UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 25, 2015

El Paso Electric Company

(Exact name of registrant as specified in its charter)

|

| | |

Texas | 001-14206 | 74-0607870 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

Stanton Tower, 100 North Stanton, El Paso, Texas | | 79901 |

(Address of principal executive offices) | | (Zip Code) |

(915) 543-5711

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On February 25, 2015, the Company announced its financial results for the quarter ended December 31, 2014. A copy of the press release containing the announcement and a copy of the presentation at the Company's 4th Quarter 2014 Earnings Conference Call is included as Exhibit 99.01 and Exhibit 99.02 to this Current Report and is incorporated herein by reference. The Company does not intend for this exhibit to be incorporated by reference into future filings under the Securities Exchange Act of 1934.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

99.01 Earnings Press Release, dated February 25, 2015

99.02 Presentation at the 4th Quarter 2014 Earnings Conference Call

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

EL PASO ELECTRIC COMPANY

(Registrant)

By: /s/ NATHAN T. HIRSCHI

Name: Nathan T. Hirschi

Title: Senior Vice President - Chief Financial Officer

Dated: February 25, 2015

EXHIBIT INDEX

|

| | |

Exhibit Number | Description of Exhibit | |

99.01 | Earnings Press Release, dated February 25, 2015 | |

99.02 | Presentation at the 4th Quarter 2014 Earnings Conference Call | |

Exhibit 99.01 |

| | |

| | News Release |

For Immediate Release | |

Date: February 25, 2015 | | |

El Paso Electric Announces Fourth Quarter and Annual Financial Results

Overview

| |

• | For the fourth quarter of 2014, El Paso Electric Company ("EE" or the "Company") reported net income of $4.2 million, or $0.10 basic and diluted earnings per share. In the fourth quarter of 2013, EE reported net income of $1.2 million, or $0.03 basic and diluted earnings per share. |

| |

• | For the twelve months ended December 31, 2014, EE reported net income of $91.4 million, or $2.27 basic and diluted earnings per share. Net income for the twelve months ended December 31, 2013 was $88.6 million, or $2.20 basic and diluted earnings per share. |

“We closed 2014 with solid financial results as net income increased more than $3.0 million in the three months ended December 31, 2014 when compared to the same period last year,” said Tom Shockley, Chief Executive Officer. “Reflecting back on the year, we are pleased that we achieved critical milestones and the goals established at the outset of the year to include significant progress on the construction of the Montana Power Station and Eastside Operations Center, the appointment of Mary Kipp as President of the Company, reaching a new native system peak of 1,766 MW in June 2014, and raising $150 million in the debt market. Additionally, we continued to experience an increase in the number of customers served. Earlier this month, we began working out of the new operations center. We now focus on our key objectives for 2015. Units 1 and 2 of the new Montana Power Station are expected to be completed by March 31, 2015 and will serve our customers with safe, dependable, cost effective and environmental-friendly power for many years to come. Following the completion of the first two generation units, we will seek rate relief for the construction costs incurred. We are excited to be part of a dynamic and growing community and are working responsibly to meet the region's expanding energy needs with clean and reliable technology."

|

| | |

| Page 1 of 14 | |

| El Paso Electric Ÿ P.O.Box 982 Ÿ El Paso, Texas 79960 | |

Earnings Summary

The table and explanations below present the major factors affecting 2014 net income relative to 2013 net income:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Quarter Ended | | Twelve Months Ended |

| | | | Pre-Tax Effect | | After-Tax Net Income | | Basic EPS | | Pre-Tax

Effect | | After-Tax

Net Income | | Basic EPS |

December 31, 2013 | | | $ | 1,191 |

| | $ | 0.03 |

| | | | $ | 88,583 |

| | $ | 2.20 |

|

Changes in: | | | | | | | | | | | |

| Investment and interest income | 3,214 |

| | 2,583 |

| | 0.06 |

| | 6,600 |

| | 5,309 |

| | 0.13 |

|

| Allowance for funds used during construction | 2,896 |

| | 2,548 |

| | 0.06 |

| | 6,967 |

| | 6,157 |

| | 0.15 |

|

| Non-base revenue, net of energy expense | 2,610 |

| | 1,696 |

| | 0.04 |

| | 5,814 |

| | 3,779 |

| | 0.10 |

|

| Retail non-fuel base revenues | 1,518 |

| | 987 |

| | 0.02 |

| | (5,434 | ) | | (3,533 | ) | | (0.09 | ) |

| Income taxes | | | (3,254 | ) | | (0.08 | ) | | | | 15 |

| | — |

|

| Palo Verde operations and maintenance | (1,945 | ) | | (1,264 | ) | | (0.03 | ) | | (2,516 | ) | | (1,635 | ) | | (0.04 | ) |

| Taxes other than income taxes | (902 | ) | | (586 | ) | | (0.01 | ) | | (5,003 | ) | | (3,252 | ) | | (0.08 | ) |

| Depreciation and amortization expense | (726 | ) | | (471 | ) | | (0.01 | ) | | (3,716 | ) | | (2,415 | ) | | (0.06 | ) |

| Other | | | 811 |

| | 0.02 |

| | | | (1,580 | ) | | (0.04 | ) |

December 31, 2014 | | | $ | 4,241 |

| | $ | 0.10 |

| | | | $ | 91,428 |

| | $ | 2.27 |

|

Fourth Quarter 2014

Income for the quarter ended December 31, 2014, when compared to the same period last year, was positively affected by:

| |

• | Increased investment and interest income primarily due to increased gains on the sales of equity investments in our Palo Verde decommissioning trust funds compared to the same period last year. |

| |

• | Increased allowance for funds used during construction ("AFUDC") due to higher balances of construction work in progress, including the Montana Power Station and the Eastside Operations Center. |

| |

• | Increased non-base revenue net of energy expense primarily due to a Texas energy efficiency bonus of $2.0 million awarded by the Public Utility Commission of Texas in PUCT Docket No. 42449 in November 2014 for our 2013 energy efficiency program results, and an increase in deregulated Palo Verde Unit 3 revenues related to an increase in generation. |

| |

• | Increased retail non-fuel base revenues primarily due to increased revenues from our residential and small commercial and industrial customers. KWh sales to residential and small commercial and industrial customers increased 2.2% and 2.3%, respectively and reflect customer growth and increased cooling degree days in October 2014 (at the end of the summer cooling season) compared to October 2013. |

Income for the quarter ended December 31, 2014, when compared to the same period last year, was negatively affected by:

| |

• | Income taxes, not reflected in other income items above, increased primarily due to the legislative timing of the bonus depreciation extension in 2014 associated with the Tax Increase Prevention Act of 2014 which was signed into law on December 19, 2014, and benefits recorded in the fourth quarter of 2013 related to positive developments in state income tax audits and settlements with no comparable level of benefits in the current period. |

|

| | |

| Page 2 of 14 | |

| El Paso Electric Ÿ P.O.Box 982 Ÿ El Paso, Texas 79960 | |

| |

• | Increased Palo Verde operation and maintenance expense primarily due to increased payroll including incentive compensation. |

Other items impacting earnings included increased taxes other than income taxes primarily due to a favorable adjustment to sales and use tax in 2013 with no comparable adjustment in 2014, increased payroll taxes, and increased revenue related taxes. Also impacting earnings was an increase in depreciation and amortization expense primarily due to an increase in depreciable plant balances.

