Edison International (NYSE: EIX) today reported first quarter

2016 net income on a GAAP basis of $271 million, or $0.83 per

share, compared to $299 million, or $0.92 per share, in the first

quarter of 2015. On an adjusted basis, Edison International’s first

quarter 2016 core earnings were $268 million, or $0.82 per share,

compared to $294 million, or $0.90 per share, in the first quarter

of 2015.

Southern California Edison's (SCE) first quarter 2016 core

earnings decreased by $18 million, or $0.05 per share, from the

first quarter 2015 primarily due to the timing of revenue

recognized in 2015 due to the delay in receiving the 2015

California Public Utilities Commission General Rate Case decision,

higher operation and maintenance costs and lower incremental income

tax benefits.

Edison International Parent and Other’s first quarter 2016 core

losses increased by $8 million, or $0.03 per share, compared to

first quarter 2015 core losses primarily due to higher development

and operating costs at Edison Energy Group and subsidiaries and

income in the first quarter of 2015 from Edison Capital's

investments in affordable housing projects.

Edison International's first quarter 2016 core earnings exclude

income of $3 million, or $0.01 per share, and first quarter 2015

core earnings exclude income of $5 million, or $0.02 per share,

both primarily related to losses allocated to tax equity investors

under the hypothetical liquidation at book value accounting

method.

“First quarter results were consistent with our expectation

leading us to reaffirm 2016 core earnings guidance,” said Ted

Craver, chairman and chief executive officer of Edison

International. “At SCE, we continue to see significant rate base

growth driven by continued investment in infrastructure reliability

and public safety and supporting California’s low-carbon policy

objectives.”

Edison International uses core earnings, which is a non-GAAP

financial measure that adjusts for significant discrete items that

management does not consider representative of ongoing earnings.

Edison International management believes that core earnings provide

more meaningful comparisons of performance from period to period.

Please see the attached tables for a reconciliation of core

earnings to basic GAAP earnings.

2016 Earnings Guidance

The company reaffirmed core earnings guidance of $3.81 to $4.01

per share for 2016 and updated its basic earnings guidance to $3.82

to $4.02 per share for a first quarter non-core item. See the

presentation accompanying the company’s conference call for further

information including key guidance assumptions.

2016 Core and Basic Earnings

Guidance

2016 Earnings Guidance 2016 Earnings Guidance

as of February 23, 2016 as of May 2, 2016 Low

Mid High Low

Mid High SCE $ 4.09 $

4.09 EIX Parent & Other (0.18 ) (0.18 )

EIX Core EPS

$ 3.81 $ 3.91 $ 4.01

$ 3.81 $ 3.91 $ 4.01

Non-core Items* - - - 0.01 0.01 0.01

EIX Basic EPS $

3.81 $ 3.91 $ 4.01 $

3.82 $ 3.92 $ 4.02

* Non-core items recorded for the three

months ended March 31, 2016.

About Edison International

Edison International (NYSE:EIX), through its subsidiaries, is a

generator and distributor of electric power and an investor in

energy services and technologies, including renewable energy.

Headquartered in Rosemead, Calif., Edison International is the

parent company of Southern California Edison, one of the nation’s

largest electric utilities.

Appendix

Use of Non-GAAP Financial

Measures

Edison International’s earnings are prepared in accordance with

generally accepted accounting principles used in the United States

and represent the company’s earnings as reported to the Securities

and Exchange Commission. Our management uses core earnings and core

earnings per share (EPS) internally for financial planning and for

analysis of performance of Edison International and Southern

California Edison. We also use core earnings and core EPS when

communicating with analysts and investors regarding our earnings

results to facilitate comparisons of the Company’s performance from

period to period. Financial measures referred to as net income,

basic EPS, core earnings, or core EPS also apply to the description

of earnings or earnings per share.

Core earnings and core EPS are non-GAAP financial measures and

may not be comparable to those of other companies. Core earnings

and core EPS are defined as basic earnings and basic EPS excluding

income or loss from discontinued operations and income or loss from

significant discrete items that management does not consider

representative of ongoing earnings. Basic earnings and losses refer

to net income or losses attributable to Edison International

shareholders. Core earnings are reconciled to basic earnings in the

attached tables. The impact of participating securities (vested

awards that earn dividend equivalents that may participate in

undistributed earnings with common stock) for the principal

operating subsidiary is not material to the principal operating

subsidiary’s EPS and is therefore reflected in the results of the

Edison International holding company, which is included in Edison

International Parent and Other.

