UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 4, 2015

EXTERRAN HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-33666 |

|

74-3204509 |

|

(State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

16666 Northchase Drive

Houston, Texas |

|

77060 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (281) 836-7000

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 Regulation FD Disclosure.

On August 4, 2015, Exterran Holdings, Inc. (the “Company”) held a conference call regarding the Company’s financial results for the quarter ended June 30, 2015. The transcript of that conference call is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

Exhibit No. |

|

Description |

|

99.1 |

|

Transcript of the Exterran Holdings, Inc. Conference Call with respect to the Quarter Ended June 30, 2015. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EXTERRAN HOLDINGS, INC. |

|

|

|

|

August 4, 2015 |

By: |

/s/ Kenneth R. Bickett |

|

|

|

Kenneth R. Bickett |

|

|

|

Vice President, Controller |

3

Exhibit Index

|

Exhibit No. |

|

Description |

|

99.1 |

|

Transcript of the Exterran Holdings, Inc. Conference Call with respect to the Quarter Ended June 30, 2015. |

4

Exhibit 99.1

EXTERRAN HOLDINGS, INC. AND EXTERRAN PARTNERS, L.P.

EDITED TRANSCRIPT: Q2 2015 EARNINGS CALL

AUGUST 4, 2015

3:00 PM GMT

CORPORATE PARTICIPANTS

Brad Childers Exterran Holdings, Inc. - President, and CEO

Jon Biro Exterran Holdings, Inc. - SVP, CFO

David Miller Exterran Partners, L.P. - SVP, CFO

CONFERENCE CALL PARTICIPANTS

Mike Urban Deutsche Bank - Analyst

Praveen Narra Raymond James & Associates, Inc. - Analyst

Blake Hutchinson Howard Weil Incorporated - Analyst

Andrew Burd JPMorgan - Analyst

T.J. Schultz RBC Capital Markets - Analyst

Daniel Burke Johnson Rice & Company - Analyst

Sharon Lui Wells Fargo Securities, LLC - Analyst

PRESENTATION

Operator

Good morning and welcome to the Exterran Holdings and Exterran Partners second-quarter 2015 earnings call. At this time, I’d like to inform you this conference is being recorded and that all participants are in a listen-only mode. We will open the teleconference for questions after the presentation. Earlier today Exterran Holdings and Exterran Partners released their financial results for the second-quarter 2015. If you have not received a copy, you can find the information on the Company’s website at exterran.com.

During today’s call Exterran Holdings may be referred to as Exterran or EXH, and Exterran Partners as either Exterran Partners or EXLP. Because EXLP’s financial results and position are consolidated into Exterran, the discussion of Exterran will include Exterran Partners unless otherwise noted. Also, the term international will be used to refer to Exterran’s operations outside the US and Canada, and the combination of US and Canada will be referred to as North America.

I want to remind listeners that the news release issued this morning by Exterran Holdings and Exterran Partners, the Company’s prepared remarks on this conference call, and the related question-and-answer session include forward-looking statements. These forward-looking statements include projections and expectations of the Company’s performance and represent the Company’s current beliefs. Various factors could cause results to differ materially from those projected in the forward-looking statements.

Information concerning the risk factors, challenges, and uncertainties that could cause actual results to differ materially from those in the forward-looking statements can be found in the Company’s press release as well as in the Exterran Holdings Annual Report on Form 10-K for the year ended December 31, 2014; Exterran Partners Annual Report on Form 10-K for the year ended December 31, 2014; and those set forth from time to time in Exterran Holdings’s and Exterran Partners’s filings with Securities and Exchange Commission, which are currently available at exterran.com.

Except as required by law, the Companies expressly disclaim any intention or obligation to revise or update any forward-looking statements. And your host for this morning’s call is Brad Childers, President and CEO; and I would now like to turn the call over to him. Mr. Childers, you may now begin your conference.

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Thank you, operator; and good morning, everyone. By way of introduction, because we have not yet completed our separation transaction, the format for this second-quarter call will be the same as we have used for past calls: that is, we will discuss the Company’s results overall and not broken out into Archrock and Exterran Corporation’s results. So with that format in mind, joining me today for the call will be Jon Biro, CFO of Exterran Holdings; and David Miller, CFO of Exterran Partners.

1

Before we begin our view of Exterran Holdings’s and Exterran Partners’s results, let me start by addressing the status of our separation transaction. In November 2014, we announced our separation plan with a goal of completing the transaction during the second half of 2015. Over the past eight months, we’ve made tremendous progress to be in a position to do just that, so much so that today we are prepared internally to separate the Companies into Exterran Corporation — our international services and global fabrication business; and Archrock, our domestic contract service business, early in the third quarter.

On our first-quarter conference call, with this progress well in hand, we tightened our time frame for the separation from the second half of 2015 to the third quarter. Our preparation to separate required significant investment of time, energy, and effort on the part of our employees. And we were able to prepare ourselves for separation faster than anticipated.

And we did this while maintaining our focus on delivering high-quality products and services to our customers and managing our operational and financial performance to deliver stable and profitable results for our investors. On July 13, we launched one of the final steps in the separation process: a senior notes offering for Exterran Corporation, or SpinCo. The proceeds from this offering were to be used to pay off the $350 million in senior notes currently outstanding at Exterran Holdings.

If this financing had been completed as planned, today we would most likely be operating separately as Exterran Corporation and Archrock. But the timing of our financing was unfortunate. Macro events and a significant deterioration in oil prices in mid-July, coupled with a precipitous decline in the prices of existing energy-related debt securities, caused the market to effectively close to new energy-related issuers. This led us to withdraw our debt offering on July 24 and delay the closing of our separation transaction.