Year to Date

Income for the twelve months ended December 31, 2014, when compared to the same period last year, was positively affected by:

| |

• | Increased AFUDC due to higher balances of construction work in progress, including the Montana Power Station and Eastside Operations Center. |

| |

• | Increased investment and interest income primarily due to increased gains on the sales of equity investments in our Palo Verde decommissioning trust funds compared to the same period last year. |

| |

• | Increased non-base revenues net of energy expenses due to (i) recognition of $2.2 million in Palo Verde performance rewards associated with the 2009 to 2012 performance periods, net of disallowed fuel and purchased power costs related to the resolution of the Texas fuel reconciliation proceeding designated as PUCT Docket No. 41852, (ii) a $2.0 million Texas Energy Efficiency bonus awarded in the fourth quarter of 2014, and (iii) an increase of $3.6 million in deregulated Palo Verde Unit 3 revenues. The increase was partially offset by a decrease of $3.3 million in transmission wheeling revenues. |

Income for the twelve months ended December 31, 2014, when compared to the same period last year, was negatively affected by:

| |

• | Decreased retail non-fuel base revenues primarily due to (i) a $3.0 million reduction in sales to public authorities reflecting increased use of an interruptible rate at a military installation in our service territory as well as other energy saving programs at military installations; (ii) a $2.3 million decrease in sales to residential customers primarily due to milder weather; and (iii) a $1.0 million decrease in sales to large commercial and industrial customers. |

| |

• | Increased taxes other than income taxes primarily due to higher property tax values and assessment rates. Additionally, in the first quarter of 2014, the Arizona tax district in which Palo Verde operates adjusted its 2013 property tax rate resulting in an additional charge of $1.3 million. |

| |

• | Increased depreciation and amortization due to increased depreciable plant balances including Rio Grande Unit 9, which began commercial operation on May 13, 2013. |

| |

• | Increased Palo Verde operations and maintenance expense primarily due to increased payroll including incentive compensation. |

Retail Non-fuel Base Revenues

Retail non-fuel base revenues increased $1.5 million, pre-tax, or 1.3% in the fourth quarter of 2014 compared to the same period in 2013. This increase reflects a $1.2 million increase from sales to residential customers. KWh sales to residential customers increased by 2.2% reflecting warmer weather in October 2014 at the end of the summer cooling season and a 1.2% increase in the average number of residential customers served. Cooling degree days increased 70.0% for the fourth quarter of 2014, compared to the same quarter last year, and were 16.2% above the 10-year average. Heating degree days decreased 14.8% for the fourth quarter of 2014, compared to the same period last year, and were 7.4% below the 10-year average. Retail non-fuel base revenues also increased due to a $0.6 million increase in non-fuel base revenues from sales to small commercial and industrial customers. KWh sales to small commercial and industrial customers in the fourth quarter of 2014 increased

|

| | |

| Page 3 of 14 | |

| El Paso Electric Ÿ P.O.Box 982 Ÿ El Paso, Texas 79960 | |

2.3%, compared to the same quarter in 2013, and the average number of small commercial and industrial customers served increased 1.9%. KWh sales to public authorities decreased 4.4% primarily due to energy savings from energy conservation and efficiency programs and use of solar distributed generation at military installations. Non-fuel base revenues and kWh sales are provided by customer class on page 10 of this release.

For the twelve months ended December 31, 2014, retail non-fuel base revenues decreased $5.4 million, pre-tax, or 1.0%, compared to the same period in 2013. This decrease reflects a $3.0 million decrease from sales to public authorities primarily due to an increased use of an interruptible rate by a military installation customer, as well as other energy savings from energy conservation and efficiency programs and use of solar distributed generation at military installations. Non-fuel base revenues from sales to residential customers decreased $2.3 million and reflects milder weather in 2014, primarily in the first quarter, which impacted sales to not only residential customers, but also small commercial and industrial customers, and to a lesser extent public authority customers. Heating degree days decreased 21.7% when compared to the same period last year, and were 12.9% below the 10-year average. Cooling degree days were relatively consistent with both the same period last year and the 10-year average. KWh sales to residential customers decreased 1.4% while the average number of residential customers served increased 1.3%. Non-fuel base revenues from sales to small commercial and industrial customers increased slightly, when compared to the same period in 2013, due to a 2.0% increase in the average number of customers served partially offset by milder weather. KWh sales to large commercial and industrial customers decreased 2.8%, and non-fuel base revenues decreased 2.5% as several customers ceased operations. Non-fuel base revenues and kWh sales are provided by customer class on page 12 of this release.

Capital and Liquidity

In December 2014, we issued $150 million of 5.0% Senior Notes, due to mature on December 1, 2044, to fund construction expenditures and to repay the outstanding balance of our revolving credit facility (the "RCF") used for working capital and general corporate purposes. We continue to maintain a strong capital structure in which common stock equity represented 45.8% of our capitalization (common stock equity, long-term debt, current maturities of long-term debt, and short-term borrowings under the RCF). At December 31, 2014, we had a balance of $40.5 million in cash and cash equivalents. Based on current projections, we believe that we will have adequate liquidity through our current cash balances, cash from operations, and available borrowings under the RCF to meet all of our anticipated cash requirements for the next 12 months including the $15 million maturity of our Series A 3.67% Senior Notes (due August 2015) . We may also issue long-term debt in the capital markets to finance capital requirements in late 2015 or early 2016.

Cash flows from operations for the twelve months ended December 31, 2014 were $243.3 million compared to $247.5 million in the corresponding period in 2013. A component of cash flows from operations is the change in net over-collection and under-collection of fuel revenues. The difference between fuel revenues collected and fuel expense incurred is deferred to be either refunded (over-recoveries) or surcharged (under-recoveries) to customers in the future. During the twelve months ended December 31, 2014, the Company had a fuel under-recovery of $3.1 million compared to an under-recovery of fuel costs of $10.8 million during the twelve months ended December 31, 2013. At December 31, 2014, we had a net fuel under-recovery balance of $9.3 million, including an under-recovery balance of $10.3 million for the Texas and FERC jurisdictions and an over-recovery balance of $0.9 million in New Mexico.

During the twelve months ended December 31, 2014, our primary capital requirements were for the construction and purchase of electric utility plant, payment of common stock dividends, and purchases of nuclear fuel. Capital requirements for the new electric plant were $277.1 million for the twelve months ended December 31, 2014 and $237.4 million for the twelve months ended December 31, 2013. Capital requirements for purchases of nuclear fuel were $37.9 million for the twelve months ended December 31, 2014 and $30.5 million for the twelve months ended December 31, 2013.

|

| | |

| Page 4 of 14 | |

| El Paso Electric Ÿ P.O.Box 982 Ÿ El Paso, Texas 79960 | |

On January 29, 2015, the Board of Directors declared a quarterly cash dividend of $0.28 per share payable on March 31, 2015 to shareholders of record on March 16, 2015. On December 30, 2014, we paid a quarterly cash dividend of $0.28 per share, or $11.3 million, to shareholders of record on December 12, 2014. We paid a total of $44.6 million in cash dividends during the twelve months ended December 31, 2014. We expect to continue paying quarterly cash dividends during 2015 and we expect to review the dividend policy in the second quarter of 2015.

