NOTICE

OF ANNUAL MEETING OF

S

TOCKHOLDERS

March 25, 2016

Dear Stockholder:

It is my pleasure to invite you to attend

the 2016 Annual Meeting of Stockholders of FMC Technologies, Inc., which will be held at the time and place noted below. References

in the accompanying Proxy Statement to the “Annual Meeting” also refer to any adjournments, postponements or changes

in location of the Annual Meeting, to the extent applicable.

This year, we are using the “Notice

and Access” method of providing proxy materials to stockholders via the Internet. We believe that this process provides stockholders

with a convenient and efficient way to access the proxy materials and vote. We will mail to most of our stockholders a Notice of

Internet Availability of Proxy Materials containing instructions on how (1) to access our 2016 Proxy Statement and our Annual Report

on Form 10-K for the year ended December 31, 2015 and (2) to vote electronically via the Internet. This notice will also contain

instructions on how to receive a paper copy of the proxy materials. All stockholders who do not receive a notice will receive a

paper copy of the proxy materials by mail or an electronic copy of the proxy materials by email.

|

TIME AND DATE

|

Friday, May 6, 2016, at 11:00 a.m. Central Time

|

|

|

|

|

|

PLACE

|

The Four Seasons Hotel

1300 Lamar Street

Houston, Texas 77010

|

|

|

|

|

|

ITEMS OF BUSINESS

|

1.

|

Elect 12 directors;

|

|

|

|

|

|

|

2.

|

Ratify the appointment of KPMG LLP (“KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2016;

|

|

|

|

|

|

|

3.

|

Hold an advisory vote to approve our 2015 executive compensation; and

|

|

|

|

|

|

|

4.

|

Transact any other business that may properly come before the Annual Meeting.

|

|

|

|

|

|

RECORD DATE

|

March 14, 2016

|

|

|

|

|

|

PROXY VOTING

|

It is important that your shares be represented and voted at the Annual Meeting. You can vote your shares electronically via the Internet, by telephone or by completing and returning the proxy card or voting instruction card if you requested paper proxy materials. Voting instructions are provided in the Notice of Internet Availability of Proxy Materials, or, if you requested printed materials, the instructions are printed on your proxy card and included in the accompanying Proxy Statement. You can revoke a proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the Proxy Statement.

|

|

|

By order of the Board of Directors,

|

|

|

|

|

|

Dianne B. Ralston

|

|

|

Senior Vice President, General Counsel and Secretary

|

|

|

IMPORTANT NOTICE

REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2016 ANNUAL

MEETING OF STOCKHOLDERS TO BE HELD ON MAY 6, 2016

The Notice of Annual Meeting

of Stockholders, our Proxy Statement for the Annual Meeting and our Annual Report to Stockholders for the fiscal year ended December

31, 2015 are available at

www.proxyvote.com

.

|

|

Along

with the Notice of Annual Meeting of Stockholders, we are providing this Proxy Statement and the Company’s Annual Report

on Form 10-K for the year ended December 31, 2015 (the “Proxy Materials”) in connection with FMC Technologies, Inc.’s

(“FMC Technologies,” the “Company,” “we,” “us” or “our”) 2016 Annual

Meeting of Stockholders. The Notice of Internet Availability of Proxy Materials (the “Notice”) and the Proxy Materials

were first made available to stockholders on or about March 25, 2016. If you requested printed versions by mail, your Proxy Materials

also include the proxy card or voting instruction form for the Annual Meeting.

This

summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information

that you should consider, and you should read the entire Proxy Statement carefully before voting.

|

|

|

|

|

Meeting

Information

|

|

|

|

|

|

•

|

Time and Date

|

Friday, May 6, 2016, at 11:00 a.m. Central Time

|

|

|

|

|

|

•

|

Place

|

The Four Seasons Hotel

|

|

|

|

1300 Lamar Street

|

|

|

|

Houston, Texas 77010

|

|

|

|

|

|

•

|

Record Date

|

March 14, 2016

|

|

|

|

|

|

•

|

Voting

|

Stockholders as of the close of business on the record date, March

14, 2016, are entitled to vote. Each share of our Common Stock is entitled to one vote for each director nominee and one vote

for each of the proposals to be voted on.

|

|

|

|

|

|

•

|

Admission

|

You are entitled to attend the Annual Meeting only if you are a

stockholder as of the close of business on the record date or hold a valid proxy for the meeting. In order to be admitted

to the Annual Meeting, you must present proof of ownership of Company stock on the record date. Please refer to the section

“General Information about the Annual Meeting—What do I need to attend the Annual Meeting?” for detailed

instructions.

|

|

Voting

Matters and Board Recommendations

|

|

|

|

|

|

|

Matter

|

Board of Directors

Vote Recommendation

|

Page

Reference

|

|

1.

|

Election of Directors

|

FOR EACH DIRECTOR NOMINEE

|

12

|

|

2.

|

Ratification of Appointment of KPMG as Independent Registered Public

Accounting Firm for 2016

|

FOR

|

66

|

|

3.

|

Advisory Vote to Approve 2015 Executive Compensation

|

FOR

|

68

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

We

are asking stockholders to elect 12 directors to serve for a one-year term. The following table provides summary information about

each director nominee.

|

|

|

|

|

|

|

|

|

|

|

Name

|

Age

|

Director

Since

|

Occupation

|

Independent

|

AC

|

CC

|

NGC

|

Other Public

Company

Boards

|

|

Clarence P. Cazalot, Jr.

|

65

|

2013

|

Retired

Chairman,

President

and Chief Executive Officer of Marathon Oil Corporation

|

L

|

|

X

|

X

|

2

|

|

Eleazar de Carvalho Filho

|

58

|

2010

|

Founding Partner of Virtus BR Partners

Assessoria Corporativa Ltda. and Sinfonia Consultoria Financeira e Participações Ltda.

|

X

|

F

|

|

X

|

3

|

|

C. Maury Devine

|

65

|

2005

|

Retired President and Managing Director

of ExxonMobil Norway, Inc.

|

X

|

F

|

|

X

|

3

|

|

Claire S. Farley

|

57

|

2009

|

Vice-Chairman of the Energy & Infrastructure

business of KKR & Co. L.P.

|

X

|

F

|

X

|

|

1

|

|

John T. Gremp

|

64

|

2011

|

Chairman and Chief Executive Officer

of FMC Technologies, Inc.

|

|

|

|

|

1

|

|

Thomas M. Hamilton

|

72

|

2001

|

Co-owner of Medora Investments, LLC

|

X

|

F

|

X

|

|

1

|

|

Peter Mellbye

|

66

|

2013

|

Retired Executive Vice President of Statoil

ASA

|

X

|

|

X

|

X

|

None

|

|

Joseph H. Netherland

|

69

|

2001

|

Retired Chairman, President and Chief

Executive Officer of FMC Technologies, Inc.