Now, given the severity and speed of the decline in the financial markets that caused us to pull our debt offering, it should be apparent that this delay is not a reflection of Exterran’s operating performance, as you will see shortly. Nor is it a reflection of our financial position or credit profile, which remain strong with more than ample liquidity. It was merely a consequence of bad timing.

Importantly, this delay does not impact our conviction that operating as two Companies is in the best interest of our shareholders and provides the best long-term opportunity for growth and profitability of all of Exterran’s business lines. In short, we remain firmly committed to completing our spinoff.

This is only a delay in our plan, which had progressed rapidly and productively to put us in a position to close when we complete our financing. Today, we are working on all available financing options to complete the spinoff. Fortunately, we are not locked into any one path for the completion of the transaction. And we are committed to completing the transaction as expeditiously as possible and launching both Companies in a strong financial position.

In the interim we are also well positioned to continue operating as one Company. Our financial position is strong, and our operational performance is solid. Internally we will continue the operational migration toward managing our businesses as Exterran Corporation and Archrock and continue to pursue growth opportunities and manage our costs prudently for both.

While we operate as one Company, we will benefit from new perspectives and insights brought to us by new members of our management team and by new members of the Board that joined Exterran in anticipation of the completion of the separation. We are especially pleased with the addition of Andrew Way. Andrew will be appointed CEO of Exterran Corporation at the conclusion of the separation. But he is already on board with us and fully participating in our progress toward the separation, and diving into the operations of our international services and global fabrication businesses, which will become Exterran Corporation after the spinoff.

So with that, let’s take a look at second quarter. Exterran’s production-focused services and fabrication businesses achieved solid operating performance in the quarter, especially in light of current market conditions. In our North America contract operations business, operating horsepower revenues were down only 2% compared to first-quarter results. We continued to see production-based demand in growth plays, including the Eagle Ford and Permian, though we experienced some declines primarily in non-shale or conventional plays.

Despite the revenue decline, gross margin percent was strong, coming in at 59% in the second quarter, unchanged from the first quarter of 2015 and up 160 basis points compared to the second quarter of 2014. This continued gross margin performance and year-over-year improvement is the result of our ability to maintain pricing as well as lower lube and fuel costs and other cost reductions that we put into our North America operations.

Our international contract operations business also generated good operating results in the second quarter, with revenue and gross margin generally in line with expectations. Operating horsepower declined modestly due in part to the exercise of purchase options in Argentina and slightly higher stop activity throughout Latin America.

But this decline is temporary, as these stops will be replaced by new projects that will use a significant amount of existing horsepower, including a major project in Brazil starting late in the third quarter and a project in Bolivia that will start producing revenue in 2016.

Our aftermarket services businesses have continued to be a bright spot and have performed well, both in the US and in international. Overall, we continue to see a mostly normal level of maintenance activities from our global customer base, without significant deferrals of required maintenance. And our cost reduction efforts that are helping with our contract operations businesses are also positively impacting our aftermarket services profitability.

2

In fabrication, our revenues came in at the lower end of our guidance range, but this modest underperformance was primarily the result of project delays, some at the request of our customers, that we believe we will capture in the third quarter. And despite the markedly different commodity price environment, our second-quarter 2015 fabrication revenues were only down about 13% compared to the prior-year period, as we worked through the high backlog levels we achieved coming into 2015.

In addition, our fabrication gross margin percentage held up well in the second quarter after taking into account in inventory charge that we recorded in the quarter. This was achieved through solid cost management during a period of declining volumes and an increasingly competitive environment. While we are still in a period of reduced capital investment by our customers, fabrication bookings did still improve by $53 million over the first quarter’s results.

Now let’s turn to our markets. And as I do, I want first to discuss our view of the overall market environment and its potential impact on our production-related businesses. We believe that our US and international services business, which represented about 84% of our second-quarter gross margin dollars, will continue to be relatively stable.

As these businesses are tied primarily to existing production levels for natural gas and secondarily to new production additions, they are not as impacted by commodity price volatility as compared to businesses that are more closely tied to drilling and completion activities. On the other hand, we expect that our fabrication business, which represented the remaining 16% of our gross margin dollars in the quarter, will be more impacted by the industry slowdown, as that business relies more on new capital spending driven by new production capacity additions.

Now let me provide a more detailed outlook for each business, starting with our North America contract operations business. Through the first half of 2015, North America contract operations revenue was $400 million, up about 18% over prior-year levels, driven by the mid-con acquisitions and organic growth supported by investments in our compression fleet. We believe our production-related business model should continue to support relatively stable performance in our North America contract operations business over the course of the year.

Still, we have seen a reduction in new bookings and an increased level of stop activity compared to 2014. We expect that delays in drilling and completion activities and increased focus on costs by our customers will exert some pressure on both our new bookings and the level of stop activity, as customers seek to reduce their lease operating expenses by optimizing compression. From an overall perspective, however, compression horsepower needs to remain flat or grow for natural gas production levels in the US to remain flat or grow.

Even with the dynamics I describe, we continue to see demand in select, highly-utilized portions of our fleet. And as a result we expect to add additional units to the fleet in the second half of 2015.

On our overall CapEx spend, however, in response to the more challenging market conditions and our focus on maintaining cash flow, we’ve reduced 2015 growth CapEx in our North America contract operations business and now expect about a 40% reduction compared to 2014 levels.

Turning to our international contract operations, revenues for the first half of 2015 were down 4% compared to the prior-year levels, which benefited from additional revenue on a project in Brazil that terminated earlier than expected. Excluding this benefit, first-half revenues in 2015 would have increased modestly over the prior-year period.

While we’ve not seen — and we do not expect — the same level of new project opportunities in 2015 that we saw in 2014, our key focus this year is on the execution of our backlog of committed projects. These projects, like most of our international contract operations business, are underpinned by relatively long-term, fee-based contracts.

