FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

Dated March 6, 2015

Commission File Number 1-14878

GERDAU S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

Av. Farrapos 1811

Porto Alegre, Rio Grande do Sul - Brazil CEP 90220-005

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused the Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 6, 2015

|

|

GERDAU S.A. |

|

|

|

|

|

|

|

|

By: |

/s/ André Pires de Oliveira Dias |

|

|

Name: |

André Pires de Oliveira Dias |

|

|

Title: |

Executive Vice President Investor Relations Officer |

|

|

|

2

EXHIBIT INDEX

|

Exhibit |

|

Description of Exhibit |

|

|

|

|

|

99.1 |

|

Quarterly Results—4Q 14, March 4, 2015 |

|

99.2 |

|

Management Report 2014, March 4, 2015 |

|

99.3 |

|

Notice to Shareholders—Payment of Dividends, March 4, 2015 |

3

Exhibit 99.1

Mission

To create value for our customers, shareholders, employees and communities by operating as a sustainable steel business.

Vision

To be a global organization and a benchmark in any business we conduct.

Values

Be the CUSTOMER’S choice

SAFETY above all

Respected, engaged and fulfilled EMPLOYEES

Pursuing EXCELLENCE with SIMPLICITY

Focus on RESULTS

INTEGRITY with all stakeholders

Economic, social and environmental SUSTAINABILITY

Gerdau is the leading manufacturer of long steel in the Americas and a major global supplier of special steel. In Brazil, also produces flat steel and iron ore, activities that are expanding its product mix and the competitiveness of its operations. Gerdau has industrial operations in 14 countries — the Americas, Europe and Asia — with a combined installed capacity of more than 25 million tonnes of steel a year. It is also Latin America’s biggest recycler and, worldwide, transforms millions of tonnes of scrap metal into steel every year, reinforcing its commitment to sustainable development in the regions where it operates. With more than 120,000 shareholders, Gerdau’s shares are listed on the New York, São Paulo and Madrid stock exchanges.

Highlights in the fourth quarter of 2014

|

Key Information |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Steel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production of Crude Steel (1,000 tonnes) |

|

4,323 |

|

4,446 |

|

-2.8 |

% |

4,472 |

|

-3.3 |

% |

18,028 |

|

18,009 |

|

0.1 |

% |

|

Shipments (1,000 tonnes) |

|

4,399 |

|

4,555 |

|

-3.4 |

% |

4,558 |

|

-3.5 |

% |

17,869 |

|

18,519 |

|

-3.5 |

% |

|

Net Sales (R$ million) |

|

10,843 |

|

10,321 |

|

5.1 |

% |

10,706 |

|

1.3 |

% |

42,546 |

|

39,863 |

|

6.7 |

% |

|

EBITDA (R$ million) |

|

1,536 |

|

1,370 |

|

12.1 |

% |

1,224 |

|

25.5 |

% |

5,126 |

|

4,784 |

|

7.1 |

% |

|

Adjusted EBITDA(1) (R$ million) |

|

1,238 |

|

1,370 |

|

-9.6 |

% |

1,224 |

|

1.1 |

% |

4,828 |

|

4,784 |

|

0.9 |

% |

|

Net Income (R$ million) |

|

393 |

|

492 |

|

-20.1 |

% |

262 |

|

50.0 |

% |

1,488 |

|

1,694 |

|

-12.2 |

% |

|

Gross margin |

|

11.8 |

% |

13.1 |

% |

|

|

11.9 |

% |

|

|

12.1 |

% |

12.9 |

% |

|

|

|

EBITDA Margin |

|

14.2 |

% |

13.3 |

% |

|

|

11.4 |

% |

|

|

12.0 |

% |

12.0 |

% |

|

|

|

Adjusted EBITDA Margin |

|

11.4 |

% |

13.3 |

% |

|

|

11.4 |

% |

|

|

11.3 |

% |

12.0 |

% |

|

|

|

Shareholders’ equity (R$ million) |

|

33,255 |

|

32,021 |

|

|

|

33,208 |

|

|

|

33,255 |

|

32,021 |

|

|

|

|

Total Assets (R$ million) |

|

63,042 |

|

58,215 |

|

|

|

61,472 |

|

|

|

63,042 |

|

58,215 |

|

|

|

|

Gross debt / Total capitalization (2) |

|

36.0 |

% |

34.0 |

% |

|

|

35.0 |

% |

|

|

36.0 |

% |

34.0 |

% |

|

|

|

Net debt(3) / EBITDA(4) |

|

2.4x |

|

2.5x |

|

|

|

2.7x |

|

|

|

2.4x |

|

2.5x |

|

|

|

(1) - Adjusted EBITDA = EBITDA CVM Instruction 527 + Impairment of assets - Gains in joint venture operations.

(2) - Total capitalization = shareholders’ equity + gross debt (principal)

(3) - Net debt = gross debt (principal) - cash, cash equivalents and short-term investments

(4) - EBITDA in the last 12 months, note that, 4Q14 and fiscal year 2014 includes gains in joint venture operations.

1

World Steel Market

|

Steel Industry Production

(1,000 tonnes) |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Crude Steel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brazil |

|

8,356 |

|

8,333 |

|

0.3% |

|

8,808 |

|

-5.1% |

|

33,912 |

|

34,163 |

|

-0.7 |

% |

|

North America (except Mexico) |

|

25,030 |

|

24,646 |

|

1.6% |

|

26,095 |

|

-4.1% |

|

100,943 |

|

99,227 |

|

1.7 |

% |

|

Latin America (except Brazil) |

|

8,513 |

|

8,238 |

|

3.3% |

|

7,953 |

|

7.0% |

|

32,232 |

|

31,692 |

|

1.7 |

% |

|

Europe |

|

41,528 |

|

42,262 |

|

-1.7% |

|

40,191 |

|

3.3% |

|

166,343 |

|

169,390 |

|

-1.8 |

% |

|

India |

|

20,724 |

|

20,020 |

|

3.5% |

|

20,939 |

|

-1.0% |

|

83,197 |

|

81,299 |

|

2.3 |

% |

|

China |

|

198,417 |

|

193,497 |

|

2.5% |

|

204,776 |

|

-3.1% |

|

812,804 |

|

822,000 |

|

-1.1 |

% |

|

Others |

|

97,909 |

|

98,889 |

|

-1.0% |

|

97,837 |

|

0.1% |

|

398,148 |

|

387,356 |

|

2.8 |

% |

|

Total(1) |

|

400,477 |

|

395,885 |

|

1.2% |

|

406,599 |

|

-1.5% |

|

1,627,579 |

|

1,625,127 |

|

0.2 |

% |

Source: worldsteel and Gerdau

(1) - Figures represent approximately 98% of global production.

· World steel production remained stable in 2014 compared to 2013 (see table above), with China accounting for 49.9% of global production. Average capacity utilization in the world steel industry stood at 76.7% in 2014, compared to 78.4% in 2013. Production performance in the regions where Gerdau operates was as follows: in Brazil, production decreased slightly, in line with the country’s slower economic growth; in North America, the increased production was due to the ongoing economic recovery observed, in particular, in the United States; in Latin America, the increase was due to economic growth in certain countries in the region, despite the impacts observed in the commodities market in general; in Europe, the lower production was due to slower economic growth in certain countries in the region.

