UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| |

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

May 5, 2015

|

EXTERRAN HOLDINGS, INC.

__________________________________________

(Exact name of registrant as specified in its charter)

| |

|

|

|

Delaware

|

001-33666

|

74-3204509

|

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

16666 Northchase Drive,

|

|

|

|

Houston, Texas

|

|

77060

|

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

| |

|

|

|

Registrant’s telephone number, including area code:

|

|

(281) 836-7000

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On May 5, 2015, Exterran Holdings, Inc. issued a press release announcing our financial results for the quarter ended March 31, 2015. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and will not be incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press release dated May 5, 2015, announcing Exterran Holdings, Inc.’s results of operations for the quarter ended March 31, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

| |

|

EXTERRAN HOLDINGS, INC.

|

| |

|

|

|

|

|

|

|

|

|

|

|

May 5, 2015

|

|

By:

|

|

/s/ JON C. BIRO

|

| |

|

|

|

Jon C. Biro

|

| |

|

|

|

Senior Vice President and Chief Financial Officer

|

| |

|

|

|

|

Exhibit Index

| |

|

|

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Press release dated May 5, 2015, announcing Exterran Holdings, Inc.’s results of operations for the quarter ended March 31, 2015.

|

Exhibit 99.1

Exterran Holdings Reports First-Quarter 2015 Results

|

● EBITDA, as adjusted, of $182 million for the quarter

|

|

● Net income from continuing operations attributable to Exterran common stockholders of $0.27 per diluted share, excluding items, for the quarter

|

HOUSTON, May 5, 2015 – Exterran Holdings, Inc. (NYSE: EXH) today reported EBITDA, as adjusted (as defined below), of $182.0 million for the first quarter 2015, compared to $182.3 million for the fourth quarter 2014 and $144.8 million for the first quarter 2014.

Revenue was $729.1 million for the first quarter 2015, compared to $793.6 million for the fourth quarter 2014 and $643.0 million for the first quarter 2014.

Fabrication backlog was $730.4 million at March 31, 2015, compared to $953.2 million at December 31, 2014 and $669.1 million at March 31, 2014. Fabrication bookings were $96.4 million for the first quarter 2015, compared to $474.9 million for the fourth quarter 2014 and $276.6 million for the first quarter 2014.

Exterran Holdings declared a dividend of $0.15 per share of common stock, a rate of $0.60 per share on an annualized basis, which will be paid on May 18, 2015 to stockholders of record at the close of business on May 11, 2015.

“In the first quarter 2015, we achieved solid operating performance across all our businesses. We benefitted from the relative stability and cost improvement activities in our production-related services businesses as well as solid execution of the significant backlog with which we entered the year in our fabrication business,” said Brad Childers, Exterran Holdings’ President and Chief Executive Officer. “As expected, fabrication bookings declined in this period of reduced capital spending and activity levels in the oil and gas industry. With this development in our fabrication business, we have taken steps to reduce our costs and are working aggressively to right size our businesses until this environment improves.”

“We continue to make progress toward the planned separation of our international services and global fabrication businesses into a new publicly traded company, and we now expect the transaction to close in the third quarter of this year. We expect this strategic transaction will create two strong businesses, the U.S. services business and the international services and global fabrication business, that will be better positioned to capture more profit and growth, as well as generate more value for our investors,” added Childers.

Net income (loss) from continuing operations attributable to Exterran stockholders, excluding items, for all periods excludes the benefit of proceeds from the two previously announced sales of Exterran Holdings’ previously-nationalized Venezuelan assets, the benefit of which was $23.7 million for the first quarter 2015, compared to $18.5 million for the fourth quarter 2014 and $22.7 million for the first quarter 2014. At March 31, 2015, Exterran was still due approximately $121 million of principal payments from the sales of these assets.

