Fluor Corporation (NYSE: FLR) today announced financial results

for its third quarter ended September 30, 2016. Earnings from

continuing operations attributable to Fluor for the third quarter

were $5 million, or $0.03 per diluted share, compared to $176

million, or $1.21 per diluted share a year ago. Results for the

quarter include an after-tax charge of $154 million, or $1.10 per

diluted share, for estimated cost increases on a petrochemical

facility in the United States. Consolidated segment profit for the

quarter was $25 million, including the impact of the charge

mentioned above, down from $240 million a year ago. Third quarter

revenue was $4.8 billion, up from $4.4 billion in the prior

year.

New awards for the quarter were $7.0 billion, including $5.6

billion in Energy, Chemicals & Mining and $955 million in

Government. Consolidated ending backlog of $44.3 billion compares

to $41.7 billion a year ago.

"We are very disappointed in the construction progress on a

fixed-price Gulf Coast project that led to a significant charge

this quarter," said David Seaton, Fluor chairman and chief

executive officer. "Looking ahead to 2017, we remain focused on

project execution and continuing to capture key prospects as they

develop across our businesses.”

Corporate G&A expense for the third quarter of 2016 was $27

million, compared to $35 million a year ago. Fluor’s cash and

marketable securities balance at the end of the third quarter was

$2.1 billion.

Outlook

As a result of the charge in Energy, Chemicals & Mining, the

Company is revising its 2016 guidance for EPS to a range of $2.20

to $2.40 per diluted share, from the previous range of $3.25 to

$3.50 per diluted share. For 2017, the Company is establishing its

initial EPS guidance at a range of $2.75 to $3.25 per diluted

share. Guidance for 2017 assumes continued challenges in our

commodity focused segment, offset by increasing opportunities in

infrastructure, industrial and government.

Business Segments

Fluor’s Energy, Chemicals & Mining segment reported a

segment loss of $60 million, compared to a segment profit of

$208 million a year ago. Results for the quarter reflect a $241

million pre-tax charge on a petrochemical facility in the United

States. Revenue of $2.3 billion declined from $2.8 billion a year

ago primarily due to lower mining activities. Third quarter new

awards of $5.6 billion include an award for the Tengiz Oil

Expansion Project in Kazakhstan. Ending backlog was $23.7 billion

compared to $30.1 billion a year ago, and reflects an adjustment

for an LNG contract that has been suspended.

The Industrial, Infrastructure & Power segment reported

segment profit of $28 million, compared to a loss of $29 million in

the third quarter of 2015 that was primarily due to cost increases

on a power project. Revenue for the segment increased 89 percent to

$1.1 billion from $596 million a year ago. Results for the quarter

reflect increased execution activities on nuclear and gas-fired

power projects. Ending backlog for the segment was $11.5 billion,

up from $5.1 billion a year ago.

The Government segment reported segment profit of $26 million,

compared to $30 million a year ago. Revenue for the quarter

was $681 million, compared to $661 million a year ago. Third

quarter new awards of $955 million include additional funding on

the Savannah River project. Ending backlog was $5.9 billion, up

from $3.8 billion a year ago.

The Maintenance, Modification & Asset Integrity segment

reported segment profit of $29 million in the third quarter of

2016, compared to $32 million a year ago. Revenue for the quarter

was $632 million compared to $326 million in the third quarter of

2015. Results for the quarter reflect contributions from the Stork

business, offset by declines in the equipment and power services

business lines. New awards totaled $350 million for the quarter,

and ending backlog was $3.3 billion, up from $2.7 billion a year

ago.

Third Quarter Conference

Call

Fluor will host a conference call at 5:30 p.m. Eastern time on

Thursday, November 3, which will be webcast live on the Internet

and can be accessed by logging onto http://investor.fluor.com. A

supplemental slide presentation will be available shortly before

the call begins. The webcast and presentation will be archived for

30 days following the call.