· On October 06, 2014, World Steel Association released its latest Short Range Outlook containing forecasts for global apparent steel consumption in 2015, in which it estimated growth at 2.0%. The association revised downward the forecast it made in April 2014 (+3.3% in 2015), due to the slower growth expected in both emerging and developing economies. In the case of China, slower growth is expected in its steel consumption in 2015 (+0.8%), reflecting the structural transformation of its economy. On the other hand, the continued good performance of the U.S. economy should support growth in the country’s apparent consumption of 1.9% in 2015. In the European Union, apparent consumption is also expected to grow in 2015, by 2.9%. In short, apparent steel consumption in developed economies should grow by 1.7% in 2015, while developing economies are expected to grow their consumption by 2.2% in 2015.

Gerdau’s performance in the fourth quarter of 2014

The Consolidated Financial Statements of Gerdau S.A. are presented in accordance with the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB) and the accounting practices adopted in Brazil, which are fully aligned with the international accounting standards issued by the Accounting Pronouncement Committee (CPC).

The information in this report does not include data for jointly controlled entities and associate companies, except where stated otherwise.

Consolidated Information

Steel Production and Shipments

|

Consolidated

(1,000 tonnes) |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Production of crude steel |

|

4,323 |

|

4,446 |

|

-2.8 |

% |

4,472 |

|

-3.3 |

% |

18,028 |

|

18,009 |

|

0.1 |

% |

|

Shipments of steel |

|

4,399 |

|

4,555 |

|

-3.4 |

% |

4,558 |

|

-3.5 |

% |

17,869 |

|

18,519 |

|

-3.5 |

% |

· Consolidated crude steel production decreased in 4Q14 in relation to 4Q13 and 3Q14, accompanying the lower shipments in the period.

· Consolidated shipments decreased in 4Q14 compared to 4Q13, reflecting the lower steel shipments in all business operations. Compared to 3Q14, the decrease was due to seasonality.

2

Consolidated Results

Net sales, cost and gross margin

|

Consolidated

(R$ million) |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Net Sales |

|

10,843 |

|

10,321 |

|

5.1 |

% |

10,706 |

|

1.3 |

% |

42,546 |

|

39,863 |

|

6.7 |

% |

|

Cost of Goods Sold |

|

(9,559 |

) |

(8,971 |

) |

6.6 |

% |

(9,430 |

) |

1.4 |

% |

(37,406 |

) |

(34,728 |

) |

7.7 |

% |

|

Gross profit |

|

1,284 |

|

1,350 |

|

-4.9 |

% |

1,276 |

|

0.6 |

% |

5,140 |

|

5,135 |

|

0.1 |

% |

|

Gross margin (%) |

|

11.8 |

% |

13.1 |

% |

|

|

11.9 |

% |

|

|

12.1 |

% |

12.9 |

% |

|

|

· Consolidated net sales increased in 4Q14 compared to 4Q13, which is mainly explained by the effects from exchange variation arising from the depreciation in the average price of the Brazilian real against the currencies of the countries where Gerdau operates and by the net sales growth at the North America BO. Compared to 3Q14, consolidated net sales increased, mainly reflecting the higher exports from Brazil and the higher net sales in the Latin America BO due to the effects from exchange variation.

· On a consolidated basis, gross profit and gross margin fell in 4Q14 compared to 4Q13, due to the weaker performances of the Iron Ore and Brazil BOs, which were partially offset by the better performances of the North America and Special Steel BOs. Compared to 3Q14, the relative stability in consolidated gross profit and gross margin reflects the Company’s geographic diversification, with the better performance of the Brazil BO offsetting the reduction observed in the North America BO.

Selling, general and administrative expenses

|

Consolidated

(R$ million) |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Selling expenses |

|

166 |

|

165 |

|

0.6 |

% |

172 |

|

-3.5 |

% |

691 |

|

659 |

|

4.9 |

% |

|

General and administrative expenses |

|

515 |

|

504 |

|

2.2 |

% |

489 |

|

5.3 |

% |

2,037 |

|

1,953 |

|

4.3 |

% |

|

Total |

|

681 |

|

669 |

|

1.8 |

% |

661 |

|

3.0 |

% |

2,728 |

|

2,612 |

|

4.4 |

% |

|

% of net sales |

|

6.3 |

% |

6.5 |

% |

|

|

6.2 |

% |

|

|

6.4 |

% |

6.6 |

% |

|

|

· Selling, general and administrative expenses as a ratio of net sales remained relatively stable in relation to both 4Q13 and 3Q14, demonstrating the efforts made by the Company over the course of 2014 to rationalize these expenses.

Other operating income (expenses)

|

Consolidated

(R$ million) |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Other operating income (expenses) |

|

33 |

|

109 |

|

-69.7 |

% |

19 |

|

73.7 |

% |

88 |

|

178 |

|

-50.6 |

% |

|

Impairment of assets |

|

(339 |

) |

— |

|

— |

|

— |

|

— |

|

(339 |

) |

— |

|

— |

|

|

Gains in joint ventures operations |

|

637 |

|

— |

|

— |

|

— |

|

— |

|

637 |

|

— |

|

— |

|

|

Equity in earnings of unconsolidated companies |

|

13 |

|

19 |

|

-31.6 |

% |

35 |

|

-62.9 |

% |

102 |

|

54 |

|

88.9 |

% |

· The reduction in the line “other operating income (expenses)” in 4Q14 compared to 4Q13 is explained by the divestments of commercial properties in Brazil in the amount of R$ 98.6 million that were recorded in 4Q13.

· The line “Impairment of assets” recorded in 2014 refers to the lack of expectation of utilizing certain assets in the Latin American BO identified through impairment testing.

· The line “gain in joint ventures operations” in 4Q14 includes the sale of the 50% interest in Gallatin Steel Company on October 8, 2014.

· The jointly controlled entities and associate companies, whose results are calculated using the equity method, recorded steel shipments of 142,000 tonnes in 4Q14 based on their respective equity interests, resulting in net sales of R$ 345.7 million.

3

EBITDA

|

Breakdown of Consolidated EBITDA

(R$ million) |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Net income |

|

393 |

|

492 |

|

-20.1 |

% |

262 |

|

50.0 |

% |

1,488 |

|

1,694 |

|

-12.2 |

% |

|

Net financial result |

|

673 |

|

355 |

|

89.6 |

% |

575 |

|

17.0 |

% |

1,561 |

|

1,301 |

|

20.0 |

% |

|

Provision for income and social contribution taxes |

|

(120 |

) |

(39 |

) |

207.7 |

% |

(168 |

) |

-28.6 |

% |

(150 |

) |

(241 |

) |

-37.8 |

% |

|

Depreciation and amortization |

|

590 |

|

562 |

|

5.0 |

% |

555 |

|

6.3 |

% |

2,227 |

|

2,030 |

|

9.7 |

% |

|

EBITDA (1) |

|

1,536 |

|

1,370 |

|

12.1 |

% |

1,224 |

|

25.5 |

% |

5,126 |

|

4,784 |

|

7.1 |

% |

|

EBITDA Margin |

|

14.2 |

% |

13.3 |

% |

|

|

11.4 |

% |

|

|

12.0 |

% |

12.0 |

% |

|

|

|

Impairment of Assets |

|

339 |

|

— |

|

— |

|

— |

|

— |

|

339 |

|

— |

|

— |

|

|

Gains in joint ventures operations |

|

(637 |

) |

— |

|

— |

|

— |

|

— |

|

(637 |

) |

— |

|

— |

|

|

Adjusted EBITDA(1) |

|

1,238 |

|

1,370 |

|

-9.6 |

% |

1,224 |

|

1.1 |

% |

4,828 |

|

4,784 |

|

0.9 |

% |

|

Adjusted EBITDA Margin |

|

11.4 |

% |

13.3 |

% |

|

|

11.4 |

% |

|

|

11.3 |

% |

12.0 |

% |

|

|

(1) - Includes the results from jointly controlled entities and associate companies based on the equity income method.