|

X

|

|

|

|

None

|

|

Peter Oosterveer

|

58

|

2015

|

Chief Operating Officer of Fluor Corporation

|

X

|

F

|

|

X

|

None

|

|

Richard A. Pattarozzi

|

72

|

2002

|

Retired Vice President of Shell Oil Company

|

X

|

|

X

|

X

|

2

|

|

Kay G. Priestly

|

60

|

2015

|

Retired Chief Executive Officer of

Turquoise Hill Resources Ltd.

|

X

|

F

|

|

|

2

|

|

James M. Ringler

|

70

|

2001

|

Non-executive Chairman of Teradata Corporation

|

X

|

F

|

X

|

|

4

|

|

AC

|

Audit Committee

|

|

|

|

CC

|

Compensation Committee

|

F

|

Audit Committee Financial Expert

|

|

NGC

|

Nominating and Governance Committee

|

L

|

Lead Independent Director

|

Our

Board of Directors believes that the purpose of corporate governance is to ensure that we maximize stockholder value in a manner

that is consistent with our Code of Business Conduct (“Code of Conduct”) and core values vision statement, as well

as all applicable legal requirements. The following highlights some key characteristics of our Board and governance practices.

|

|

|

|

|

Size of Board after 2016 Annual Meeting

|

|

12

|

|

Number of Independent Directors after 2016 Annual Meeting

|

|

11

|

|

Average Age of Directors

|

|

65

|

|

Number of Board Meetings in 2015

|

|

9

|

|

Annual Election of Directors

|

|

P

|

|

Majority Voting for Directors

|

|

P

|

|

Lead Independent Director

|

|

P

|

|

Regular Executive Sessions of Independent Directors

|

|

P

|

|

All Board Committee Members are Independent Directors

|

|

P

|

|

Annual Board and Committee Evaluations

|

|

P

|

|

Director Stock Ownership Requirements

|

|

P

|

|

Code of Conduct Applicable to Directors

|

|

P

|

|

Governance Principles with Director Retirement Policy

|

|

P

|

|

Annual Advisory Vote to Approve Executive Compensation

|

|

P

|

|

Risk Oversight by Full Board and Committees

|

|

P

|

|

Ratification

of Independent Registered Public Accounting Firm

|

As a

matter of sound corporate governance, we are asking our stockholders to ratify the appointment of KPMG as our independent registered

public accounting firm for the fiscal year ending December 31, 2016. Set forth below is summary information with respect to KPMG’s

fees for services provided in 2015 and 2014.

|

Type of Fees

|

|

|

2015

|

|

2014

|

|

|

|

(in millions)

|

|

Audit Fees

|

|

$5.74

|

|

$6.15

|

|

Audit-Related Fees

|

|

0

|

|

0.10

|

|

Tax Fees

|

|

0.08

|

|

0.27

|

|

Other Fees

|

|

0

|

|

0

|

|

Total

|

|

$5.82

|

|

$6.52

|

|

Advisory

Vote to Approve 2015 Executive Compensation

|

We are

asking stockholders to approve on an advisory basis our 2015 named executive officer (“NEO”) compensation. The Board

recommends a “FOR” vote because it believes that our executive compensation policies and practices serve us and our

stockholders by helping us (1) reward executives for financial and operational achievements that align with stockholder interests

and enhance stockholder long-term value and (2) attract, motivate and retain an exceptionally talented team of executives who

deliver superior operational performance and provide leadership for delivering technological innovation in a dynamic and competitive

market.

|

Components

of Compensation

|

|

In

order to attract and retain the needed level of executive talent for our Company, compensation for our NEOs consists of three

primary elements designed to reward performance and service: base pay, annual non-equity incentive awards and long-term equity

awards. We allocate these elements between short-term and long-term compensation. Additionally, our compensation program is designed

to ensure that the majority of our executives’ pay is “at risk,” meaning there is no guarantee that such “at

risk” compensation values on the date of grant will be realized. This “at risk” feature demonstrates management’s

focus on performance-based compensation and alignment with our stockholders’ interests.

|

|

|

|

|

|

|

|

|

|

Component

|

Objectives

|

|

Key Features

|

|

At Risk

|

|

|

Base Pay

|

Reflects executive’s responsibilities, job characteristics and scope, performance, experience and skill set

|

|

Reviewed annually and subject to adjustment based on individual performance, experience, business conditions, market factors and comparable market data from our peer group

|

|

No

|

|

Annual Non-Equity Incentive

|

Focuses executives on performance factors important to achieve

predetermined financial and operational goals

Aligns executive compensation closely with Company performance

and maximizing stockholder value

|

|

75% of award is based on business performance measured through

three equally-weighted elements: Working Capital Efficiency, EBIT Growth and EBIT Percentage of Sales

25% of award is based on individual performance against established

objectives

|

|

Yes, pays out only based on achievement of predetermined financial and operational goals

|

|

|

Performance-Based Restricted Stock Units (“RSUs”) (⅔)

|

Incentivizes executive contributions to Company performance

Retains executives in a competitive energy market

Provides strong incentive to outperform industry peers in the

PHLX Oil Service Sector Index (“OSX”)

|

|

Earned based on achieving targets for Company EBITDA Growth,

Return on Investment (“ROI”) and Total Stockholder Return (“TSR”) relative to our OSX peers

3-year “cliff” vesting requirement

|

|

Yes, pays out based on achievement of Company performance targets

vs. OSX

Must remain employed with the Company for 3 years for RSUs to

vest

|

|

Time-Based RSUs (⅓)

|

Correlates executive’s award to long-term increases in

stockholder value

Retains executives in a competitive energy market

|

|

Value based on changes in stockholder value

3-year “cliff” vesting requirement

|

|

Yes, value from grant date increases or decreases based on share

price

Must remain employed with the Company for 3 years for RSUs to

vest

|

|

Other Key

Compensation Features

|

|

|

|

|

|

Executive stock ownership and retention requirements

|

P

|

|

“Clawback” policy that permits recoupment of an executive

officer’s equity compensation upon the occurrence of certain events

|

P

|

|

Stock trading policy that prohibits executives from hedging, pledging

and short-selling our Common Stock

|

P

|

|

Limits on maximum incentive plan payouts consistent with peer company

practices

|

P

|

|

No employment agreements

|

P

|

|

No tax gross-ups for executive officers

|

P

|

|

2015 Compensation

Decisions

|

|

The

oil and gas industry endured a difficult year in 2015 as an unprecedented combination of market forces and events drove oil prices

to their lowest levels in decades. We responded by moving aggressively to help customers improve project economics, developing

innovative technologies and approaches, and demonstrating our commitment to invest in their success throughout the life of the

field. These steps, combined with a large backlog in our Subsea Technologies business, continued gains in execution, and significant

cost reductions, supported our financial results in a difficult environment.