Net income from continuing operations attributable to Exterran stockholders, excluding items, for the first quarter 2015 was $18.6 million, or $0.27 per diluted common share. In addition to excluding the benefit related to our nationalized Venezuelan assets discussed above, these amounts also exclude non-cash long-lived asset impairment charges of $12.7 million primarily related to our contract operations businesses and restructuring charges of $4.8 million related to costs associated with the planned spin-off that primarily consisted of legal, consulting, audit and professional fees. Net income from continuing operations attributable to Exterran stockholders, excluding items, for the first quarter 2015 included charges of $7.5 million for currency losses related to the functional currency remeasurement of our foreign subsidiaries’ U.S. dollar denominated intercompany obligations. Net income from continuing operations attributable to Exterran stockholders, excluding items, was $21.4 million, or $0.31 per diluted common share, for the fourth quarter 2014, and $13.9 million, or $0.20 per diluted common share, for the first quarter 2014.

Net income attributable to Exterran stockholders was $32.1 million, or $0.46 per diluted common share, for the first quarter 2015, compared to $19.1 million, or $0.27 per diluted common share, for the fourth quarter 2014, and $32.6 million, or $0.47 per diluted common share, for the first quarter 2014.

The cash distribution to be received by Exterran Holdings based upon its limited partner and general partner interests in Exterran Partners, L.P. is $15.6 million for the first quarter 2015, compared to $15.2 million for the fourth quarter 2014 and $13.7 million for the first quarter 2014.

Conference Call Details

Exterran Holdings and Exterran Partners, L.P. will host a joint conference call on Tuesday, May 5, 2015, to discuss their first-quarter 2015 financial results. The call will begin at 11:00 a.m. Eastern Time.

To listen to the call via a live webcast, please visit Exterran’s website at www.exterran.com. The call will also be available by dialing 800-446-2782 in the United States and Canada, or +1-847-413-3235 for international calls. Please call approximately 15 minutes prior to the scheduled start time and reference Exterran conference call number 39431196.

A replay of the conference call will be available on Exterran’s website for approximately seven days. Also, a replay may be accessed by dialing 888-843-7419 in the United States and Canada, or +1-630-652-3042 for international calls. The access code is 39431196#.

*****

EBITDA, as adjusted, a non-GAAP measure, is defined as net income (loss) excluding income (loss) from discontinued operations (net of tax), cumulative effect of accounting changes (net of tax), income taxes, interest expense (including debt extinguishment costs and gain or loss on termination of interest rate swaps), depreciation and amortization expense, impairment charges, restructuring charges, non-cash gains or losses from foreign currency exchange rate changes recorded on intercompany obligations, expensed acquisition costs and other items. EBITDA, as adjusted, excludes the benefit of the two previously announced sales of Exterran Holdings’ Venezuelan assets.

Gross Margin, a non-GAAP measure, is defined as total revenue less cost of sales (excluding depreciation and amortization expense). Gross margin percentage is defined as gross margin divided by revenue.

About Exterran Holdings

Exterran Holdings, Inc. is a global market leader in full service natural gas compression and a premier provider of operations, maintenance, service and equipment for oil and gas production, processing and transportation applications. Exterran Holdings serves customers across the energy spectrum—from producers to transporters to processors to storage owners. Headquartered in Houston, Texas, Exterran has approximately 10,000 employees and operates in approximately 30 countries. Exterran Holdings owns an equity interest, including all of the general partner interest, in Exterran Partners, L.P. (NASDAQ: EXLP), a master limited partnership, the leading provider of natural gas contract compression services to customers throughout the United States. For more information, visit www.exterran.com.