Note: EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is not a method used in accounting practices, does not represent cash flow for the periods in question and should not be considered an alternative to cash flow as an indicator of liquidity.

The Company’s EBITDA was calculated pursuant to Instruction 527 of the CVM, as well as EBITDA adjusted to provide more information on the cash flow generation in the period.

|

Conciliation of Consolidated EBITDA

(R$ million) |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

3rd Quarter

2014 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

|

EBITDA (1) |

|

1,536 |

|

1,370 |

|

1,224 |

|

5,126 |

|

4,784 |

|

|

Depreciation and amortization |

|

(590 |

) |

(562 |

) |

(555 |

) |

(2,227 |

) |

(2,030 |

) |

|

OPERATING INCOME BEFORE FINANCIAL RESULT AND TAXES(2) |

|

946 |

|

808 |

|

669 |

|

2,899 |

|

2,754 |

|

(1) - Non-accounting measure calculated pursuant to Instruction 527 of the CVM.

(2) - Accounting measurement disclosed in consolidated Statements of Income.

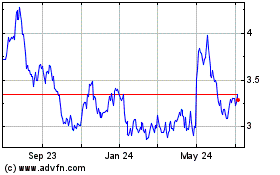

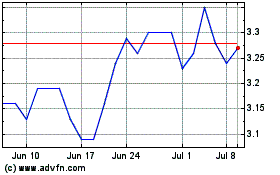

Consolidated EBITDA (R$ million) and EBITDA Margin (%)

· Adjusted EBITDA and adjusted EBITDA margin decreased in 4Q14 compared to 4Q13, mainly due to the weaker performances of the Iron Ore and Brazil BOs, which was partially offset by the better performances of the North America and Special Steel BOs. Compared to 3Q14, adjusted EBITDA and adjusted EBITDA margin accompanied the stability in gross profit and gross margin, due to the better performance of the Brazil BO, which offset the reduction observed in the North America BO.

Net financial result and net income

|

Consolidated

(R$ million) |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Income before financial income (expenses) and taxes (1) |

|

946 |

|

808 |

|

17.1 |

% |

669 |

|

41.4 |

% |

2,899 |

|

2,754 |

|

5.3 |

% |

|

Financial Result |

|

(673 |

) |

(355 |

) |

89.6 |

% |

(575 |

) |

17.0 |

% |

(1,561 |

) |

(1,301 |

) |

20.0 |

% |

|

Financial income |

|

60 |

|

91 |

|

-34.1 |

% |

66 |

|

-9.1 |

% |

276 |

|

293 |

|

-5.8 |

% |

|

Financial expenses |

|

(392 |

) |

(280 |

) |

40.0 |

% |

(346 |

) |

13.3 |

% |

(1,397 |

) |

(1,053 |

) |

32.7 |

% |

|

Exchange variation, net |

|

(372 |

) |

(177 |

) |

110.2 |

% |

(308 |

) |

20.8 |

% |

(476 |

) |

(544 |

) |

-12.5 |

% |

|

Exchange variation on net investment hedge |

|

(214 |

) |

(118 |

) |

81.4 |

% |

(260 |

) |

-17.7 |

% |

(328 |

) |

(323 |

) |

1.5 |

% |

|

Exchange variation - other lines |

|

(158 |

) |

(59 |

) |

167.8 |

% |

(48 |

) |

229.2 |

% |

(148 |

) |

(221 |

) |

-33.0 |

% |

|

Gains (losses) on financial instruments, net |

|

31 |

|

11 |

|

181.8 |

% |

13 |

|

138.5 |

% |

36 |

|

3 |

|

1100.0 |

% |

|

Income before taxes (1) |

|

273 |

|

453 |

|

-39.7 |

% |

94 |

|

190.4 |

% |

1,338 |

|

1,453 |

|

-7.9 |

% |

|

Income and social contribution taxes |

|

120 |

|

39 |

|

207.7 |

% |

168 |

|

-28.6 |

% |

150 |

|

241 |

|

-37.8 |

% |

|

On net investment hedge |

|

214 |

|

118 |

|

81.4 |

% |

260 |

|

-17.7 |

% |

328 |

|

323 |

|

1.5 |

% |

|

Other lines |

|

(94 |

) |

(79 |

) |

19.0 |

% |

(92 |

) |

2.2 |

% |

(178 |

) |

(82 |

) |

117.1 |

% |

|

Consolidated Net Income (1) |

|

393 |

|

492 |

|

-20.1 |

% |

262 |

|

50.0 |

% |

1,488 |

|

1,694 |

|

-12.2 |

% |

(1) - Includes the results from jointly controlled entities and associate companies based on the equity income method.

· In 4Q14 compared to 4Q13, the higher negative financial result mainly reflects the higher negative exchange variation on liabilities contracted in U.S. dollar (depreciation in the end-of-period price of the Brazilian real against

4

the U.S. dollar of 8.4% in 4Q14 and 5.0% in 4Q13) and the higher financial expenses resulting from the increase in gross debt in the comparison periods.

· Compared to 3Q14, the higher negative financial result is explained mainly by the higher financial expenses of subsidiaries abroad due to exchange variation.

· Note that, in accordance with the IFRS, the Company designated the bulk of its debt in foreign currency contracted by companies in Brazil as a hedge for a portion of the investments in subsidiaries located abroad. As a result, only the effect from exchange variation on the portion of debt not linked to investment hedge is recognized in the financial result, with this effect neutralized by the line “Income and Social Contribution taxes on net investment hedge.”

· Consolidated net income decreased in 4Q14 compared to 4Q13, mainly due to the higher negative financial result, despite the higher operating income, which includes the non-recurring events described in “Other operating revenue and expenses.” Compared to 3Q14, the increase in net income was mainly due to the higher operating income, despite the higher negative financial result.

Dividends

· Gerdau S.A., based on the results in 4Q14, approved the prepayment of the minimum mandatory dividend of R$ 119.3 million (R$ 0.07 per share).

Payment date: March 26, 2015

Record date: close of trading on March 16, 2015

Ex-dividend date: March 17, 2015

· In 2014, Gerdau S.A. distributed R$ 426.1 million (R$ 0.25 per share) in the form of dividends and interest on equity.

Investments

· In 4Q14, investments in fixed assets amounted to R$ 673.1 million. Of the amount invested in the quarter, 41.3% was allocated to the Brazil BO, 21.0% to the Special Steel BO, 14.4% to the North America BO, 16.8% to the Latin America BO and 6.5% to the Iron Ore BO.