No shares of common stock were repurchased during the twelve months ended December 31, 2014. As of December 31, 2014, a total of 393,816 shares remain available for repurchase under the currently authorized stock repurchase program. The Company may repurchase shares in the open market from time to time.

We maintain the RCF for working capital and general corporate purposes and financing of nuclear fuel through the Rio Grande Resources Trust (the "RGRT"). The RGRT, the trust through which we finance our portion of nuclear fuel for Palo Verde, is consolidated in the Company's financial statements. The RCF has a term ending January 14, 2019. The aggregate unsecured borrowing available under the RCF is $300 million. We may increase the RCF by up to $100 million (up to a total of $400 million) during the term of the agreement, upon the satisfaction of certain conditions, more fully set forth in the agreement, including obtaining commitments from lenders or third party financial institutions. The amounts we borrow under the RCF may be used for working capital and general corporate purposes. The total amount borrowed for nuclear fuel by the RGRT was $124.5 million at December 31, 2014, of which $14.5 million had been borrowed under the RCF, and $110 million was borrowed through senior notes. Borrowings by the RGRT for nuclear fuel were $124.4 million as of December 31, 2013, of which $14.4 million had been borrowed under the RCF and $110 million was borrowed through senior notes. Interest costs on borrowings to finance nuclear fuel are accumulated by the RGRT and charged to us as fuel is consumed and recovered through fuel recovery charges. No borrowings were outstanding at December 31, 2014 or December 31, 2013 under the RCF for working capital and general corporate purposes.

2015 Earnings Guidance

We are providing earnings guidance for 2015 within a range of $1.75 to $2.15 per basic share.

Conference Call

A conference call to discuss fourth quarter 2014 financial results is scheduled for 10:30 A.M. Eastern Time, on February 25, 2015. The dial-in number is 888-510-1786 with a conference ID number of 8983997. The international dial-in number is 719-325-2435. The conference leader will be Lisa Budtke, Assistant Treasurer. A replay will run through March 11, 2015 with a dial-in number of 888-203-1112 and a conference ID number of 8983997. The replay international dial-in number is 719-457-0820. The conference call and presentation slides will be webcast live on the Company's website found at http://www.epelectric.com. A replay of the webcast will be available shortly after the call.

Safe Harbor

This news release includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: (i) increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased costs to customers or to recover previously incurred fuel costs in rates; (ii) recovery of capital investments and operating costs through rates in Texas and New Mexico; (iii) uncertainties and instability in the general economy and the resulting impact on EE's sales and profitability; (iv) changes in customers' demand for electricity as a result of

|

| | |

| Page 5 of 14 | |

| El Paso Electric Ÿ P.O.Box 982 Ÿ El Paso, Texas 79960 | |

energy efficiency initiatives and emerging competing services and technologies; (v) unanticipated increased costs associated with scheduled and unscheduled outages of generating plant; (vi) the size of our construction program and our ability to complete construction on budget; (vii) potential delays in our construction schedule due to legal challenges or other reasons; (viii) costs at Palo Verde; (ix) deregulation and competition in the electric utility industry; (x) possible increased costs of compliance with environmental or other laws, regulations and policies; (xi) possible income tax and interest payments as a result of audit adjustments proposed by the IRS or state taxing authorities; (xii) uncertainties and instability in the financial markets and the resulting impact on EE's ability to access the capital and credit markets; (xiii) possible physical or cyber attacks, intrusions or other catastrophic events; and (xiv) other factors detailed by EE in its public filings with the Securities and Exchange Commission. EE's filings are available from the Securities and Exchange Commission or may be obtained through EE's website, http://www.epelectric.com. Any such forward-looking statement is qualified by reference to these risks and factors. EE cautions that these risks and factors are not exclusive. EE does not undertake to update any forward-looking statement that may be made from time to time by or on behalf of EE except as required by law.

|

| |

Media Contacts | |

Eddie Gutierrez | |

915.543.5763 | |

eduardo.gutierrez@epelectric.com | |

| |

El Paso Electric Investor Relations | |

Lisa Budtke | |

915.543.5947 | |

lisa.budtke@epelectric.com | |

|

| | |

| Page 6 of 14 | |

| El Paso Electric Ÿ P.O.Box 982 Ÿ El Paso, Texas 79960 | |

|

| | | | | | | | | | | | | |

El Paso Electric Company |

Statements of Operations |

Quarter Ended December 31, 2014 and 2013 |

(In thousands except for per share data) |

(Unaudited) |

| | | | | | | |

| | 2014 | | 2013 | | Variance | |

| | | | | | | |

Operating revenues, net of energy expenses: | | | | | | |

| Base revenues | $ | 114,728 |

| | $ | 113,137 |

| | $ | 1,591 |

| (a) |

| Deregulated Palo Verde Unit 3 revenues | 3,109 |

| | 2,163 |

| | 946 |

|

|

| Other | 8,812 |

| | 7,148 |

| | 1,664 |

|

|

Operating Revenues Net of Energy Expenses | 126,649 |

| | 122,448 |

| | 4,201 |

|

|

| | | | | | | |

Other operating expenses: | | | | | | |

| Other operations and maintenance | 51,722 |

| | 53,915 |

| | (2,193 | ) |

|

| Palo Verde operations and maintenance | 31,183 |

| | 29,238 |

| | 1,945 |

|

|

Taxes other than income taxes | 13,867 |

| | 12,965 |

| | 902 |

|

|

Other income | 4,867 |

| | 1,783 |

| | 3,084 |

|

|

Earnings Before Interest, Taxes, Depreciation and Amortization | 34,744 |

| | 28,113 |

| | 6,631 |

| (b) |

| | | | | | | |

Depreciation and amortization | 21,006 |

| | 20,280 |

| | 726 |

|

|

Interest on long-term debt | 15,225 |

| | 14,806 |

| | 419 |

|

|

AFUDC and capitalized interest | 8,269 |

| | 5,466 |

| | 2,803 |

|

|

Other interest expense | 351 |

| | (25 | ) | | 376 |

|

|

Income (Loss) Before Income Taxes | 6,431 |

| | (1,482 | ) | | 7,913 |

|

|

| | | | | | | |

Income tax expense (benefit) | 2,190 |

| | (2,673 | ) | | 4,863 |

|

|

| | | | | | | |

Net Income | $ | 4,241 |

| | $ | 1,191 |

| | $ | 3,050 |

|

|

| | | | | | | |

Basic Earnings per Share | $ | 0.10 |

| | $ | 0.03 |

| | $ | 0.07 |

|

|

| | | | | | | |

Diluted Earnings per Share | $ | 0.10 |

| | $ | 0.03 |

| | $ | 0.07 |

|

|

| | | | | | | |

Dividends declared per share of common stock | $ | 0.280 |

| | $ | 0.265 |

| | $ | 0.015 |

|

|

| | | | | | | |

Weighted average number of shares outstanding | 40,220 |

| | 40,135 |

| | 85 |

|

|

| | | | | | | |

Weighted average number of shares and dilutive | | | | | | |

| potential shares outstanding | 40,220 |

| | 40,135 |

| | 85 |

|

|

| | | | | | | |

(a) | Base revenues exclude fuel recovered through New Mexico base rates of $16.0 million and $16.1 million, respectively. |

