Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

March 14 2016 - 1:37PM

Edgar (US Regulatory)

|

|

Free Writing Prospectus Filed Pursuant to Rule 433 |

|

|

Registration No. 333-205965 |

|

|

March 14, 2016 |

FLUOR CORPORATION

PRICING TERM SHEET

March 14, 2016

€500 million 1.750% Senior Notes due 2023

|

Issuer: |

|

Fluor Corporation |

|

|

|

|

|

Ratings:* |

|

Moody’s: A3 (Stable) / S&P: A- (Stable) / Fitch: BBB+ (Stable) |

|

|

|

|

|

Offering Format: |

|

SEC-Registered |

|

|

|

|

|

Size: |

|

€500 million |

|

|

|

|

|

Maturity Date: |

|

March 21, 2023 |

|

|

|

|

|

Coupon (Interest Rate): |

|

1.750% |

|

|

|

|

|

Yield to Maturity: |

|

1.772% |

|

|

|

|

|

Spread to Benchmark Security: |

|

+191.5 basis points |

|

|

|

|

|

Benchmark Security: |

|

DBR 1.500% due February 15, 2023 |

|

|

|

|

|

Benchmark Security Price and Yield: |

|

111.43 and -0.143% |

|

|

|

|

|

Spread to Mid-Swap: |

|

+150 bps |

|

|

|

|

|

Mid-Swap Yield: |

|

0.272% |

|

|

|

|

|

Interest Payment Dates: |

|

Annually on March 21 of each year, commencing on March 21, 2017 |

|

|

|

|

|

Make-Whole Call: |

|

+30 bps (prior to December 21, 2022) |

|

|

|

|

|

Par Call: |

|

On or after December 21, 2022 |

|

|

|

|

|

Price to Public: |

|

99.856% |

|

|

|

|

|

Trade Date: |

|

March 14, 2016 |

|

|

|

|

|

Settlement Date: |

|

March 21, 2016 (T+ 5) |

|

|

|

|

|

Denominations: |

|

€100,000 and integral multiples of €1,000 in excess thereof |

|

Day Count Convention: |

|

ACTUAL/ACTUAL (ICMA) |

|

|

|

|

|

Payment Business Days: |

|

New York, London and TARGET2 |

|

|

|

|

|

Listing: |

|

Application will be made to list the notes in the New York Stock Exchange |

|

|

|

|

|

CUSIP Number: |

|

343412 AE2 |

|

|

|

|

|

Common Code: |

|

138238547 |

|

|

|

|

|

ISIN: |

|

XS1382385471 |

|

|

|

|

|

Clearing and Settlement: |

|

Euroclear/Clearstream |

|

|

|

|

|

Stabilization: |

|

Stabilization/FCA |

|

|

|

|

|

Joint Book-Running Managers: |

|

Merrill Lynch International

BNP Paribas

Crédit Agricole Corporate and Investment Bank |

|

|

|

|

|

Senior Co-Managers: |

|

Citigroup Global Markets Limited

Mitsubishi UFJ Securities International plc |

|

|

|

|

|

Co-Managers: |

|

ING Bank N.V., Belgian Branch

Lloyds Bank plc

Scotiabank Europe plc

SMBC Nikko Capital Markets Limited

Standard Chartered Bank

Wells Fargo Securities International Limited

Banco Santander, S.A.

Barclays Bank PLC

Goldman, Sachs & Co.

HSBC Bank plc

U.S. Bancorp Investments, Inc.

ANZ Securities, Inc.

Mizuho International plc

Regions Securities LLC |

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

This Pricing Term Sheet supplements the Preliminary Prospectus Supplement issued by Fluor Corporation on March 14, 2016 relating to its Prospectus dated July 30, 2015.

We expect that delivery of the notes will be made to investors on or about March 21, 2016, which will be the fifth business day following the date of such Preliminary Prospectus Supplement. Under Rule 15c6-1 under the Exchange Act, trades in the secondary market are required, subject to certain exceptions, to settle in three business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes on the date of pricing or the next succeeding business day will be required, by virtue of the fact that the notes will initially settle

in T+5, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Those purchasers should consult their advisors.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering.

You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the underwriters can arrange to send you the prospectus if you request it by calling Merrill Lynch International at +44 (0)20 7995 3966, by calling BNP Paribas toll free at 1-800-854-5674 or, by calling Crédit Agricole Corporate and Investment Bank at (866) 807-6030.

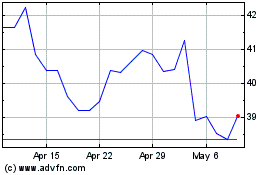

Fluor (NYSE:FLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

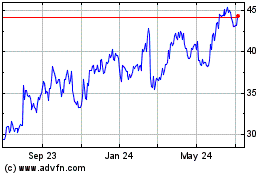

Fluor (NYSE:FLR)

Historical Stock Chart

From Apr 2023 to Apr 2024