Non-GAAP Financial

Measure

This press release contains a discussion of consolidated segment

profit that would be deemed a non-GAAP financial measure under SEC

rules. Segment profit is calculated as revenue less cost of revenue

and earnings attributable to noncontrolling interests excluding:

corporate general and administrative expense; interest expense;

interest income; domestic and foreign income taxes; other

non-operating income and expense items; and loss from discontinued

operations. The company believes that consolidated segment profit

provides a meaningful perspective on its business results as it is

the aggregation of individual segment profit measures that the

company utilizes to evaluate and manage its business performance. A

reconciliation of this measure to earnings from continuing

operations attributable to Fluor Corporation is included in the

press release tables.

About Fluor Corporation

Fluor Corporation (NYSE: FLR) is a global engineering,

procurement, fabrication, construction and maintenance company that

designs, builds and maintains capital-efficient facilities for its

clients on six continents. For more than a century, Fluor has

served our clients by delivering innovative and integrated

solutions across the globe. With headquarters in Irving, Texas,

Fluor ranks 155 on the FORTUNE 500 list with revenue of $18.1

billion in 2015 and has more than 60,000 employees worldwide. For

more information, please visit www.fluor.com or follow us on

Twitter @FluorCorp.

Forward-Looking Statements: This

release may contain forward-looking statements (including without

limitation statements to the effect that the Company or its

management "believes," "expects," is “positioned” or other similar

expressions). These forward-looking statements, including

statements relating to future growth, backlog, earnings and the

outlook for the Company’s business are based on current management

expectations and involve risks and uncertainties. Actual results

may differ materially as a result of a number of factors,

including, among other things, the cyclical nature of many of the

markets the Company serves, including the Company’s Energy,

Chemicals & Mining commodity-based segment; the Company's

failure to receive anticipated new contract awards; difficulties or

delays incurred in the execution of contracts, including those

caused by the performance of the Company’s clients, subcontractors,

suppliers and joint venture or teaming partners; failure to meet

timely completion or performance standards; intense competition in

the industries in which we operate; failure of our joint venture or

other partners to perform their obligations; failure to obtain

favorable results in existing or future litigation or dispute

resolution proceedings or claims; client delays or defaults in

making payments; risks or uncertainties associated with events

outside of our control, including weather conditions; current

economic conditions affecting our clients, partners, subcontractors

and suppliers; cyber-security breaches; liabilities arising from

faulty services; client cancellations of, or scope adjustments to,

existing contracts; risks or uncertainties associated with

acquisitions, dispositions and investments; risks arising from the

inability to successfully integrate acquired businesses; foreign

economic and political uncertainties; the Company’s failure, or the

failure of our agents or partners, to comply with laws; the

potential impact of certain tax matters; possible information

technology interruptions or inability to protect intellectual

property; liabilities associated with the performance of nuclear

services; foreign exchange risks; the inability to hire and retain

qualified personnel; failure to maintain safe worksites and

international security risks; the availability of credit and

restrictions imposed by credit facilities, both for the Company and

our clients, suppliers, subcontractors or other partners; possible

limitations on bonding or letter of credit capacity; and the

Company’s ability to secure appropriate insurance. Caution must be

exercised in relying on these and other forward-looking statements.

Due to known and unknown risks, the Company’s results may differ

materially from its expectations and projections.

Additional information concerning these and other factors can be

found in the Company's public periodic filings with the Securities

and Exchange Commission, including the discussion under the heading

"Item 1A. Risk Factors" in the Company's Form 10-K filed on

February 18, 2016. Such filings are available either publicly or

upon request from Fluor's Investor Relations Department: (469)

398-7070. The Company disclaims any intent or obligation other than

as required by law to update its forward-looking statements in

light of new information or future events.