Our

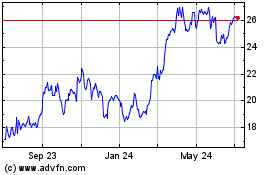

performance reflected a plunge in crude oil prices that surpassed all predictions. In 2015, our revenue was $6.4 billion, a

20% decline from the prior year. Net income attributable to our stockholders was $393.1 million in 2015, a decrease of 44%

from the prior year. Our total stockholder returns over the prior 1-year, 3-year and 5-year periods were -38.1%, -32.3% and

-34.8%, respectively. Consistent with our compensation philosophy of linking executive pay to Company performance, as Company

performance fell below target results, our NEOs’ annual non-equity incentive bonus also declined. In February 2016, a

below target payment was approved for annual non-equity incentive bonuses related to our 2015 performance. Our NEOs’

average annual non-equity incentive bonus was paid at 59% of target, declining by an average of 64% from 2014. However, above

target payouts for performance-based awards for EBITDA Growth and ROI were approved by our Compensation Committee in February

2016 based on our performance when compared to that of our OSX peers.

In

general, the deadline for stockholder proposals to be included in the proxy statement and form of proxy pursuant to Rule 14a-8

for our 2017 Annual Meeting of Stockholders is December 7, 2016.

|

GENERAL

INFORMATION ABOUT THE ANNUAL MEETING

|

|

What

is the location of the 2016 Annual Meeting?

|

The Annual Meeting

will be held at The Four Seasons Hotel, 1300 Lamar Street in Houston, Texas 77010, on Friday, May 6, 2016, at 11:00 a.m. Central

Time or at such other time and place to which the Annual Meeting may be adjourned or postponed.

|

Who

is soliciting my vote?

|

The Board of Directors

of FMC Technologies (the “Board”) is soliciting your vote at the 2016 Annual Meeting of Stockholders.

|

What

is the purpose of the Annual Meeting?

|

You will be voting

on the following items of business:

|

|

(1)

|

the

election of 12 directors (Proposal 1);

|

|

|

(2)

|

the

ratification of the appointment of KPMG as our independent registered public accounting

firm for the fiscal year ending December 31, 2016 (Proposal 2); and

|

|

|

(3)

|

an

advisory vote to approve our 2015 executive compensation (Proposal 3).

|

If any other business

properly comes before the meeting, you will be voting on those items as well.

|

How

does the Board recommend that I vote my shares?

|

The Board recommends

that you vote your shares as follows:

|

|

(1)

|

FOR

the election of each of the nominees for director to serve for one-year terms

(Proposal 1);

|

|

|

(2)

|

FOR

the ratification of the appointment of KPMG as our independent registered public

accounting firm for the fiscal year ending December 31, 2016 (Proposal 2); and

|

|

|

(3)

|

FOR

the approval of our 2015 executive compensation (Proposal 3).

|

Our Board does not

know of any other matters that are to be presented for action at the Annual Meeting. However, if any other matters are properly

presented, the persons named as proxies will vote or refrain from voting on any matter in accordance with their best judgment.

|

How

will I receive Proxy Materials?

|

This year, we are using

the “Notice and Access” method of providing Proxy Materials to stockholders via the Internet. With “Notice and

Access,” we are permitted to furnish Proxy Materials to our stockholders by providing access to such documents on the Internet

instead of mailing printed copies. Accordingly, you will receive our Proxy Materials in one of the following ways:

|

|

|

•

|

Notice

and Access

:

Most stockholders will not receive printed copies of the Proxy Materials

unless they request them. Instead, the Notice, which was mailed to most of our stockholders

beginning on or about March 25, 2016, will instruct you on how to access and review all

of the Proxy Materials on the Internet. The Notice also instructs you on how you may

submit your proxy on the Internet. If you would like to receive a paper or email copy

of our Proxy Materials, you should follow the instructions for requesting such materials

in the Notice. Any request to

|

|

|

|

|

receive

Proxy Materials by mail or email will remain in effect until you revoke it. All stockholders

who do not receive a Notice will receive a paper copy of the Proxy Materials by mail or an

electronic copy of the Proxy Materials by email (see below).

|

|

|

|

•

|

Email

Access to Proxy Materials

:

Stockholders who previously elected to receive notice

of access to Proxy Materials via email will not receive the Notice in the mail. You should

have received an email with links to the Proxy Materials and online proxy voting.

|

|

|

|

•

|

Paper

Copy of Proxy Materials with Proxy Card

:

Stockholders who previously requested

paper copies of the Proxy Materials will not receive the Notice. Instead, you will continue

to receive a paper copy of the Proxy Materials until you request a change. You can eliminate

all such paper mailings in the future by electing to receive an email that will provide

Internet links to these documents. Opting to receive all future Proxy Materials online

will save us the cost of producing and mailing documents to your home or business and

help us conserve natural resources. To request electronic delivery, please follow the

instructions on your proxy card or voting instruction card.

|

These documents will

also be made available at the Annual Reports section of our website

www.fmctechnologies.com

under the heading “

Investors

> Financial Information > SEC Filings

,” as well as at

www.proxyvote.com

.

You can vote at the

Annual Meeting if you were a holder of our Common Stock as of 5:00 p.m. Eastern Time on March 14, 2016, our record date. You will

have one vote for each share of Common Stock you owned at the close of business on the record date, provided those shares were

either held directly in your name as the stockholder of record or were held for you as the beneficial owner through a broker,

bank or other nominee. As of March 14, 2016, we had 226,825,347 shares of Common Stock outstanding and entitled to vote.

|

Who

can attend the Annual Meeting?

|

Only stockholders as

of the record date, and any stockholder’s spouse or duly appointed proxy, may attend. No guests will be allowed to attend

the Annual Meeting.

|

What

do I need to attend the Annual Meeting?

|

The Annual Meeting

will be held at The Four Seasons Hotel, 1300 Lamar Street in Houston, Texas 77010. Admission to the Annual Meeting will begin

at 10:00 a.m., Central Time on Friday, May 6, 2016.

In order to be admitted

to the Annual Meeting, you should:

|

|

|

•

|

Arrive

shortly after 10:00 a.m., Central Time, to ensure that you are seated by the commencement

of the Annual Meeting at 11:00 a.m., Central Time;

|

|

|

|

•

|

Be

prepared to comply with security requirements, which may include security guards searching

all bags, among other security measures;

|

|

|

|

•

|

Leave

your camera at home because cameras, transmission, broadcasting and other recording devices,

including certain smart phones, may not be permitted in the meeting room; and

|

|

|

|

•

|

Bring

photo identification, such as a driver’s license, and proof of ownership of Company

Common Stock on the record date, March 14, 2016. Proof of ownership may be the Notice,

a brokerage statement or letter from a bank or broker indicating ownership on March 14,

2016, a proxy card, a legal proxy or voting instruction card provided by your broker,

bank or nominee.

|

Any holder of a proxy

from a stockholder must present a properly executed legal proxy and a copy of the proof of ownership.