At June 30, 2015, our international contract operations backlog of new projects was $56 million of annual revenue, including 71,000 horsepower of compression. We believe these new contracts will allow us to continue to generate stable revenues and gross margins as they come online and replace some of the recent stops we’ve experienced.

In our aftermarket services business, we continue to see strong demand in most of our markets. Aftermarket services revenue in the first half of 2015 was down 6% over prior-year levels, driven primarily by our exit from Australia and Gabon.

Gross margin percent, on the other hand, was up 150 basis points for the first half of 2015. And gross margin dollars were essentially flat compared to the prior-year period, primarily as a result of these strategic market exits and continued strong demand in our other markets.

In our fabrication business in the first half of 2015, revenue was down just 2% over prior-year levels as we worked through the high backlog level we had entering 2015. The second-quarter bookings were modestly higher than the first quarter, and we’ve seen higher levels of inquiries and activities across many of our product lines in the second quarter, which is encouraging.

Despite this, we are not booking sufficient new business to replace the level of backlog runoff we are experiencing. And as a result, we may see declining revenues in our fabrication business late in 2015.

Before I close the Exterran Holdings portion of my comments, I would like to talk about our cost management efforts. As I discussed last quarter, in light of market conditions and in order to maximize profitability, cash flow, and our financial position, we have continued to reduce our cost structure. Our cost reduction efforts have

3

cut across all of our business segments and our corporate overhead, with the goal of ensuring that each business line is and will remain rightsized for business activity levels.

Steps that we’ve taken so far in 2015 include the following. We’ve reduced our global headcount by about 1,200 full-time employees and contractors, or by about 12% of our total workforce. These reductions have occurred throughout the Company, with the largest reductions coming out of our fabrication businesses in the United States, Singapore, and Dubai.

We implemented a Companywide salary and wage freeze and have taken other steps to manage overall compensation and benefit costs. And we have continued to drive additional cost reductions across our supply chain.

Overall, we’ve accomplished a reduction in SG&A of over $40 million on an annualized basis, comparing the current quarter annualized with the prior-year level. Looking ahead, however, we have recently added some incremental SG&A costs in preparation for our separation transaction. Jon will provide a little more color on those.

In addition to improving our cost structure, we’ve also scaled back our capital spending, driven by lower investment in our North America contract operations business. Our total CapEx in 2015 is expected to be about $100 million or 18% lower than 2014 levels.

Despite continued challenges in the market, Exterran had a stable and steady second quarter, with solid execution in our business segments. Looking ahead, we will continue to stay close to our customers, managing our costs in line with activity levels, and focusing on differentiating our products and services. Last, we remain completely committed to our strategic separation transaction and will pursue every opportunity to close the transaction when reasonable financing is secured.

Now let’s review the Partnership’s results. Exterran Partners’s stable natural gas compression business produced strong distributable cash flow coverage and solid results in the second quarter. And the results benefited from the compression assets we acquired from Exterran Holdings in April of this year. For the second-quarter 2015, we increased the quarterly distribution to $0.5675 per limited partner units or $2.27 on an annualized basis. We will continue to seek to grow the partnership through fleet additions and acquisitions.

Now, moving to the financial section of today’s call, I would like to turn the call over to Jon for a review of the financial results for Exterran Holdings and quarterly trends and guidance for the third quarter of 2015.

Jon Biro — Exterran Holdings, Inc. - SVP, CFO

Thanks, Brad. First I will provide a summary of the results for the second quarter, and then I will provide guidance for Exterran Holdings. Exterran generated EBITDA as adjusted of $162 million on revenues of $684 million for the second quarter. Compared to the prior-year period EBITDA, EBITDA increased modestly by 1% while revenues declined 7%. We also reported diluted net income from continuing operations attributed to Exterran common shareholders excluding items of $0.22 per share in the second quarter compared to a $0.07 loss in the prior-year period.

Now turning to segment results, the financial performance of each of our segment was generally in line with our prior guidance. North America contract operations revenue came in at $198 million in the second quarter, down 2% compared to the first quarter, but up 9% over the prior-year period. In our North America contract operations business, growth capital expenditures were $42 million in the second quarter, down compared to $77 million in the first quarter as we focus on cash flow generation in this environment.

Maintenance capital expenditures were $21 million in the second quarter compared to $17 million the first quarter. In our international contract operations business, revenues were $115 million in the second quarter, down 5% compared to the first quarter and down 14% compared to the second quarter last year. As a reminder, second-quarter 2014 results included revenue of $17 million from a project in Brazil that terminated in 2014. Gross margin was a solid 61% in the quarter.

In our aftermarket services business, revenues were $91 million in the second quarter, up 5% from the first quarter and down 9% compared to last year’s second quarter. This year-over-year revenue decline was primarily due to our exit from Gabon in Australia. Gross margins were very acceptable at 23% in the second quarter.

In our US aftermarket services business, second-quarter 2015 revenues were $57 million, and gross margin was 19%. In our international aftermarket services business, revenues were $34 million, and gross margin was 29%.

We had another solid quarter in our fabrication business. Revenue of $279 million during the second quarter breaks down to about 53% production and processing and installation, 32% compression, and about 15% from Belleli. Geographically, the revenue split was roughly 60% from North America and 40% from international.

Fabrication gross margins were 14% compared to 16% in the first quarter of 2015 and 13% in the second quarter of 2014. Second-quarter margins included an increase of $3.5 million in expense for inventory reserves compared to the prior-year period, which reduced gross margins by approximately 130 basis points in the quarter.

4

Our fabrication backlog was $600 million at June 30, 2015, compared to $730 million at March 31, 2014. Bookings were $150 million for the second quarter, up from depressed first-quarter levels of $96 million. In the second quarter, bookings were roughly 50% from North America and 50% from international markets. And quarter-end backlog also was roughly 50% from North America and 50% from international markets.