· In 2014, investments in fixed assets amounted to R$ 2.3 billion, which was inflated by the depreciation in the Brazilian real against the U.S. dollar in the closing months of the year, since most investments are linked to the dollar. The Company continued to invest in its ongoing capacity expansion and productivity improvement projects, as well as in the maintenance actions scheduled for the period.

· Based on the investments scheduled for 2015, Gerdau plans to invest R$ 1.9 billion, considering the investments in productivity improvements and maintenance.

Working Capital and Cash Conversion Cycle

5

· In December 2014, the cash conversion cycle (working capital divided by daily net sales in the quarter) decreased slightly in relation to September 2014, reflecting the growth in net sales and decline in working capital.

· Note that the decrease in working capital of R$ 100.0 million between September and December includes the effects from exchange variation, especially on the working capital of companies abroad. Excluding this variation, the cash effect on the reduction in working capital was R$ 469.0 million.

Financial Liabilities

|

Debt composition

(R$ million) |

|

12.31.2014 |

|

09.30.2014 |

|

12.31.2013 |

|

|

Short Term |

|

2,038 |

|

1,949 |

|

1,838 |

|

|

Local Currency (Brazil) |

|

79 |

|

35 |

|

491 |

|

|

Foreign Currency (Brazil) |

|

304 |

|

281 |

|

262 |

|

|

Companies abroad |

|

1,655 |

|

1,633 |

|

1,085 |

|

|

Long Term |

|

17,484 |

|

16,516 |

|

14,869 |

|

|

Local Currency (Brazil) |

|

4,073 |

|

4,245 |

|

2,927 |

|

|

Foreign Currency (Brazil) |

|

10,717 |

|

9,395 |

|

8,725 |

|

|

Companies abroad |

|

2,694 |

|

2,876 |

|

3,217 |

|

|

Gross Debt (principal + interest) |

|

19,522 |

|

18,465 |

|

16,707 |

|

|

Interest on the debt |

|

(344 |

) |

(340 |

) |

(391 |

) |

|

Gross Debt (principal) |

|

19,178 |

|

18,125 |

|

16,316 |

|

|

Cash, cash equivalents and short-term investments |

|

5,849 |

|

4,671 |

|

4,222 |

|

|

Net Debt(1) |

|

13,329 |

|

13,454 |

|

12,094 |

|

(1) - Net debt = gross debt (principal) - cash, cash equivalents and short-term investments

· On December 31, 2014, the composition of gross debt (principal) was 8.8% short term and 91.2% long term. The foreign currency exposure of gross debt (principal + interest) stood at 78.7% on December 31, 2014. The R$ 1.1 billion increase in gross debt between September and December 2014 was due to the effect of exchange variation in the period. Excluding this effect, gross debt would have decreased by R$ 412 million.

· The increase in the cash position of R$ 1.2 billion between September and December 2014 is mainly explained by the recording of the proceeds from the divestment of Gallatin Steel Company. On December 31, 2014, 40.7% of this cash was held by Gerdau companies abroad and denominated mainly in U.S. dollar.

· The slight decrease in net debt on December 31, 2014 compared to September 30, 2014 was due to the growth in the cash position more than offsetting the growth in gross debt.

· On December 31, 2014, the nominal weighted average cost of gross debt (principal) was 6.5%, or 9.4% for the portion denominated in Brazilian real, 5.9% plus foreign exchange variation for the portion denominated in U.S. dollar contracted by companies in Brazil, and 5.9% for the portion contracted by subsidiaries abroad. On December 31, 2014, the average gross debt term was 7.1 years.

· The Company’s main debt indicators are shown below:

|

Indicators |

|

12.31.2014 |

|

09.30.2014 |

|

12.31.2013 |

|

|

Gross debt / Total capitalization (1) |

|

36 |

% |

35 |

% |

34 |

% |

|

Net debt(2) / EBITDA (3) |

|

2.4x |

|

2.7x |

|

2.5x |

|

|

EBITDA (3) / Net financial expenses (3) |

|

5.1x |

|

5.2x |

|

6.3x |

|

(1) - Total capitalization = shareholders’ equity + gross debt (principal)

(2) - Net debt = gross debt (principal) - cash, cash equivalents and short-term investments

(3) - EBITDA in the last 12 months.

Note: EBITDA in the last 12 months, note that, 4Q14 and fiscal year 2014 includes gains in joint venture operations.

6

Indebtedness

(R$ billion)

· On December 31, 2014, the gross debt (principal) payment schedule was as follows:

Amortization schedule of gross debt (principal)

|

Short Term |

|

R$ million |

|

|

1st quarter of 2015 |

|

466 |

|

|

2nd quarter of 2015 |

|

288 |

|

|

3rd quarter of 2015 |

|

794 |

|

|

4th quarter of 2015 |

|

146 |

|

|

Total |

|

1,694 |

|

|

Long Term |

|

R$ million |

|

|

2016 |

|

893 |

|

|

2017 |

|

3,152 |

|

|

2018 |

|

755 |

|

|

2019 and after |

|

12,684 |

|

|

Total |

|

17,484 |

|

Subsequent Events

Share Buyback

· On January 19, 2015, Gerdau S.A. announced a buyback program involving up to 30,000,000 preferred shares (GGBR4) or American Depositary Receipts — ADRs (GGB), representing in aggregate approximately 3.4% of the preferred shares comprising the free-float, which on December 31, 2014 totaled 875,443,630 shares, for the purposes of: (i) meeting the needs of the Long Term Incentive Programs of the Company and its subsidiaries; (ii) holding in treasury; (iii) cancelling; or (iv) subsequent sale in the market. The program will have a maximum term of three months, from January 19, 2015 to April 17, 2015, inclusive.

7

Business Operations (BO)

The information in this report is divided into five Business Operations (BO), in accordance with Gerdau’s corporate governance, as follows:

· Brazil BO — includes the steel operations in Brazil (except special steel) and the metallurgical and coking coal operation in Colombia;

· North America BO — includes all North American operations, except Mexico and special steel;

· Latin America BO — includes all Latin American operations, except the operations in Brazil and the metallurgical and coking coal operation in Colombia;

· Special Steel BO — includes the special steel operations in Brazil, Spain, United States and India.

· Iron Ore BO — includes the iron ore operations in Brazil.

Net sales

EBITDA and EBITDA Margin

8

Brazil BO

Production and shipments

|

Brazil BO

(1,000 tonnes) |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Production of crude steel |

|

1,619 |

|

1,691 |

|

-4.3 |

% |

1,603 |

|

1.0 |

% |

6,458 |

|

6,963 |

|

-7.3 |

% |

|

Shipments of steel |

|

1,738 |

|

1,792 |

|

-3.0 |

% |

1,660 |

|

4.7 |

% |

6,583 |

|

7,281 |

|

-9.6 |

% |

|

Domestic Market |

|

1,357 |

|

1,416 |

|

-4.2 |

% |

1,369 |

|

-0.9 |

% |

5,540 |

|

5,883 |

|

-5.8 |

% |

|

Exports |

|

381 |

|

376 |

|

1.3 |

% |

291 |

|

30.9 |

% |

1,043 |

|

1,398 |

|

-25.4 |

% |

· Crude steel production decreased in 4Q14 compared to 4Q13, mainly due to the lower shipments in the period. Compared to 3Q14, production increased slightly, due to the higher exports in the period.

