EARNINGS PREVIEW: European Utilities Eye Asset Sales; Debt

May 07 2009 - 10:41AM

Dow Jones News

TAKING THE PULSE: The key issue for European utilities will be

debt as companies seek to recoup funds following aquisitions and

boost cash reserves through asset disposals.

A number of European utilities have already outlined around

EUR30 billion of asset disposal plans, so prices will have to be

competitive, analysts say.

French utility Electricite de France SA (EDF.FR) could also be

considering selling its U.K. electricity distribution business for

between GBP3 billion and GBP5 billion to reduce ballooning debt,

according to media reports.

EDF's debt reached EUR24.5 billion at the end of 2008, a 50%

increase on the previous year, but it needs billions to build the

new nuclear power stations its committed to.

Investors also want to see if U.K. utility Centrica PLC (CNA.LN)

concludes talks with EDF over a 25% stake in its U.K. nuclear

subsidiary British Energy or if it decides it is too expensive

given falling valuations and pulls out.

COMPANIES TO WATCH:

Enel SpA (ENEL.MI) (1Q09, May 12)

MARKET EXPECTATIONS: Three analysts polled by Dow Jones

Newswires expect an average 16% drop in first-quarter net profit to

EUR840 million on higher financial charges following its large debt

pile to take over Endesa SA (ELE.MC). Earnings before interest,

taxes, depreciation and amortization is forecast to rise 2.3% to

EUR3.53 billion due to forward electricity sales of recent years

despite the recent lower power demand from the economic slump.

MAIN FOCUS: Analysts are looking for any details on disposal of

assets as the company's main objective of slashing its debts, which

was about EUR50 billion in December. They will also be looking at

the EUR8 billion capital hike and the prospectus that will be

presented to securities regulator in the week starting May 8.

Electricite de France SA (EDF.FR) (1Q09 Revenue, May 12)

MARKET EXPECTATIONS: Higher regulated power tariffs should help

compensate for lower demand as the downturn bites, said one analyst

who expects revenue to be flat. However, the relatively cold winter

in the quarter could boost revenue, a second analyst said, adding

he expects revenue to be mostly unchanged from the fourth

quarter.

MAIN FOCUS: If power demand from industrial clients has fallen,

then EDF could end up losing less than it anticipated through the

below-market Tartam regulated tariff. Investors are also seeking

any details on negotiations with Centrica on selling part of

British Energy and any update on EDF's plans to sell other

assets.

E.ON AG (EAON.XE) (1Q09, May 13)

MARKET EXPECTATIONS: E.ON is forecast to post a year-on-year

rise in first-quarter operating profit and sales driven by higher

realized power prices as the company sold a large part of 2009

power production in 2008 when prices were higher, analysts said.

Also, contributions from newly consolidated businesses in Spain,

Italy and France should help drive earnings higher. U.K. and Nordic

businesses are expected to be burdened by declines of the

respective currencies. Midstream and upstream gas are likely to

have suffered from falling energy prices.

MAIN FOCUS: Investors will be looking for an update of E.ON's

divestment plans, including its municipal utilities holding company

Thuega. The company has said it intends to sell EUR10 billion worth

of assets through 2010. Further focus will be on power and gas

consumption expectations as well as the company's 2009 earnings

forecast. Some analysts said a mere reiteration of the outlook may

be seen as disappointing, especially if E.ON posts strong

first-quarter results.

RWE AG (RWE.XE) (1Q 09, May 14)

MARKET EXPECTATIONS: RWE is expected to report flat to slightly

stronger results with power generation mostly offsetting weaker

contributions from other business areas as average realized power

prices have increased. Earnings may be hit by lengthy outages of

the Biblis nuclear reactors, lower margins in the upstream business

due to falling energy prices and the weaker British pound and

government programs to improve energy efficiencyon the U.K.

business.

MAIN FOCUS: Analysts will be looking for an update on RWE's

planned EUR9.3 billion takeover of Dutch utility Essent NV. Last

month the planned acquisition suffered a setback after the council

of Dutch province North Brabant, which owns just under 31% of

Essent, recommended the government not accept RWE's offer. Focus

will also lie on RWE's forecast for power consumption amid the

economic downturn and its impact on earnings. RWE has so far has

said it expects only a slight decrease in power consumption.

RWE is expected to reiterate its 2009 financial guidance aiming

for stable recurrent net profit, operating profit and earnings

before interest, taxes, depreciation and amortization.

Company Web sites: http://www.edf.com

http://www.enel.com

http://www.rwe.com

http://www.eon.com

http://centrica.co.uk

-By Selina Williams, Dow Jones Newswires, +44 207 842 9262;

selina.williams@dowjones.com

(Jan Hromadko in Frankfurt, Liam Moloney in Rome and Adam

Mitchell in Paris contributed to this report.)

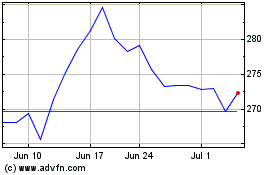

Essex Property (NYSE:ESS)

Historical Stock Chart

From Mar 2024 to Apr 2024

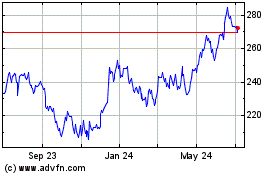

Essex Property (NYSE:ESS)

Historical Stock Chart

From Apr 2023 to Apr 2024