SG&A expenses were $84 million in the second quarter, a decline of 12% compared to $96 million in the second quarter of 2014. Decreased compensation and benefits costs were the primary driver for the year-over-year cost savings.

Depreciation and amortization expense was $94 million for the second quarter, down $17.6 million compared to last year due to a project in Brazil that commenced and terminated operations in 2014. In the quarter we recognized restructuring and other charges of $19.6 million, primarily related to our separation transaction, including inventory write-downs and workforce reductions associated with the current market environment. In addition, we recognized non-cash long-lived asset impairments of $15.4 million related to our idle compressor fleet.

Interest expense was $28 million, a modest increase compared to first-quarter levels. And, last, our consolidated tax rate was 19% for the quarter. This rate was lower than expected, primarily due to lower state income taxes as a result of a Texas margin tax rate reduction enacted in the quarter and nontaxable joint venture proceeds received in the quarter.

Now turning to guidance for the third quarter of 2015, in North America contract operations, we expect revenue of approximately $195 million and gross margin to be in the 58% to 59% range. For our international contract operations, we expect revenue in the $110 million to $115 million range, with gross margins around 60%. The potential modest sequential revenue decline will be driven by lower deferred revenue recognition for a project in Mexico and lower cost recoveries from a customer in Brazil, partially offset by the impact of a new project starting up in Brazil.

In aftermarket services we expect revenue in the $80 million to $90 million range, with gross margins around 20%. In US aftermarket services we expect revenue in the $50 million to $55 million range, with gross margins around 18%. In international aftermarket services, we expect revenue in the $30 million to $35 million range, with gross margins in the mid-20% range.

In our fabrication business, we expect third-party revenue of between $240 million and $280 million, with gross margins around 13%. We expect SG&A expenses to be around the mid- to high $80 million level. The sequential increase will be due to de-synergies of approximately $4.5 million of quarterly costs as a result of our cost structure being positioned to support two separate Companies following the closing of our spinoff transaction.

In the third quarter of 2015, we expect depreciation and amortization expense in the $95 million to $100 million range and interest expense of approximately $28 million. For the third quarter and full-year 2015, our effective tax rate from net income from continuing operations attributable to Exterran stockholders excluding items is expected to be in the low to mid 40% range.

Now, regarding capital expending, net capital expenditures were $104 million for the second quarter. Gross capital spending in the second quarter was $66 million, which included $42 million for North America, primarily for our fleet newbuild program. Maintenance capital expenditures for the quarter were $30 million, up from first-quarter levels at $22 million. For 2015, we continue to expect net capital expenditures to be between $400 million and $450 million and maintenance capital expenditures of between $100 million and $110 million.

In our North America contract operations business, we now expect growth capital spending in the $165 million to $185 million range in 2015 compared to previous guidance in the $160 million to $180 million range. In North America, we expect about 90% of these capital expenditures will be for the customers of Exterran Partners and will be funded by Exterran Partners. North American contract operations maintenance capital spending in the third quarter is expected to be flat to slightly higher compared to second-quarter levels.

For our international operations, we expect growth capital expenditures of around $105 million to $115 million in 2015, approximately half of which will be reimbursed by our customers on or before project startup. During the second quarter, debt increased $2 million at the Exterran Holdings parent level. Debt increased $40 million at the Partnership level, largely due to fleet investments funded under our Partnership’s revolver.

Therefore, in total, consolidated debt increased by $42 million in the quarter. Exterran Holdings’s leverage ratio as defined in our credit agreement was 1.6 times at June 30, 2015, compared to 1.5 times at March 31, 2015.

As Brad mentioned, Exterran has ample liquidity with undrawn and available capacity of $808 million under our credit facilities as of June 30, 2015, including $359 million at Exterran Partners. Cash distributions to be received by Exterran Holdings based on its limited partner and general partner interest in Exterran Partners are $18.5 million for the second quarter compared to $15.6 million for the first quarter.

Last week Exterran Holdings’s Board of Directors declared the seventh quarterly cash dividend to common stockholders of $0.15 per share. This will be paid on August 17, 2015, to shareholders of record on August 10. I will now turn the call over to David Miller to talk about Exterran Partners. David?

5

David Miller — Exterran Partners, L.P. - SVP, CFO

Thanks, Jon. Exterran Partners had a strong operating result in the second quarter. The Partner’s financial results and leverage position was bolstered by the $102.3 million drop-down completed early in the quarter.

In the all-equity finance drop-down, Exterran Partners issued approximately 4 million LP units and 80,000 GP units to Exterran Holdings to acquire customer contracts and associated compression units representing 148,000 horsepower, and additional compression units totaling 66,000 horsepower that were previously leased from Exterran Holdings to Exterran Partners.

Exterran Partners’s EBITDA as further adjusted was $83.2 million in the second quarter of 2015 compared to $78.7 million in the first quarter of 2015. The increase in EBITDA as further adjusted was driven primarily by higher average operating horsepower due to the contribution of assets purchased from Exterran Holdings this quarter, as well as by approximately $1.8 million of gains on sales of assets to customers.

Distributable cash flow was $48.3 million in the second quarter of 2015 compared to $51 million in the first quarter of 2015. The decline in distributable cash flow was largely attributable to higher maintenance capital expenditures in the second quarter, which were $15.3 million as compared to $10.1 million in the first quarter of 2015, and higher interest expense in the quarter.

Our distributable cash flow coverage was a solid 1.24 times in the second quarter of 2015, down from 1.42 times in the first quarter, primarily as a result of higher maintenance capital expenditures. In addition, we closed the drop-down transaction on April 17, 2015. As a result we did not have a full quarter’s benefit of the cash flows from the acquired assets but paid full distributions on the units issued to acquire the assets from Exterran Holdings.