Risk Disclosure Statement

Forward-looking statements about the financial outlook for

Edison International and its subsidiaries are included in this news

release. These forward-looking statements reflect our current

expectations; however, such statements involve risks and

uncertainties. Actual results could differ materially from current

expectations. Important factors that could cause different results

are discussed under the headings “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” in Edison International’s Form 10-K, most recent Form

10-Q, and other reports and presentations filed with the Securities

and Exchange Commission which are available at:

www.edisoninvestor.com. These forward-looking statements represent

our expectations only as of the date of this news release, and

Edison International assumes no duty to update them to reflect new

information, events or circumstances.

Reminder: Edison

International Will Hold a Conference Call Today

When: Monday, May 2, 2016, 1:30 p.m. (Pacific

Time) Telephone Numbers: 1-800-369-2198 (US) and 1-773-756-4618

(Int'l) - Passcode: Edison Telephone Replay: 1-866-378-7479 (US)

and 1-203-369-0329 (Int’l) - Passcode: 50216 Telephone replay

available through May 13, 2016 Webcast:

www.edisoninvestor.com

First Quarter Reconciliation of Core

Earnings Per Share to Basic Earnings Per Share

Three months endedMarch 31,

2016 2015

Change Earnings (loss) per share attributable to Edison

International Continuing operations SCE $ 0.88 $ 0.93

$ (0.05 ) Edison International Parent and Other (0.05 ) (0.01 )

(0.04 ) Discontinued operations — —

— Edison International 0.83

0.92 (0.09 ) Less: Non-core items SCE —

— — Edison International Parent and Other 0.01 0.02 (0.01 )

Discontinued operations — —

— Total non-core items 0.01 0.02

(0.01 ) Core earnings (losses) SCE 0.88 0.93

(0.05 ) Edison International Parent and Other (0.06 )

(0.03 ) (0.03 ) Edison International

$ 0.82 $ 0.90 $

(0.08 )

Note: Diluted earnings were $0.82 and

$0.91 per share for the three months ended March 31, 2016 and 2015,

respectively.

First Quarter Reconciliation of Core

Earnings to Basic Earnings (in millions)

Three months endedMarch 31,

(in millions) 2016 2015

Change Net income (loss) attributable to Edison

International Continuing operations SCE $ 287 $ 305 $ (18 ) Edison

International Parent and Other (17 ) (6 ) (11 ) Discontinued

operations 1 — 1

Edison International 271 299

(28 ) Less: Non-core items SCE — — — Edison International

Parent and Other 2 5 (3 ) Discontinued operations 1

— 1 Total non-core items 3

5 (2 ) Core earnings

(losses) SCE 287 305 (18 ) Edison International Parent and Other

(19 ) (11 ) (8 ) Edison International

$ 268 $ 294

$ (26 )

Consolidated Statements of Income

Edison International

Three months ended March 31,

(in millions, except per-share amounts, unaudited)

2016 2015

Total operating revenue $

2,440 $ 2,512 Purchased power and fuel

794 786 Operation and maintenance 629 636

Depreciation, decommissioning and amortization 477 463 Property and

other taxes 92 89

Total operating

expenses 1,992 1,974

Operating

income 448 538 Interest and other income 31 39 Interest expense

(140 ) (143 ) Other expenses (6 ) (10 )

Income

from continuing operations before income taxes 333 424 Income

tax expense 38 106

Income from

continuing operations 295 318 Income from discontinued

operations, net of tax 1 —

Net

income 296 318 Preferred and preference stock dividend

requirements of SCE 30 28 Other noncontrolling interests (5 )

(9 )

Net income attributable to Edison

International common shareholders $ 271 $

299

Amounts attributable to Edison International common

shareholders: Income from continuing operations, net of tax $

270 $ 299 Income from discontinued operations, net of tax 1

—

Net income attributable to Edison

International common shareholders $ 271 $

299

Basic earnings per common share attributable to

Edison International common shareholders: Weighted-average

shares of common stock outstanding 326 326 Continuing operations $

0.83 $ 0.92

Total $ 0.83

$ 0.92

Diluted earnings per common share

attributable to Edison International common shareholders:

Weighted-average shares of common stock outstanding, including

effect of dilutive securities 328 329 Continuing operations $ 0.82

$ 0.91

Total $ 0.82

$ 0.91

Dividends declared per common

share $ 0.4800 $

0.4175

Consolidated Balance Sheets Edison

International (in millions, unaudited)