· Steel shipments decreased in 4Q14 compared to 4Q13, due to weaker demand caused by slower growth in the construction and manufacturing industries in Brazil, reflecting the country’s weak GDP growth. Compared to 3Q14, shipments registered growth due to higher exports, driven by improvement in the international market for semi-finished products.

Operating result

|

Brazil BO |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Net Sales (R$ million) |

|

3,634 |

|

3,747 |

|

-3.0 |

% |

3,559 |

|

2.1 |

% |

14,294 |

|

14,837 |

|

-3.7 |

% |

|

Domestic Market |

|

3,039 |

|

3,175 |

|

-4.3 |

% |

3,131 |

|

-2.9 |

% |

12,635 |

|

12,863 |

|

-1.8 |

% |

|

Exports(1) |

|

595 |

|

572 |

|

4.0 |

% |

428 |

|

39.0 |

% |

1,659 |

|

1,974 |

|

-16.0 |

% |

|

Cost of Goods Sold (R$ million) |

|

(2,915 |

) |

(2,982 |

) |

-2.2 |

% |

(2,967 |

) |

-1.8 |

% |

(11,641 |

) |

(11,884 |

) |

-2.0 |

% |

|

Gross profit (R$ million) |

|

719 |

|

765 |

|

-6.0 |

% |

592 |

|

21.5 |

% |

2,653 |

|

2,953 |

|

-10.2 |

% |

|

Gross margin (%) |

|

19.8 |

% |

20.4 |

% |

|

|

16.6 |

% |

|

|

18.6 |

% |

19.9 |

% |

|

|

|

EBITDA (R$ million) |

|

738 |

|

848 |

|

-13.0 |

% |

587 |

|

25.7 |

% |

2,654 |

|

2,978 |

|

-10.9 |

% |

|

EBITDA margin (%) |

|

20.3 |

% |

22.6 |

% |

|

|

16.5 |

% |

|

|

18.6 |

% |

20.1 |

% |

|

|

(1) - Includes coking coal and coke net sales.

· The lower net sales in 4Q14 compared to 4Q13 was mainly due to the lower shipments in the domestic market. Compared to 3Q14, the increase in net sales was mainly due to higher exports in the period, despite the less favorable sales mix in the domestic market.

· Cost of goods sold decreased in 4Q14 compared to 4Q13, accompanying the lower shipments in the period. The decrease in net sales to a greater degree than the decrease in cost of goods sold led to a slight reduction in gross margin in the period. Compared to 3Q14, the increase in gross margin is explained by the greater dilution of fixed costs resulting from higher exports and lower production costs at the Ouro Branco unit.

· EBITDA decreased in 4Q14 compared to 4Q13, which reflects the recording in 4Q13 of the proceeds from property divestments in the amount of R$98.6 million. Excluding this effect, EBITDA margin remained relatively stable in the comparison period. Compared to 3Q14, the performance of EBITDA margin accompanied the performance of gross margin.

9

EBITDA (R$ million) and EBITDA Margin (%)

10

North America BO

Production and shipments

|

North America BO

(1,000 tonnes) |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Production of crude steel |

|

1,509 |

|

1,549 |

|

-2.6 |

% |

1,705 |

|

-11.5 |

% |

6,649 |

|

6,121 |

|

8.6 |

% |

|

Shipments of steel |

|

1,402 |

|

1,476 |

|

-5.0 |

% |

1,648 |

|

-14.9 |

% |

6,154 |

|

6,145 |

|

0.1 |

% |

· Production decreased in 4Q14 compared to 4Q13 and 3Q14, mainly due to the lower shipments and efforts to optimize inventories.

· Shipments decreased in 4Q14 compared to 4Q13, due to greater pressure from imported products in the region. Compared to 3Q14, shipments decreased due to seasonality.

Operating result

|

North America BO |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Net Sales (R$ million) |

|

3,516 |

|

3,102 |

|

13.3 |

% |

3,694 |

|

-4.8 |

% |

14,049 |

|

12,562 |

|

11.8 |

% |

|

Cost of Goods Sold (R$ million) |

|

(3,284 |

) |

(2,964 |

) |

10.8 |

% |

(3,346 |

) |

-1.9 |

% |

(13,093 |

) |

(11,919 |

) |

9.8 |

% |

|

Gross profit (R$ million) |

|

232 |

|

138 |

|

68.1 |

% |

348 |

|

-33.3 |

% |

956 |

|

643 |

|

48.7 |

% |

|

Gross margin (%) |

|

6.6 |

% |

4.4 |

% |

|

|

9.4 |

% |

|

|

6.8 |

% |

5.1 |

% |

|

|

|

EBITDA (R$ million)(1) |

|

199 |

|

139 |

|

43.2 |

% |

337 |

|

-40.9 |

% |

888 |

|

575 |

|

54.4 |

% |

|

EBITDA margin (%)(1) |

|

5.7 |

% |

4.5 |

% |

|

|

9.1 |

% |

|

|

6.3 |

% |

4.6 |

% |

|

|

(1) Adjusted EBITDA and adjusted EBITDA margin in the 4Q14 and 2014 (does not include gains in joitn venture operations).

· Net sales increased in 4Q14 compared to 4Q13, mainly due to the increase in net sales per tonne sold in U.S. dollar and the effect from exchange variation (11.7% depreciation in the average price of the Brazilian real against the U.S. dollar), despite the lower shipments. Compared to 3Q14, net sales decreased, due to the lower shipments, which were partially offset by the exchange variation in the period (11.8% depreciation in the average price of the Brazilian real against the U.S. dollar).

· The increase in net sales at a higher pace than the increase in cost of goods sold supported gross margin expansion in 4Q14 compared to 4Q13. Compared to 3Q14, the decrease in gross margin was due to lower shipments and the resulting lower dilution of fixed costs.

· The higher EBITDA recorded in 4Q14 compared to 4Q13 is explained by the increase in gross profit, which supported EBITDA margin expansion. Compared to 3Q14, the lower gross profit led to reductions in EBITDA and EBITDA margin. Note that the result of this operation in 4Q14 does not include the equity in earnings from Gallatin Steel Company, due to the divestment of this asset on October 8, 2014.

EBITDA (R$ million) and EBITDA Margin (%)

11

Latin America BO

Production and shipments

|

Latin America BO

(1,000 tonnes) |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Production of crude steel |

|

384 |

|

426 |

|

-9.9 |

% |

386 |

|

-0.5 |

% |

1,614 |

|

1,726 |

|

-6.5 |

% |

|

Shipments of steel |

|

664 |

|

715 |

|

-7.1 |

% |

647 |

|

2.6 |

% |

2,623 |

|

2,807 |

|

-6.6 |

% |

· Production and shipments decreased in 4Q14 compared to 4Q13, due to the growth in imports and slower economic growth in the region.