IF YOU DO NOT PROVIDE

VALID PHOTO IDENTIFICATION AND COMPLY WITH THE OTHER PROCEDURES OUTLINED ABOVE FOR ATTENDING THE ANNUAL MEETING IN PERSON, WE

WILL BE UNABLE TO ADMIT YOU TO ATTEND THE ANNUAL MEETING IN PERSON.

|

What

is the difference between a record holder and a holder of shares in

street

name?

|

|

|

Most of our stockholders

hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are

some differences between shares held of record and those owned beneficially in street name.

|

|

|

•

|

Stockholders

of Record.

If your shares are registered directly in your name with our transfer

agent, Wells Fargo Shareowner Services, you are considered the stockholder of record

with respect to those shares, and the Notice or Proxy Materials are being sent directly

to you. As the stockholder of record, you have the right to grant your voting proxy directly

to us, to vote electronically or to vote in person at the Annual Meeting. If you have

requested printed Proxy Materials, we have enclosed a proxy card for you to use.

|

|

|

|

•

|

Beneficial Owners.

If your shares are held in a stock brokerage account or by a bank or other nominee,

you are considered the beneficial owner of shares held in “street name,”

and the Notice or these Proxy

Materials are being forwarded to you by your broker, bank or nominee who is considered the stockholder of record with respect

to those shares. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and are also

invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person

at the Annual Meeting, unless you request, complete and deliver a legal proxy from your broker, bank or nominee. If you requested

printed Proxy Materials, your broker, bank or nominee has enclosed a voting instruction card for you to use in directing the broker,

bank or nominee regarding how to vote your shares.

|

Your

vote is important. You may vote on the Internet, by telephone, by mail or by attending the Annual Meeting and voting by ballot,

all as described below. The Internet and telephone voting procedures are designed to authenticate stockholders by use of a control

number and to allow you to confirm that your instructions have been properly recorded. If you vote by telephone or on the Internet,

you do not need to return your proxy card or voting instruction card.

Telephone and Internet voting facilities are available

now and will be available 24 hours a day until 11:59 p.m., Eastern Time, on May 5, 2016.

If you are a stockholder

of record, you may vote by going to

www.proxyvote.com

, which is available 24 hours a day, and following the instructions

in the Notice. If you requested printed Proxy Materials, you may follow the instructions provided with your Proxy Materials and

on your proxy card. If your shares are held with a broker, you will need to go to the website provided on your Notice or voting

instruction card. Have your Notice, proxy card or voting instruction card available when you access the voting website.

If you are a stockholder

of record, you may also vote by telephone by calling, toll-free, 1-800-690-6903, which is available 24 hours a day, and following

the pre-recorded instructions. If your shares are held with a broker, you can vote by telephone by dialing the number specified

on your voting instruction card. Have your Notice, proxy card or voting instruction card available when you call.

If you requested printed

Proxy Materials, you may choose to vote by mail, by marking your proxy card or voting instruction card, dating and signing it,

and returning it in the postage-paid envelope provided. If you vote by mail, your proxy card must be received by May 5, 2016.

Please allow sufficient time for mailing if you decide to vote by mail. Please note that if you choose to vote on the Internet

or by telephone, you do not need to return your proxy card.

The method or timing

of your vote will not limit your right to vote at the Annual Meeting if you attend the Annual Meeting and vote in person. However,

if your shares are held in the name of a bank, broker or other nominee, you must obtain a legal proxy, executed in your favor,

from the holder of record to be able to vote at the Annual Meeting. You should allow yourself enough time prior to the Annual

Meeting to obtain this proxy from the holder of record.

The shares voted electronically, telephonically, or represented by the

proxy cards received, properly marked, dated, signed and not revoked, will be voted at the Annual Meeting.

|

How

do I vote my 401(k) shares?

|

If you participate

in the FMC Technologies, Inc. Savings and Investment Plan and invest in the FMC Technologies, Inc. Stock Fund, you may vote the

number of shares equivalent to your interest in the FMC Technologies, Inc. Stock Fund as credited to your account on the record

date. You will receive instructions on how to vote your shares via e-mail from Broadridge Investor Communication Services (“Broadridge”),

our proxy distributor.

|

Can

I revoke a proxy after I submit it?

|

Yes. If you are a stockholder

of record, you may revoke your proxy at any time before it is exercised by:

|

|

|

•

|

sending

a written notice revoking your proxy to our Corporate Secretary at our principal executive offices at 5875 N. Sam Houston Parkway

W., Houston, Texas 77086, by May 5, 2016;

|

|

|

|

•

|

delivering

a properly executed, later-dated proxy by May 5, 2016;

|

|

|

|

•

|

voting

again through the Internet or by telephone in accordance with the instructions provided to you for voting your shares by May 5,

2016; or

|

|

|

|

|

|

|

|

|

•

|

attending the Annual

Meeting and voting in person.

|

If you are a street name stockholder, you may change your vote

by submitting new voting instructions to your broker, bank, trust or other holder of record in accordance with that entity’s

procedures.

|

How

many votes must be present to hold the Annual Meeting?

|

Your shares are counted

as present at the Annual Meeting if you attend the Annual Meeting and vote in person or if you properly return a proxy by Internet,

telephone or mail. A quorum of stockholders is necessary to transact business at the Annual Meeting. A quorum exists if the holders

of a majority of our outstanding shares entitled to vote as of March 14, 2016 are present in person or by proxy at the Annual

Meeting, including proxies on which abstentions (withholding authority to vote) are indicated. Abstentions and broker non-votes

will be counted for purposes of establishing a quorum at the Annual Meeting.

If less than a quorum

is represented at the Annual Meeting, the presiding officer of the meeting or persons representing a majority of the shares represented

may move to adjourn the meeting. In the event a quorum is present at the Annual Meeting but sufficient votes to approve any of

the items proposed by our Board have not been received, the presiding officer of the meeting or the persons named as proxies may

propose one or more adjournments of the Annual Meeting to permit further solicitation of proxies. A stockholder vote may be taken

on one or more of the proposals in this Proxy Statement prior to such adjournment if sufficient proxies have been received and

it is otherwise appropriate.

|

What

if I don’t give specific voting instructions?

|

Stockholders

of Record.

If you are a stockholder of record and you indicate when voting by Internet or by telephone that you wish to

vote as recommended by our Board of Directors, or you return a signed proxy card but do not indicate how you wish to vote, then

your shares will be voted:

|

|

|

•

|

In

accordance with the recommendations of the Board on all matters presented in this Proxy Statement; and

|

|

|

|

•

|

As

the proxy holders may determine in their discretion regarding any other matters properly presented for a vote at the Annual Meeting.

|

If you indicate a choice

with respect to any matter to be acted upon on your proxy card, the shares will be voted in accordance with your instructions

on such matter.

