ADRs Close Higher; BHP, Petrobras Trade Actively

February 22 2016 - 6:15PM

Dow Jones News

By Maria Armental

International stocks trading in New York closed higher on

Monday.

The BNY Mellon index of American depositary receipts rose 1.3%

to 116.69. The European index improved 0.87% to 116.18, the Asian

index gained 1.8% to 124.19. The Latin American index moved up 4.5%

to 147.67. And the emerging-markets index rose 2.7% to 208.85.

BHP Billiton Ltd. (BHP, BHP.AU) and Petróleo Brasileiro SA (PBR,

PETR3.BR, PETR4.BR) were among the companies with ADRs that traded

actively.

AngloGold Ashanti Ltd. (AU, ANG.JO) reported a loss of $70

million in 2015, compared with a loss of $39 million a year

earlier, beating expectations as the company continued to focus on

reducing debt and improving margins even as gold prices continued

to fall. ADRs rose 4% to $11.34.

After New York's market close, BHP Billiton, the world's largest

mining company by market value, slashed its midyear dividend by

74%, a move it said would safeguard its balance sheet. The company,

which had been under pressure from rating firms and some of its

investors, had long pledged to maintain its dividend payouts. The

cut comes as the miner posted a $5.67 billion first-half loss.

ADRs, which had risen 5.5%during the day, fell 3% to $24.52 in

after-hours trading.

HSBC Holdings PLC (HSBC, HSBA, 0005.HK) said on Monday that

slower economic expansion in Asia and volatile markets could hit

revenue and delay parts of its strategy this year, as it reported

worse-than-expected fourth-quarter results Monday. The British bank

swung to a $1.33 billion net loss in the last three months of 2015,

from a $511 million net profit in the fourth quarter of 2014,

mainly due to lower revenue from Asia and provisions to cover

souring energy loans in the U.S. and elsewhere. The bank also

disclosed a new probe by the U.S. Securities and Exchange

Commission around its hiring practices in Asia, and said further

potential financial crime has been found by the independent monitor

overseeing the bank's compliance with a 2012 deferred prosecution

agreement in the U.S. ADRs fell 1.8% to $31.60.

ADRs of Brazilian companies rose on Monday and the country's

currency strengthened against the dollar as the price of oil and

other hard commodities rose. Among the companies whose ADRs rose

were iron-ore miner Vale SA (VALE, VALE3.BR, VALE5.BR, VALE5.FR),

up 13.6% at $3.34; aircraft maker Embraer SA (ERJ, EMBR3.BR), up

3.7% to $30.25; and state-controlled oil company Petrobras rose

16.8% to $3.68 on Monday.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

February 22, 2016 18:00 ET (23:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

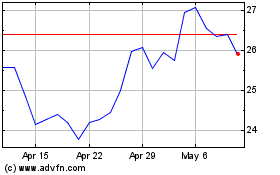

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

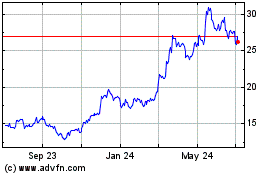

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024