(b) | Earnings before interest, taxes, depreciation and amortization ("EBITDA") is a non-generally accepted accounting principles ("GAAP") financial measure and is not a substitute for net income or other measures of financial performance in accordance with GAAP. |

|

| | | | | | | | | | | | | |

El Paso Electric Company |

Statements of Operations |

Twelve Months Ended December 31, 2014 and 2013 |

(In thousands except for per share data) |

(Unaudited) |

| | | | | | | |

| | 2014 | | 2013 | | Variance | |

| | | | | | | |

Operating revenues, net of energy expenses: | | | | | | |

| Base revenues | $ | 553,341 |

| | $ | 558,670 |

| | $ | (5,329 | ) | (a) |

| Deregulated Palo Verde Unit 3 revenues | 15,012 |

| | 11,423 |

| | 3,589 |

| |

| Palo Verde performance rewards, net | 2,220 |

| | — |

| | 2,220 |

| |

| Other | 31,143 |

| | 31,138 |

| | 5 |

| |

Operating Revenues Net of Energy Expenses | 601,716 |

| | 601,231 |

| | 485 |

| |

| | | | | | | |

Other operating expenses: | | | | | | |

| Other operations and maintenance | 205,237 |

| | 201,515 |

| | 3,722 |

| |

| Palo Verde operations and maintenance | 99,224 |

| | 96,708 |

| | 2,516 |

| |

Taxes other than income taxes | 62,750 |

| | 57,747 |

| | 5,003 |

| |

Other income | 13,509 |

| | 4,307 |

| | 9,202 |

| |

Earnings Before Interest, Taxes, Depreciation and Amortization | 248,014 |

| | 249,568 |

| | (1,554 | ) | (b) |

| | | | | | | |

Depreciation and amortization | 83,342 |

| | 79,626 |

| | 3,716 |

| |

Interest on long-term debt | 59,028 |

| | 58,635 |

| | 393 |

| |

AFUDC and capitalized interest | 28,122 |

| | 21,362 |

| | 6,760 |

| |

Other interest expense | 1,250 |

| | 431 |

| | 819 |

| |

Income Before Income Taxes | 132,516 |

| | 132,238 |

| | 278 |

| |

| | | | | | | |

Income tax expense | 41,088 |

| | 43,655 |

| | (2,567 | ) | |

| | | | | | | |

Net Income | $ | 91,428 |

| | $ | 88,583 |

| | $ | 2,845 |

| |

| | | | | | | |

Basic Earnings per Share | $ | 2.27 |

| | $ | 2.20 |

| | $ | 0.07 |

| |

| | | | | | | |

Diluted Earnings per Share | $ | 2.27 |

| | $ | 2.20 |

| | $ | 0.07 |

| |

| | | | | | | |

Dividends declared per share of common stock | $ | 1.105 |

| | $ | 1.045 |

| | $ | 0.060 |

| |

| | | | | | | |

Weighted average number of shares outstanding | 40,191 |

| | 40,115 |

| | 76 |

| |

| | | | | | | |

Weighted average number of shares and dilutive | | | | | | |

| potential shares outstanding | 40,212 |

| | 40,127 |

| | 85 |

| |

| | | | | | | |

(a) | Base revenues exclude fuel recovered through New Mexico base rates of $71.6 million and $73.3 million, respectively. |

(b) | EBITDA is a non-GAAP financial measure and is not a substitute for net income or other measures of financial performance in accordance with GAAP. |

|

| | | | | | | | | | | |

El Paso Electric Company |

Cash Flow Summary |

Twelve Months Ended December 31, 2014 and 2013 |

(In thousands and Unaudited) |

| | | | | | | |

| | | | 2014 | | 2013 | |

Cash flows from operating activities: | | | | |

| Net income | $ | 91,428 |

| | $ | 88,583 |

| |

| Adjustments to reconcile net income to net cash provided by operations: | | | | |

| | Depreciation and amortization of electric plant in service | 83,342 |

| | 79,626 |

| |

| | Amortization of nuclear fuel

| 43,864 |

| | 42,537 |

| |

| | Deferred income taxes, net | 39,129 |

| | 44,678 |

| |

| | Gain on sale of decommissioning trust funds | (7,350 | ) | | (553 | ) | |

| | Other | 1,533 |

| | 6,176 |

| |

| Change in: | | | | |

| | Accounts receivable | (5,815 | ) | | (2,450 | ) | |

| | Net undercollection of fuel revenues | (3,121 | ) | | (10,843 | ) | |

| | Accounts payable | 9,684 |

| | 8,180 |

| |

| | Other | (9,354 | ) | | (8,459 | ) | |

| | | Net cash provided by operating activities | 243,340 |

| | 247,475 |

| |

| | | | | | | |

Cash flows from investing activities: | | | | |

| Cash additions to utility property, plant and equipment | (277,078 | ) | | (237,411 | ) | |