Forward-Looking Statements

All statements in this release (and oral statements made regarding the subjects of this release) other than historical facts are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of uncertainties and factors, many of which are outside Exterran Holdings’ control, which could cause actual results to differ materially from such statements. Forward-looking information includes, but is not limited to: Exterran Holdings’ financial and operational strategies and ability to successfully effect those strategies; Exterran Holdings’ plan to conduct a separation of certain of its businesses, the possibility that the proposed transaction will be consummated, the timing of its consummation and the expected benefits from the proposed transaction; Exterran Holdings’ expectations regarding future economic and market conditions; Exterran Holdings’ financial and operational outlook and ability to fulfill that outlook; demand for Exterran Holdings’ products and services and growth opportunities for those products and services; and statements regarding amounts due from the sales of Exterran Holdings’ nationalized Venezuelan assets.

While Exterran Holdings believes that the assumptions concerning future events are reasonable, it cautions that there are inherent difficulties in predicting certain important factors that could impact the future performance or results of its business. Among the factors that could cause results to differ materially from those indicated by such forward-looking statements are: local, regional, national and international economic conditions and the impact they may have on Exterran Holdings and its customers; changes in tax laws that impact master limited partnerships; conditions in the oil and gas industry, including a sustained decrease in the level of supply or demand for oil or natural gas or a sustained decrease in the price of oil or natural gas; delays, costs and difficulties that could impact the completion and expected results of the proposed separation transaction; Exterran Holdings’ ability to timely and cost-effectively execute larger projects; changes in political or economic conditions in key operating markets, including international markets; any non-performance by third parties of their contractual obligations; changes in safety, health, environmental and other regulations; and the performance of Exterran Partners.

These forward-looking statements are also affected by the risk factors, forward-looking statements and challenges and uncertainties described in Exterran Holdings’ Annual Report on Form 10-K for the year ended December 31, 2014, and those set forth from time to time in Exterran Holdings’ filings with the Securities and Exchange Commission, which are available at www.exterran.com. Except as required by law, Exterran Holdings expressly disclaims any intention or obligation to revise or update any forward-looking statements whether as a result of new information, future events or otherwise.

SOURCE

Exterran Holdings, Inc.

|

EXTERRAN HOLDINGS, INC.

|

|

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

(In thousands, except per share amounts)

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| |

|

March 31,

|

|

|

December 31,

|

|

|

March 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2014

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

North America contract operations

|

|

$ |

202,261 |

|

|

$ |

199,640 |

|

|

$ |

156,523 |

|

|

International contract operations

|

|

|

120,691 |

|

|

|

124,066 |

|

|

|

111,040 |

|

|

Aftermarket services

|

|

|

86,856 |

|

|

|

108,362 |

|

|

|

88,048 |

|

|

Fabrication

|

|

|

319,274 |

|

|

|

361,560 |

|

|

|

287,397 |

|

| |

|

|

729,082 |

|

|

|

793,628 |

|

|

|

643,008 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales (excluding depreciation and amortization expense):

