Essex Property Trust Announces Expiration & Final Results for Exchange Offers & Consent Solicitations Relating to Senior Note...

April 02 2014 - 4:01PM

Marketwired

Essex Property Trust Announces Expiration and Final Results for

Exchange Offers and Consent Solicitations Relating to Senior Notes

Previously Issued by BRE Properties, Inc.

PALO ALTO, CA--(Marketwired - Apr 2, 2014) - Essex Property

Trust, Inc. (NYSE: ESS), a Maryland corporation ("Essex"), today

announced the expiration of and final results for the previously

announced exchange offers by its operating partnership, Essex

Portfolio, L.P., a California limited partnership ("EPLP"), to

exchange any and all of the 5.500% Senior Notes due 2017 (CUSIP No.

05564E BK1) (the "Existing 2017 Notes"), 5.200% Senior Notes due

2021 (CUSIP No. 05564E BL9) (the "Existing 2021 Notes") and 3.375%

Senior Notes due 2023 (CUSIP No. 05564E BM7) (the "Existing 2023

Notes" and, collectively with the Existing 2017 Notes and the

Existing 2021 Notes, the "Existing Notes") issued by BRE

Properties, Inc., a Maryland corporation ("BRE"), which in

accordance with the merger agreement, dated December 19, 2013,

between Essex and BRE, was merged into a wholly owned subsidiary of

Essex on April 1, 2014 (the "BRE Merger"), for EPLP's new 5.500%

Senior Notes due 2017 (the "New 2017 Notes"), 5.200% Senior Notes

due 2021 (the "New 2021 Notes") and 3.375% Senior Notes due 2023

(the "New 2023 Notes" and, collectively with the New 2017 Notes and

the New 2021 Notes, the "New Notes"), respectively, each guaranteed

by Essex and each with registration rights (collectively, the

"Exchange Offers"). EPLP has been advised by D.F. King &

Co., Inc., the exchange agent for the Exchange Offers, that holders

of:

- $274,188,000, or approximately 91.40% of the principal amount

of the Existing 2017 Notes;

- $282,577,000, or approximately 94.19% of the principal amount

of the Existing 2021 Notes; and

- $286,458,000, or approximately 95.49% of the principal amount

of the Existing 2023 Notes,

had validly tendered and not validly withdrawn their Existing

Notes as of the expiration date of 11:59 p.m., New York City time,

on April 1, 2014 (the "Expiration Date"). The settlement date for

the Exchange Offers is expected to occur on April 4, 2014.

Based on the results announced above, EPLP, on behalf of BRE,

received and accepted the requisite consents from the holders of

the Existing Notes and amended the indenture governing the Existing

Notes to eliminate substantially all of the restrictive and

affirmative covenants, eliminate an event of default provision, and

modify certain other provisions. Such amendments became effective

on April 1, 2014.

The following table sets forth the exchange consideration, the

early participation premium and the total exchange consideration

for each series of Existing Notes:

| |

|

|

|

|

|

|

|

|

|

|

| Title of Security |

|

CUSIP No. |

|

Aggregate Principal Amount Outstanding |

|

Exchange Consideration (1) |

|

Early Participation Premium (1) |

|

Total Exchange Consideration (1)(2) |

|

Notes |

|

Notes |

|

Cash |

|

Notes |

|

Cash |

|

5.500% Senior Notes due 2017 |

|

05564E BK 1 |

|

$300,000,000 |

|

$970 |

|

$30 |

|

$2.50 |

|

$1,000 |

|

$2.50 |

|

5.200% Senior Notes due 2021 |

|

05564E BL 9 |

|

$300,000,000 |

|

$970 |

|

$30 |

|

$2.50 |

|

$1,000 |

|

$2.50 |

|

3.375% Senior Notes due 2023 |

|

05564E BM 7 |

|

$300,000,000 |

|

$970 |

|

$30 |

|

$2.50 |

|

$1,000 |

|

$2.50 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

For

each $1,000 principal amount of Existing 2017 Notes, Existing 2021

Notes and Existing 2023 Notes, as the case may be, in each case,

subject to rounding down to $2,000 or the nearest integral multiple

of $1,000 in excess thereof. |

|

(2) |

Includes the early participation premium. |

Eligible holders whose Existing Notes were validly tendered at

or prior to the early participation and consent date of 5:00 p.m.,

New York City time, on March 18, 2014 (the "Early Participation and

Consent Date") and accepted for purchase will receive the total

exchange consideration. Eligible holders whose Existing Notes were

validly tendered at or prior to the Expiration Date but after the

Early Participation and Consent Date and accepted for purchase will

receive the exchange consideration, which, in the case of each

series is equal to the total exchange consideration minus the early

participation premium.

The New Notes have not been registered under the Securities Act

of 1933, as amended (the "Securities Act"), or the securities laws

of any state and may not be offered or sold in the United States

absent registration or an exemption from the registration

requirements of the Securities Act and applicable state securities

laws. This press release is neither an offer to sell, nor the

solicitation of an offer to buy, nor a solicitation of consents

with respect to any securities, nor shall there be any sale of the

New Notes in any state or jurisdiction in which such an offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such

jurisdiction.

The New Notes were offered only to qualified institutional

buyers as defined in Rule 144A under the Securities Act in reliance

on the exemption provided by Section 4(a)(2) of the Securities Act

or outside the United States to institutions other than "U.S.

persons" pursuant to Regulation S under the Securities Act

(collectively, "eligible holders").

About Essex Property

Trust, Inc.

Essex Property Trust, Inc., an S&P 500 company, is a fully

integrated real estate investment trust (REIT) that acquires,

develops, redevelops, and manages apartment communities located in

highly desirable, supply-constrained markets. As of April 1, 2014,

after giving effect to the BRE merger, Essex has ownership

interests in 233 multifamily properties with an additional 15

properties in various stages of development. Additional information

about Essex can be found on the Company's web site at

www.essexpropertytrust.com.

Contact

Information Barb Pak Director of Investor Relations

(650) 494-3700

bpak@essexpropertytrust.com

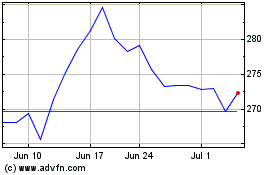

Essex Property (NYSE:ESS)

Historical Stock Chart

From Mar 2024 to Apr 2024

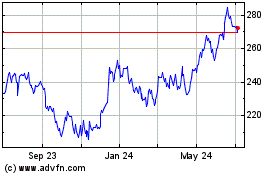

Essex Property (NYSE:ESS)

Historical Stock Chart

From Apr 2023 to Apr 2024