilities |

|

624,840 |

|

858,901 |

|

|

|

|

8,119,741 |

|

7,772,796 |

|

|

|

|

|

|

|

|

|

NON-CURRENT LIABILITIES |

|

|

|

|

|

|

Long-term debt |

|

19,712,177 |

|

17,148,580 |

|

|

Debentures |

|

269,702 |

|

335,036 |

|

|

Deferred income taxes |

|

1,214,858 |

|

944,546 |

|

|

Unrealized losses on financial instruments |

|

3,618 |

|

8,999 |

|

|

Provision for tax, civil and labor liabilities |

|

1,729,114 |

|

1,576,355 |

|

|

Environmental liabilities |

|

101,279 |

|

93,396 |

|

|

Employee benefits |

|

1,489,794 |

|

1,272,631 |

|

|

Other non-current liabilities |

|

676,229 |

|

635,457 |

|

|

|

|

25,196,771 |

|

22,015,000 |

|

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

Capital |

|

19,249,181 |

|

19,249,181 |

|

|

Treasury stocks |

|

(389,379 |

) |

(233,142 |

) |

|

Capital reserves |

|

11,597 |

|

11,597 |

|

|

Retained earnings |

|

11,813,348 |

|

11,366,957 |

|

|

Operations with non-controlling interests |

|

(1,732,962 |

) |

(1,732,962 |

) |

|

Other reserves |

|

5,401,547 |

|

3,539,188 |

|

|

EQUITY ATTRIBUTABLE TO THE EQUITY HOLDERS OF THE PARENT |

|

34,353,332 |

|

32,200,819 |

|

|

|

|

|

|

|

|

|

NON-CONTROLLING INTERESTS |

|

1,108,603 |

|

1,053,715 |

|

|

|

|

|

|

|

|

|

EQUITY |

|

35,461,935 |

|

33,254,534 |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

68,778,447 |

|

63,042,330 |

|

15

GERDAU S.A.

CONSOLIDATED STATEMENTS OF INCOME

In thousands of Brazilian reais (R$)

(Unaudited)

|

|

|

For the three-month period ended |

|

For the six-month period ended |

|

|

|

|

June 30, 2015 |

|

June 30, 2014 |

|

June 30, 2015 |

|

June 30, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET SALES |

|

10,759,391 |

|

10,442,822 |

|

21,206,767 |

|

20,996,598 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

(9,577,977 |

) |

(9,179,154 |

) |

(18,913,500 |

) |

(18,417,178 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

1,181,414 |

|

1,263,668 |

|

2,293,267 |

|

2,579,420 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

(184,878 |

) |

(179,548 |

) |

(364,397 |

) |

(353,131 |

) |

|

General and administrative expenses |

|

(452,181 |

) |

(498,944 |

) |

(932,623 |

) |

(1,032,749 |

) |

|

Other operating income |

|

43,528 |

|

41,606 |

|

100,379 |

|

88,472 |

|

|

Other operating expenses |

|

(37,199 |

) |

(24,207 |

) |

(67,237 |

) |

(51,888 |

) |

|

Equity in earnings of unconsolidated companies |

|

7,267 |

|

26,990 |

|

13,802 |

|

53,623 |

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE FINANCIAL INCOME (EXPENSES) AND TAXES |

|

557,951 |

|

629,565 |

|

1,043,191 |

|

1,283,747 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial income |

|

94,512 |

|

88,659 |

|

203,628 |

|

150,707 |

|

|

Financial expenses |

|

(393,883 |

) |

(370,585 |

) |

(765,947 |

) |

(659,311 |

) |

|

Exchange variations, net |

|

94,392 |

|

76,315 |

|

(556,862 |

) |

203,993 |

|

|

Gain and losses on financial instruments, net |

|

(1,903 |

) |

(5,231 |

) |

13,734 |

|

(7,701 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

INCOME (LOSS) BEFORE TAXES |

|

351,069 |

|

418,723 |

|

(62,256 |

) |

971,435 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current |

|

(244,403 |

) |

(11,652 |

) |

(289,788 |

) |

(117,215 |

) |

|

Deferred |

|

157,808 |

|

(13,733 |

) |

883,879 |

|

(20,791 |

) |

|

Income and social contribution taxes |

|

(86,595 |

) |

(25,385 |

) |

594,091 |

|

(138,006 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

|

264,474 |

|

393,338 |

|

531,835 |

|

833,429 |

|

|

|

|

|

|

|

|

|

|

|

|

|

ATTRIBUTABLE TO: |

|

|

|

|

|

|

|

|

|

|

Owners of the parent |

|

255,628 |

|

356,455 |

|

548,690 |

|

753,679 |

|

|

Non-controlling interests |

|

8,846 |

|

36,883 |

|

(16,855 |

) |

79,750 |

|

|

|

|

264,474 |

|

393,338 |

|

531,835 |

|

833,429 |

|

16

GERDAU S.A.