Operating result

|

Latin America BO |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Net Sales (R$ million) |

|

1,541 |

|

1,464 |

|

5.3 |

% |

1,428 |

|

7.9 |

% |

5,670 |

|

5,366 |

|

5.7 |

% |

|

Cost of Goods Sold (R$ million) |

|

(1,377 |

) |

(1,295 |

) |

6.3 |

% |

(1,277 |

) |

7.8 |

% |

(5,023 |

) |

(4,801 |

) |

4.6 |

% |

|

Gross profit (R$ million) |

|

164 |

|

169 |

|

-3.0 |

% |

151 |

|

8.6 |

% |

647 |

|

565 |

|

14.5 |

% |

|

Gross margin (%) |

|

10.6 |

% |

11.5 |

% |

|

|

10.6 |

% |

|

|

11.4 |

% |

10.5 |

% |

|

|

|

EBITDA (R$ million)(1) |

|

109 |

|

136 |

|

-19.9 |

% |

109 |

|

0.0 |

% |

470 |

|

428 |

|

9.8 |

% |

|

EBITDA margin (%)(1) |

|

7.1 |

% |

9.3 |

% |

|

|

7.6 |

% |

|

|

8.3 |

% |

8.0 |

% |

|

|

(1) Adjusted EBITDA and adjusted EBITDA margin in 4T14 and 2014 (does not include the impairment of assets).

· Net sales increased in 4Q14 compared to 4Q13, which is explained by the exchange variation impact resulting from the depreciation in the average price of the Brazilian real against the currencies of the countries where Gerdau operates, despite the reduction in shipments. Compared to 3Q14, the increase in net sales was due to the exchange variation and higher shipments in 4Q14.

· Cost of goods sold increased in 4Q14 compared to 4Q13 due to the effects of exchange variation, despite the lower shipments. Compared to 3Q14, cost of goods sold increased, driven by the effects of exchange variation and the higher shipments in 4Q14. In 4Q14, gross margin remained relatively stable in relation to both 4Q13 and 3Q14 due to the proportionate increases in net sales and cost of goods sold in the comparison periods.

· EBITDA decreased in 4Q14 compared to 4Q13 due to the non-recurring increase in operating expenses, which also impacted EBITDA margin in the period. Compared to 3Q14, EBITDA in nominal terms remained stable.

EBITDA (R$ million) and EBITDA Margin (%)

12

Special Steel BO

Production and shipments

|

Special Steel BO

(1,000 tonnes) |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Production of crude steel |

|

811 |

|

780 |

|

4.0 |

% |

778 |

|

4.2 |

% |

3,307 |

|

3,199 |

|

3.4 |

% |

|

Shipments of steel |

|

677 |

|

711 |

|

-4.8 |

% |

710 |

|

-4.6 |

% |

2,894 |

|

2,857 |

|

1.3 |

% |

· The increase in crude steel production in 4Q14 compared to 4Q13 was driven by higher production at the units in Spain and the United States, where demand from the automotive industry has been improving. Compared to 3Q14, the increase in production occurred mainly at the units in Spain due to seasonality (summer vacation).

· Shipments decreased in 4Q14 compared to both 4Q13 and 3Q14, due to weaker demand in Brazil.

Operating result

|

Special Steel BO |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Net Sales (R$ million) |

|

2,104 |

|

2,044 |

|

2.9 |

% |

2,095 |

|

0.4 |

% |

8,644 |

|

8,023 |

|

7.7 |

% |

|

Cost of Goods Sold (R$ million) |

|

(1,911 |

) |

(1,911 |

) |

0.0 |

% |

(1,921 |

) |

-0.5 |

% |

(7,922 |

) |

(7,309 |

) |

8.4 |

% |

|

Gross profit (R$ million) |

|

193 |

|

133 |

|

45.1 |

% |

174 |

|

10.9 |

% |

722 |

|

714 |

|

1.1 |

% |

|

Gross margin (%) |

|

9.2 |

% |

6.5 |

% |

|

|

8.3 |

% |

|

|

8.4 |

% |

8.9 |

% |

|

|

|

EBITDA (R$ million) |

|

254 |

|

205 |

|

23.9 |

% |

231 |

|

10.0 |

% |

918 |

|

909 |

|

1.0 |

% |

|

EBITDA margin (%) |

|

12.1 |

% |

10.0 |

% |

|

|

11.0 |

% |

|

|

10.6 |

% |

11.3 |

% |

|

|

· Net sales in 4Q14 compared to 4Q13 and 3Q14 did not accompany the decline in shipments in the comparison periods, due to the effects of exchange variation on shipments at the units abroad and the increase in net sales per tonne sold at the units in Brazil.

· Cost of goods sold remained stable in 4Q14 compared to 4Q13 and 3Q14, despite the lower shipments in the comparison periods, due to the effects of exchange variation on the Special Steel operations abroad. The growth in net sales outpacing the increase in cost of goods sold supported gross margin expansion in 4Q14 compared to 4Q13 and 3Q14.

· EBITDA growth in 4Q14 compared to 4Q13 and 3Q14 was driven by the growth in gross profit, which supported EBITDA margin expansion.

EBITDA (R$ million) and EBITDA Margin (%)

13

Iron Ore BO

Production and shipments

|

Iron Ore BO

(1,000 tonnes) |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Production |

|

1,681 |

|

1,842 |

|

-8.7 |

% |

2,219 |

|

-24.2 |

% |

7,623 |

|

5,586 |

|

36.5 |

% |

|

Shipments |

|

2,254 |

|

2,139 |

|

5.4 |

% |

1,981 |

|

13.8 |

% |

7,971 |

|

5,017 |

|

58.9 |

% |

|

Gerdau units |

|

1,281 |

|

1,088 |

|

17.7 |

% |

1,289 |

|

-0.6 |

% |

4,404 |

|

3,775 |

|

16.7 |

% |

|

Third parties |

|

973 |

|

1,051 |

|

-7.4 |

% |

692 |

|

40.6 |

% |

3,567 |

|

1,242 |

|

187.2 |

% |

· Production decreased in 4Q14 compared to 4Q13 and 3Q14, due to the operation’s adjustment to the low international iron ore prices.

· Shipments increased in 4Q14 compared to 4Q13, due to the higher volumes shipped to the Ouro Branco unit. Compared to 3Q14, despite the challenging scenario, shipments increased due to the shipments to third parties already scheduled for the period.

Operating result

|

Iron Ore BO |

|

4th Quarter

2014 |

|

4th Quarter

2013 |

|

Variation

4Q14/4Q13 |

|

3rd Quarter

2014 |

|

Variation

4Q14/3Q14 |

|

Fiscal Year

2014 |

|

Fiscal Year

2013 |

|

Variation

2014/2013 |

|

|

Net Sales (R$ million) |

|

205 |

|

374 |

|

-45.2 |

% |

207 |

|

-1.0 |

% |

945 |

|

704 |

|

34.2 |

% |

|

Gerdau units |

|

80 |

|

133 |

|

-39.8 |

% |

107 |

|

-25.2 |

% |

412 |

|

430 |

|

-4.2 |

% |

|

Third parties |

|

125 |

|

241 |

|

-48.1 |

% |

100 |

|

25.0 |

% |

533 |

|

274 |

|

94.5 |

% |

|

Cost of Goods Sold (R$ million) |

|

(228 |

) |

(233 |

) |

-2.1 |

% |

(198 |

) |

15.2 |

% |

(788 |

) |

(442 |

) |

78.3 |

% |

|

Gross profit (R$ million) |

|

(23 |

) |

141 |

|

— |

|

9 |

|

— |

|

157 |

|

262 |

|

-40.1 |

% |

|

Gross margin (%) |

|

-11.2 |

% |

37.7 |

% |

|

|

4.3 |

% |

|

|

16.6 |

% |

37.2 |

% |

|

|

|

EBITDA (R$ million) |

|

(24 |

) |

141 |

|

— |

|

10 |

|

— |

|

161 |

|

250 |

|

-35.6 |

% |

|

EBITDA margin (%) |

|

-11.7 |

% |

37.7 |

% |

|

|

4.8 |

% |

|

|

17.0 |

% |

35.5 |

% |

|

|

· The decrease in net sales in 4Q14 compared to 4Q13, is explained by the lower prices practiced in international markets.