| Cash additions to nuclear fuel | (37,877 | ) | | (30,535 | ) | |

| Decommissioning trust funds | (9,364 | ) | | (9,343 | ) | |

| Other | (6,873 | ) | | (5,475 | ) | |

| | | Net cash used for investing activities | (331,192 | ) | | (282,764 | ) | |

| | | | | | | |

Cash flows from financing activities: | | | | |

| Dividends paid | (44,556 | ) | | (42,049 | ) | |

| Borrowings under the revolving credit facility, net | 180 |

| | (7,803 | ) | |

| Proceeds from issuance of long-term senior notes | 149,468 |

| | — |

| |

| Other | (2,328 | ) | | (324 | ) | |

| | | Net cash provided by (used for) financing activities | 102,764 |

| | (50,176 | ) | |

| | | | | | | |

Net increase (decrease) in cash and cash equivalents | 14,912 |

| | (85,465 | ) | |

| | | | | | | |

Cash and cash equivalents at beginning of period | 25,592 |

| | 111,057 |

| |

| | | | | | | |

Cash and cash equivalents at end of period | $ | 40,504 |

| | $ | 25,592 |

| |

| | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | |

El Paso Electric Company |

Quarter Ended December 31, 2014 and 2013 |

Sales and Revenues Statistics |

| | | | | | | | | | | |

| | | | | | | | | | Increase (Decrease) | |

| | | | | | 2014 | | 2013 | | Amount | | Percentage | |

kWh sales (in thousands): | | | | | | | | |

| Retail: | | | | | | | | |

| | Residential | 552,977 |

| | 540,826 |

| | 12,151 |

| | 2.2 | % | |

| | Commercial and industrial, small | 548,369 |

| | 535,818 |

| | 12,551 |

| | 2.3 | % | |

| | Commercial and industrial, large | 269,584 |

| | 282,280 |

| | (12,696 | ) | | (4.5 | )% | |

| | Public authorities | 360,381 |

| | 376,806 |

| | (16,425 | ) | | (4.4 | )% | |

| | | Total retail sales | 1,731,311 |

| | 1,735,730 |

| | (4,419 | ) | | (0.3 | )% | |

| Wholesale: | | | | | | | | |

| | Sales for resale | 9,798 |

| | 8,919 |

| | 879 |

| | 9.9 | % | |

| | Off-system sales | 606,749 |

| | 580,761 |

| | 25,988 |

| | 4.5 | % | |

| | | Total wholesale sales | 616,547 |

| | 589,680 |

| | 26,867 |

| | 4.6 | % | |

| | | | Total kWh sales | 2,347,858 |

| | 2,325,410 |

| | 22,448 |

| | 1.0 | % | |

Operating revenues (in thousands): | | | | | | | | |

| Non-fuel base revenues: | | | | | | | | |

| | Retail: | | | | | | | | |

| | | Residential | $ | 47,653 |

| | $ | 46,409 |

| | $ | 1,244 |

| | 2.7 | % | |

| | | Commercial and industrial, small | 38,449 |

| | 37,805 |

| | 644 |

| | 1.7 | % | |

| | | Commercial and industrial, large | 9,019 |

| | 9,240 |

| | (221 | ) | | (2.4 | )% | |

| | | Public authorities | 19,229 |

| | 19,378 |

| | (149 | ) | | (0.8 | )% | |

| | | | Total retail non-fuel base revenues | 114,350 |

| | 112,832 |

| | 1,518 |

| | 1.3 | % | |

| | Wholesale: | | | | | | | | |

| | | Sales for resale | 378 |

| | 305 |

| | 73 |

| | 23.9 | % | |

| | | | Total non-fuel base revenues | 114,728 |

| | 113,137 |

| | 1,591 |

| | 1.4 | % | |

| Fuel revenues: | | | | | | | | |

| | Recovered from customers during the period | 34,945 |

| | 31,424 |

| | 3,521 |

| | 11.2 | % | |

| | Under collection of fuel | 1,887 |

| | 2,480 |

| | (593 | ) | | (23.9 | )% | |

| | New Mexico fuel in base rates | 15,971 |

| | 16,082 |

| | (111 | ) | | (0.7 | )% | |

| | | Total fuel revenues (a) | 52,803 |

| | 49,986 |

| | 2,817 |

| | 5.6 | % | |

| Off-system sales: | | | | | | | | |

| | Fuel cost | 13,246 |

| | 16,862 |

| | (3,616 | ) | | (21.4 | )% | |

| | Shared margins | 6,602 |

| | 2,762 |

| | 3,840 |

| | — | % | |

| | Retained margins | 418 |

| | 322 |

| | 96 |

| | 29.8 | % | |

| | | Total off-system sales | 20,266 |

| | 19,946 |

| | 320 |

| | 1.6 | % | |

| Other (b) (c) | 8,766 |

| | 7,228 |

| | 1,538 |

| | 21.3 | % | |

| | | Total operating revenues | $ | 196,563 |

| | $ | 190,297 |

| | $ | 6,266 |

| | 3.3 | % | |

| | | | | | | | | | | | | |

(a) | Includes deregulated Palo Verde Unit 3 revenues for the New Mexico jurisdiction of $3.1 million and $2.2 million, respectively. |

(b) | Includes energy efficiency bonuses of $2.0 million and $0.3 million, respectively. |

(c) | Represents revenues with no related kWh sales. |

|

| | | | | | | | | | | | | |

El Paso Electric Company |

Quarter Ended December 31, 2014 and 2013 |

Other Statistical Data |

| | | | | | | | | |

| | | | | Increase (Decrease) |

| | | 2014 | | 2013 | | Amount | | Percentage |

| | | | | | | | | |

Average number of retail customers: (a) | | | | | | | |

| Residential | 353,657 |

| | 349,494 |

| | 4,163 |

| | 1.2 | % |

| Commercial and industrial, small | 39,969 |

| | 39,232 |

| | 737 |

| | 1.9 | % |

| Commercial and industrial, large | 49 |

| | 50 |

| | (1 | ) | | (2.0 | )% |

| Public authorities | 5,090 |

| | 5,046 |

| | 44 |

| | 0.9 | % |

| | Total | 398,765 |

| | 393,822 |

| | 4,943 |

| | 1.3 | % |

| | | | | | | | | |

Number of retail customers (end of period): (a) | | | | | | | |

| Residential | 353,885 |

| | 349,629 |

| | 4,256 |

| | 1.2 | % |

| Commercial and industrial, small | 40,038 |

| | 39,164 |

| | 874 |

| | 2.2 | % |

| Commercial and industrial, large | 49 |

| | 50 |

| | (1 | ) | | (2.0 | )% |

| Public authorities | 5,017 |

| | 5,043 |

| | (26 | ) | | (0.5 | )% |

| | Total | 398,989 |

| | 393,886 |

| | 5,103 |

| | 1.3 | % |

| | | | | | | | | |

Weather statistics: (b) | | | | | 10-Yr Average | | |

| Heating degree days | 858 |

| | 1,007 |

| | 927 |

| | |

| Cooling degree days | 136 |

| | 80 |

| | 117 |

| | |

| | | | | | | | | |

Generation and purchased power (kWh, in thousands): | | | | | Increase (Decrease) |

| | | 2014 | | 2013 | | Amount | | Percentage |

| | | | | | | | | |

| Palo Verde | 1,180,602 |

| | 1,044,033 |

| | 136,569 |

| | 13.1 | % |

| Four Corners | 159,363 |

| | 149,173 |

| | 10,190 |

| | 6.8 | % |

| Gas plants | 889,502 |

| | 840,477 |

| | 49,025 |

| | 5.8 | % |

| | Total generation | 2,229,467 |

| | 2,033,683 |

| | 195,784 |

| | 9.6 | % |

| Purchased power: | | | | | | | |

| | Photovoltaic | 53,941 |

| | 23,828 |

| | 30,113 |

| | 126.4 | % |

| | Other | 188,194 |

| | 380,720 |

| | (192,526 | ) | | (50.6 | )% |

| | Total purchased power | 242,135 |

| | 404,548 |

| | (162,413 | ) | | (40.1 | )% |

| | Total available energy | 2,471,602 |

| | 2,438,231 |

| | 33,371 |

| | 1.4 | % |

| Line losses and Company use | 123,744 |

| | 112,821 |

| | 10,923 |

| | 9.7 | % |

| | Total kWh sold | 2,347,858 |

| | 2,325,410 |

| | 22,448 |

| | 1.0 | % |

| | | | | | | | | |

|

| | | | | | | | | | | | |

| Palo Verde capacity factor | 85.9 | % | | 76.0 | % | | 9.9 | % | | |

| |

(a) | The number of retail customers is based on the number of service locations. |

| | | | | | | | | |

(b) | A degree day is recorded for each degree that the average outdoor temperature varies from a standard of 65 degrees Fahrenheit. |

