DuPont Pushes Back Dow Deal Closing Date Amid EU Scrutiny--Update

January 24 2017 - 11:00AM

Dow Jones News

By Jacob Bunge

DuPont Co. pushed back the closing date for its merger with Dow

Chemical Co., as European antitrust authorities scrutinize the

companies' agricultural businesses.

DuPont Chief Executive Ed Breen said the companies are

negotiating potential divestitures in their pesticide operations to

win approval for the deal, which would create an industrial

behemoth worth nearly $129 billion.

The deal, announced in December 2015, has faced delays as

antitrust regulators sought reams of information concerning the

companies' competing businesses in insecticides, weedkillers and

crop seeds. Dow and DuPont initially expected their deal to close

late last year, but Mr. Breen told analysts Tuesday it is now

unlikely to be completed until after March.

"The main concern is in the crop protection area," Mr. Breen

said on a conference call discussing DuPont's fourth-quarter

results. "That's where we've been focused with a remedy

package."

Mr. Breen said the negotiations also concern some research and

development commitments to soothe competition authorities' concerns

that farmers could be left with fewer product choices, and a

slimmer pipeline of new seeds and sprays.

"One of the reasons we're doing the merger is to create a new ag

company with more resources in new product development," Mr. Breen

said.

DuPont and Dow aim to unite their vast portfolios of chemicals,

crop seeds, plastics and electronic components, eliminate $3

billion in annual costs and split into three separate companies

within about 18 months. One company will be focused on agriculture,

another on materials, and the third on specialty products like food

ingredients and safety equipment. Mr. Breen said Tuesday the

regulatory delays hadn't changed the cost-cutting target or the

timeline for the breakup.

The companies are pursuing their deal amid global challenges

facing industrial and agricultural companies. Regulators also are

evaluating proposed agricultural deals between Bayer AG and

Monsanto Co., and China National Chemical Corp. and Syngenta

AG.

DuPont expects the U.S. dollar to continue strengthening in

2017, Chief Financial Officer Nick Fanandakis said, making

U.S.-made products more expensive abroad. Meanwhile developing

economies like Brazil have stalled and political uncertainty in the

European Union is growing.

DuPont forecast first-quarter 2017 earnings would fall 18% but

increase 8% on an adjusted basis. The past year's cost-cutting

efforts are paying off, Mr. Breen said, but DuPont's agricultural

division will suffer as U.S. farmers plant fewer acres of corn this

year in favor of soybeans, a smaller business for the company.

Shares of DuPont gained 1.5% early in Tuesday's trading

session.

DuPont reported an overall profit of $353 million or 29 cents a

share for the quarter, compared with a loss of $421 million, or 26

cents a share, a year earlier. Excluding items, the company earned

51 cents a share, up from 27 cents.

Revenue dropped 2% to $5.21 billion. Analysts polled by Thomson

Reuters had forecast earnings of 42 cents on $5.29 billion in

revenue.

--Imani Moise contributed to this article

Write to Jacob Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

January 24, 2017 10:45 ET (15:45 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

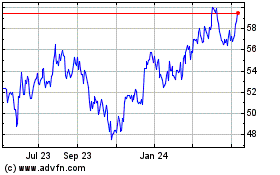

Dow (NYSE:DOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

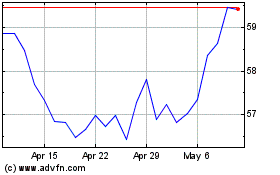

Dow (NYSE:DOW)

Historical Stock Chart

From Apr 2023 to Apr 2024