Beneficial

Owners.

If you are a beneficial owner and hold your shares in street name and do not provide the organization that

holds your shares with voting instructions, one of two things can happen, depending upon whether a proposal is

“routine.” Under the New York Stock Exchange’s (the “NYSE”) rules, brokers have discretion to

cast votes on routine matters, such as the ratification of the appointment of KPMG as our independent registered public

accounting firm for 2016, without receiving voting instructions from their clients. Brokers are not permitted, however, to

cast votes on “non-routine” matters without such voting instructions.

The election of directors and the

proposal on executive compensation are considered “non-routine” matters, so if you are a beneficial owner, your broker,

bank, trust or other holder of record is not permitted to vote your shares on these matters if the broker does not receive voting

instructions from you. Accordingly, the broker may return the proxy card without voting on these proposals, and this is known

as a “broker non-vote.” The ratification of auditors is considered a “routine” matter, so if you are a

beneficial owner, your broker, bank, trust or other holder of record is permitted to vote your shares on the ratification of auditors

even if the broker does not receive voting instructions from you.

In

summary, if you hold your shares in street name, your broker, bank, trust or other holder of record

will not

have discretionary

authority to vote your shares for Proposals 1 and 3 if you do not provide instructions. As such, we strongly encourage you to

exercise your right to vote as a stockholder.

|

How

many votes are needed to approve the proposals?

|

|

Election of Directors

(Proposal 1)

|

|

With respect to the

election of our directors, you may (a) vote FOR, (b) vote AGAINST or (c) ABSTAIN from voting as to one or more director nominees.

Our Amended and Restated By-Laws (the “By-Laws”) provide that nominees for director are elected by a majority of the

votes cast, which means that a nominee is elected only if the votes cast FOR his/her election exceed the votes cast AGAINST his/her

election. A vote to ABSTAIN is not considered a vote FOR or AGAINST and thus will have no effect on the outcome of the vote. Broker

non-votes are not entitled to vote on this matter, and therefore, will not be counted as votes cast on this matter. You may not

cumulate your votes in the election of our directors. An incumbent director who fails to receive a majority of FOR votes will

be required to tender his or her resignation to our Board for consideration. The Nominating and Governance Committee will make

a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken.

|

Ratification

of the Appointment of KPMG as Our Independent Registered Public Accounting Firm

for

2016 (Proposal 2)

|

|

With

respect to the ratification of the appointment of KPMG as our independent registered public accounting firm for 2016, you

may (a) vote FOR, (b) vote AGAINST or (c) ABSTAIN from voting. A majority of the shares of Common Stock present in person or

represented by proxy at our Annual Meeting and entitled to vote must be voted FOR ratification in order for Proposal 2 to

pass. Votes cast FOR, AGAINST and ABSTENTIONS with respect to this matter will be counted as shares entitled to vote. A vote

to ABSTAIN will have the effect of a vote AGAINST the approval of this proposal. The ratification of auditors is considered a

“routine” matter, so if you are a beneficial owner, your broker, bank, trust or other holder of record is

permitted to vote your shares on the ratification of auditors even if the broker does not receive voting instructions from

you.

|

Advisory

Vote to Approve Our 2015 Executive Compensation (Proposal 3)

|

|

With

respect to the advisory vote to approve our 2015 executive compensation, you may (a) vote FOR, (b) vote AGAINST or (c)

ABSTAIN from voting. A majority of the shares of Common Stock present in person or represented by proxy at our Annual Meeting

and entitled to vote must be voted FOR approval in order for Proposal 3 to pass. Votes cast FOR, AGAINST and ABSTENTIONS with

respect to this matter will be counted as shares entitled to vote. A vote to ABSTAIN will have the effect of a vote AGAINST

the approval of this proposal. Broker non-votes are not entitled to vote on this matter, and therefore, will not be counted

as votes cast on this matter. While this vote is required by law, it will neither be binding on the Company or our Board, nor

will it create or imply any change in the fiduciary duties of, or impose any additional fiduciary duty on, the Company or our

Board. However, the Compensation Committee, which is responsible for designing and administering our executive compensation

program, values the opinions expressed by stockholders and will continue to consider the outcome of the vote when making

future executive compensation decisions.

|

Could

other matters be decided at the Annual Meeting?

|

At the date this Proxy

Statement went to press, we did not know of any matters to be raised at the Annual Meeting other than those referred to in this

Proxy Statement. No matters were brought to the attention of our Corporate Secretary in accordance with the required procedures

listed in our By-Laws or under Rule 14a-8 and explained in our 2015 Proxy Statement under the section “Proposals for the

2016 Annual Meeting of Stockholders.” If any other matters arise, the named proxies will vote in accordance with their best

judgment.

|

ELECTION

OF DIRECTORS (PROPOSAL 1)

|

The

Board has authority under our By-Laws to fill vacancies and to increase or, upon the occurrence of a vacancy, decrease the

Board’s size between annual stockholder meetings. The size of our Board of Directors is currently at 13. Mike R.

Bowlin, a member of our Board, has decided to retire from our Board effective immediately prior to our 2016 Annual Meeting,

and, as a result, will not stand for re-election at such meeting. Accordingly, the size of our Board of Directors will be

reduced to 12 directors immediately prior to the 2016 Annual Meeting.

Listed below are the

12 nominees for election as a director, each of whom currently serves on the Board. At the Annual Meeting, proxies cannot be voted

for a greater number of individuals than the 12 nominees named in this Proxy Statement. Each of the directors listed below has

consented to serving as a nominee, being named in this Proxy Statement, and serving on the Board if elected. Each director elected

at the Annual Meeting will serve for a one-year term expiring at the 2017 Annual Meeting of Stockholders or until his or her successor

is elected and qualified or until his or her earlier death, retirement, resignation or removal.

The Board comprises a diverse group of leaders in their

respective fields. All of our directors have had senior leadership experience at major domestic and/or international companies.

In these positions, they have gained significant and diverse management experience, including strategic and financial planning,

public company financial reporting, compliance, risk management and leadership development. All of our directors also have experience

serving as executive officers or on boards of directors and board committees of other public and private companies and have an

understanding of corporate governance practices and trends. Many of our directors also have experience as directors or trustees

of significant academic, non-profit and philanthropic institutions and bring unique perspectives to the Board.

