Bank Of America Settlement Viewed As Blueprint For More Pacts

June 29 2011 - 2:39PM

Dow Jones News

The $8.5 billion pact that Bank of America Corp. (BAC) reached

with a group of institutional investors Wednesday could be a

blueprint for claims other banks face over soured mortgage-backed

securities.

Though analysts were split in their opinions as to whether such

a result would be good or bad for banks, investors expressed relief

that a major worry of the financial crisis could be put in the

rear-view mirror.

Bank of America, in its settlement, paid more than most analysts

expected but the pact was viewed in the market as removing a

significant question mark from the company's future. Shares rose

3.3% to $11.18.

Meanwhile, shares of other banks rose as investors hoped they

could now use the Bank of America settlement as a basis for their

own agreements. J.P. Morgan Chase & Co. (JPM) rose 2.4% to

$40.50, while Citigroup Inc. (C) advanced 2.9% to $41.33 and Wells

Fargo & Co. (WFC) added 1.3% to $27.86.

Still, the high cost paid by Bank of America was raising

expectations for what other banks might have to pay to investors

claiming the mortgages underlying the securities they purchased had

been improperly underwritten. And other analysts fretted that

investors, not just banks, could use the settlement for a

blueprint, leading to more demands for settlements.

"The good news is it implies the exposures are very manageable

relative to capital and tangible book values," Nomura analysts

said. "The bad news is now that BofA has settled, it would stand to

reason that investors will look for settlements from others as

well."

Bank of America, the nation's biggest bank by assets, certainly

had the biggest headache in mortgages. Between 2004 and 2008, the

bank sold some $963 billion in mortgage-backed securities to

private investors.

Bank of America said that, by paying $8.5 billion, it was taking

care of $424 billion in original principal, of which $221 billion

was unpaid. This means the bank was paying 2 cents on the dollar

for the initial principal and just under 4 cents on the dollar on

the unpaid principal.

In addition, Bank of America said it could face an additional $5

billion in private losses. That means it is estimating it would

have to pay less than 1 cent for every dollar in the remaining

outstanding initial principal.

Nomura said Bank of America, and Countrywide, likely has a

particularly severe loan book, so using the math from the

settlement at other banks is "far from perfect" but can at least

provide a benchmark.

Nomura, using the 4-cent rate Bank of America had on unpaid

principal and reducing it to account for differences at each bank,

estimated Wells Fargo could face $700 million in a potential

settlement.

The firm also estimated that Capital One Financial Corp. (COF)

could settle its unpaid balances for $600 million, while First

Horizon National Corp. (FHN) and SunTrust Banks Inc. (STI) could

settle for $200 million each.

Meanwhile, JMP analysts said costs are likely to be higher than

expected at J.P. Morgan and Citigroup, given Bank of America's

settlement.

J.P. Morgan said it had $180 billion in unpaid principal amounts

at the end of March, adding repurchase claims have been limited. It

had forecast $3.5 billion in liabilities for losses.

If the same math that Bank of America had were applied to J.P.

Morgan--to be sure, an estimate that can't necessarily be

assumed--J.P. Morgan could be facing $7.2 billion in potential

settlement costs.

At Citigroup, its unpaid principle balance was $36 billion at

the end of March. If Bank of America's payment was duplicated

there, again an assumption that potentially oversimplifies, Citi

could be facing about $1.44 billion in any settlement.

-By David Benoit, Dow Jones Newswires; 212-416-2458;

david.benoit@dowjones.com

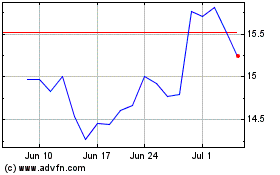

First Horizon (NYSE:FHN)

Historical Stock Chart

From Mar 2024 to Apr 2024

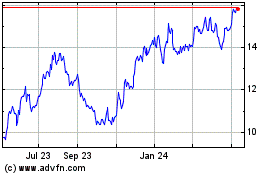

First Horizon (NYSE:FHN)

Historical Stock Chart

From Apr 2023 to Apr 2024