· Cost of goods sold decreased in 4Q14 compared to 4Q13 due to the lower share in total shipments of shipments to third parties. Even so, the decrease in logistics costs did not accompany the decrease in international iron ore prices, leading to a reduction in gross margin. Compared to 3Q14, the increase in cost of goods sold is explained by higher shipments to third parties, leading to a reduction in gross margin.

· EBITDA decreased in 4Q14 compared to 4Q13 and 3Q14, accompanying the performance of gross profit.

EBITDA (R$ million) and EBITDA Margin (%)

14

Corporate Governance

Corporate Sustainability Index (ISE)

· Gerdau S.A. and Metalúrgica Gerdau S.A. were selected for the ninth consecutive time as components of the Corporate Sustainability Index (ISE) of the São Paulo Stock Exchange (BM&FBovespa). The index composition is valid from January 5, 2015 to January 2, 2016.

Apimec Meeting

· In November 2014, Gerdau held Apimec meetings in São Paulo and Brasília in which approximately 150 people participated.

THE MANAGEMENT

This document contains forward-looking statements. These statements are based on estimates, information or methods that may be incorrect or inaccurate and that may not occur. These estimates are also subject to risk, uncertainties and assumptions that include, among other factors: general economic, political and commercial conditions in Brazil and in the markets where we operate and existing and future government regulations. Potential investors are cautioned that these forward-looking statements do not constitute guarantees of future performance, given that they involve risks and uncertainties. Gerdau does not undertake and expressly waives any obligation to update any of these forward-looking statements, which are valid only on the date on which they were made.

15

GERDAU S.A.

CONSOLIDATED BALANCE SHEETS

as of December 31, 2014 and 2013

In thousands of Brazilian reais (R$)

|

|

|

2014 |

|

2013 |

|

|

CURRENT ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

3,049,971 |

|

2,099,224 |

|

|

Short-term investments |

|

|

|

|

|

|

Held for Trading |

|

2,798,834 |

|

2,123,168 |

|

|

Trade accounts receivable - net |

|

4,438,676 |

|

4,078,806 |

|

|

Inventories |

|

8,866,888 |

|

8,499,691 |

|

|

Tax credits |

|

686,958 |

|

716,806 |

|

|

Income and social contribution taxes recoverable |

|

468,309 |

|

367,963 |

|

|

Unrealized gains on financial instruments |

|

41,751 |

|

319 |

|

|

Other current assets |

|

331,352 |

|

291,245 |

|

|

|

|

20,682,739 |

|

18,177,222 |

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

|

Tax credits |

|

78,412 |

|

103,469 |

|

|

Deferred income taxes |

|

2,567,189 |

|

2,056,445 |

|

|

Related parties |

|

80,920 |

|

87,159 |

|

|

Judicial deposits |

|

1,430,865 |

|

1,155,407 |

|

|

Other non-current assets |

|

375,732 |

|

220,085 |

|

|

Prepaid pension cost |

|

196,799 |

|

555,184 |

|

|

Investments in associates and jointly-controlled entities |

|

1,394,383 |

|

1,590,031 |

|

|

Goodwill |

|

12,556,404 |

|

11,353,045 |

|

|

Other Intangibles |

|

1,547,098 |

|

1,497,919 |

|

|

Property, plant and equipment, net |

|

22,131,789 |

|

21,419,074 |

|

|

|

|

42,359,591 |

|

40,037,818 |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

63,042,330 |

|

58,215,040 |

|

16

GERDAU S.A.

CONSOLIDATED BALANCE SHEETS

as of December 31, 2014 and 2013

In thousands of Brazilian reais (R$)

|

|

|

2014 |

|

2013 |

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

Trade accounts payable |

|

3,236,356 |

|

3,271,419 |

|

|

Short-term debt |

|

2,037,869 |

|

1,810,783 |

|

|

Debentures |

|

— |

|

27,584 |

|

|

Taxes payable |

|

405,490 |

|

473,773 |

|

|

Income and social contribution taxes payable |

|

388,920 |

|

177,434 |

|

|

Payroll and related liabilities |

|

668,699 |

|

655,962 |

|

|

Dividends payable |

|

119,318 |

|

119,455 |

|

|

Employee benefits |

|

34,218 |

|

50,036 |

|

|

Environmental liabilities |

|

23,025 |

|

15,149 |

|

|

Unrealized losses on financial instruments |

|

— |

|

274 |

|

|

Other current liabilities |

|

858,901 |

|

634,761 |

|

|

|

|

7,772,796 |

|

7,236,630 |

|

|

|

|

|

|

|

|

|

NON-CURRENT LIABILITIES |

|

|

|

|

|

|

Long-term debt |

|

17,148,580 |

|

14,481,497 |

|

|

Debentures |

|

335,036 |

|

386,911 |

|

|

Related parties |

|

— |

|

43 |

|

|

Deferred income taxes |

|

944,546 |

|

1,187,252 |

|

|

Unrealized losses on financial instruments |

|

8,999 |

|

3,009 |

|

|

Provision for tax, civil and labor liabilities |

|

1,576,355 |

|

1,294,598 |

|

|

Environmental liabilities |

|

93,396 |

|

90,514 |

|

|

Employee benefits |

|

1,272,631 |

|

942,319 |

|

|

Other non-current liabilities |

|

635,457 |

|

571,510 |

|

|

|

|

22,015,000 |

|

18,957,653 |

|

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

Capital |

|

19,249,181 |

|

19,249,181 |

|

|

Treasury stocks |

|

(233,142 |

) |

(238,971 |

) |

|

Capital reserves |

|

11,597 |

|

11,597 |

|

|

Retained earnings |

|

11,366,957 |

|

10,472,752 |

|

|

Operations with non-controlling interests |

|

(1,732,962 |

) |

(1,732,962 |

) |

|

Other reserves |

|

3,539,188 |

|

2,577,482 |

|

|

EQUITY ATTRIBUTABLE TO THE EQUITY HOLDERS OF THE PARENT |

|

32,200,819 |

|

30,339,079 |

|

|

|

|

|

|

|

|

|

NON-CONTROLLING INTERESTS |

|

1,053,715 |

|

1,681,678 |

|

|

|

|

|

|

|

|

|

EQUITY |

|

33,254,534 |

|

32,020,757 |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

63,042,330 |

|

58,215,040 |

|

17

GERDAU S.A.