The Board and its Nominating

and Corporate Governance Committee believe the skills, experience, perspective and diversity of the directors provide the Company

with business acumen and a diverse range of perspectives to engage each other and management to address effectively the Company’s

evolving needs and represent the best interests of the Company’s stockholders. The biographies below describe the skills,

qualities and experience of the nominees that led the Board and the Nominating and Governance Committee to determine that it is

appropriate to nominate these directors.

|

What does the Board

recommend?

|

|

THE

BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE FOLLOWING DIRECTOR NOMINEES: CLARENCE

P. CAZALOT, JR., ELEAZAR DE CARVALHO FILHO, C. MAURY DEVINE, CLAIRE S. FARLEY, JOHN T. GREMP, THOMAS M. HAMILTON, PETER MELLBYE,

JOSEPH H. NETHERLAND, PETER OOSTERVEER, RICHARD A. PATTAROZZI, KAY G. PRIESTLY AND JAMES M. RINGLER.

Director Nominees

|

|

|

|

|

|

|

|

|

Clarence P. Cazalot, Jr.

|

|

|

|

Independent Lead Director

|

|

|

|

Age:

65

|

|

|

|

Director Since:

2013

|

|

|

|

(Independent)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Committees:

|

|

Other Public Directorships:

|

|

|

•

|

Compensation

|

|

•

|

Baker Hughes, Inc.

|

|

|

•

|

Nominating and Governance

|

|

•

|

Spectra Energy Corp.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Public Directorships Held During the Past Five

Years:

|

|

|

•

|

Marathon Oil Corporation (retired 2013)

|

|

|

|

|

|

|

|

Professional Experience:

Mr.

Cazalot is the retired Chairman, President and Chief Executive Officer of Marathon Oil Corporation, an international energy

company, formerly known as USX Corporation. He served as Chairman of Marathon Oil Corporation from July 2011 to December 2013

and as President and Chief Executive Officer from 2002 to July 2013. He served as President of Marathon Oil Company from 2000 to

2001. From 1972 to 2000, Mr. Cazalot served in the following executive positions at Texaco: President of Worldwide Production

Operations of Texaco Inc. from 1999 to 2000; President of International Production and Chairman of London-based Texaco Ltd.

from 1998 to 1999; President of International Marketing and Manufacturing from 1997 to 1998; President of Texaco Exploration

and Production Inc. from 1994 to 1996; and Vice President of Texaco Inc. and President of Texaco’s Latin America/West

Africa Division from 1992 to 1994. In addition to his public directorships, Mr. Cazalot serves on the Advisory Board of the

James A. Baker III Institute for Public Policy at Rice University, the Board of the Memorial Hermann Healthcare System, the

Board of Visitors of The University of Texas M.D. Anderson Cancer Center and the Board of the LSU Foundation.

Why this Director is an Asset to Our

Board:

Mr. Cazalot brings to our Board his (1) independence; (2) experience as a chief executive officer of

an international energy company; (3) financial expertise; (4) thorough understanding of different cultural, political and

regulatory requirements through his international experience in countries where we have a significant presence; (5) prior and

current experience as a board member of public companies with international operations and (6) contribution to the Board in a

way that enhances perspective through diversity in geographic origin and experience.

|

|

|

|

|

|

|

|

|

Eleazar de Carvalho Filho

|

|

|

|

Age:

58

|

|

|

|

Director Since:

2010

|

|

|

|

(Independent)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Committees:

|

|

Other Public Directorships:

|

|

|

•

|

Audit

|

|

•

|

Brookfield Renewable

|

|

|

•

|

Nominating and Governance

|

|

|

Energy Partners L.P.

|

|

|

|

|

|

•

|

Companhia Brasileira

|

|

|

|

|

|

|

de Distribuicão—Grupo

|

|

|

|

|

|

|

Pão de Acúcar

|

|

|

|

|

|

•

|

Cnova N.V.

|

|

|

|

|

|

|

|

|

|

Former Public Directorships Held During the Past Five

Years:

|

|

|

None

|

|

|

|

|

|

|

|

Professional Experience:

Mr. de Carvalho

Filho has been a Founding Partner of Virtus BR Partners Assessoria Corporativa Ltda. since May 2009, and is also a Founding Partner

of Sinfonia Consultoria Financeira e Participações Ltda. since August 2012, which are financial advisory and consulting

firms. He served as Chief Executive Officer and Managing Partner of Unibanco Investment Bank, a Brazilian investment bank, from

April 2008 to March 2009. Mr. de Carvalho Filho was a Consultant for BHP Billiton Metais S.A., a global natural resources company,

from 2006 to 2011. He was a Founding Partner of Iposeira Capital Ltda., established in 2003, as well as STK Capital Gestora de

Recursos Ltda., established in 2010, which are independent advisory and asset management companies. In addition to his public

directorships, Mr. de Carvalho Filho also serves as Chairman of the Board of Trustees of the Brazilian Symphony Orchestra Foundation.

Why this Director is an Asset to

Our Board:

Mr. de Carvalho Filho brings to our Board his (1) independence; (2) experience as a chief executive officer

and founding/managing partner of international investment organizations; (3) financial expertise; (4) thorough understanding

of different cultural, political and regulatory requirements through his international experience in countries where we

have a significant presence; (5) prior and current experience as a board member of public and private companies with

international operations and (6) contribution to the Board in a way that enhances perspective through diversity in geographic

origin and experience.

|

|

|

|

|

|

|

|

|

C. Maury Devine

|

|

|

|

Age:

65

|

|

|

|

Director Since:

2005

|

|

|

|

(Independent)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Committees:

|

|

Other Public Directorships:

|

|

|

•

|

Audit (Chair)

|

|

•

|

John Bean Technologies

|

|

|

•

|

Nominating and Governance

|

|

|

Corporation

|

|

|

|

|

|

•

|

Technip S.A.

|

|

|

|

|

|

•

|

Valeo S.A.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Public Directorships Held During the Past Five

Years:

|

|

|

None

|

|

|

|

|

|

|

|

Professional Experience:

Ms.

Devine served as President and Managing Director of ExxonMobil Corporation’s Norwegian affiliate, ExxonMobil Norway,

Inc., from 1996 to 2000. Prior to the merger of ExxonMobil, she served as Corporate Secretary of Mobil Corporation from 1994

to 1996. From 1990 to 1994, Ms. Devine managed Mobil’s international government relations. Prior to joining Mobil, Ms.

Devine served 15 years in the United States government in positions at the White House, the American Embassy in Paris,

France, and the U.S. Department of Justice. In addition, from 2000 to 2003, Ms. Devine was a Fellow at Harvard

University’s Belfer Center for Science and International Affairs. In addition to her public directorships, Ms. Devine

is also a member of the Council on Foreign Relations and a member of the Board of Directors of the Washington School for

Girls and Georgetown Visitation Preparatory School.