FLUOR CORPORATION

CONSOLIDATED FINANCIAL RESULTS (in millions, except per

share amounts) Unaudited CONSOLIDATED

OPERATING RESULTS THREE MONTHS ENDED SEPTEMBER 30

2016 2015 Revenue $ 4,766.9 $ 4,384.6 Cost and

expenses: Cost of revenue 4,729.7 4,133.8 Gain related to a partial

sale of a subsidiary - (68.2 ) Corporate general and administrative

expense 27.1 35.2 Interest expense, net 12.8

5.6 Total cost and expenses 4,769.6

4,106.4 Earnings (loss) from continuing operations before

taxes (2.7 ) 278.2 Income tax expense (benefit) (20.1 )

91.4 Earnings from continuing operations 17.4 186.8

Loss from discontinued operations, net of taxes -

(5.1 ) Net earnings 17.4 181.7 Less: Net earnings

attributable to noncontrolling interests 12.6

10.4 Net earnings attributable to Fluor Corporation $ 4.8

$ 171.3 Amounts attributable to Fluor

Corporation: Earnings from continuing operations $ 4.8 $ 176.4 Loss

from discontinued operations, net of taxes -

(5.1 ) Net earnings $ 4.8 $ 171.3 Basic

earnings (loss) per share attributable to Fluor Corporation:

Earnings from continuing operations

$

0.03 $ 1.22 Loss from discontinued operations, net of taxes

- (0.03 ) Net earnings $ 0.03 $ 1.19

Weighted average shares 139.3 144.3 Diluted earnings (loss)

per share attributable to Fluor Corporation: Earnings from

continuing operations 0.03 1.21 Loss from discontinued operations,

net of taxes - (0.04 ) Net earnings $ 0.03

$ 1.17 Weighted average shares 140.9 146.1 New

awards $ 7,021.5 $ 5,294.3 Backlog $ 44,325.3 $ 41,693.3 Work

performed $ 4,661.6 $ 4,264.5

FLUOR CORPORATION CONSOLIDATED FINANCIAL

RESULTS (in millions, except per share amounts)

Unaudited CONSOLIDATED OPERATING RESULTS

NINE MONTHS ENDED SEPTEMBER 30 2016

2015 Revenue $ 14,046.9 $ 13,743.4 Cost and expenses: Cost

of revenue 13,505.7 12,901.2 Gain related to a partial sale of a

subsidiary - (68.2 ) Corporate general and administrative expense

134.9 124.1 Interest expense, net 38.4 20.4

Total cost and expenses 13,679.0 12,977.5

Earnings from continuing operations before taxes 367.9 765.9 Income

tax expense 111.5 252.8 Earnings from

continuing operations 256.4 513.1 Loss from discontinued

operations, net of taxes - (5.1 ) Net earnings 256.4

508.0 Less: Net earnings attributable to noncontrolling interests

45.5 44.2 Net earnings attributable to Fluor

Corporation $ 210.9 $ 463.8 Amounts attributable to

Fluor Corporation: Earnings from continuing operations $ 210.9 $

468.9 Loss from discontinued operations, net of taxes -

(5.1 ) Net earnings $ 210.9 $ 463.8 Basic

earnings (loss) per share attributable to Fluor Corporation:

Earnings from continuing operations

$

1.52 $ 3.21 Loss from discontinued operations, net of taxes

- (0.03 ) Net earnings $ 1.52 $ 3.18 Weighted average

shares 139.1 146.1 Diluted earnings (loss) per share

attributable to Fluor Corporation: Earnings from continuing

operations 1.50 3.17 Loss from discontinued operations, net of

taxes - (0.04 ) Net earnings $ 1.50 $ 3.13

Weighted average shares 140.9 148.0 New awards $ 18,134.7 $

14,010.4 Backlog $ 44,325.3 $ 41,693.3 Work performed $ 13,730.7 $

13,368.1

FLUOR CORPORATION Unaudited

BUSINESS SEGMENT FINANCIAL REVIEW AND U.S. GAAP

RECONCILIATION ($ in millions) THREE MONTHS

ENDED SEPTEMBER 30 2016

2015 (1)