|

| | | | | | | | | | | | | | | | | | | | |

El Paso Electric Company |

Twelve Months Ended December 31, 2014 and 2013 |

Sales and Revenues Statistics |

| | | | | | | | | | | | | |

| | | | | | | | | | Increase (Decrease) | |

| | | | | | 2014 | | 2013 | | Amount | | Percentage | |

kWh sales (in thousands): | | | | | | | | |

| Retail: | | | | | | | | |

| | Residential | 2,640,535 |

| | 2,679,262 |

| | (38,727 | ) | | (1.4 | )% | |

| | Commercial and industrial, small | 2,357,846 |

| | 2,349,148 |

| | 8,698 |

| | 0.4 | % | |

| | Commercial and industrial, large | 1,064,475 |

| | 1,095,379 |

| | (30,904 | ) | | (2.8 | )% | |

| | Public authorities | 1,562,784 |

| | 1,622,607 |

| | (59,823 | ) | | (3.7 | )% | |

| | | Total retail sales | 7,625,640 |

| | 7,746,396 |

| | (120,756 | ) | | (1.6 | )% | |

| Wholesale: | | | | | | | | |

| | Sales for resale | 61,729 |

| | 61,232 |

| | 497 |

| | 0.8 | % | |

| | Off-system sales | 2,609,769 |

| | 2,472,622 |

| | 137,147 |

| | 5.5 | % | |

| | | Total wholesale sales | 2,671,498 |

| | 2,533,854 |

| | 137,644 |

| | 5.4 | % | |

| | | | Total kWh sales | 10,297,138 |

| | 10,280,250 |

| | 16,888 |

| | 0.2 | % | |

Operating revenues (in thousands): | | | | | | | | |

| Non-fuel base revenues: | | | | | | | | |

| | Retail: | | | | | | | | |

| | | Residential | $ | 234,371 |

| | $ | 236,651 |

| | $ | (2,280 | ) | | (1.0 | )% | |

| | | Commercial and industrial, small | 185,388 |

| | 184,568 |

| | 820 |

| | 0.4 | % | |

| | | Commercial and industrial, large | 39,239 |

| | 40,235 |

| | (996 | ) | | (2.5 | )% | |

| | | Public authorities | 92,066 |

| | 95,044 |

| | (2,978 | ) | | (3.1 | )% | |

| | | | Total retail non-fuel base revenues | 551,064 |

| | 556,498 |

| | (5,434 | ) | | (1.0 | )% | |

| | Wholesale: | | | | | | | | |

| | | Sales for resale | 2,277 |

| | 2,172 |

| | 105 |

| | 4.8 | % | |

| | | | Total non-fuel base revenues | 553,341 |

| | 558,670 |

| | (5,329 | ) | | (1.0 | )% | |

| | | | | | | | | | | | | |

| Fuel revenues: | | | | | | | | |

| | Recovered from customers during the period | 161,052 |

| | 133,481 |

| | 27,571 |

| | 20.7 | % | |

| | Under collection of fuel (a) | 3,110 |

| | 10,849 |

| | (7,739 | ) | | (71.3 | )% | |

| | New Mexico fuel in base rates | 71,614 |

| | 73,295 |

| | (1,681 | ) | | (2.3 | )% | |

| | | Total fuel revenues (b) | 235,776 |

| | 217,625 |

| | 18,151 |

| | 8.3 | % | |

| | | | | | | | | | | | | |

| Off-system sales: | | | | | | | | |

| | Fuel cost | 74,716 |

| | 68,241 |

| | 6,475 |

| | 9.5 | % | |

| | Shared margins | 21,117 |

| | 13,016 |

| | 8,101 |

| | 62.2 | % | |

| | Retained margins | 2,147 |

| | 1,549 |

| | 598 |

| | 38.6 | % | |

| | | Total off-system sales | 97,980 |

| | 82,806 |

| | 15,174 |

| | 18.3 | % | |

| Other (c) (d) | 30,428 |

| | 31,261 |

| | (833 | ) | | (2.7 | )% | |

| | | Total operating revenues | $ | 917,525 |

| | $ | 890,362 |

| | $ | 27,163 |

| | 3.1 | % | |

| | | | | | | | | | | | | |

(a) | 2014 includes a Department of Energy refund related to spent fuel storage of $8.3 million offset in part by $2.2 million related to Palo Verde performance rewards, net. |

(b) | Includes deregulated Palo Verde Unit 3 revenues for the New Mexico jurisdiction of $15.0 million and $11.4 million, respectively. |

(c) | Includes energy efficiency bonuses of $2.0 million and $0.5 million, respectively. |

(d) | Represents revenues with no related kWh sales. |

|

| | | | | | | | | | | | | |

El Paso Electric Company |

Twelve Months Ended December 31, 2014 and 2013 |

Other Statistical Data |

| | | | | | | |

| | | | | Increase (Decrease) |

| | | 2014 | | 2013 | | Amount | | Percentage |

| | | | | | | | | |

Average number of retail customers: (a) | | | | | | | |

| Residential | 352,277 |

| | 347,891 |

| | 4,386 |

| | 1.3 | % |

| Commercial and industrial, small | 39,600 |

| | 38,836 |

| | 764 |

| | 2.0 | % |

| Commercial and industrial, large | 49 |

| | 50 |

| | (1 | ) | | (2.0 | )% |

| Public authorities | 5,088 |

| | 4,997 |

| | 91 |

| | 1.8 | % |

| | Total | 397,014 |

| | 391,774 |

| | 5,240 |

| | 1.3 | % |

| | | | | | | | | |

Number of retail customers (end of period): (a) | | | | | | | |

| Residential | 353,885 |

| | 349,629 |

| | 4,256 |

| | 1.2 | % |

| Commercial and industrial, small | 40,038 |

| | 39,164 |

| | 874 |

| | 2.2 | % |

| Commercial and industrial, large | 49 |

| | 50 |

| | (1 | ) | | (2.0 | )% |

| Public authorities | 5,017 |

| | 5,043 |

| | (26 | ) | | (0.5 | )% |

| | Total | 398,989 |

| | 393,886 |

| | 5,103 |

| | 1.3 | % |

| | | | | | | | | |

Weather statistics: (b) | | | | | 10-Yr Average | | |

| Heating degree days | 1,900 |

| | 2,426 |

| | 2,182 |

| | |

| Cooling degree days | 2,671 |

| | 2,695 |

| | 2,667 |

| | |

| | | | | | | | | |

Generation and purchased power (kWh, in thousands): | | | | | Increase (Decrease) |

| | | 2014 | | 2013 | | Amount | | Percentage |

| | | | | | | | | |

| Palo Verde | 5,106,668 |

| | 4,966,233 |

| | 140,435 |

| | 2.8 | % |

| Four Corners | 596,252 |

| | 635,717 |

| | (39,465 | ) | | (6.2 | )% |

| Gas plants | 3,774,209 |

| | 3,686,823 |

| | 87,386 |

| | 2.4 | % |

| | Total generation | 9,477,129 |

| | 9,288,773 |

| | 188,356 |

| | 2.0 | % |

| Purchased power: | | | | | | | |

| Photovoltaic | 227,979 |

| | 120,926 |

| | 107,053 |

| | 88.5 | % |

| Other | 1,162,511 |

| | 1,427,004 |

| | (264,493 | ) | | (18.5 | )% |

| | Total purchased power | 1,390,490 |

| | 1,547,930 |

| | (157,440 | ) | | (10.2 | )% |

| | Total available energy | 10,867,619 |

| | 10,836,703 |

| | 30,916 |

| | 0.3 | % |

| Line losses and Company use | 570,481 |

| | 556,453 |

| | 14,028 |

| | 2.5 | % |

| Total kWh sold | 10,297,138 |

| | 10,280,250 |

| | 16,888 |

| | 0.2 | % |

|

| | | | | | | | | | | | |

| Palo Verde capacity factor | 93.7 | % | | 91.1 | % | | 2.6 | % | | |

| | | | | | | | | |

(a) | The number of retail customers presented is based on the number of service locations. |

