Gannett Nears Deal to Buy Journal Media

October 07 2015 - 6:50PM

Dow Jones News

USA Today owner Gannett Co. is nearing a deal to buy Journal

Media Group, owner of the Milwaukee Journal Sentinel and other

newspapers, in a sign a long-awaited round of consolidation in the

beleaguered industry may be under way.

The deal could be announced as early as Thursday and value

Journal Media at just under $300 million, according to people

familiar with the matter. Journal Media had a market value of $192

million at Wednesday's close, meaning Gannett would be paying a

relatively big takeover premium. Gannett had a value of $1.7

billion.

The deal would add Journal Media publications—which include a

handful of dailies besides the Journal Sentinel as well as dozens

of community papers throughout the Midwest and South—to Gannett's

network of 92 mostly small- and medium-market daily newspapers in

the U.S.

Journal Media was created this year from a complex deal that

combined the newspaper assets of E.W. Scripps and Journal

Communications. Its other titles include the Memphis Commercial

Appeal, the Knoxville News Sentinel and the Naples Daily News.

Shares of Journal Media are down 19% since their inception.

Gannett itself is fresh off its June spinoff as a pure newspaper

company. The company, with its television assets now in a

separately traded public company called Tegna Inc., has a new chief

executive, Robert Dickey, who has said the company is on the hunt

to acquire newspapers in markets that have populations between one

and three million people. He added that it also would consider

smaller markets of more than 500,000 people—but only as a purchase

of a larger media group. Milwaukee, the largest market in which

that Journal Media Group operates, has a population of 600,000.

Since the split, Gannett took control of some additional

newspapers in Texas, New Mexico and Pennsylvania as part of an

asset swap with Digital First Media, and it acquired 28 weekly and

a daily newspaper in the U.K.

The deal would represent one of the first major acquisitions of

the newspaper assets that were jettisoned in the past few years

amid a wave of spinoffs that sought to free the faster-growing

television businesses of diversified media companies from the

steady decline of advertising and other woes that print operations

are suffering.

In the immediate aftermath of the splits, most of the

deal-making has been done on the television side, as

broadcast-station owners look to bulk up to negotiate higher fees

from pay-TV operators and content providers.

But slowly, over the past year, consolidation has come to the

newspaper industry as well in part because prices for newspaper

assets have fallen so precipitously and because of the cost and

other synergies that such combinations promise.

New players like Gannett and New Media Investment Group—launched

in 2013 with assets of GateHouse Media Inc. and the Dow Jones Local

Media Group—are snapping up newspaper assets they see as

undervalued. New Media, for example, agreed to buy Stephens Media

LLC, owner of 65 weekly and niche publications including the Las

Vegas Review-Journal, for $102.5 million and Halifax Media Group,

owner of 36 newspapers including the Tuscaloosa News, for $280

million.

Write to Dana Cimilluca at dana.cimilluca@wsj.com and Keach

Hagey at keach.hagey@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 07, 2015 18:35 ET (22:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

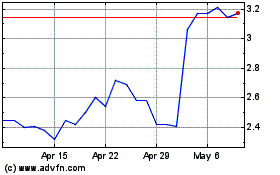

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

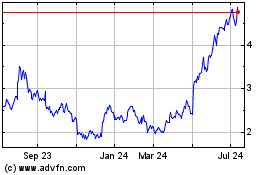

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024