Copper's Rout Deepens As China's Inflation Decelerates

November 10 2015 - 2:14PM

Dow Jones News

By Tatyana Shumsky

Copper prices extended their six-year low on Tuesday after

Chinese inflation decelerated, stoking investor concerns about

demand from the world's top copper buyer.

China's consumer price index, a measure of inflation, rose 1.3%

in October from a year earlier, less than the 1.4% gain economists

predicted and a slowdown from September's 1.6% increase. The lack

of price pressure suggests that demand and overall economic

activity continue to lose steam in the world's no. 2 economy.

"The Chinese economy is in a slowdown and it needs more stimulus

to start movement that would utilize all the copper they already

have," said Ira Epstein, a broker with Linn & Associates in

Chicago. "If they don't stimulate, you're going to get another leg

lower to $2.10 copper and it's going to create a lot of pain."

China drives about 40% of the world's copper demand, but

investors worry the country's metal purchases will decline as its

economic growth sputters. The industrial metal is widely used in

construction and manufacturing, two sectors of China's economy

where activity has been slowing. Some traders fear that as China

cuts back its copper purchases, demand from other countries won't

pick up the slack, leading to a substantial supply surplus.

"There's nobody really that can step in and consume copper at

the rate that China can consume it," said Bob Haberkorn, a senior

commodities broker with RJO Futures in Chicago. "There's no other

country out there that's in an infrastructure boom the size that

China has had over the past 10 years."

The most actively traded copper-futures contract, for December

delivery, fell 1.25 cents, or 0.6%, to settle at $2.2175 a pound on

the Comex division of the New York Mercantile Exchange. This was

the lowest close since July 10, 2009.

The decline in copper prices reverberated across the global

mining sector, which has struggled to cope with the prolonged slump

in commodities. The S&P Metals and Mining Select Index, which

tracks the share prices of 30 companies, was recently down 0.8%,

bringing year-to-date losses to 46%.

Shares of Glencore PLC, one of the world's largest copper

producers, were down 4.2%. Copper's selloff has been particularly

painful for Glencore, which got 20% of its operating income from

copper production in the first half of 2015.

So far this year, copper prices have slid 22%, compared with a

16% decrease in the S&P GSCI.

Moody's Investors Service, a credit-ratings firm, in September

had highlighted copper below $2.20 a pound as a particular threat

to Glencore.

However, Glencore has since put a number of mines up for sale

and sold nearly $1 billion of future silver production to pay down

its debt, helping assuage those worries, analysts and traders

said.

"Management has been proactive in reducing debt and it's proving

the skeptics wrong," said Charl Malan, who helps manage the $2.3

billion Van Eck Global Hard Assets Fund, which owns Glencore

shares.

Glencore and other producers, such as Freeport McMoRan Inc.,

have shuttered mines and slashed capital spending on new projects

in recent months in response to tumbling prices and weak

demand.

Still, many investors and analysts say more existing mines are

likely to close to make way for new ones that are expected to bring

additional metal to the market in coming years. Global copper

output is expected to reach a record 22.89 million metric tons this

year, while demand is expected at 22.4 million metric tons,

according to Barclays.

"There's over a million tons of additional supply coming on line

next year and the year after during a time when demand is seeming

to stall," said Dane Davis, a metals analyst with Barclays in New

York. "Not only are prices going to be lower, they will be lower

for a sustained (period)."

Mr. Davis said he expects copper to average $2.55 a pound in

2016 and $2.30 a pound in 2017.

Settlements:

Nov $2.2165, down 1.35 cents; Range $2.2090-$2.3190

Dec $2.2175, down 1.25 cents; Range $2.2060-$2.2420

Write to Tatyana Shumsky at tatyana.shumsky@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 10, 2015 13:59 ET (18:59 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

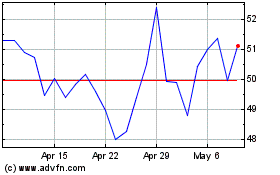

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Aug 2024 to Sep 2024

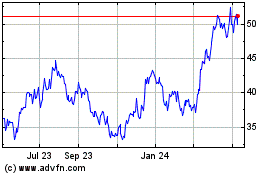

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Sep 2023 to Sep 2024