Second-quarter ending operating horsepower increased sequentially by 98,000 to approximately 3.13 million operating horsepower, as the addition of the assets purchased from Exterran Holdings on April 2015 more than offset a modest decline in the underlying fleet. Excluding the drop-down, Exterran Partners saw an organic horsepower decline of approximately 50,000 operating horsepower as a result of customer purchases of equipment approximating 16,400 horsepower and larger declines in non-shale, non-growth plays than additions from growth in shale plays such as the Eagle Ford and Permian.

Revenue for the second quarter was $167.8 million as compared to $164.3 million in the first quarter. Revenue improved largely as a result of increased average operating horsepower in the second quarter due to the contribution from assets purchased from Exterran Holdings in April 2015.

Gross margin was 61% in the second quarter, flat as compared to the first-quarter levels, but up approximately 180 basis points from Q2 2014 levels. Our strong second-quarter gross margin percent is attributable to our maintenance of revenue per horsepower in this challenging environment and lower cost per horsepower, both sequentially and year-over-year.

Cost of sales per average operating horsepower was $21.08 in the second quarter. This was down 1.9% compared to the first quarter of 2015. Versus the prior-year period, cost of sales per average operating horsepower was down 4.6%, driven by the benefits of the mid-con acquisitions, organic growth, cost management and efficiency initiatives, and lower lube oil prices.

SG&A expenses were $20.7 million for the second quarter, consistent with the first-quarter level despite the additional SG&A related to the drop-down assets, due in large part to the reduction in overall SG&A at Exterran. Interest expense for the second quarter was $19.1 million, up from $17.8 million in the first quarter, due primarily to a higher average debt balance during the second quarter.

Net income per limited partner unit was $0.30 in the second quarter, up from $0.28 in the first quarter. Net income per limited partner unit excluding items for the second quarter was $0.33, excluding $2.1 million due primarily to non-cash, long-lived asset impairment charges related to our fleet.

Last week, Exterran Partners announced its distribution of $0.5675 per limited partner unit or $2.27 per limited partner unit on an annualized basis. Our quarterly distribution is $0.005 higher than the first-quarter distribution and $0.025 higher than the second-quarter 2014 distribution.

On the balance sheet, total debt increased by $40 million during the quarter to approximately $1.4 billion at June 30, 2015. The increase in debt was due to additional borrowings to fund the purchase of fleet units. Available undrawn debt capacity under Exterran Partners’s debt facilities at June 30 was approximately $359 million.

As of June 30, 2015, Exterran Partners had a total leverage ratio — which is covenant debt to adjusted EBITDA, as defined in the credit agreement — of 4.2 times as compared to 4.4 times at the end of the first quarter. The improvement in this leverage metric was largely attributable to the all-equity drop-down we completed in the second quarter.

Gross capital expenditures for the second quarter were $71 million, consisting of $56 million for fleet growth capital and $15 million for maintenance activities. For the full-year 2015, we now expect total fleet growth capital expenditures to be in the $155 million to $175 million range as compared to previous guidance, in the $135 million to $155 million range, due to continued customer demand for types of compression units that are highly utilized within Exterran’s fleet.

Through June 30, 2015 EXLP spent approximately $114 million in growth capital. So even with this increase, second-half 2015 growth capital expenditures are expected to be significantly lower than the first-half investment in new fleet units. We continue to expect maintenance capital expenditures in the $50 million to $55 million range.

6

In summary, second-quarter highlights for Exterran Partners included the completion of a drop-down, solid gross margin management, and attractive distributable cash flow coverage of 1.24 times. At this point, I would like to turn the call back over to the operator to open it up for questions.

QUESTION AND ANSWER

Operator

(Operator Instructions) Mike Urban, Deutsche Bank.

Mike Urban — Deutsche Bank - Analyst

On your previous call, you’d talked about a little bit of — and I guess a little bit here today — talked about some pricing, or requests, at least, for pricing concessions from your customers. One, have you seen that normalize or stabilize as you worked through all those issues? And, two, do you think you’ve been able to offset that from a cost perspective? Your margins and your guidance would imply that you have, but would be interested in your thoughts on that.

Brad Childers — Exterran Holdings, Inc. - President, and CEO

You somewhat have the analysis in the way you phrased the question. We do believe that we’ve endured pricing pressure really well, and one of the reasons for that, we believe, is that compared with prior downturns, we didn’t enter this downturn with the same amount of excess compression in the field that we believe was available in prior downturns. And so pricing has held up, I think, a bit better because of that.

And then, in addition, we didn’t have the same amount of price increase coming into this, and the industry didn’t have, as we saw in prior downturns. So we think that the customers noted that and understood that our pricing position was in a different spot.

So through this period, while we worked closely with our customers on this issue to help them manage their businesses, we think pricing has held up well, and we think we have made it through the past round of that pressure intact. And we did get some benefit to offsetting price — or, I should say, cost management within our operations to maintain our margin in the position that we maintained it.

Mike Urban — Deutsche Bank - Analyst

So as it stands today, then, just given the pricing dynamic that — the leading edge and what your costs have done at the leading edge, you feel like you can kind of at least hang in somewhere around current margin? Is that a fair comment?

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Well, Jon gave some — gave the guidance of what we’re looking for in Q3, which is still pretty solid margin performance. But our customers have tough businesses to manage, and the current oil price environment is making it harder on them. So the way I think of it is: I think we made it through a wild round one. And we will see if there are additional rounds of pressure that we have to navigate. But we are ambitious overall in maintaining the stability of our performance on both horsepower as well as margin from an overall perspective.

Mike Urban — Deutsche Bank - Analyst

Okay, great. And then I don’t think anybody has been thrilled to see the new renewed drop in the oil price. But has that created any renewed sense of urgency or maybe perhaps accelerated any discussions you might be having regarding customer purchases or purchases of customer assets? Maybe they were hoping for a rebound, and maybe focused on ramping up again. And maybe now that has kind of been put on hold.