March 31,2016

December 31,2015

ASSETS Cash and cash equivalents $ 137 $ 161 Receivables,

less allowances of $59 and $62 for uncollectible accounts at

respective dates 649 771 Accrued unbilled revenue 512 565 Inventory

268 267 Derivative assets 65 79 Regulatory assets 538 560 Other

current assets 258 251

Total current

assets 2,427 2,654 Nuclear decommissioning

trusts 4,290 4,331 Other investments 208 203

Total investments 4,498 4,534 Utility

property, plant and equipment, less accumulated depreciation and

amortization of $8,751 and $8,548 at respective dates 35,323 34,945

Nonutility property, plant and equipment, less accumulated

depreciation of $88 and $85 at respective dates 141

140

Total property, plant and equipment 35,464

35,085 Derivative assets 78 84 Regulatory assets

7,628 7,512 Other long-term assets 364 360

Total long-term assets 8,070 7,956

Total assets $ 50,459

$ 50,229

Consolidated Balance Sheets

Edison International (in millions, except

share amounts, unaudited)

March 31,2016

December 31,2015

LIABILITIES AND EQUITY Short-term debt $ 363 $ 695 Current

portion of long-term debt 295 295 Accounts payable 938 1,310

Accrued taxes 139 72 Customer deposits 253 242 Derivative

liabilities 232 218 Regulatory liabilities 1,157 1,128 Other

current liabilities 856 967

Total

current liabilities 4,233 4,927

Long-term debt 11,243 10,883

Deferred income taxes and credits 7,699 7,480 Derivative

liabilities 1,136 1,100 Pensions and benefits 1,771 1,759 Asset

retirement obligations 2,597 2,764 Regulatory liabilities 5,920

5,676 Other deferred credits and other long-term liabilities 2,225

2,246

Total deferred credits and

other liabilities 21,348 21,025

Total liabilities 36,824 36,835

Commitments and contingencies

Redeemable noncontrolling

interest 4 6 Common stock, no par value (800,000,000 shares

authorized; 325,811,206 shares issued and outstanding at respective

dates) 2,491 2,484 Accumulated other comprehensive loss (54 ) (56 )

Retained earnings 9,002 8,940

Total

Edison International's common shareholders' equity 11,439

11,368 Noncontrolling interests –

preferred and preference stock of SCE 2,192

2,020

Total equity 13,631 13,388

Total liabilities and equity

$ 50,459 $ 50,229

Consolidated Statements of

Cash Flows Edison International

Three months ended March 31,

(in millions, unaudited) 2016

2015

Cash flows from operating activities: Net

income $ 296 $ 318 Less: Income from discontinued operations 1

— Income from continuing operations 295

318 Adjustments to reconcile to net cash provided by operating

activities: Depreciation, decommissioning and amortization 499 485

Allowance for equity during construction (22 ) (21 ) Deferred

income taxes and investment tax credits 35 72 Other 5 5 Nuclear

decommissioning trusts (106 ) 29 Changes in operating assets and

liabilities: Receivables 117 31 Inventory (1 ) (10 ) Accounts

payable (184 ) 63 Prepaid and accrued taxes 66 38 Other current

assets and liabilities (43 ) (229 ) Derivative assets and

liabilities, net 5 (10 ) Regulatory assets and liabilities, net 119

193 Other noncurrent assets and liabilities 68

—

Net cash provided by operating activities 853

964

Cash flows from financing

activities:

Long-term debt issued, net of discount and

issuance costs of $3 and $13 for respective periods

397 1,287 Long-term debt matured (40 ) (419 ) Preference stock

issued, net 294 — Preference stock redeemed (125 ) — Short-term

debt financing, net (332 ) (355 ) Dividends to noncontrolling

interests (35 ) (34 ) Dividends paid (156 ) (136 ) Other (46 )

(30 )

Net cash (used in) provided by financing

activities (43 ) 313

Cash flows from

investing activities: Capital expenditures (951 ) (1,268 )

Proceeds from sale of nuclear decommissioning trust investments 793

1,026 Purchases of nuclear decommissioning trust investments (687 )

(1,062 ) Other 11 10

Net cash used

in investing activities (834 ) (1,294 )

Net

decrease in cash and cash equivalents (24 ) (17 ) Cash and cash

equivalents at beginning of period 161 132

Cash and cash equivalents at end of period

$ 137 $ 115

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160502005941/en/

Edison InternationalMedia relations

contact:Charles Coleman, (626) 302-7982orInvestor relations

contact:Scott Cunningham, (626) 302-2540

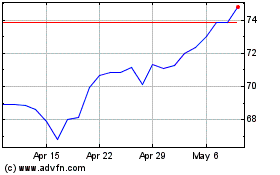

Edison (NYSE:EIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Edison (NYSE:EIX)

Historical Stock Chart

From Apr 2023 to Apr 2024