|

|

|

|

|

|

|

|

|

|

|

North America contract operations

|

|

|

82,679 |

|

|

|

85,094 |

|

|

|

71,081 |

|

|

International contract operations

|

|

|

44,339 |

|

|

|

49,891 |

|

|

|

41,032 |

|

|

Aftermarket services

|

|

|

65,934 |

|

|

|

85,804 |

|

|

|

67,821 |

|

|

Fabrication

|

|

|

267,118 |

|

|

|

297,490 |

|

|

|

229,588 |

|

|

Selling, general and administrative

|

|

|

86,686 |

|

|

|

94,658 |

|

|

|

92,578 |

|

|

Depreciation and amortization

|

|

|

95,808 |

|

|

|

90,337 |

|

|

|

85,522 |

|

|

Long-lived asset impairment

|

|

|

12,732 |

|

|

|

20,640 |

|

|

|

3,807 |

|

|

Restructuring charges

|

|

|

4,790 |

|

|

|

2,159 |

|

|

|

4,822 |

|

|

Interest expense

|

|

|

27,298 |

|

|

|

27,411 |

|

|

|

28,308 |

|

|

Equity in income of non-consolidated affiliates

|

|

|

(5,006 |

) |

|

|

- |

|

|

|

(4,693 |

) |

|

Other (income) expense, net

|

|

|

7,841 |

|

|

|

3,189 |

|

|

|

(2,434 |

) |

| |

|

|

690,219 |

|

|

|

756,673 |

|

|

|

617,432 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

38,863 |

|

|

|

36,955 |

|

|

|

25,576 |

|

|

Provision for income taxes

|

|

|

16,491 |

|

|

|

27,163 |

|

|

|

9,409 |

|

|

Income from continuing operations

|

|

|

22,372 |

|

|

|

9,792 |

|

|

|

16,167 |

|

|

Income from discontinued operations, net of tax

|

|

|

18,713 |

|

|

|

18,175 |

|

|

|

18,727 |

|

|

Net income

|

|

|

41,085 |

|

|

|

27,967 |

|

|

|

34,894 |

|

|

Less: net income attributable to the noncontrolling interest

|

|

|

(8,943 |

) |

|

|

(8,824 |

) |

|

|

(2,298 |

) |

|

Net income attributable to Exterran stockholders

|

|

$ |

32,142 |

|

|

$ |

19,143 |

|

|

$ |

32,596 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic income per common share(1):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations attributable to Exterran common stockholders

|

|

$ |

0.19 |

|

|

$ |

0.01 |

|

|

$ |

0.21 |

|

|

Income from discontinued operations attributable to Exterran common stockholders

|

|

|

0.27 |

|

|

|

0.27 |

|

|

|

0.28 |

|

|

Net income attributable to Exterran common stockholders

|

|

$ |

0.46 |

|

|

$ |

0.28 |

|

|

$ |

0.49 |

|

|

Diluted income per common share(1):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations attributable to Exterran common stockholders

|

|

$ |

0.19 |

|

|

$ |

0.01 |

|

|

$ |

0.20 |

|

|

Income from discontinued operations attributable to Exterran common stockholders

|

|

|

0.27 |

|

|

|

0.26 |

|

|

|

0.27 |

|

|

Net income attributable to Exterran common stockholders

|

|

$ |

0.46 |

|

|

$ |

0.27 |

|

|

$ |

0.47 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding used in computing income per common share:

|

|

|

Basic

|

|

|

68,252 |

|

|

|

67,366 |

|

|

|

65,390 |

|

|

Diluted

|

|

|

68,534 |

|

|

|

68,422 |

|

|

|

67,792 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared and paid per common share

|

|

$ |

0.15 |

|

|

$ |

0.15 |

|

|

$ |

0.15 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Basic and diluted net income attributable to Exterran common stockholders per common share was computed using the two-class method to determine the net income per share for each class of common stock and participating security (restricted stock and certain of our stock settled restricted stock units) according to dividends declared and participation rights in undistributed earnings. Accordingly, we have excluded net income attributable to participating securities from our calculation of basic and diluted net income attributable to Exterran common stockholders per common share.

|

|

|

EXTERRAN HOLDINGS, INC.

|

|

|

UNAUDITED SUPPLEMENTAL INFORMATION

|

|

|

(In thousands, except percentages)

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| |

|

March 31,

|

|

|

December 31,

|

|

|

March 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2014

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

North America contract operations

|

|

$ |

202,261 |

|

|

$ |

199,640 |

|

|

$ |

156,523 |

|

|

International contract operations

|

|

|

120,691 |

|

|

|

124,066 |

|

|

|

111,040 |

|

|

Aftermarket services

|

|

|

86,856 |

|

|

|

108,362 |

|

|

|

88,048 |

|

|

Fabrication

|

|

|

319,274 |

|

|

|

361,560 |

|

|

|

287,397 |

|

|

Total

|

|

$ |

729,082 |

|

|

$ |

793,628 |

|

|

$ |

643,008 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Margin (1):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America contract operations