And, I guess, based on your own experience in the high-yield markets, maybe those options aren’t available to your customers, either, for financing themselves. So does that create any potential opportunities? And has that changed versus maybe three or six months ago?

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Well, Mike, I like the way you are thinking. Let’s hope some of our customers have some of those same thoughts right now. But in fairness, it’s just too early to tell. We are literally days into the dynamic you just described. And so it is just too early to really get there. But we are working hard on those opportunities and we believe we will capture some growth through smaller acquisitions in the fleet over time. So I like the way you’re thinking. Hopefully our customers are listening.

7

Mike Urban — Deutsche Bank - Analyst

Okay, and then last question — just a housekeeping question. I appreciate the additional breakout on US versus international aftermarket. But as we model SpinCo, you gave some preliminary guidance when you were marketing the high-yield [deal] on G&A allocated to SpinCo. Do you have the final number there?

Jon Biro — Exterran Holdings, Inc. - SVP, CFO

You came in very close to and within the range that we provided in Q2.

Mike Urban — Deutsche Bank - Analyst

So, just split the difference is — middle of the range is a reasonable number?

Jon Biro — Exterran Holdings, Inc. - SVP, CFO

Yes.

Mike Urban — Deutsche Bank - Analyst

Okay, that’s all for me. Thank you.

Operator

Praveen Narra, Raymond James.

Praveen Narra — Raymond James & Associates, Inc. - Analyst

Could you give us some color on what inning you guys are in in terms of the process cost initiatives? Have you guys identified most of what you think you can get out of the system? Or are you still finding additional possibilities as we move along?

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Good question. And we do get the question phrased as what inning we are in fairly often. And my first response is usually the same, which is that I am never going to feel like I’m going to call that we are past the fifth inning. And I’m not sure it’s really innings-based, because the opportunity to improve our business is not going to go away.

That said, we obviously captured some really nice gains over the last couple of years through great cost management. And the next increments are getting harder. But I remain committed that we have more operational efficiency in our field operations that we are going to get through more systematic yet harder to reach cost reductions, and that we are working on those.

And this market environment reinforces every incentive we already had to make sure we capture them. So you are not going to get me to call past the fifth inning. I still think we have good work to do, and we are focused on capturing those.

Praveen Narra — Raymond James & Associates, Inc. - Analyst

Okay. And then in terms of the utilization, obviously people are still ordering what sounds like the higher-horsepower equipment. Can you give us a sense — for the utilization that has ticked down, is that solely happening on the gas lift side? Or what are the dynamics behind that?

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Yes, I can give you some color. From an overall perspective, it has not hit any portion of our fleet harder than others from an equipment perspective. It is different on a play perspective. So let me unload that a little bit.

8

Surprisingly, by the way, the fleet from a gas lift perspective has remained at the same level of utilization as we have had in prior quarters, as we have seen real good both stick and resilience in that part of our fleet. So across the board, the decline is coming from all categories of equipment, not any one large or small disproportionately.

Where we do see more returns and higher levels of stop activity is in the conventional dry gas plays. As we have continued to experience the migration and with accelerated focus for cost management by our customers, we continue to see the migration overall in North America in natural gas production from legacy conventional plays to the more growth-oriented shale plays.

Praveen Narra — Raymond James & Associates, Inc. - Analyst

That’s helpful, thank you.

Operator

Blake Hutchinson, Howard Weil.

Blake Hutchinson — Howard Weil Incorporated - Analyst

First of all, Brad, around some of your commentary on fabrication order flow, from the sound of it, it didn’t exactly sound like you had given up on getting to the point where you can replace topline, however declining, in fabrication with order flow as the year goes on. Could we take that to suggest, along with the commentary around inquiries, that 2Q order flow may represent somewhat of a baseline to improve upon here? Or do you not want to step out that far?

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Blake, did you really just give me the option? (laughter) I think that the good news is that we did see both the orders come in as well as activity inquiries higher than we saw in Q1. And you may recall, when we talked and Q1 — and the industry was trying to figure out Q1 — it really did feel like the market stood still for a quarter while people were trying to figure out what to do.

They finally got onto their capital plans and activity levels in Q2. So I think it did stabilize a bit, and we are optimistic that Q2 is certainly more indicative of what the market should offer than Q1.

The thing that gives us pause is, of course — the most recent, days-old retrenching on the oil price gives us a bit of a caution on that. But we remain committed that this is a good business, and that while production is — in natural gas in particular in North America and internationally is going to grow, that we are going to go through these periods of adjustment. And they could last longer than we want them to last. But this business is a good business that is going to fabricate business that goes right into production of natural gas. And we’ve seen a better performance and, I think, more indicative performance in Q2 than we experienced in Q1.

Blake Hutchinson — Howard Weil Incorporated - Analyst

And the project delays you cited, just to be clear, were delays in potential order flow? Or those were delays in getting revenue out the door?

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Thanks. Great clarification. They were primarily delays in getting revenue out the door as we slowed down activity within our own system. And as I said, some of it was at customer request. Others were allow us to manage costs well. But it really pushed some revenue that would have been in Q2 otherwise into Q3.

Blake Hutchinson — Howard Weil Incorporated - Analyst

Great. And then on the international contract compression operations, just wanted to understand — I guess we understand that your CapEx this year and what you’re working on this year was essentially born of success in bidding in 2014. Coming into 2015, was the pipeline for new opportunities that you kind of had on the drawing board or potential-bid board always a bit leaner than 2014? Or has this been a product of a tougher oil price environment? Trying to differentiate how that — what that pipeline looks like.

9

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Yes, sure. Great question. I love the question, because it demonstrates some of the core fundamentals of that international compression business really well. But 2014 was, comparatively speaking — I mean, going back to 2013 and 2012 — a monster bookings year for contract operations in international. We hadn’t seen that level of activity in some time.