| | | | | | | | | |

(b) | A degree day is recorded for each degree that the average outdoor temperature varies from a standard of 65 degrees Fahrenheit. |

|

| | | | | | | | | |

El Paso Electric Company |

Financial Statistics |

At December 31, 2014 and 2013 |

(In thousands, except number of shares, book value per share, and ratios) |

| | | | | |

Balance Sheet | | 2014 | | 2013 |

| | | | | |

Cash and cash equivalents | | $ | 40,504 |

| | $ | 25,592 |

|

| | | | | |

Common stock equity | | $ | 984,254 |

| | $ | 943,833 |

|

Long-term debt | | 1,134,179 |

| | 999,620 |

|

| Total capitalization | | $ | 2,118,433 |

| | $ | 1,943,453 |

|

| | | | | |

Current maturities of long-term debt | | $ | 15,000 |

| | $ | — |

|

| | | | | |

Short-term borrowings under the revolving credit facility | | $ | 14,532 |

| | $ | 14,352 |

|

| | | | | |

Number of shares - end of period | | 40,356,624 |

| | 40,266,709 |

|

| | | | | |

Book value per common share | | $ | 24.39 |

| | $ | 23.44 |

|

| | | | | |

Common equity ratio (a) | | 45.8 | % | | 48.2 | % |

Debt ratio | | 54.2 | % | | 51.8 | % |

| | | | | |

(a) | The capitalization component includes common stock equity, long-term debt and the current maturities of long-term debt, and short-term borrowings under the RCF. |

| | | | | |

Safe Harbor Statement 2 This presentation includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: Increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased costs to customers or to recover previously incurred fuel costs in rates Recovery of capital investments and operating costs through rates in Texas and New Mexico Uncertainties and instability in the general economy and the resulting impact on EE’s sales and profitability Changes in customers’ demand for electricity as a result of energy efficiency initiatives and emerging competing services and technologies Unanticipated increased costs associated with scheduled and unscheduled outages of generating plant The size of our construction program and our ability to complete construction on budget Potential delays in our construction schedule due to legal challenges or other reasons Costs at Palo Verde Deregulation and competition in the electric utility industry Possible increased costs of compliance with environmental or other laws, regulations and policies Possible income tax and interest payments as a result of audit adjustments proposed by the IRS or state taxing authorities Uncertainties and instability in the financial markets and the resulting impact on EE’s ability to access the capital and credit markets Possible physical or cyber attacks, intrusions or other catastrophic events Other factors detailed by EE in its public filings with the Securities and Exchange Commission. EE’s filings are available from the Securities and Exchange Commission or may be obtained through EE’s website, http://www.epelectric.com February 25, 2015

Recent Highlights 3 Board elected new Chairman and Vice Chairman Board appointed Mary Kipp as President Strengthened our management team Set a new Native Peak record of 1,766 MW in June 2014 Palo Verde Nuclear Generating Station increased its capacity factor in 2014 to 93.7 percent Obtained all permits and regulatory approvals required to construct Montana Power Station (MPS) Finished construction of Eastside Operations Center February 25, 2015 Eastside Operations Center

Recent Highlights (Continued) 4 More than doubled utility scale solar from 47 MW to 107 MW, which represents 6 percent of dedicated generation resources Contract finalized for the sale of our interest in Four Corners to Arizona Public Service Settled Texas fuel reconciliation case Increased the quarterly dividend by 5.7 percent to $0.28 per share Issued $150mm in long-term debt to fund construction program February 25, 2015 Newman Solar Facility

EE’s Commitment to the Community 5 EE’s employees are committed to delivering safe, reliable, and cost effective power consistently ranking at the top for grid reliability in Texas EE’s 2014 annual customer satisfaction survey results were the highest level achieved in the past six years Employees of EE contributed over 13,000 hours in 2014 to various volunteer organizations through the Volunteers in Action Program Combined employee/company contributions to the United Way Campaign totaled more than $350,000 February 25, 2015 Walk to End Alzheimer’s • Walk to End Alzheimer’s • March of Dimes • Child Crisis Center of El Paso* • Susan G. Komen Race for the Cure* • Opportunity Center for the Homeless* • Salvation Army • Big Brothers Big Sisters Over 100 Organizations and Activities Benefited from EE Contributions in 2014 Including: * EE represented largest corporate team participation

Objectives 6 Complete construction and start commercial operation of MPS Units 1 & 2 Begin construction of MPS Units 3 & 4 Maintain top reliability rankings Continue strong focus on safety and customer satisfaction Continue commitment to affordable utility scale solar Continue to improve relationships with our stakeholders February 25, 2015 Progress at New Montana Power Station

Historical Test Year End (Mar 2015) Need for Rate Case 7 February 25, 2015 Historical Test Year End (Dec 2014) File Rate Case (Apr or May 2015) Rate Increase Effective (Mar 2016) 2016 2014 2015 2016 File Rate Case (Jul or Aug 2015) Rate Increase Effective (Mar 2016) 2015 2014 Building new plant to support load growth, possible unit retirements and to continue providing safe, reliable, and cost effective service into the future EE will have placed $1.3 billion of new assets in service since July 1, 2009 PROPOSED NEW MEXICO RATE CASE TIMELINE PROPOSED TEXAS RATE CASE TIMELINE * Timelines reflect MPS Units 1 & 2 go into service by March 31, 2015

Historical Service Territory Growth 8 EE’s service territory has benefited from positive economic growth since 2008 driven by several major construction projects BRAC initiated investment at Fort Bliss totaling $5 billion Union Pacific’s $400 million intermodal rail yard in NM New $60 million downtown baseball stadium February 25, 2015 Texas Tech University Paul L. Foster School of Medicine Five story $60 million Health Sciences building at UTEP Gayle Greve Hunt School of Nursing New Sierra Providence Hospital El Paso Children’s Hospital

Future Service Territory Growth 9 Quality-of-Life bonds approved in 2012 totaling $473 million is mostly slated for projects going forward El Paso’s unemployment rate is the lowest level since 2008 El Paso’s industrial space vacancy rate is the lowest since 2007 New projects under construction $1 billion Army Medical Center at Fort Bliss Over $1 billion of state and federal transportation infrastructure projects $120 million Tenet Hospital $85 million Burrell College of Osteopathic Medicine in Las Cruces Recent corporate expansion announcements Charles Schwab to add 445 new jobs Prudential Financial to add 300 new jobs Automatic Data Processing to add 1,100 new jobs February 25, 2015

Vision Mission 10 February 25, 2015 2014 Financial Re ults

Vision Mission 4th Quarter 2014 net income of $4.2 million or $0.10 per share, compared to 4th Quarter 2013 net income of $1.2 million or $0.03 per share YTD 2014 net income of $91.4 million or $2.27 per share, compared to YTD 2013 net income of $88.6 million or $2.20 per share 2014 Financial Results 11 February 25, 2015