Revenue Energy, Chemicals & Mining $ 2,325.2 $ 2,801.4

Industrial, Infrastructure & Power 1,128.3 596.2 Government

681.2 660.7 Maintenance, Modification & Asset Integrity

632.2 326.3

Total revenue $

4,766.9 $ 4,384.6 Segment

profit (loss) $ and margin % (3) Energy, Chemicals &

Mining $ (59.7 ) (2.6 )% $ 208.2 7.4 % Industrial, Infrastructure

& Power (2) 28.4 2.5 % (29.4) (4.9 )% Government 26.4 3.9 %

30.0 4.5 % Maintenance, Modification & Asset Integrity

29.5 4.7 % 31.5 9.7 %

Total segment profit $ and

margin % $ 24.6 0.5 % $

240.3 5.5 % Gain related to a partial

sale of a subsidiary - 68.2 Corporate general and administrative

expense (27.1 ) (35.2) Interest expense, net (12.8 ) (5.6) Income

tax (expense) benefit 20.1 (91.4)

Earnings

from continuing operations attributable to Fluor Corporation

$ 4.8 $ 176.3 NINE

MONTHS ENDED SEPTEMBER 30 2016

2015 (1)

Revenue Energy, Chemicals & Mining $ 7,245.1 $ 9,047.2

Industrial, Infrastructure & Power 2,971.6 1,723.8 Government

2,025.1 1,909.8 Maintenance, Modification & Asset Integrity

1,805.1 1,062.6

Total revenue $

14,046.9 $ 13,743.4 Segment

profit (loss) $ and margin % (3) Energy, Chemicals &

Mining $ 247.8 3.4 % $ 655.4 7.2 % Industrial, Infrastructure &

Power (2) 91.7 3.1 % (15.3) (0.9 )% Government 65.5 3.2 % 62.0 3.2

% Maintenance, Modification & Asset Integrity 90.7 5.0 % 95.9

9.0 %

Total segment profit $ and margin % $

495.7 3.5 % $ 798.0 5.8

% Gain related to a partial sale of a subsidiary -

68.2 Corporate general and administrative expense (134.9 ) (124.1)

Interest expense, net (38.4 ) (20.4) Income tax expense

(111.5 ) (252.8)

Earnings from continuing operations

attributable to Fluor Corporation $ 210.9

$ 468.9 (1) During the first quarter of 2016,

the company changed the composition of its reportable segments to

better reflect the diverse end markets that the company serves.

Segment operating information for 2015 has been recast to reflect

these changes. (2) Includes research and development

expenses associated with NuScale totaling $22 million and $70

million for the three and nine months ended September 30, 2016,

respectively, and $29 million and $65 million for the three and

nine months ended September 30, 2015, respectively. (3)

Segment profit margin % is calculated as segment profit divided by

segment revenue.

FLUOR CORPORATION Unaudited SELECTED

BALANCE SHEET ITEMS ($ in millions, except per share

amounts) SEPTEMBER 30, DECEMBER 31, 2016

2015 Cash and marketable securities, including noncurrent $

2,061.6 $ 2,367.6 Total current assets 5,741.6 5,105.4

(1)

Total assets 9,316.6 7,625.4

(1)

Total short-term debt 133.7 - Total current liabilities 3,876.2

2,935.4 Long-term debt 1,555.5 986.6

(1)

Shareholders' equity 3,106.3 2,997.3

SELECTED CASH FLOW

ITEMS ($ in millions) NINE MONTHS ENDED

SEPTEMBER 30 2016 2015 Cash provided by

operating activities $

452.5 $

570.4

Investing activities Net (purchases) sales and

maturities of marketable securities 136.4 (38.7 ) Capital

expenditures (165.5 ) (181.1 ) Proceeds from disposal of property,

plant and equipment 60.8 70.4 Proceeds from a partial sale of a

subsidiary - 45.6 Investments in partnerships and joint ventures

(518.0 ) (80.9 ) Acquisitions, net of cash acquired (240.7 ) -

Other items 10.2 14.5

Cash utilized

by investing activities (716.8 )