|

|

$ |

119,582 |

|

|

$ |

114,546 |

|

|

$ |

85,442 |

|

|

International contract operations

|

|

|

76,352 |

|

|

|

74,175 |

|

|

|

70,008 |

|

|

Aftermarket services

|

|

|

20,922 |

|

|

|

22,558 |

|

|

|

20,227 |

|

|

Fabrication

|

|

|

52,156 |

|

|

|

64,070 |

|

|

|

57,809 |

|

|

Total

|

|

$ |

269,012 |

|

|

$ |

275,349 |

|

|

$ |

233,486 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, General and Administrative

|

|

$ |

86,686 |

|

|

$ |

94,658 |

|

|

$ |

92,578 |

|

|

% of revenue

|

|

|

12 |

% |

|

|

12 |

% |

|

|

14 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA, as Adjusted (1)

|

|

$ |

181,993 |

|

|

$ |

182,254 |

|

|

$ |

144,805 |

|

|

% of revenue

|

|

|

25 |

% |

|

|

23 |

% |

|

|

23 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures

|

|

$ |

139,783 |

|

|

$ |

155,956 |

|

|

$ |

99,214 |

|

|

Less: Proceeds from sale of PP&E

|

|

|

(8,910 |

) |

|

|

(4,637 |

) |

|

|

(10,863 |

) |

|

Net Capital expenditures

|

|

$ |

130,873 |

|

|

$ |

151,319 |

|

|

$ |

88,351 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Margin Percentage:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America contract operations

|

|

|

59 |

% |

|

|

57 |

% |

|

|

55 |

% |

|

International contract operations

|

|

|

63 |

% |

|

|

60 |

% |

|

|

63 |

% |

|

Aftermarket services

|

|

|

24 |

% |

|

|

21 |

% |

|

|

23 |

% |

|

Fabrication

|

|

|

16 |

% |

|

|

18 |

% |

|

|

20 |

% |

|

Total

|

|

|

37 |

% |

|

|

35 |

% |

|

|

36 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Available Horsepower (at period end):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America contract operations

|

|

|

4,246 |

|

|

|

4,209 |

|

|

|

3,476 |

|

|

International contract operations

|

|

|

1,239 |

|

|

|

1,236 |

|

|

|

1,254 |

|

|

Total

|

|

|

5,485 |

|

|

|

5,445 |

|

|

|

4,730 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Horsepower (at period end):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America contract operations

|

|

|

3,689 |

|

|

|

3,700 |

|

|

|

2,901 |

|

|

International contract operations

|

|

|

960 |

|

|

|

976 |

|

|

|

984 |

|

|

Total

|

|

|

4,649 |

|

|

|

4,676 |

|

|

|

3,885 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Operating Horsepower:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America contract operations

|

|

|

3,695 |

|

|

|

3,638 |

|

|

|

2,894 |

|

|

International contract operations

|

|

|

971 |

|

|

|

975 |

|

|

|

982 |

|

|

Total

|

|

|

4,666 |

|

|

|

4,613 |

|

|

|

3,876 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Horsepower Utilization (at period end):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America contract operations

|

|

|

87 |

% |

|

|

88 |

% |

|

|

83 |

% |

|

International contract operations

|

|

|

77 |

% |

|

|

79 |

% |

|

|

78 |

% |

|

Total

|

|

|

85 |

% |

|

|

86 |

% |

|

|

82 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

March 31,

|

|

|

December 31,

|

|

|

March 31,

|

|

|

Fabrication Backlog:

|

|

2015 |

|

|

2014 |

|

|

2014 |

|

|

Compression & accessory

|

|

$ |

185,640 |

|

|

$ |

270,297 |

|

|

$ |

176,708 |

|

|

Production & processing equipment

|

|

|

458,143 |

|

|

|

561,153 |

|

|

|

433,842 |

|

|

Installation

|

|

|

86,590 |

|

|

|

121,751 |

|

|

|

58,513 |

|

|

Total

|

|

$ |

730,373 |

|

|

$ |

953,201 |

|

|

$ |

669,063 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt - Parent level

|

|

$ |

704,994 |

|

|

$ |

726,607 |

|

|

$ |

783,828 |

|

|

Debt - Exterran Partners, L.P.