CONSOLIDATED STATEMENTS OF INCOME

In thousands of Brazilian reais (R$)

|

|

|

For the three-month period ended |

|

For the Year ended |

|

|

|

|

December 31, 2014 |

|

December 31, 2013 |

|

December 31, 2014 |

|

December 31, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET SALES |

|

10,843,796 |

|

10,320,997 |

|

42,546,339 |

|

39,863,037 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

(9,559,065 |

) |

(8,971,343 |

) |

(37,406,328 |

) |

(34,728,460 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

1,284,731 |

|

1,349,654 |

|

5,140,011 |

|

5,134,577 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

(165,684 |

) |

(165,240 |

) |

(691,021 |

) |

(658,862 |

) |

|

General and administrative expenses |

|

(515,381 |

) |

(504,020 |

) |

(2,036,926 |

) |

(1,953,014 |

) |

|

Other operating income |

|

85,872 |

|

172,704 |

|

238,435 |

|

318,256 |

|

|

Other operating expenses |

|

(53,285 |

) |

(64,162 |

) |

(150,542 |

) |

(140,535 |

) |

|

Impairment of assets |

|

(339,374 |

) |

— |

|

(339,374 |

) |

— |

|

|

Gains in Joint ventures operations |

|

636,528 |

|

— |

|

636,528 |

|

— |

|

|

Equity in earnings of unconsolidated companies |

|

13,024 |

|

19,337 |

|

101,875 |

|

54,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE FINANCIAL INCOME (EXPENSES) AND TAXES |

|

946,431 |

|

808,273 |

|

2,898,986 |

|

2,754,423 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial income |

|

59,486 |

|

90,610 |

|

276,249 |

|

292,910 |

|

|

Financial expenses |

|

(392,296 |

) |

(279,890 |

) |

(1,397,375 |

) |

(1,053,385 |

) |

|

Exchange variations, net |

|

(371,942 |

) |

(176,619 |

) |

(476,367 |

) |

(544,156 |

) |

|

Gain and losses on financial instruments, net |

|

30,958 |

|

10,537 |

|

36,491 |

|

2,854 |

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE TAXES |

|

272,637 |

|

452,911 |

|

1,337,984 |

|

1,452,646 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income and social contribution taxes |

|

|

|

|

|

|

|

|

|

|

Current |

|

(246,238 |

) |

(67,913 |

) |

(571,926 |

) |

(318,422 |

) |

|

Deferred |

|

366,594 |

|

106,609 |

|

722,315 |

|

559,478 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

|

392,993 |

|

491,607 |

|

1,488,373 |

|

1,693,702 |

|

|

|

|

|

|

|

|

|

|

|

|

|

ATTRIBUTABLE TO: |

|

|

|

|

|

|

|

|

|

|

Owners of the parent |

|

396,972 |

|

450,094 |

|

1,402,873 |

|

1,583,731 |

|

|

Non-controlling interests |

|

(3,979 |

) |

41,513 |

|

85,500 |

|

109,971 |

|

|

|

|

392,993 |

|

491,607 |

|

1,488,373 |

|

1,693,702 |

|

18

GERDAU S.A.

CONSOLIDATED STATEMENTS OF CASH FLOWS

for the years ended December 31, 2014, 2013 and 2012

In thousands of Brazilian reais (R$)

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities |

|

|

|

|

|

|

Net income for the year |

|

1,488,373 |

|

1,693,702 |

|

|

Adjustments to reconcile net income for the year to net cash provided by operating activities |

|

|

|

|

|

|

Depreciation and amortization |

|

2,227,396 |

|

2,029,507 |

|

|

Impairment of Assets |

|

339,374 |

|

— |

|

|

Equity in earnings of unconsolidated companies |

|

(101,875 |

) |

(54,001 |

) |

|

Exchange variation, net |

|

476,367 |

|

544,156 |

|

|

(Gains) Losses on financial instruments, net |

|

(36,491 |

) |

(2,854 |

) |

|

Post-employment benefits |

|

200,699 |

|

95,514 |

|

|

Stock based remuneration |

|

39,614 |

|

38,223 |

|

|

Income tax |

|

(150,389 |

) |

(241,056 |

) |

|

(Gains) Losses on disposal of property, plant and equipment and investments |

|

(48,639 |

) |

(133,593 |

) |

|

Gains in Joint ventures operations |

|

(636,528 |

) |

— |

|

|

Allowance for doubtful accounts |

|

49,890 |

|

47,345 |

|

|

Provision for tax, labor and civil claims |

|

281,876 |

|

205,167 |

|

|

Interest income on investments |

|

(144,723 |

) |

(135,040 |

) |

|

Interest expense on loans |

|

1,178,034 |

|

901,273 |

|

|

Interest on loans with related parties |

|

(2,743 |

) |

(1,573 |

) |

|

Provision for net realisable value adjustment in inventory |

|

63,440 |

|

56,752 |

|

|

Release of allowance for inventory against cost upon sale of the inventory |

|

(69,502 |

) |

(61,453 |

) |

|

|

|

5,154,173 |

|

4,982,069 |

|

|

Changes in assets and liabilities |

|

|

|

|

|

|

(Increase) Decrease in trade accounts receivable |

|

(36,468 |

) |

(23,790 |

) |

|

(Increase) Decrease in inventories |

|

(173,191 |

) |

1,018,398 |

|

|

Decrease in trade accounts payable |

|

(251,911 |

) |

(128,942 |

) |

|

(Increase) Decrease in other receivables |

|

(701,550 |

) |

120,645 |

|

|

Increase (Decrease) in other payables |

|

280,187 |

|

162,863 |

|

|

Dividends from jointly-controlled entities |

|

95,600 |

|

63,073 |

|

|

Purchases of trading securities |

|

(3,028,974 |

) |

(3,360,144 |

) |

|

Proceeds from maturities and sales of trading securities |

|

2,544,895 |

|

2,481,935 |

|

|

Cash provided by operating activities |

|

3,882,761 |

|

5,316,107 |

|

|

|

|

|

|

|

|

|

Interest paid on loans and financing |

|

(859,821 |

) |

(810,362 |

) |

|

Income and social contribution taxes paid |

|

(452,079 |

) |

(407,333 |

) |

|

Net cash provided by operating activities |

|

2,570,861 |

|

4,098,412 |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

Additions to property, plant and equipment |

|

(2,266,702 |

) |

(2,598,265 |

) |

|

Proceeds from sales of property, plant and equipment, investments and other intangibles |

|

1,067,938 |

|

237,203 |

|

|

Additions to other intangibles |

|

(141,956 |

) |

(158,395 |

) |

|

Advance for capital increase in jointly-controlled entity |

|

— |

|

(77,103 |

) |

|

Cash and cash equivalents consolidated in business combinations |

|

— |

|

— |

|

|

Payment for business acquisitions, net of cash of acquired entities |

|

— |

|

(55,622 |

) |

|

Increase in controlling interest in associated companies |

|

— |

|

(51,383 |

) |

|

Net cash used in investing activities |

|

(1,340,720 |

) |

(2,703,565 |

) |

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

(Reduction) Increase of capital by non-controlling interests |

|

(550,000 |

) |

383,788 |

|

|

Purchase of treasury shares |

|

— |

|

— |

|