(170.2 ) Financing activities

Repurchase of common stock (9.7 ) (359.6 ) Dividends paid (89.0 )

(94.6 ) Proceeds from issuance of 1.75% Senior Notes 553.0 - Debt

issuance costs (3.5 ) - Repayment of Stork Notes, convertible debt

and other borrowings (331.3 ) (28.4 ) Borrowings under revolving

lines of credit 883.3 - Repayment of borrowings under revolving

lines of credit (884.9 ) - Distributions paid to noncontrolling

interests, net of capital contributions (17.1 ) (40.9 ) Other Items

(3.0 ) (10.7 )

Cash provided (utilized) by

financing activities 97.8

(534.2 ) Effect of exchange rate changes on

cash (3.0 ) (77.7 )

Decrease in cash and cash equivalents $

(169.5

) $

(211.7 )

Depreciation $

155.1 $

141.0

(1) Certain amounts in 2015 have been reclassified to

conform to the 2016 presentation due to the implementation of new

accounting pronouncements.

FLUOR CORPORATION

Supplemental Fact Sheet Unaudited

NEW AWARDS ($ in millions) THREE MONTHS

ENDED SEPTEMBER 30 2016

2015 (1)

Energy, Chemicals & Mining $ 5,643 80 % $ 3,628 69 %

Industrial, Infrastructure & Power 74 1 % 1,281 24 % Government

955 14 % 277 5 % Maintenance, Modification & Asset Integrity

350 5 % 108 2 %

Total new awards $ 7,022

100 % $ 5,294

100 % NINE MONTHS ENDED SEPTEMBER 30

2016

2015 (1)

Energy, Chemicals & Mining $ 7,395 41 % $ 9,822 70 %

Industrial, Infrastructure & Power 4,860 27 % 1,903 13 %

Government 4,461 24 % 1,077 8 % Maintenance, Modification &

Asset Integrity 1,419 8 % 1,208

9 %

Total new awards $ 18,135

100 % $ 14,010

100 % BACKLOG

TRENDS ($ in millions) AS OF SEPTEMBER 30

2016

2015 (1)

Energy, Chemicals & Mining $ 23,682 54 % $ 30,051 72 %

Industrial, Infrastructure & Power 11,461 26 % 5,084 12 %

Government 5,899 13 % 3,826 9 % Maintenance, Modification &

Asset Integrity 3,283 7 % 2,732

7 %

Total backlog $ 44,325

100 % $ 41,693

100 % United States $ 20,784 47

% $ 14,369 34 % The Americas (excluding the United States) 3,635 8

% 10,058 24 % Europe, Africa and the Middle East 17,660 40 % 14,327

35 % Asia Pacific (including Australia) 2,246

5 % 2,939 7 %

Total backlog

$ 44,325 100 % $

41,693 100 % (1)

During the first quarter of 2016, the company changed the

composition of its reportable segments to better reflect the

diverse end markets that the company serves. New awards and backlog

for 2015 have been recast to reflect these changes.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161103006551/en/

Fluor CorporationMedia RelationsBrian Mershon,

469-398-7621orBrett Turner, 864-281-6976orInvestor RelationsGeoff

Telfer, 469-398-7070orJason Landkamer, 469-398-7222

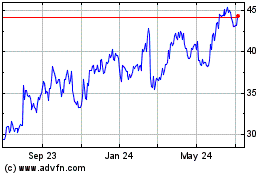

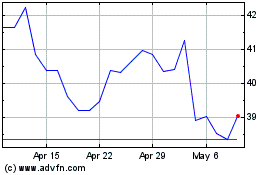

Fluor (NYSE:FLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fluor (NYSE:FLR)

Historical Stock Chart

From Apr 2023 to Apr 2024