|

|

|

1,342,581 |

|

|

|

1,300,295 |

|

|

|

801,595 |

|

|

Total consolidated debt

|

|

$ |

2,047,575 |

|

|

$ |

2,026,902 |

|

|

$ |

1,585,423 |

|

|

Exterran stockholders' equity

|

|

$ |

1,809,730 |

|

|

$ |

1,797,260 |

|

|

$ |

1,702,787 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Management believes EBITDA, as adjusted, and gross margin provide useful information to investors because these non-GAAP measures, when viewed with our GAAP results and accompanying reconciliations, provide a more complete understanding of our performance than GAAP results alone. Management uses these non-GAAP measures as supplemental measures to review current period operating performance, comparability measures and performance measures for period to period comparisons. In addition, management uses EBITDA, as adjusted, as a valuation measure.

|

|

|

EXTERRAN HOLDINGS, INC.

|

|

|

UNAUDITED SUPPLEMENTAL INFORMATION

|

|

|

(In thousands, except per share amounts)

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| |

|

March 31,

|

|

|

December 31,

|

|

|

March 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2014

|

|

| |

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP to Non-GAAP Financial Information:

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

41,085 |

|

|

$ |

27,967 |

|

|

$ |

34,894 |

|

|

Income from discontinued operations, net of tax

|

|

|

(18,713 |

) |

|

|

(18,175 |

) |

|

|

(18,727 |

) |

|

Income from continuing operations

|

|

|

22,372 |

|

|

|

9,792 |

|

|

|

16,167 |

|

|

Depreciation and amortization

|

|

|

95,808 |

|

|

|

90,337 |

|

|

|

85,522 |

|

|

Long-lived asset impairment

|

|

|

12,732 |

|

|

|

20,640 |

|

|

|

3,807 |

|

|

Restructuring charges

|

|

|

4,790 |

|

|

|

2,159 |

|

|

|

4,822 |

|

|

Investment in non-consolidated affiliates impairment

|

|

|

- |

|

|

|

- |

|

|

|

197 |

|

|

Proceeds from sale of joint venture assets

|

|

|

(5,006 |

) |

|

|

- |

|

|

|

(4,890 |

) |

|

Interest expense

|

|

|

27,298 |

|

|

|

27,411 |

|

|

|

28,308 |

|

|

(Gain) loss on currency exchange rate remeasurement of intercompany balances

|

|

|

7,508 |

|

|

|

3,730 |

|

|

|

(81 |

) |

|

Loss on sale of businesses

|

|

|

- |

|

|

|

961 |

|

|

|

- |

|

|

Expensed acquisition costs

|

|

|

- |

|

|

|

61 |

|

|

|

1,544 |

|

|

Provision for income taxes

|

|

|

16,491 |

|

|

|

27,163 |

|

|

|

9,409 |

|

|

EBITDA, as adjusted (1)

|

|

|

181,993 |

|

|

|

182,254 |

|

|

|

144,805 |

|

|

Selling, general and administrative

|

|

|

86,686 |

|

|

|

94,658 |

|

|

|

92,578 |

|

|

Equity in income of non-consolidated affiliates

|

|

|

(5,006 |

) |

|

|

- |

|

|

|

(4,693 |

) |

|

Investment in non-consolidated affiliates impairment

|

|

|

- |

|

|

|

- |

|

|

|

(197 |

) |

|

Proceeds from sale of joint venture assets

|

|

|

5,006 |

|

|

|

- |

|

|

|

4,890 |

|

|

Gain (loss) on currency exchange rate remeasurement of intercompany balances

|

|

|

(7,508 |

) |

|

|

(3,730 |

) |

|

|

81 |

|

|

Loss on sale of businesses

|

|

|

- |

|

|

|

(961 |

) |

|

|

- |

|

|

Expensed acquisition costs

|

|

|

- |

|

|

|

(61 |

) |

|

|

(1,544 |

) |

|

Other (income) expense, net

|

|

|

7,841 |

|

|

|

3,189 |

|

|

|

(2,434 |

) |

|

Gross Margin (1)