So it’s just a great bookings year. And it’s largely coincidence that so many large projects hit at the same time in international contract operations. And we had a really good capture rate in the market. And so we knew that 2014 was a standout. And so while 2014 was all about bookings, 2015 would be all about execution on those projects — which it has been. And the execution on those projects is going extremely well.

But the other point, and the more important point, is that what we are seeing this year and what we saw in 2014 was really not macro-market driven. That international contract operations business strength comes from its production of natural gas, typically associated with micro-pricing environments — that is, gas markets that are not influenced directly by global commodity prices. And so those projects were more independently developed based upon supply and demand within local markets — so, for example, within Brazil; or marketing gas from Bolivia to Brazil; or within Mexico, or within Argentina.

So they are very independently driven. They’re not really subjected to the macro market environment. We really think that is one of the key strengths and sticking points for that ICO business.

Blake Hutchinson — Howard Weil Incorporated - Analyst

Great, that’s it for me. Thanks. I will turn it back.

Operator

Andrew Burd, JPMorgan.

Andrew Burd — JPMorgan - Analyst

The 11% yield on Exterran Partners seems to hardly be crediting growth there. How do you guys approach distribution growth, given the strong coverage heading into the third quarter?

David Miller — Exterran Partners, L.P. - SVP, CFO

So we saw — we had 1.24 coverage in this quarter, which we think is a nice level of coverage. And we think it was a little bit lower due to some of the factors I cited on the call. We like having a little bit of cushion in our coverage as we are entering a market like this or in a market like this.

And then, secondly, as I pointed out last call, we are at 4.2 times debt to EBITDA. We are a little bit more levered than we would like to be. And so we like this consistent, steady distribution growth and a little bit of cushion in our distribution coverage as we move forward.

Andrew Burd — JPMorgan - Analyst

Great, thanks. And then staying on Exterran Partners, back to the cost savings, there was a pretty sizable savings quarter over quarter. Should we think about the recent shift as kind of a new normal, now that the lubricant and fuel savings have been realized? Or is there more to come on a short-term basis in terms of cost savings, other than continued progress on the longer-term cost management program?

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Yes, look, this is a tough market to call getting that through into our margin on a very short-term basis, so I wouldn’t go there. I would be very bullish about what we can continue to drive for gross margin and profits on a longer-term basis.

Andrew Burd — JPMorgan - Analyst

Okay, great. And then last question — a nice little increase in the growth CapEx estimate for North America contract compression. Is that from a particular basin that you are seeing strength in? Or a certain stage in the midstream value chain? Any color will be helpful there. Thanks.

10

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Sure. So that investment reflects that we have some categories of units in our fleet that we are very highly utilized, and we just are trying to stay ahead of the curve and not run out of high demand units from our customers. But from a basin perspective, the growth that we are experiencing and where we are still seeing the most traction includes, as we mentioned — the Eagle Ford, the Permian, the Bakken, and the Niobrara is where we really see that horsepower growing. Hopefully that was helpful.

Andrew Burd — JPMorgan - Analyst

Great. And then can you just remind us what Exterran’s positioning is for contract compression within the Marcellus, and how you see the Partnership growing its footprint there? And that’s it for me, thank you.

Brad Childers — Exterran Holdings, Inc. - President, and CEO

So the Marcellus is a market we are in. It’s the market we have been in for a long time. I would tell you, though, it’s one of the most competitive markets that we have on two fronts: strong competition within the outsourced service providers — you know, very solid, very good competition. So that means that we fight and they fight for opportunity there.

It’s also a market with the most — I don’t know if it’s the most significant, but really significant midstream presence, and so a lot of owned horsepower. So we sell a bunch of compression in the Marcellus as well. But we still see that as an attractive growth play. And we continue to fight for market share in the Marcellus.

Andrew Burd — JPMorgan - Analyst

Great. Thank you, and congratulations on the nice quarter.

Operator

T.J. Schultz, RBC Capital Markets.

T.J. Schultz — RBC Capital Markets - Analyst

Great, thanks. Post the spin, what’s the expectation on time frame to drop the rest of the horsepower or the pace of drops into the MLP?

David Miller — Exterran Partners, L.P. - SVP, CFO

As you know, we don’t typically provide guidance on timing for drop-downs. And there is a lot of considerations that go into how we decide when we are going to make a drop-down. Those can be competing opportunities in the market, where our unit price is trading, availability of capital. There’s a number of factors that go into it. And so as we think about drop-downs going forward, we will consider all of those. And in addition, we have to keep in mind that we need to make sure we preserve the tax-free nature of the spin. And drop-downs are a part of that consideration, along with a number of other things.

T.J. Schultz — RBC Capital Markets - Analyst

Thanks, that’s all I had.

Operator

Daniel Burke, Johnson Rice.

Daniel Burke — Johnson Rice & Company - Analyst

I guess I wanted to address stops out there in the market. I thought the topline guide for NACO looked pretty good. Brad, you have coached us that stops have a little bit of a seasonal bias towards Q2. It sounds like you also sold some horsepower to customers. But how do we think about stop activity looking ahead to the second half of the year?

11

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Yes, very fair question and a really good question. We’ve given the top-line guidance through Q3, which we think is reflective of what we expect from horsepower moves in the quarter. And I will also agree that in the past, we’ve seen that in the cycle it’s not so much seasonal in a way that is traditional for other types of businesses; but what we see in our customer activity that they very often focus on a lot of their maintenance activities as well as field assessments of their assets — both their owned and outsourced — during this time of the year.

And that is what has led to us seeing that — some of that potential or apparent seasonality. And so while that holds true, I’m just going to point out: this is a very interesting and unique market environment for us to call it this tightly.