Why this Director is an Asset to Our

Board:

Ms. Devine brings to our Board her (1) independence; (2) financial expertise; (3) extensive corporate

governance experience as corporate secretary of a major U.S. public company, the vice chairman of a major Norwegian energy

company and prior and current experience as a member of the boards of both public companies and private organizations; (4)

international and U.S. governmental experience in various positions at the White House, the American Embassy in Paris,

France, and the U.S. Department of Justice and as the manager of a major U.S. public company’s international government

relations; (5) academic experience as a Fellow at Harvard University’s Belfer Center and (6) contribution to the Board

in a way that enhances perspective through diversity of experience.

|

|

|

|

|

|

|

|

|

Claire S. Farley

|

|

|

|

Age:

57

|

|

|

|

Director Since:

2009

|

|

|

|

(Independent)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Committees:

|

|

Other Public Directorships:

|

|

|

•

|

Audit

|

|

•

|

LyondellBasell Industries

|

|

|

•

|

Compensation

|

|

|

B.V.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Public Directorships Held During the Past Five

Years:

|

|

|

•

|

Encana Corporation (retired 2014)

|

|

|

|

|

|

|

|

Professional Experience:

Ms.

Farley has been a Vice-Chairman in the Energy & Infrastructure business of KKR & Co. L.P., a global investment firm

(“KKR”) since January 2016. She began her affiliation with KKR in September 2010 as a co-founder of RPM Energy,

LLC, a privately-owned oil and gas exploration and development company, which partnered with KKR. Prior to founding RPM

Energy, Ms. Farley was an Advisory Director at Jefferies Randall & Dewey, a global oil and gas industry advisor, and was

Co-President of Jefferies Randall & Dewey from February 2005 to July 2008. Prior to that, Ms. Farley served as Chief

Executive Officer of Randall & Dewey, an oil and gas asset transaction advisory firm, from September 2002 until February

2005, when Randall and Dewey became the Oil and Gas Investment Banking Group of

Jefferies & Company. Ms. Farley has

extensive oil and gas exploration expertise, holding several positions within Texaco from 1981 to 1999, including President

of Worldwide Exploration and New Ventures, President of North American Production and Chief Executive Officer of

Hydro-Texaco, Inc. Ms. Farley also served as Chief Executive Officer of Intelligent Diagnostics Corporation from October 1999

to January 2001 and Trade-Ranger Inc. from January 2001 to May 2002. In addition to her public directorships, Ms. Farley is

also a board member of Samson Resources, a private company, and a Trustee of the Houston Ballet Foundation.

Why this Director is an Asset to Our Board:

Ms. Farley brings to our Board her (1) independence; (2) experience as a chief executive officer of several major organizations;

(3) extensive oil and gas exploration and production experience; (4) financial expertise; (5) prior and current experience as

a board member of public companies with international operations and (6) contribution to the Board in a way that enhances perspective

through diversity of experience.

|

|

|

|

|

|

|

|

|

John T. Gremp

|

|

|

|

Age:

64

|

|

|

|

Director Since:

2011

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Committees:

|

|

Other Public Directorships:

|

|

|

None

|

|

•

|

Joy Global Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Public Directorships Held During the Past Five

Years:

|

|

|

None

|

|

|

|

|

|

|

|

Professional Experience:

Mr. Gremp serves as our Chairman of the Board and Chief Executive Officer (our “CEO”). Mr. Gremp

has served as our CEO since March 2011 and Chairman of the Board since November 2011. He served as our President and Chief

Operating Officer from April 2010 to February 2011 and retained his role as President from March 2011 to July 2012. He again

assumed the role of President from December 2013 to May 2015. Mr. Gremp served as our Executive Vice President—Energy

Systems from January 2007 to March 2010 and as our Vice President—Energy Production Systems from March 2004 to December

2006. Mr. Gremp has held other leadership positions within our Company, including as General Manager of Energy Production

Systems, General Manager of the Fluid Control Division and General Manager of the Asia Pacific and Middle East region. He

also has held various plant, operations and regional manager positions since joining our Company as a Financial Analyst in

1975. In addition to his public directorships, Mr. Gremp also serves on the Boards of Directors of the American Petroleum

Institute and the Offshore Technology Conference. He is a member of the Board of Trustees of the United Way of Greater

Houston and a member of the National Petroleum Council.

Why this Director is an Asset to Our

Board:

Mr. Gremp brings to our Board his (1) experience as our Chairman, President and CEO; (2) experience in leading

each of our major business operations; (3) extensive knowledge of our strategy, markets, competitors, financial and operational

issues and regulatory concerns; (4) thorough understanding of industry regulations and public policy related to workplace health,

safety, environment and social responsibility and a demonstrated commitment to our health, safety, environment and social responsibility;

(5) demonstrated ability to continually create vision and alignment for our Company while achieving significant growth; (6) thorough

understanding of different cultural, political and regulatory requirements through his international experience in countries where

we have a significant presence and (7) extensive oil service industry experience.

|

|

|

|

|

|

|

|

|

Thomas M. Hamilton

|

|

|

|

Age:

72

|

|

|

|

Director Since:

2001

|

|

|

|

(Independent)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Committees:

|

|

Other Public Directorships:

|

|

|

•

|

Audit

|

|

•

|

Methanex Corporation

|

|

|

•

|

Compensation (Chair)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Public Directorships Held During the Past Five

Years:

|

|

|

•

|

HCC Insurance Holdings, Inc. (retired 2015)

|

|

|

•

|

Hercules Offshore, Inc. (retired 2015)

|

|

|

|

|

|

|

|

Professional Experience:

Mr. Hamilton has been a

co-owner and director of Medora Investments, LLC, a private investment firm, since April 2003. Mr. Hamilton served as the

Chairman, President and Chief Executive Officer of EEX Corporation, an oil and gas exploration company, from January 1997

until his retirement in November 2002. From 1992 to 1997, Mr. Hamilton served as Executive Vice President of Pennzoil Company

and as President of Pennzoil Exploration and Production Company. Mr. Hamilton was a director of BP Exploration, where he

served as Chief Executive Officer of the Frontier and International Operating Company of BP Exploration from 1989 to 1991 and

as the General Manager for East Asia/ Australia/Latin America from 1988 to 1989. From 1985 to 1988, he held the position of

Senior Vice President of Exploration at Standard Oil Company, prior to its merger with BP. Mr. Hamilton serves as a Trustee

on The Harris Center for Mental Health and Intellectual and Developmental Disabilities.