|

|

$ |

269,012 |

|

|

$ |

275,349 |

|

|

$ |

233,486 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income attributable to Exterran stockholders

|

|

$ |

32,142 |

|

|

$ |

19,143 |

|

|

$ |

32,596 |

|

|

Income from discontinued operations

|

|

|

(18,713 |

) |

|

|

(18,175 |

) |

|

|

(18,727 |

) |

|

Foreign tax credit valuation allowance

|

|

|

- |

|

|

|

7,224 |

|

|

|

- |

|

|

Items, after-tax:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-lived asset impairment (including the impact on noncontrolling interest)

|

|

|

7,146 |

|

|

|

11,094 |

|

|

|

1,472 |

|

|

Restructuring charges (including the impact on noncontrolling interest)

|

|

|

3,017 |

|

|

|

1,360 |

|

|

|

2,897 |

|

|

Investment in non-consolidated affiliates impairment

|

|

|

- |

|

|

|

- |

|

|

|

197 |

|

|

Proceeds from sale of joint venture assets

|

|

|

(5,006 |

) |

|

|

- |

|

|

|

(4,890 |

) |

|

Loss on sale of businesses

|

|

|

- |

|

|

|

718 |

|

|

|

- |

|

|

Expensed acquisition costs (including the impact on noncontrolling interest)

|

|

|

- |

|

|

|

14 |

|

|

|

398 |

|

|

Net income from continuing operations attributable to Exterran stockholders, excluding items

|

|

$ |

18,586 |

|

|

$ |

21,378 |

|

|

$ |

13,943 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted income from continuing operations attributable to Exterran common stockholders

|

|

$ |

0.19 |

|

|

$ |

0.01 |

|

|

$ |

0.20 |

|

|

Adjustment for items, after-tax, per common share (2)

|

|

|

0.08 |

|

|

|

0.30 |

|

|

|

- |

|

Diluted net income from continuing operations attributable to Exterran common stockholders per common

share, excluding items (1)(2)

|

|

$ |

0.27 |

|

|

$ |

0.31 |

|

|

$ |

0.20 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Management believes EBITDA, as adjusted, diluted net income from continuing operations attributable to Exterran common stockholders per common share, excluding items, and gross margin provide useful information to investors because these non-GAAP measures, when viewed with our GAAP results and accompanying reconciliations, provide a more complete understanding of our performance than GAAP results alone. Management uses these non-GAAP measures as supplemental measures to review current period operating performance, comparability measures and performance measures for period to period comparisons. In addition, management uses EBITDA, as adjusted, as a valuation measure.

|

|

|

(2) Diluted net income from continuing operations attributable to Exterran common stockholders per common share, excluding items, was computed using the two-class method to determine the net income per share for each class of common stock and participating security (restricted stock and certain of our stock settled restricted stock units) according to dividends declared and participation rights in undistributed earnings. Accordingly, we have excluded net income from continuing operations attributable to participating securities, excluding items, of $0.2 million, $0.4 million and $0.2 million for the three months ended March 31, 2015, December 31, 2014 and March 31, 2014, respectively, from our calculation of diluted net income from continuing operations attributable to Exterran common stockholders per common share, excluding items.

|

|

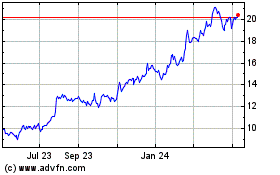

Archrock (NYSE:AROC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Archrock (NYSE:AROC)

Historical Stock Chart

From Apr 2023 to Apr 2024