What I do believe is that the overall stability of this business model, where we may lose a little bit of horsepower, and we are going to gain a little horsepower in quarters and in periods that look like this, is that the overall stability of our cash flow and the profitability of the business is incredibly resilient compared to what you can find elsewhere in the oil patch for investment right now. So whether we’re 50,000 up or 50,000 down, candidly, we are really pleased. And we’ll continue to push and maximize the performance of what is, at base, a very stable business.

Daniel Burke — Johnson Rice & Company - Analyst

Okay, that’s helpful. And then maybe on the CapEx uptick at the partner’s level, if I followed all the numbers correctly, it seemed like maybe a part of that is actually a shift of some planned capital spend from the parent level to EXLP? I guess I just wanted to ask — did I follow that correctly? And if so, what is sort of the rationale or the thinking there?

David Miller — Exterran Partners, L.P. - SVP, CFO

It wasn’t really a shift from the parent to the MLP. It just — most of the increase at the parent is — with more than 80% of the operating assets down at partnership, most of the shift at the parent is going to go to EXLP customers. And so, again, like Brad said earlier, what we’ve seen is continued demand in some highly utilized areas of our fleet. So we’ve seen the need to build more of those units. And we think that most of those units that we have built and put to work will go to work at the partnership level.

Daniel Burke — Johnson Rice & Company - Analyst

Okay, that is helpful. And then maybe just one last one, if I could cram it on. Brad, I thought the comparison on the NACO side between this downturn and prior downturns was helpful. And to the extent that it looks like aftermarket is proving pretty resilient in this downturn, I was curious if you might be able to outline some ways the aftermarket is a little different this cycle than during prior downturns as well?

Brad Childers — Exterran Holdings, Inc. - President, and CEO

That one is harder to call, because part of the rationale on the contract operations side was really associated with the equipment in the marketplace. But I do think that one positive in the AMS business right now that we are benefiting from is just — very directly, a few years ago we overhauled how we managed our AMS business. I think we now have a stronger overall management into the market of that business, which is building in both better revenue capture and certainly better cost management, and keeping that team well utilized.

I don’t think — and, you know, we’ve been watching this pretty closely — I just don’t think that to date our customers have the total collapse in their budgets, not from a maintenance of their existing production. And remember, our AMS business, just like our contract operations business, is very much tied to the maintenance of production. So they haven’t seen a lot of deferrals or risk-taking or deferred maintenance and rationalization around the activities that maintain production, unlike in other parts of the business, where they have slashed CapEx around production capacity additions and drilling and completions.

So I do find and I do believe that it’s just a distinction for that business, as with contract ops, that we are much more on the production-associated side of what and where our customers spend their money.

Daniel Burke — Johnson Rice & Company - Analyst

Great. Well, thanks, guys. Thanks for squeezing me in.

Operator

Sharon Lui, Wells Fargo.

12

Sharon Lui — Wells Fargo Securities, LLC - Analyst

Just given the commodity backdrop, maybe if you can touch on how you’re managing perhaps any changes in the credit quality of some of your key E&P customers?

Jon Biro — Exterran Holdings, Inc. - SVP, CFO

We are monitoring the credit profiles of our customers very closely. We have refined some of our internal processes. But I think historically, our bad debt expense has been very low. So we have managed that situation very well, and we are heightening our management in that particular area.

Sharon Lui — Wells Fargo Securities, LLC - Analyst

Okay. And have any opportunities materialized in terms of maybe perhaps acquiring the compression units?

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Yes, we have talked about this in the past, Sharon. It is definitely a discussion we have with our customers. And it’s an opportunity set that we, too, expect in this environment, given budget constraints, some of our customers should find more appealing than previously.

But those transactions are hard to pull together. It’s been a challenge, and it remains a challenge, for our customers to pull their treasury CapEx management team together with their operations field and lift operating cost team in a way that has produced a lot of traction on this transaction. So while we remain optimistic, especially in this environment, haven’t landed any yet.

Sharon Lui — Wells Fargo Securities, LLC - Analyst

Okay. And I guess looking at the CapEx budget for the MLP, as you mentioned, for the second half is much lower than the first half. Any thoughts whether that could trend into 2016, if current commodity prices persist?

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Look, from a macro environment, I think it’s very fair to say that if we don’t see a change in the environment, then we will not drive a change in our current level of spending. We will need to see more opportunity for our fleet to go to work and utilization to be maintained or improved before we will see and drive a drastic change in our CapEx budget looking forward.

Sharon Lui — Wells Fargo Securities, LLC - Analyst

Okay. So I guess the guidance sort of implies an annualized CapEx number of about $100 million. Is that a reasonable assumption going forward?

Jon Biro — Exterran Holdings, Inc. - SVP, CFO

I don’t think so, Sharon. Part of that is we front-end loaded them of our CapEx this year. And so I would look at it more on an annual basis, and that will be more of an annualized run rate than what we will spend in the second half.

Sharon Lui — Wells Fargo Securities, LLC - Analyst

Okay, all right. Thank you.

Operator

That was our final question. I will now turn it back over to Brad for closing comments.

Brad Childers — Exterran Holdings, Inc. - President, and CEO

Great. Thanks, everybody. We appreciate your interest in Exterran Holdings and Exterran Partners. We’ll look forward to updating you following our third quarter. Thanks very much.

13

Operator

Thank you, ladies and gentlemen. That concludes today’s conference. Thank you for participating, and you may now disconnect.

14

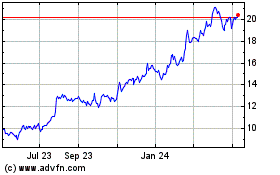

Archrock (NYSE:AROC)

Historical Stock Chart

From Apr 2024 to May 2024

Archrock (NYSE:AROC)

Historical Stock Chart

From May 2023 to May 2024