Why this Director is an Asset to Our Board:

Mr. Hamilton brings to our Board his (1) independence; (2) financial expertise; (3) experience as a chief

executive officer and senior officer of major organizations with international operations in the oil and gas industry; (4) prior

and current experience as a board member of public companies with international operations and (5) thorough understanding of different

cultural, political and regulatory requirements through his international experience in countries where we have a significant presence.

|

|

|

|

|

|

|

|

|

Peter Mellbye

|

|

|

|

Age:

66

|

|

|

|

Director Since:

2013

|

|

|

|

(Independent)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Committees:

|

|

Other Public Directorships:

|

|

|

•

|

Compensation

|

|

None

|

|

|

•

|

Nominating and Governance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Public Directorships Held During the Past Five

Years:

|

|

|

•

|

North Energy ASA (retired 2014)

|

|

|

|

|

|

|

|

Professional Experience:

Mr. Mellbye served as

Executive Vice President, Development & Production, International, of Statoil ASA, an international oil and gas company,

from January 2011 until his retirement in September 2012. He was Executive Vice President, Production & International

Exploration of Statoil from August 2004 to January 2011. From 1992 to 2004, Mr. Mellbye was Statoil’s Executive Vice

President, Natural Gas, and from 1990 to 1992, he served as Senior Vice President, Natural Gas. He joined Statoil in 1982 as

Vice President, Gas Marketing, a position he held until 1990. Mr. Mellbye worked in the Norwegian Ministry of Trade and

Industry from 1975 to 1979 before joining the Norwegian Trade Council, where he worked from 1979 to 1982. In addition to

serving on our Board, Mr. Mellbye also serves as a director of the following non-public companies: Competentia, Half Wave AS,

Qinterra Technologies (previously known as Oz, or Aker Well Service AS), Resoptima AS and Wellesley Petroleum AS.

Why this Director is an Asset to Our Board:

Mr. Mellbye brings to our Board his (1) independence; (2) experience as a senior officer of a major oil and gas company with international operations; (3) prior and current experience as a board member of public and private companies with international operations; (4) thorough understanding of different cultural, political and regulatory requirements through his international experience in countries where we have a significant presence; and (5) contribution to the Board in a way that enhances perspective through diversity in geographic origin and experience.

|

|

|

|

|

|

|

|

|

Joseph H. Netherland

|

|

|

|

Age:

69

|

|

|

|

Director Since:

2001

|

|

|

|

(Independent)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Committees:

|

|

Other Public Directorships:

|

|

|

None

|

|

None

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Public Directorships Held During the Past Five

Years:

|

|

|

•

|

Newfield Exploration Company (retired 2014)

|

|

|

•

|

Spectra Energy Corp. (retired 2013)

|

|

|

•

|

Tidewater Inc. (retired 2013)

|

|

|

|

|

|

|

|

Professional Experience:

Mr. Netherland served as our

Chairman of the Board from December 2001 until his retirement in October 2008. Mr. Netherland also served as our Chief

Executive Officer from 2001 to March 2007 and as President from 2001 to February 2006. Previously, Mr. Netherland served as a

director of FMC Corporation from 1998 to 2001 and as Executive Vice President of FMC Corporation from 1998 until his

appointment as its President in 2000. Mr. Netherland was the General Manager of FMC Corporation’s Energy and

Transportation Group from 1992 to 2001. Mr. Netherland became General Manager of FMC Corporation’s former Petroleum

Equipment Group and General Manager of its former Specialized Machinery Group in 1985 and 1989, respectively. In addition to

serving on our Board, Mr. Netherland is a director of the Petroleum Equipment & Services Association.

Why this Director is an Asset to Our Board:

Mr.

Netherland brings to our Board his (1) experience as our prior Chairman, Chief Executive Officer and President and resulting

extensive knowledge of our strategy, markets, competitors, financial and operational issues and regulatory concerns; (2)

understanding of issues related to workplace health, safety, environment and social responsibility; (3) thorough

understanding of different cultural, political and regulatory requirements through his international experience in countries

where we have a significant presence; (4) extensive oil and gas experience, including skills

gained as a board member of multinational corporations in the oil and gas industry and (5) prior experience as a board member

of major U.S. organizations with international operations.

|

|

|

|

|

|

|

|

|

Peter Oosterveer

|

|

|

|

Age:

58

|

|

|

|

Director Since:

2015

|

|

|

|

(Independent)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Committees:

|

|

Other Public Directorships:

|

|

|

•

|

Audit Committee

|

|

None

|

|

|

•

|

Nominating and Governance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Public Directorships Held During the Past Five

Years:

|

|

|

None

|

|

|

|

|

|

|

|

Professional Experience:

Mr. Oosterveer has served as

Chief Operating Officer of Fluor Corporation, a global engineering construction company, since February 2014. Prior to

serving as Chief Operating Officer, Mr. Oosterveer served in various executive capacities at Fluor Corporation, including

President, Energy and Chemicals from March 2009 to January 2014; Senior Vice President, Business Line Lead – Chemicals

from February 2007 to February 2009; as Vice President, Business Line Lead – Chemicals from September 2005 to January

2007; and as Vice President, Operations from October 2002 to August 2005.

Why this Director is an Asset to Our Board:

Mr.

Oosterveer brings to our Board his (1) independence; (2) experience as an executive officer of a major organization with

international operations in the oil and gas industry; (3) engineering and project management expertise in the chemical and

energy industries and (4) thorough understanding of different cultural, political and regulatory requirements through his

extensive oil and gas experience.

|

|

|

|

|

|

|

|

|

Richard A. Pattarozzi

|

|

|

|

Age:

72

|

|

|

|

Director Since:

2002

|

|

|

|

(Independent)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Committees:

|

|

Other Public Directorships:

|

|

|

•

|

Compensation

|

|

•

|

Stone Energy Corporation

|

|

|

•

|

Nominating and Governance (Chair)

|

|

•

|

Tidewater Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Public Directorships Held During the Past Five

Years:

|

|

|

•

|

Global Industries, Ltd. (retired 2011)

|

|

|

|

|

|

|

|

Professional Experience:

Mr. Pattarozzi served as

Vice President of Shell Oil Company from March 1999 until his retirement in January 2000. He previously served as President

and Chief Executive Officer for both Shell Deepwater Development, Inc. and Shell Deepwater Production, Inc. from 1995 until

1999. In April 1991, he was appointed General Manager of Shell’s Deepwater Production Division and in October 1991,

General Manager of Shell’s Deepwater Exploration and Production Division. In addition to his public directorships, Mr.

Pattarozzi is a member of the Board of Trustees of the Army War College Foundation.

Why this Director is an Asset to Our Board:

Mr.

Pattarozzi brings to our Board his (1) independence; (2) experience as a chief executive officer and senior officer of

major organizations with international

operations in the oil and gas industry; (3) prior and current experience as a board member of public companies with

international operations and (4) thorough understanding of different cultural, political and regulatory requirements through

his extensive oil and gas experience.

|

|

|

|

|

|

|

|

|

Kay G. Priestly

|

|

|

|

Age:

60

|

|

|

|

Director Since:

2015

|

|

|

|

(Independent)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Committees:

|

|

Other Public Directorships:

|

|

|

•

|

Audit

|

|

•

|

New Gold Inc.

|

|

|

|

|

|

•

|

Stone Energy Corporation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Public Directorships Held During the Past Five

Years:

|

|

|

•

|

SouthGobi Resources Ltd (retired 2014)

|

|

|

•

|

Turquoise Hill Resources (retired 2014)

|

|

|

|

|

|

|

|

Professional Experience:

Ms. Priestly served as Chief Executive