CONSOLIDATED STATEMENTS OF CASH FLOWS

In thousands of Brazilian reais (R$)

(Unaudited)

|

|

|

For the six-month period ended |

|

|

|

|

June 30, 2015 |

|

June 30, 2014 |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities |

|

|

|

|

|

|

Net income for the period |

|

531,835 |

|

833,429 |

|

|

Adjustments to reconcile net income for the period to net cash provided by operating activities |

|

|

|

|

|

|

Depreciation and amortization |

|

1,229,583 |

|

1,081,899 |

|

|

Equity in earnings of unconsolidated companies |

|

(13,802 |

) |

(53,623 |

) |

|

Exchange variation, net |

|

556,862 |

|

(203,993 |

) |

|

(Gains) Losses on financial instruments, net |

|

(13,734 |

) |

7,701 |

|

|

Post-employment benefits |

|

122,141 |

|

80,893 |

|

|

Stock based remuneration |

|

28,424 |

|

18,051 |

|

|

Income and social contribution taxes |

|

(594,091 |

) |

138,006 |

|

|

Gains on disposal of property, plant and equipment and investments, net |

|

(3,057 |

) |

(28,779 |

) |

|

Allowance for doubtful accounts |

|

38,983 |

|

25,349 |

|

|

Provision for tax, labor and civil claims |

|

162,928 |

|

144,716 |

|

|

Interest income on trading securities |

|

(95,502 |

) |

(71,747 |

) |

|

Interest expense on loans |

|

689,562 |

|

579,202 |

|

|

Interest on loans with related parties |

|

(1,752 |

) |

(1,995 |

) |

|

Reversal for net realizable value adjustment in inventory |

|

(18,368 |

) |

(5,861 |

) |

|

|

|

2,620,012 |

|

2,543,248 |

|

|

Changes in assets and liabilities |

|

|

|

|

|

|

Increase in trade accounts receivable |

|

(37,619 |

) |

(497,714 |

) |

|

Decrease (Increase) in inventories |

|

38,494 |

|

(882,577 |

) |

|

(Decrease) Increase in trade accounts payable |

|

(57,405 |

) |

401,136 |

|

|

Increase in other receivables |

|

(383,295 |

) |

(190,769 |

) |

|

Decrease in other payables |

|

(230,614 |

) |

(290,622 |

) |

|

Dividends from associates and jointly-controlled entities |

|

30,706 |

|

44,408 |

|

|

Purchases of trading securities |

|

(580,350 |

) |

(1,434,416 |

) |

|

Proceeds from maturities and sales of trading securities |

|

1,657,601 |

|

2,272,092 |

|

|

Cash provided by operating activities |

|

3,057,530 |

|

1,964,786 |

|

|

|

|

|

|

|

|

|

Interest paid on loans and financing |

|

(446,675 |

) |

(470,978 |

) |

|

Income and social contribution taxes paid |

|

(385,022 |

) |

(212,487 |

) |

|

Net cash provided by operating activities |

|

2,225,833 |

|

1,281,321 |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

Additions to property, plant and equipment |

|

(1,260,537 |

) |

(1,155,421 |

) |

|

Proceeds from sales of property, plant and equipment, investments and other intangibles |

|

6,906 |

|

41,859 |

|

|

Additions to other intangibles |

|

(33,507 |

) |

(31,028 |

) |

|

Payment for business acquisitions |

|

(20,929 |

) |

— |

|

|

Capital increase in jointly-controlled entity |

|

(40,524 |

) |

— |

|

|

Net cash used in investing activities |

|

(1,348,591 |

) |

(1,144,590 |

) |

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

Purchase of treasury shares |

|

(189,071 |

) |

— |

|

|

Proceeds from exercise of shares |

|

— |

|

3,635 |

|

|

Dividends and interest on capital paid |

|

(208,829 |

) |

(236,588 |

) |

|

Proceeds from loans and financing |

|

1,324,900 |

|

1,968,026 |

|

|

Repayment of loans and financing |

|

(1,243,682 |

) |

(1,266,853 |

) |

|

Intercompany loans, net |

|

20,503 |

|

12,167 |

|

|

Net cash (used) provided in financing activities |

|

(296,179 |

) |

480,387 |

|

|

|

|

|

|

|

|

|

Exchange variation on cash and cash equivalents |

|

159,486 |

|

(88,281 |

) |

|

|

|

|

|

|

|

|

Increase in cash and cash equivalents |

|

740,549 |

|

528,837 |

|

|

Cash and cash equivalents at beginning of period |

|

3,049,971 |

|

2,099,224 |

|

|

Cash and cash equivalents at end of period |

|

3,790,520 |

|

2,628,061 |

|

17

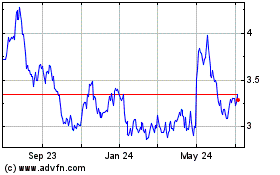

Gerdau (NYSE:GGB)

Historical Stock Chart

From Mar 2024 to Apr 2024

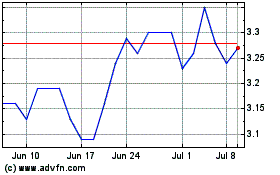

Gerdau (NYSE:GGB)

Historical Stock Chart

From Apr 2023 to Apr 2024