Vision Mission 4th Quarter Key Earnings Drivers 12 Basic EPS Description December 31, 2013 0.03$ Changes In: Investment and interest income 0.06 Increased due to gains on the sales of equity investments in Palo Verde decommissioning trust funds Allowance for funds used during construction 0.06 Increased due to higher construction balances Non-base revenue items, net of energy expense 0.04 Increased primarily due to PUCT awarded Texas Energy Efficiency bonus of $2.0 million Retail non-fuel base revenues 0.02 Increased due to customer growth in residential and small commercial customers and increased cooling degree days in October Income taxes (0.08) Increased primarily due to legislative timing of the bonus depreciation extension in 2014 Palo Verde operations and maintenance (0.03) Increased expenses primarily due to increased payroll including incentive compensation December 31, 2014 0.10$ February 25, 2015

Vision Mission 4th Quarter Retail Revenues and Sales 13 Non-Fuel Base Revenues (000's) 1 Percent Change 2 MWH 1 Percent Change 2 Residential 47,653$ 2.7% 552,977 2.2% C&I Small 38,449 1.7% 548,369 2.3% C&I Large 9,019 (2.4%) 269,584 (4.5%) Public Authorities 19,229 (0.8%) 360,381 (4.4%) Total Retail 114,350$ 1.3% 1,731,311 (0.3%) Cooling Degree Days (CDD's) 136 70.0% Heating Degree Days (HDD's) 858 -14.8% Average Retail Customers 398,765 1.3% February 25, 2015 (1) Non-Fuel Base Revenues and MWH sales represent actual Q4 2014 results (2) Percent Change expressed as change from Q4 2014 over Q4 2013

Vision Mission YTD Key Earnings Drivers 14 February 25, 2015 Basic EPS Description December 31, 2013 2.20$ Changes In: Allowance for funds used during construction 0.15 Increased due to higher construction balances Investment and interest income 0.13 Increased due to gains on the sales of equity investments in Palo Verde decommissioning trust funds Non-base revenue items, net of energy expense 0.10 Increased $7.8 million primarily due to PV performance awards, Texas energy efficiency bonus, and PV3 revenues, partially offset by a decrease of $3.3 million in transmission wheeling revenues Retail non-fuel base revenues (0.09) Decreased mainly due to reduction in sales to public authorities and residential customers Taxes other than income taxes (0.08) Increased primarily due to higher property tax values and assessments Depreciation and amortization expnse (0.06) Increased due to an increase in depreciable plant balances Palo Verde operations and maintenance (0.04) Increased expenses primarily due to increased payroll including incentive compensation Other (0.04) December 31, 2014 2.27$

Vision Mission YTD Retail Revenues and Sales 15 Non-Fuel Base Revenues (000's) 1 Percent Change 2 MWH 1 Percent Change 2 Residential 234,371$ (1.0%) 2,640,535 (1.4%) C&I Small 185,388 0.4% 2,357,846 0.4% C&I Large 39,239 (2.5%) 1,064,475 (2.8%) Public Authorities 92,066 (3.1%) 1,562,784 (3.7%) Total Retail 551,064$ (1.0%) 7,625,640 (1.6%) Cooling Degree Days (CDD's) 2,671 -0.9% Heating Degree Days (HDD's) 1,900 -21.7% Average Retail Customers 397,014 1.3% February 25, 2015 (1) Non-Fuel Base Revenues and MWH sales represent actual YTD 2014 results (2) Percent Change expressed as change from YTD 2014 over YTD 2013

Historical Weather Analysis 2,176 2,020 2,286 2,188 2,144 2,273 2,402 2,009 2,426 1,900 2,549 2,457 2,512 2,272 2,768 2,738 3,141 2,876 2,695 2,671 0 500 1,000 1,500 2,000 2,500 3,000 3,500 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 December YTD Degree Days HDD CDD 10 Year HDD Avg 10 Year CDD Avg 10-Yr HDD Average – 2,182 10-Yr CDD Average – 2,668 16 February 25, 2015 2014 HDD’s lowest in over 60 years

Vision Mission Expended $277.1mm for additions to utility plant for the twelve months ended December 31, 2014 Issued $150mm in long term debt on December 1, 2014 to fund construction program Board declared quarterly cash dividend of $0.28 per share on January 29, 2015 payable on March 31, 2015 EE made $44.6mm in dividend payments for the twelve months ended December 31, 2014 At December 31, 2014, EE had liquidity of $325.6mm including a cash balance of $40.5mm and unused capacity under the revolving credit facility Capital expenditures for utility plant in 2015 are anticipated to be approximately $271mm May issue long-term debt in late 2015 or early 2016 Capital Requirements and Liquidity 17 February 25, 2015

Capital Expenditure (Cash) Projection 18 $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 2015E 2016E 2017E 2018E 2019E 5- Year Estimated Cost of $1.1 billion Generation Transmission Distribution General $199mm $254mm ($000’s) $170mm $203mm $271mm February 25, 2015

Projected Rate Base and CWIP 19 Pro forma Rate Base Balances for Future Rate Case Filings ($000) (1) Includes Palo Verde Unit 3 rate base of approximately $33mm and $34mm for each pro-forma filing in 2015 and 2016, respectfully (2) Beginning rate base is December 31, 2013 and year end balances exclude CWIP (3) Represents a pro-forma rate base projection that is subject to change based on actual rate filings MPS 1 & 2 MPS 3 & 4 Beginning Rate Base (1)(2) $1,562 $1,896 Plant Additions: MPS Transmission and Substations 20 11 New Eastside Facility 41 - Other 307 159 New Generating Units: Montana Common Plant 48 18 Montana Unit 1 77 - Montana Unit 2 74 - Montana Unit 3 - 78 Montana Unit 4 - 78 Total 567 344 Depreciation Expense (174) (99) Change in Deferred Income Taxes & Other (59) 18 Total Rate Base (3) $1,896 $2,159 2015 2016 Ending CWIP Balances ($ in millions) $310 $151 February 25, 2015

2015 Earnings Guidance 20 Interest expense Depreciation (1) Property taxes & O&M (1) Deregulated PV3 and non-fuel base revenues AFUDC (1) (2) Customer growth Return to normal weather Palo Verde decommissioning trust fund gains February 25, 2015 YOY EPS Drivers 2015 earnings are expected to decline from prior year due to regulatory lag, primarily related to major projects placed in service in Q1 2015 (1) Mainly related to MPS T&D, Common, Units 1 & 2, and the Eastside Operations Center (2) Some of the negative impact of AFUDC will be offset for AFUDC related to MPS Units 3 & 4 in 2015 2014 EPS Actual 2015 Earnings Guidance $1.75 $2.15 $2.27

Q & A 21 February 25, 2015

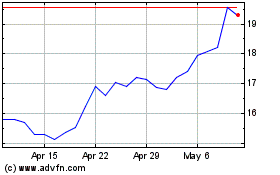

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Aug 2024 to Sep 2024

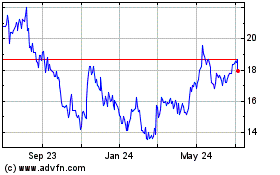

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Sep 2023 to Sep 2024